|

|

|

|

|

|

|

|

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 12b-25

NOTIFICATION OF LATE FILING

|

|

|

|

SEC FILE NUMBER

|

|

|

001-33666

|

|

|

CUSIP NUMBER

|

|

|

03957W106

|

(Check One)

:

¨

Form 10-K

¨

Form 20-F

¨

Form 11-K

x

Form 10-Q

¨

Form 10-D

¨

Form N-SAR

¨

Form N-CSR

|

|

|

|

|

|

For period ended:

June 30, 2016

|

|

¨

|

Transition Report on Form 10-K

|

|

¨

|

Transition Report on Form 20-F

|

|

¨

|

Transition Report on Form 11-K

|

|

¨

|

Transition Report on Form 10-Q

|

|

¨

|

Transition Report on Form N-SAR

|

|

For the Transition Period Ended:

N/A

|

|

|

|

|

|

Nothing in this form shall be construed to imply that the Commission

has verified any information contained herein

.

|

If the notification relates to a portion of the filing checked above, identify the Item(s) to which the notification relates:

N/A

PART I - REGISTRANT INFORMATION

Full Name of Registrant

Former Name if Applicable

Address of Principal Executive Office

(Street and Number)

City, State and Zip Code

PART II - RULES 12b-25 (b) AND (c)

If the subject report could not be filed without unreasonable effort or expense and the registrant seeks relief pursuant to Rule 12b-25(b), the following should be completed.

|

|

|

|

|

|

|

¨

|

(a)

|

The reason described in reasonable detail in Part III of this form could not be eliminated without unreasonable effort or expense;

|

|

|

|

|

(b)

|

The subject annual report, semi-annual report, transition report on Form 10-K, Form 20-F, 11-K, Form N-SAR or Form N-CSR, or portion thereof, will be filed on or before the fifteenth calendar day following the prescribed due date; or the subject quarterly report or transition report on Form 10-Q, or subject distribution report on Form 10-D, or portion thereof, will be filed on or before the fifth calendar day following the prescribed due date; and

|

|

|

|

|

(c)

|

The accountant’s statement or other exhibit required by Rule 12b-25(c) has been attached, if applicable.

|

PART III - NARRATIVE

State below in reasonable detail why Forms 10-K, 20-F, 11-K, 10-Q, 10-D, N-SAR, N-CSR, or the transition report, or portion thereof, could not be filed within the prescribed time period.

As previously reported, on November 3, 2015, Archrock, Inc. (formerly named Exterran Holdings, Inc.) completed the spin-off (the “Spin-off”) of its international contract operations, international aftermarket services and global fabrication businesses into a standalone public company operating as Exterran Corporation. Since the completion of the Spin-off, Archrock and Exterran Corporation have been independent, publicly traded companies.

As announced in a Current Report on Form 8-K filed on April 26, 2016, Archrock’s management and the Audit Committee of its Board of Directors are in the process of determining the impact to Archrock’s pre-Spin-off historical financial statements of Exterran Corporation’s identification of possible errors relating to the application of percentage-of-completion accounting principles to specific engineering, procurement and construction projects in the Middle East by its Belleli subsidiary, as described in Exterran Corporation’s Form 8-K filed on April 26, 2016. Based on the information provided by Exterran Corporation, Archrock does not believe the matters identified relate to Archrock’s ongoing operations. Exterran Corporation's results of operations have been reported as income from discontinued operations, net of tax, in Archrock’s consolidated statement of operations for all periods presented in Archrock's Annual Report on Form 10-K for the fiscal year ended December 31, 2015.

Because the investigation into the matter and the process of determining the impact to Archrock’s pre-Spin-off historical financial statements is ongoing, Archrock is not able to file its Quarterly Report on Form 10-Q for the quarter ended June 30, 2016 by the required filing date. At this time, Archrock does not expect that the Form 10-Q for the quarter ended June 30, 2016 will be filed on or before the fifth calendar day following the prescribed due date.

