AAC Holdings, Inc. (NYSE: AAC) announced its results for the

second quarter ended June 30, 2016. All comparisons included in

this release are to the comparable prior year period unless

otherwise noted.

Second Quarter 2016 Operational and Financial

Highlights:

- Client admissions increased 60% to

2,890

- Average daily residential census

increased 52% to 821

- Outpatient visits increased 397% to

13,079

- Revenues increased 33% to $71.5

million

- Net income available to common

stockholders was $0.9 million, or $0.04 per diluted share

- Cash flows provided from operations

totaled $2.0 million

- Adjusted EBITDA was $12.5 million (see

non-GAAP reconciliation herein)

- Adjusted earnings per diluted share was

$0.18 (see non-GAAP reconciliation herein)

- Average daily residential revenue was

$801

De Novo and Acquisition Highlights:

- In April 2016, completed the

acquisition of Townsend in Louisiana, adding a 32-bed in-network

facility, seven in-network outpatient centers and an in-network

lab

- In May 2016, completed the acquisition

of Solutions Recovery in Las Vegas, adding 124 sober living beds,

80 licensed in-network detoxification, residential and halfway

house beds, and two in-network outpatient centers

- In June 2016, opened the 93-bed Laguna

Treatment Hospital, in Aliso Viejo, California

- In June 2016, commenced development of

a 150-bed residential treatment center in Ringwood, New Jersey

- 44 detoxification and

residential beds and 48 sober living beds at The Oxford

Center’s existing location anticipated to come online in first

half 2017

Revenues in the second quarter of 2016 increased to $71.5

million compared with $53.8 million for the same period in the

prior year. Net income available to stockholders decreased to $0.9

million, or $0.04 per diluted share, in the second quarter of 2016

compared with $5.6 million, or $0.26 per diluted share, in the

prior-year period. Adjusted EBITDA decreased to $12.5 million

compared with $14.4 million for the same period in the prior year.

Adjusted net income available to stockholders decreased to $4.1

million, or $0.18 per diluted share, compared with $7.4 million, or

$0.35 per diluted share, in the prior-year. Adjusted net income

available to stockholders and Adjusted EBITDA are non-GAAP

financial measures. Tables reconciling these measures to net income

available to stockholders and net income, respectively, are

included in this release.

“The continued growth in admissions, census and outpatient

visits is in line with our expectations for delivering exceptional

clinical quality and reflects our ability to offer clients and

their families a broader range of treatment options and support,”

noted Michael Cartwright, Chairman and Chief Executive Officer of

AAC Holdings, Inc. “We made great strides in integrating our recent

acquisitions, ramping up and adding to our de novo projects as well

opening Laguna Treatment Hospital – our first chemical dependency

recovery hospital. With the recent enhancements to and the increase

in our credit facility, we have much improved access to attractive

sources of capital that will allow us to pursue opportunities in

our acquisition pipeline.”

De Novo Activity and Pipeline

In April 2016, the Company began construction on an 11,000

square-foot in-network lab located in Slidell, Louisiana to replace

an existing in-network lab that was part of the Townsend

acquisition. The new lab is expected to be completed in the fourth

quarter of 2016.

In June 2016, the Company opened Laguna Treatment Hospital, a

93-bed Chemical Dependency Rehabilitation Hospital near Aliso

Viejo, California. AAC has staffed the hospital to ramp up

admissions over the first 12 to 18 months of operation.

In June 2016, the Company commenced development of a 150-bed

residential treatment center in Ringwood, New Jersey. The facility

is expected to be completed in the first half of 2018.

The Company has 44 additional residential beds and 48 sober

living beds under development at The Oxford Centre in Mississippi

that are currently expected to come online in the first half of

2017.

Acquisition Activity

In April 2016, the Company has completed the acquisition of

Townsend for a total purchase price of $22.0 million. Located in

Louisiana, Townsend operates a 32-bed in-network facility, with 20

beds licensed for detoxification and inpatient treatment, seven

in-network outpatient centers that deliver intensive outpatient

treatment as well as an in-network lab.

