Herbalife Swings to Loss but Boosts Outlook

August 03 2016 - 6:30PM

Dow Jones News

Herbalife Inc. swung to second-quarter loss, hurt by a

settlement with the Federal Trade Commission, but earnings

excluding items were above the company's projections.

Herbalife also increased its full-year adjusted earnings

guidance again.

Shares rose 2.6% to $68.80 in after-hours trading.

Last month, Herbalife agreed to pay $200 million in a settlement

that requires significant changes to its business practices but

allows the nutritional-products company to avoid being classified

as a pyramid scheme.

This was a victory for Herbalife in its long-running battle with

activist investor William Ackman, who has called Herbalife a

"criminal enterprise."

However, the FTC harshly criticized Herbalife's operations and

said the company will need to improve disclosures about its

distributors and sales.

Herbalife projects full-year earnings excluding items of $4.50

to $4.80 a share, up from May guidance of $4.40 to $4.75. It

reaffirmed its outlook for sales growth of 1.5% to 4.5%.

For the third quarter, it expects earnings excluding items of 98

cents to $1.08 a share.

Over all, Herbalife reported a loss of $22.9 million, or 28

cents a share, compared with net income of $82.8 million, or 97

cents a share, a year earlier. Earnings excluding items to rose to

$1.29 a share from $1.24.

Sales rose 3.4% to $1.2 billion. Excluding the impact of

currency, sales grew 10%.

Herbalife had projected earnings excluding items of $1.10 to

$1.20 a share and sales growth of up to 3%.

Write to Josh Beckerman at josh.beckerman@wsj.com

(END) Dow Jones Newswires

August 03, 2016 18:15 ET (22:15 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

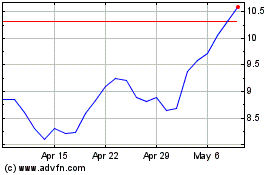

Herbalife (NYSE:HLF)

Historical Stock Chart

From Mar 2024 to Apr 2024

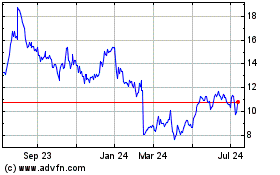

Herbalife (NYSE:HLF)

Historical Stock Chart

From Apr 2023 to Apr 2024