PART IV - OTHER INFORMATION

|

|

|

|

|

|

(1)

|

Name and telephone number of person to contact in regard to this notification:

|

|

|

|

|

|

|

|

|

|

David S. Miller

|

|

(281)

|

|

836-8000

|

|

(Name)

|

|

(Area Code)

|

|

(Telephone Number)

|

|

|

|

|

|

|

(2)

|

Have all other periodic reports required under Section 13 or 15(d) of the Securities Exchange Act of 1934 or Section 30 of the Investment Company Act of 1940 during the preceding 12 months or for such shorter period that the registrant was required to file such report(s) been filed? If answer is no, identify report(s). Yes

¨

No

x

|

|

|

|

|

|

Quarterly Report on Form 10-Q for the quarter ended March 31, 2016

|

|

|

|

|

(3)

|

Is it anticipated that any significant change in results of operations from the corresponding period for the last fiscal year will be reflected by the earnings statements to be included in the subject report or portion thereof? Yes

x

No

¨

|

|

|

|

|

|

If so, attach an explanation of the anticipated change, both narratively and quantitatively, and, if appropriate, state the reasons why a reasonable estimate of the results cannot be made.

|

On August 4, 2016, Archrock issued a press release containing an operational update for the quarter ended June 30, 2016. A copy of the press release was furnished as Exhibit 99.1 to Archrock’s Current Report on Form 8-K dated August 4, 2016.

As disclosed in the press release, Archrock reported a net loss from continuing operations of $2.4 million in the second quarter of 2016 compared to $6.7 million in the first quarter of 2016 and net income from continuing operations of $4.3 million in the second quarter of 2015. Archrock’s contract operations revenue was $163.0 million in the second quarter of 2016, compared to $176.2 million in the first quarter of 2016 and $198.3 million in the second quarter of 2015. Aftermarket services revenue was $41.2 million in the second quarter of 2016 compared to $37.1 million in the first quarter of 2016 and $56.8 million in the second quarter of 2015. Selling, general and administrative expenses were $28.1 million in the second quarter of 2016 compared to $34.7 million in the first quarter of 2016.

Based on its limited partner and general partner interests in Archrock Partners, L.P., Archrock will receive a cash distribution of $7.1 million for the second quarter of 2016, compared to $7.1 million for the first quarter of 2016.

The press release provided the following selected operating results for the for the three months ended June 30, 2016 and comparable prior periods:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ARCHROCK, INC.

|

|

SELECTED UNAUDITED CONSOLIDATED OPERATING RESULTS

|

|

(In thousands)

|

|

|

|

|

|

|

|

|

|

Three Months Ended

|

|

|

June 30,

|

|

March 31,

|

|

June 30,

|

|

|

2016

|

|

2016

|

|

2015

|

|

|

|

|

|

|

|

|

Revenues:

|

|

|

|

|

|

|

Contract operations

|

$

|

162,973

|

|

|

$

|

176,239

|

|

|

$

|

198,259

|

|

|

Aftermarket services

|

41,172

|

|

|

37,056

|

|

|

56,803

|

|

|

|

204,145

|

|

|

213,295

|

|

|

255,062

|

|

|

|

|

|

|

|

|

|

Costs and expenses:

|

|

|

|

|

|

|

Cost of sales (excluding depreciation and amortization expense):

|

|

|

|

|

|

|

Contract operations

|

58,866

|

|

|

68,179

|

|

|

81,221

|

|

|

Aftermarket services

|

34,353

|

|

|

30,362

|

|

|

45,844

|

|

|

Selling, general and administrative

|

28,080

|

|

|

34,651

|

|

|

31,357

|

|

|

Depreciation and amortization

|

51,896

|

|

|

53,927

|

|

|

57,539

|

|

|

Long-lived asset impairment

|

13,808

|

|

|

9,860

|

|

|

9,510

|

|

|

Restructuring and other charges

|

3,004

|

|

|

8,065

|

|

|

1,193

|

|

|

Interest expense

|

21,177

|

|

|

20,300

|

|

|

28,079

|

|

|

Other income, net

|

(181

|

)