In April 2016, the Company acquired a 100-room hotel in

Arlington, Texas for $5.35 million. The Company is currently in the

process of converting the facility into sober living beds. The

Company expects the property to generate approximately $5.0 million

in incremental revenue and approximately $2.0 million in

incremental Adjusted EBITDA for the Company’s Greenhouse outpatient

center in 2017.

In May 2016, the Company completed the acquisition of Las

Vegas-based Solutions Recovery for a total purchase price of $13.0

million. The acquisition included 124 sober living beds, 80

licensed in-network detoxification, residential and halfway house

beds, and two in-network outpatient centers.

Financing Activity

In July 2016, the Company increased its senior secured credit

facility to $171.25 million, consisting of a $50 million revolving

credit facility and a $121.25 million term loan. The facility is

scheduled to mature in March 2020 and bears interest at LIBOR plus

a margin between 2.25% to 3.25% or a base rate plus a margin

between 1.25% and 2.25%, in each case depending on the Company’s

leverage ratio. The facility has an accordion feature that provides

for an additional $75 million of borrowing capacity under the

credit facility, subject to certain consents and conditions,

including obtaining additional commitments from lenders.

Balance Sheet and Cash Flows from Operations

As of June 30, 2016, AAC Holdings’ balance sheet reflected cash

and cash equivalents of $7.3 million and total debt of $167.5

million. Capital expenditures in the second quarter of 2016 totaled

$12.7 million. Cash flows provided by operations totaled $2.0

million for the second quarter of 2016 compared with $9.1 million

in the prior-year period. Days sales outstanding (DSO) was 95 for

the second quarter of 2016 compared with 80 for the prior-year

period. Provision for doubtful accounts was 6.9% of total revenues

for the second quarter of 2016 compared with 7.8% of total revenues

for the prior-year period.

2016 Outlook

AAC updated its guidance for the full year 2016. Revenues are

expected to be in the range of $275 million to $285 million. This

estimate is based on average daily residential census for the year

of 840; average daily residential revenue of approximately $775 to

$800; and approximately $37 million to $39 million of revenue from

standalone outpatient centers and related lab services from those

visits, as well as the other revenue from Referral Solutions

Group.

Adjusted EBITDA is expected to be in the range of $52 million to

$55 million and adjusted earnings per diluted share is expected to

be in the range of $0.85 to $0.90. Assumptions also include an

annual effective tax rate of 37% to 39% and diluted

weighted-average shares outstanding of approximately 23 million for

the year.

This outlook does not include the impact of any future

acquisitions, transaction-related costs, litigation settlement,

expenses related to legal defenses and de novo start-up

expenses.

Earnings Conference Call

The Company will host a conference call and live audio webcast,

both open for the general public to hear, later this morning at

10:00 a.m. CT. The number to call for this interactive

teleconference is (412) 542-4144. A replay of the conference call

will be available through August 12, 2016, by dialing (412)

317-0088 and entering the replay access code: 10090116.

The live audio webcast of the Company’s quarterly conference

call will be available online at ir.americanaddictioncenters.org.

The online replay will be available on the website one hour after

the call.

About American Addiction Centers

American Addiction Centers is a leading provider of inpatient

and outpatient substance abuse treatment services. We treat clients

who are struggling with drug addiction, alcohol addiction, and

co-occurring mental/behavioral health issues. We currently operate

substance abuse treatment facilities located throughout the United

States. These facilities are focused on delivering effective

clinical care and treatment solutions. For more information, please

find us at AmericanAddictionCenters.org or follow us on Twitter

@AAC_Tweet.

