The St. Joe Company (NYSE: JOE) (the “Company”) today announced

Net Income for the second quarter of 2016 of $1.8 million, or $0.02

per share, compared with Net Loss of $(0.2) million, or $(0.00) per

share, for the second quarter of 2015. For the six months ended

June 30, 2016, the Company reported Net Income of $10.5 million, or

$0.14 per share compared to Net Loss of $(2.0) million, or $(0.02)

per share for the same period last year.

Second Quarter highlights include:

- Total revenue for the quarter was $29.5

million as compared to $37.8 million in the second quarter of 2015

due to a decrease in real estate sales and in timber sales

partially offset by an increase in resorts and leisure revenue and

in leasing revenue. The Company’s second quarter 2016 revenue was

generated from $6.7 million of real estate sales, $19.8 million

from resorts and leisure operations, $2.3 million from leasing

operations and $0.7 million from timber sales.

- Real estate sales decreased to $6.7

million in the second quarter of 2016 as compared to $14.0 million

in the second quarter of 2015. Real estate sales in the second

quarter of 2016 were comprised of $5.8 million in residential real

estate sales and $0.9 million in rural land sales. The second

quarter of 2015 included a $5.3 million rural land sale, $4.7

million in commercial real estate sales and $4.0 million in

residential real estate sales. Real estate sales vary significantly

from period to period.

- Resorts and leisure revenue increased

approximately $0.5 million in the second quarter of 2016 to $19.8

million as compared to the second quarter of 2015. The increase

during the second quarter of 2016 as compared to the same period in

2015 was primarily related to increased average room rates at both

the WaterColor Inn and in the vacation rental program as well as an

increase in membership revenue from the St. Joe Club & Resorts

private membership club.

- As of June 30, 2016, the Company had

cash, cash equivalents and investments of $399.8 million, as

compared to $394.9 million as of March 31, 2016, an increase of

$4.9 million. The increase was a result of net receipts from

operations and other activities.

- Other operating and corporate expenses

declined by $2.0 million in the second quarter of 2016 as compared

to the same time last year. The decrease was primarily due to

employee related costs.

Jorge Gonzalez, the Company’s President and Chief Executive

Officer, said, “We are pleased with our financial results through

the first six months of the year. We believe we are making progress

at creating a solid foundation for growth and value while

maintaining a low fixed expense structure.”

FINANCIAL DATA

Consolidated Results

($ in millions except share and per

share amounts)

Quarter

EndedJune 30,

Six Months

EndedJune 30,

2016

2015

2016

2015

Revenues

Real estate sales $6.7 $14.0 $13.8

$19.5 Resorts and leisure revenues 19.8 19.3

28.5 27.1 Leasing revenues 2.3 2.2 4.7

4.2 Timber sales

0.7

2.3

2.8

4.1

Total revenues

29.5

37.8

49.8

54.9

Expenses

Cost of real estate sales 3.0 6.6 4.7

9.7 Cost of resorts and leisure revenues 15.6 14.7

25.0 23.5 Cost of leasing revenues 0.8

0.6 1.5 1.3 Cost of timber sales 0.2

0.3 0.4 0.4 Other operating and corporate expenses

5.7 7.7 12.6 14.8 Depreciation,

depletion and amortization

2.1

2.1

4.4

5.1

Total expenses

27.4

32.0

48.6

54.8

Operating income

2.1

5.8

1.2

0.1

Other income (expense)

0.5

(4.2)

13.1

(1.3)

Income (loss) from operations before equity in income

from unconsolidated affiliates and income taxes

2.6

1.6

14.3

(1.2)

Income tax expense

(1.0)

(1.9)

(4.2)

(0.8)

Net income (loss)

1.6

(0.3)

10.1

(2.0)

Net loss attributable to non-controlling interest

0.2

0.1

0.4

--

Net income (loss) attributable to the Company

1.8

$(0.2)

10.5

$(2.0)

Net income (loss) per share attributable to the Company

$0.02

$(0.00)

$0.14

$(0.02)

Weighted average shares outstanding 74,338,023

92,302,636 74,573,517 92,297,467

Revenues

($ in millions)

Quarter

Ended

June

30,

Year

Ended

June

30,

2016

2015

2016

2015

Revenues:

Real estate sales

Residential $5.8 $4.0 $12.8 $9.5

Commercial -- 4.7 -- 4.7 Other sales

0.9

5.3

1.0

5.3

Total real estate sales 6.7 14.0 13.8

19.5 Resorts and leisure revenues 19.8 19.3

28.5 27.1 Leasing revenues 2.3 2.2 4.7

4.2 Timber sales

0.7

2.3

2.8

4.1

Total revenues

$29.5

$37.8

$49.8

$54.9

Summary Balance Sheet

($ in millions)