|

|

(1,989

|

)

|

|

(2,482

|

)

|

|

|

211,003

|

|

|

223,355

|

|

|

252,261

|

|

|

Income (loss) before income taxes

|

(6,858

|

)

|

|

(10,060

|

)

|

|

2,801

|

|

|

Benefit from income taxes

|

(4,500

|

)

|

|

(3,334

|

)

|

|

(1,529

|

)

|

|

Income (loss) from continuing operations

|

$

|

(2,358

|

)

|

|

$

|

(6,726

|

)

|

|

$

|

4,330

|

|

The foregoing financial information is preliminary and unaudited and may be subject to change in the Quarterly Report on Form 10-Q for the quarter ended June 30, 2016 when filed, including, without limitation, as a result of the investigation described above.

Forward-Looking Statements

All statements in this notification other than historical facts are forward-looking statements within the meaning of Section 21E of the Securities Exchange Act of 1934, as amended. These forward-looking statements rely on a number of assumptions concerning future events and are subject to a number of uncertainties and factors, many of which are outside Archrock’s control, which could cause actual results to differ materially from such statements. Forward-looking information includes, but is not limited to: Archrock’s financial and operational strategies and ability to successfully effect those strategies; Archrock’s expectations regarding the potential impact on Archrock’s pre-Spin historical financial statements of the matters described in Archrock’s April 26, 2016 and May 3, 2016 Form 8-Ks; Archrock’s expectations regarding future economic and market conditions; Archrock’s financial and operational outlook and ability to fulfill that outlook; demand for Archrock’s services; Archrock’s cost reduction plans; statements about the timing of filing the Form 10-Q; and statements about Archrock’s dividends and the anticipated impact of the dividend rate on its business and prospects.

While Archrock believes that the assumptions concerning future events are reasonable, it cautions that there are inherent difficulties in predicting certain important factors that could impact the future performance or results of its business. Among the factors that

could cause results to differ materially from those indicated by such forward-looking statements are: any direct or indirect impact of the matters described in Archrock’s April 26, 2016 and May 3, 2016 Form 8-Ks on its operating results or financial condition, including the impact of a restatement of historical financial statements, if this is determined to be required; Archrock's ability to come into compliance with its SEC filing obligations; local, regional and national economic conditions and the impact they may have on Archrock and its customers; changes in tax laws that impact master limited partnerships; conditions in the oil and gas industry, including a sustained decrease in the level of supply or demand for oil or natural gas or a sustained decrease in the price of oil or natural gas; the financial condition of Archrock’s customers; any non-performance by customers of their contractual obligations; changes in safety, health, environmental and other regulations; and the performance of Archrock Partners.

These forward-looking statements are also affected by the risk factors, forward-looking statements and challenges and uncertainties described in the Archrock Annual Report on Form 10-K for the year ended December 31, 2015, and those set forth from time to time in Archrock’s filings with the Securities and Exchange Commission, which are available at www.archrock.com. Except as required by law, Archrock expressly disclaims any intention or obligation to revise or update any forward-looking statements whether as a result of new information, future events or otherwise.

|

|

|

|

|

|

|

Archrock, Inc.

|

|

(Name of Registrant as Specified in Charter)

|

|

|

|

has caused this notification to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

Date: August 4, 2016

|

By:

|

/s/ David S. Miller

|

|

|

|

David S. Miller

Senior Vice President and Chief Financial Officer

|

|

|

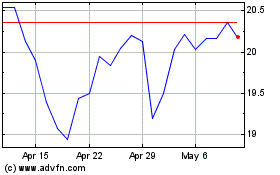

Archrock (NYSE:AROC)

Historical Stock Chart

From Mar 2024 to Apr 2024

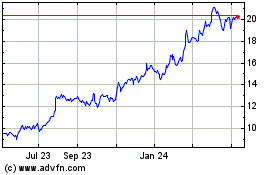

Archrock (NYSE:AROC)

Historical Stock Chart

From Apr 2023 to Apr 2024