Forward Looking Statements

This release contains forward-looking statements within the

meaning of the federal securities laws. These forward-looking

statements are made only as of the date of this release. In some

cases, you can identify forward-looking statements by terms such as

“anticipates,” “believes,” “could,” “estimates,” “expects,” “may,”

“potential,” “predicts,” “projects,” “should,” “will,” “would,” and

similar expressions intended to identify forward-looking

statements, although not all forward-looking statements contain

these words. Forward-looking statements may include information

concerning AAC Holdings, Inc.’s (collectively with its

subsidiaries; “Holdings” or the “Company”) possible or assumed

future results of operations, including descriptions of Holdings’

revenues, profitability, outlook and overall business strategy.

These statements involve known and unknown risks, uncertainties and

other factors that may cause our actual results and performance to

be materially different from the information contained in the

forward-looking statements. These risks, uncertainties and other

factors include, without limitation: (i) our inability to operate

our facilities; (ii) our reliance on our sales and marketing

program to continuously attract and enroll clients; (iii) a

reduction in reimbursement rates by certain third-party payors for

inpatient and outpatient services and point of care and definitive

lab testing; (iv) our failure to successfully achieve growth

through acquisitions and de novo expansions; (v) uncertainties

regarding the timing of the closing of acquisitions; (vi) the

possibility that a governmental entity may prohibit, delay or

refuse to grant approval for the consummation of an acquisition;

(vii) our failure to achieve anticipated financial results from

prior acquisitions; (viii) a disruption in our ability to perform

definitive drug testing services; (ix) maintaining compliance with

applicable regulatory authorities, licensure and permits to operate

our facilities and lab; (x) a disruption in our business and

reputation and potential economic consequences associated with the

indictment of certain of our subsidiaries and current and former

employees, including a former director and senior executive and the

civil securities claims brought by shareholders; (xi) our inability

to agree on conversion and other terms for the balance of

convertible debt; (xii) our inability to meet our covenants in the

loan documents; (xiii) our inability to obtain senior lender

consent to exceed the current $50 million limit in unsecured

subordinated debt; (xiv) our inability to integrate newly acquired

facilities;; and (xv) general economic conditions, as well as other

risks discussed in the “Risk Factors” section of the Company’s

Annual Report on Form 10-K, and other filings with the Securities

and Exchange Commission. As a result of these factors, we cannot

assure you that the forward-looking statements in this release will

prove to be accurate. Investors should not place undue reliance

upon forward looking statements.

AAC HOLDINGS, INC. CONDENSED CONSOLIDATED

STATEMENTS OF OPERATIONS Unaudited (Dollars in

thousands, except per share amounts)

Three

Months Ended Six Months Ended June 30, 2016

March 31, 2016 June 30, 2015 June 30, 2016

June 30, 2015 Revenues Client related revenue $ 68,226 $

62,706 $ 53,784 $ 130,932 $ 96,607 Other revenue 3,316

2,642 — 5,958

— Total revenues 71,542 65,348 53,784 136,890 96,607

Operating expenses Salaries, wages and benefits 36,191 31,971

19,733 68,162 38,107 Advertising and marketing 4,509 4,397 5,119

8,906 9,737 Professional fees 3,869 4,307 1,861 8,176 3,330 Client

related services 5,500 4,919 3,478 10,419 6,393 Other operating

expenses 7,255 6,546 5,536 13,801 10,349 Rentals and leases 1,892

1,532 1,159 3,424 1,859 Provision for doubtful accounts 4,943 5,483

4,177 10,426 7,559 Litigation settlement 42 108 1,500 150 1,520

Depreciation and amortization 4,225 3,915 1,676 8,140 3,016

Acquisition-related expenses 1,196 764

982 1,960 1,980 Total

operating expenses 69,622 63,942

45,221 133,564 83,850 Income

from operations 1,920 1,406 8,563 3,326 12,757 Interest expense

2,221 1,702 482 3,923 1,223 Other income, net (36 )

(7 ) (49 ) (43 ) (60 ) (Loss) income before

income tax expense (265 ) (289 ) 8,130 (554 ) 11,594 Income tax

(benefit) expense (107 ) (20 ) 3,014

(127 ) 4,359 Net (loss) income (158 ) (269 )

