Archer Daniels Sees Bumper Crops -- WSJ

August 03 2016 - 3:03AM

Dow Jones News

By Jacob Bunge

Commodities giant Archer Daniels Midland Co. projected a bumper

North American corn and soybean crop and said a more-stable U.S.

dollar would help revive grain-trading profit after second-quarter

profit fell.

The Chicago-based company is positioning to export an

anticipated wave of U.S. crops, which executives said could outpace

government projections, after damage to South American harvests

stemmed that region's flow of grains in recent months.

Juan Luciano, ADM's chief executive, told investors market

conditions were beginning "to turn" after a challenging year so

far.

ADM and its chief rivals in global grain markets, including

Cargill Inc., Bunge Ltd. and Louis Dreyfus Co., have been

navigating renewed volatility in trading and processing crops such

as corn, soybeans and wheat. The swings, driven by currency shifts

and bouts of uncooperative weather in South America, have created

opportunities for profitable trading but have also crimped some

South American grain exports and dented processing margins.

For the second quarter, ADM reported a 26% decline in net

income, undershooting analysts' expectations. Shares fell 2.8% to

$43.02, but remain 17% higher this year.

Challenges in ADM's grain-trading and ethanol operations

pressured its earnings, and while ADM executives projected

conditions improving, they said the company aims to press ahead in

reducing costs and emphasizing higher-profit businesses. ADM is in

talks with suitors for a potential deal involving some of its U.S.

ethanol facilities, Mr. Luciano said, as the company seeks to

improve its biofuels returns.

ADM, the largest U.S. ethanol producer in terms of capacity, has

made presentations to seven potential partners for a deal that

could involve a sale of the company's three ethanol-producing dry

mills, executives said, and bids are anticipated by the end of

August. ADM could sell the mills, set up a joint venture or pursue

some other structure, ADM Chief Financial Ray Young said, though if

ADM were offered a good price it is "highly unlikely" ADM would

keep them.

The company scaled back its ethanol production in the second

quarter in response to weak profit margins and high inventories of

the corn-based fuel additive, though ethanol stockpiles declined

toward the end of the quarter, Mr. Luciano said.

In ADM's agricultural services division, which trades grain with

food companies and governments around the world, the U.S. dollar's

stabilization against the currencies of rival breadbasket companies

puts ADM in a stronger position to sell U.S. crops on global

markets over the second half of 2016, Mr. Young said. The unit is

ADM's biggest source of revenue.

Weather problems, particularly in Argentina, slowed a wave of

crop exports from South America and global demand remains "very,

very strong, " Mr. Young said. Those factors put ADM on better

footing for the remainder of the year, with U.S. corn, soybeans and

wheat harvests potentially outpacing what U.S. Department of

Agriculture forecasters already have predicted will be a record

U.S. corn crop and the third-largest soybean harvest in

history.

For the second quarter, ADM earned $284 million, or 48 cents a

share, down from $386 million, or 62 cents a share, a year prior.

Excluding gains on sales and other special items, per-share

earnings fell to 41 cents a share from 60 cents a year before.

Revenue slid 9% to $15.63 billion. Analysts projected per-share

earnings of 45 cents on revenue of $16.97 billion.

--Joshua Jamerson contributed to this article.

Write to Jacob Bunge at jacob.bunge@wsj.com

(END) Dow Jones Newswires

August 03, 2016 02:48 ET (06:48 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

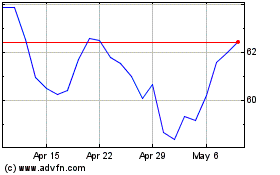

Archer Daniels Midland (NYSE:ADM)

Historical Stock Chart

From Mar 2024 to Apr 2024

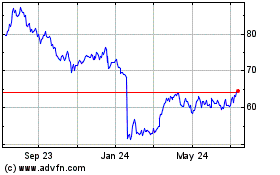

Archer Daniels Midland (NYSE:ADM)

Historical Stock Chart

From Apr 2023 to Apr 2024