June 30,

2016

December 31,

2015

Assets Investment in real

estate, net $310.2 $313.6 Cash and cash equivalents

183.5 212.8 Investments 216.3 191.2

Restricted investments 5.6 7.1 Notes receivable, net

2.4 2.6 Property and equipment, net 9.4

10.1 Claim settlement receivable 12.6 -- Other assets

35.9 36.5 Investments held by special purpose

entities

208.5

208.8

Total assets

$984.4

$982.7

Liabilities and Equity

Debt $54.2 $54.5 Other

liabilities 47.7 41.9 Deferred tax liabilities

37.5 36.8 Senior Notes held by special purpose entity

176.2

176.1

Total liabilities

315.6

309.3

Total equity

668.8

673.4

Total liabilities and equity

$984.4

$982.7

Debt Schedule

($ in millions)

June 30,

2016

December 31,

2015

Pier Park North joint venture

$47.5

$47.5

Community Development District debt

6.7

7.0

Total debt

54.2

$54.5

Other Operating and Corporate

Expenses

($ in millions)

Quarter

Ended

June

30,

Six Months

Ended

June

30,

2016

2015

2016

2015

Employee costs $1.8 $2.9 $3.5 $5.5

401(k) contribution / pension costs -- 0.3 1.4

1.1 Non-cash stock compensation costs 0.1 0.2

0.1 0.2 Property taxes and insurance 1.4

1.4 2.9 2.9 Professional fees 1.2

1.8 2.5 3.0 Marketing and owner association

costs 0.4 0.3 0.7 0.6 Occupancy,

repairs and maintenance 0.1 0.3 0.4 0.5

Other

0.7

0.5

1.1

1.0

Total other operating and corporate expense

$5.7

$7.7

$12.6

$14.8

Additional Information and Where to

Find It

Additional information with respect to the Company’s results for

the second quarter of 2016 will be available in a Form 10-Q that

will be filed with the Securities and Exchange Commission.

Important Notice Regarding

Forward-Looking Statements

This press release includes forward-looking statements,

including statements regarding the Company’s belief that it is

making progress at creating a solid foundation for growth and value

creation. The Company wishes to caution readers that certain

important factors may have affected and could in the future affect

the Company’s actual results and could cause the Company’s actual

results for subsequent periods to differ materially from those

expressed in any forward-looking statement made by or on behalf of

the Company, including (1) any changes in our strategic objectives

or our ability to successfully implement such strategic objectives;

(2) any potential negative impact of our longer-term property

development strategy, including losses and negative cash flows for

an extended period of time if we continue with the self-development

of recently granted entitlements; (3) significant decreases in the

market value of our investments in securities or any other

investments; (4) our ability to capitalize on strategic

opportunities presented by a growing retirement demographic; (5)

our ability to accurately predict market demand for the range of

potential residential and commercial uses of our real estate,

including our Bay-Walton Sector holdings; (6) volatility in the

consistency and pace of our residential real estate sales; (7) any

downturns in real estate markets in Florida or across the nation;

(8) our dependence on the real estate industry and the cyclical

nature of our real estate operations; (9) our ability to

successfully and timely obtain land use entitlements and

construction financing, maintain compliance with state law

requirements and address issues that arise in connection with the

use and development of our land, including the permits required for

mixed-use and active adult communities; (10) changes in laws,

regulations or the regulatory environment affecting the development

of real estate; (11) our ability to effectively deploy and invest

our assets, including our available-for-sale securities; (12) our

ability to effectively manage our real estate assets, as well as

the ability of our joint venture partner to effectively manage the

day-to-day activities of the Pier Park North joint venture; and

(13) increases in operating costs, including costs related to real

estate taxes, owner association fees, construction materials, labor

and insurance, and our ability to manage our cost structure; as

well as, the cautionary statements and risk factor disclosures

contained in the Company’s Securities and Exchange Commission

filings including the Company’s Annual Report on Form 10-K filed

with the Commission on March 2, 2016 as updated by subsequent

Quarterly Reports on Form 10-Qs and other current report

filings.

About The St. Joe

Company

The St. Joe Company together with its consolidated subsidiaries

is a real estate development, asset management and operating

company with real estate assets and operations currently

concentrated primarily between Tallahassee and Destin, Florida.

More information about the Company can be found on its website at

www.joe.com.

© 2016, The St. Joe Company. “St. Joe®”, “JOE®”, the “Taking

Flight” Design®, “St. Joe (and Taking Flight Design)®” are

registered service marks of The St. Joe Company.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20160803006252/en/

The St. Joe CompanyInvestor Relations Contact:Marek Bakun,

1-866-417-7132Chief Financial OfficerMarek.Bakun@Joe.Com

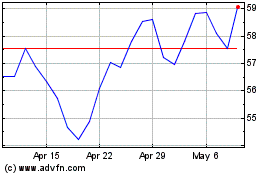

St Joe (NYSE:JOE)

Historical Stock Chart

From Mar 2024 to Apr 2024

St Joe (NYSE:JOE)

Historical Stock Chart

From Apr 2023 to Apr 2024