5,116 (427 ) 7,235 Less: net loss attributable to noncontrolling

interest 1,030 855 439

1,885 1,039 Net income attributable to

AAC Holdings, Inc. stockholders 872 586 5,555 1,458 8,274 BHR

Series A Preferred Unit dividend — — — — (147 ) Redemption of BHR

Series A Preferred Units — — —

— (534 )

Net income available to AAC Holdings, Inc.

common stockholders

$ 872 $ 586 $ 5,555 $ 1,458 $ 7,593

Basic earnings per common share $ 0.04 $ 0.03 $ 0.26

$ 0.07 $ 0.36 Diluted earnings per common share $ 0.04 $ 0.03 $

0.26 $ 0.06 $ 0.36 Weighted-average shares outstanding: Basic

22,761,671 22,094,790 21,293,512 22,429,948 21,241,839 Diluted

22,811,345 22,113,500 21,487,816 22,499,064 21,376,210

AAC HOLDINGS, INC. CONDENSED CONSOLIDATED BALANCE

SHEETS Unaudited (Dollars in thousands)

June 30, December 31,

2016 2015 Assets

Current assets Cash and cash equivalents $ 7,269 $ 18,750

Accounts receivable, net of allowances 74,692 60,934 Prepaid

expenses and other current assets 3,727 6,840

Total current assets 85,688

86,524 Property and equipment, net 128,623 109,724 Goodwill

134,847 108,722 Intangible assets, net 9,790 9,470 Other assets

3,252 1,609

Total assets $

362,200 $ 316,049

Liabilities and

Stockholders’ Equity Current liabilities Accounts

payable $ 9,500 $ 7,878 Accrued liabilities 23,097 21,653 Current

portion of long-term debt 4,702 3,611 Current portion of long-term

debt – related party — 1,195

Total

current liabilities 37,299 34,337 Deferred tax liabilities

1,050 1,195 Long-term debt, net of current portion 162,821 140,335

Other long-term liabilities 4,505 3,694

Total liabilities 205,675 179,561

Stockholders’ equity 163,576 141,654 Noncontrolling

interest (7,051 ) (5,166 ) Total stockholders’ equity

including noncontrolling interest 156,525

136,488

Total liabilities and stockholders’ equity $

362,200 $ 316,049

AAC HOLDINGS, INC.

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

Unaudited (Dollars in thousands)

Six Months Ended June 30, 2016

2015 Cash flows from operating

activities: Net (loss) income $ (427 ) $ 7,235

Adjustments to reconcile net (loss) income

to net cash provided by operating activities:

Provision for doubtful accounts 10,426 7,559 Depreciation and

amortization 8,140 3,016 Equity compensation 4,776 2,874

Amortization of debt issuance costs 208 85 Deferred income taxes

(145 ) (807 ) Changes in operating assets and liabilities: Accounts

receivable (21,189 ) (25,427 ) Prepaid expenses and other assets

920 (229 ) Accounts payable 1,169 4,865 Accrued liabilities 2,422

7,327 Other long term liabilities 18 95

Net cash provided by operating activities 6,318

6,593

Cash flows from investing activities:

Purchase of property and equipment (19,745 ) (34,087 ) Acquisition

of subsidiaries, net of cash acquired (19,150 ) (13,740 ) Escrow

funds held on acquisition — (511 ) Purchase of intangible assets —

(540 ) Sale of other assets, net — 153

Net cash used in investing activities (38,895 )

(48,725 )

Cash flows from financing activities: Proceeds

from long-term debt 24,500 73,802 Payments on long-term debt and

capital leases (2,209 ) (25,520 ) Repayment of long-term debt —

related party (1,195 ) (195 ) Repayment of subordinated notes

payable — (945 ) Redemption of BHR Series A Preferred Units

— (8,529 ) Net cash provided by financing activities

21,096 38,613 Net change in cash and

cash equivalents (11,481 ) (3,519 ) Cash and cash equivalents,

beginning of period 18,750 48,540 Cash

and cash equivalents, end of period $ 7,269 $ 45,021

AAC HOLDINGS, INC.

OPERATING METRICS Unaudited Three Months

Ended June 30, 2016 March 31, 2016 June 30,

2015 Operating Metrics: Average daily residential

census1 821 764 539 Outpatient visits2 13,079 4,978 2,634 Average

daily residential revenue3 $ 801 $ 832 $ 1,003 Average net daily

residential revenue4 $ 738 $ 756 $ 918 New admissions5 2,890 2,623

1,806 Bed count at end of period6 1,139 934 587 Effective bed count

at end of period7 1,064 892 587 Days sales outstanding (DSO)8 95 88

80

1

Includes client census at all of our owned and leased

residential facilities. 2 Represents the total number of

outpatient visits at our stand-alone outpatient centers during the

period. 3 Average daily residential revenue is calculated as

total revenues from all of our owned and leased residential

facilities during the period divided by the product of the number

of days in the period multiplied by average daily residential

census. 4 Average net daily residential revenue is

calculated as total revenues from all of our owned and leased

residential facilities less provision for doubtful accounts during

the period, divided by the product of the number of days in the

period multiplied by average daily residential census. 5

Includes total client admissions at our owned and leased

residential facilities for the period presented. 6 Bed count

at end of period includes all beds at owned and leased inpatient

facilities. 7

Effective bed count at end of period

represents beds for which our facilities are staffed based on

planned census.

8 Revenues per day is calculated by dividing the revenues

for the period by the number of days in the period. Days sales

outstanding is then calculated as accounts receivable, net of

allowance for doubtful accounts, at the end of the period divided

by revenues per day.

AAC HOLDINGS, INC.

SUPPLEMENTAL RECONCILIATION OF NON-GAAP DISCLOSURES

Unaudited (Dollars in thousands, except per share

amounts)

Reconciliation of

Adjusted EBITDA to Net Income

Three Months Ended Six Months Ended June 30,

2016 March 31, 2016 June 30, 2015 (1)

June 30, 2016 June 30, 2015 (1) Net (loss)

income $ (158 ) $ (269 ) $ 5,116 $ (427 ) $ 7,235 Non-GAAP

Adjustments: Interest expense 2,221 1,702 482 3,923 1,223

Depreciation and amortization 4,225 3,915 1,676 8,140 3,016 Income

tax (benefit) expense (107 ) (20 ) 3,014 (127 ) 4,359 Stock-based

compensation and related tax reimbursements 2,137 2,638 1,241 4,775

2,874 Litigation settlement and California matter related expense

1,311

2,325

1,500 3,636 1,520 Acquisition-related expense 1,298

860

982 2,158 1,980 De novo start-up expense and other 1,243 862 —

2,105 — Facility closure operating losses and expense 367

— 426 367

1,010 Adjusted EBITDA $ 12,537 $ 12,013 $

14,437 $ 24,550 $ 23,217

Reconciliation of

Adjusted Net Income Available to AAC Holdings, Inc. Common

Stockholders to Net Income Available to AAC Holdings, Inc. Common

Stockholders

Three Months Ended Six Months Ended June 30,

2016 March 31, 2016 June 30, 2015 (1)

June 30, 2016 'June 30, 2015 (1) Net

income available to AAC Holdings, Inc. common stockholders $ 872 $

586 $ 5,555 $ 1,458 $ 7,593 Non-GAAP Adjustments: Litigation

settlement and California matter related expense 1,311 2,325 1,500

3,636 1,520 Acquisition-related expense 1,298 860 982 2,158 1,980

De novo start-up and other expenses 1,243 862 — 2,105 — Facility

closure operating losses and expense, net of taxes 367 — 316 367

749 Redemption of BHR Series A Preferred Units — — — — 534 Income

tax effect of non-GAAP adjustments (967 ) (280 )

(920 ) (1,247 ) (1,315 ) Adjusted net

income available to AAC Holdings, Inc. common stockholders $ 4,124

$ 4,353 $ 7,433 $ 8,477 $ 11,061

Weighted-average shares outstanding - diluted

22,811,345 22,113,500 21,487,816 22,499,064 21,376,210

Adjusted diluted earnings per share $ 0.18 $ 0.20 $

0.35 $ 0.38 $ 0.52

Adjusted EBITDA, adjusted net income available to AAC Holdings,

Inc. common stockholders, and adjusted diluted earnings per share

(herein collectively referred to as "Non-GAAP Disclosures") are

“non-GAAP financial measures” as defined under the rules and

regulations promulgated by the U.S. Securities and Exchange

Commission. The Non-GAAP Disclosures should not be considered as

measures of financial performance under U.S. generally accepted

accounting principles ("GAAP"). The items excluded from the

Non-GAAP Disclosures are significant components in understanding

and assessing our financial performance and should not be

considered as an alternative to net income or other financial

statement items presented in the condensed consolidated financial

statements. Because the Non-GAAP Disclosures are not measures

determined in accordance with GAAP, the Non-GAAP Disclosures may

not be comparable to other similarly titled measures of other

companies.

Management defines Adjusted EBITDA as net (loss) income adjusted

for interest expense, depreciation and amortization expense, income

tax (benefit) expense, stock-based compensation and related tax

reimbursements, litigation settlement and California matter related

expense, acquisition-related expense (which includes professional

services for accounting, legal, valuation services and licensing

expenses), de novo start-up expenses and facility closure operating

losses and expense associated with the closing of The Academy and

FitRx in the fourth quarter of 2015.

Management defines Adjusted Net Income Available to AAC

Holdings, Inc. common stockholders as net income available to AAC

Holdings, Inc. common stockholders adjusted for litigation

settlement and California matter related expense,

acquisition-related expense (which includes professional services

for accounting, legal, valuation services and licensing expenses),

de novo start-up expenses, facility closure operating losses and

expense associated with The Academy and FitRx, redemption of BHR

Series A Preferred Units, and the income tax effect of the non-GAAP

adjustments at the then applicable effective tax rate.

Adjusted diluted earnings per share represents diluted earnings

per share calculated using adjusted net income available to AAC

Holdings, Inc. common stockholders as opposed to net income

available to AAC Holdings, Inc. common stockholders.

With respect to our “2016 Outlook” above, the Company is

omitting a reconciliation of forward-looking non-GAAP financial

measures to the most directly comparable GAAP financial measures

because the Company is unable to provide such reconciliations

without the use of unreasonable efforts. This inability results

from the inherent difficulty in forecasting generally and

quantifying certain projected amounts that are necessary for such

reconciliations. In particular, sufficient information is not

available to calculate certain adjustments required for such

reconciliations, including California litigation expenses and

acquisition-related expenses. We expect these adjustments to have a

potentially significant impact on our future GAAP financial

results.

(1) Balances shown represent recasted amounts as disclosed in

the Company's Current Form 8-k as filed with the SEC on February

23, 2016.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20160804005363/en/

SCR PartnersInvestor Contact:Tripp Sullivan,

615-760-1104IR@contactAAC.comorMedia Contact:Joy Sutton,

615-587-7728Mediarequest@contactAAC.com

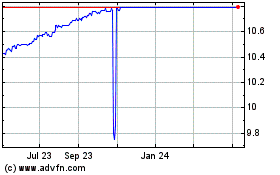

Ares Acquisition (NYSE:AAC)

Historical Stock Chart

From Mar 2024 to Apr 2024

Ares Acquisition (NYSE:AAC)

Historical Stock Chart

From Apr 2023 to Apr 2024