AIG's Profit Rises, Despite Lower Premium Volumes

August 02 2016 - 4:59PM

Dow Jones News

By Leslie Scism

American International Group Inc. posted a 6.3% increase in net

income for the second quarter as it deliberately shrank the amount

of insurance sold, part of a strategy to bolster returns and

satisfy activist investors.

The global insurance conglomerate also cut costs aggressively to

bring down expense ratios in its property-casualty insurance

operations in the U.S. and overseas, delivering on another promise

from a Jan. 26 strategy update, back when those investors were

clamoring for a three-way split of the company.

Still, the company's operating income, which is closely watched

by analysts, fell 41%. It was hurt by a sharply higher level of

claims for catastrophes, including the Fort McMurray fires in

Canada, while interest rates that were lower than in the

year-earlier period prompted upward adjustments of some claims

reserves.

The per-share operating results, which exclude realized capital

gains and losses and some other items considered nonrecurring, beat

the consensus expectation of analysts, though they aren't expected

to dwell on the upside surprise in the earnings call Wednesday.

Instead, they will be trying to gain insight about additional moves

by AIG to improve its sluggish stock-market performance.

The results are the first reported since AIG in May added to its

board a representative of billionaire activist Carl Icahn and

hedge-fund manager John Paulson.

In particular, analysts will be seeking more detail on AIG's

promise to return at least $25 billion in share buybacks and

dividends through 2017. It is an ambitious goal that is expected to

be fulfilled in part from divestitures, including the sale of a

stake in AIG's United Guaranty mortgage-insurance unit, possibly

through a public offering later this year.

AIG is also open to an outright sale of the unit, people

familiar with the matter said.

AIG said it returned $3.2 billion of capital to stockholders in

the second quarter, mostly through share buybacks, and had bought

$698 million of common stock since the quarter ended, through Aug.

2. That puts its year-to-date return of capital at $7.9

billion.

The board said in a separate release that it would add $3

billion to its stock buyback plan.

AIG reported a 21% decline in a closely watched measure of

premium volume in its core business of selling property and

casualty insurance to business clients. "Net premiums written" fell

to $4.42 billion, from $5.58 billion. The decrease primarily

occurred as AIG opted not to renew policies in certain poorly

performing product lines, and as the company declined to lower

prices for potential buyers even as some rivals have been hotly

competing for business.

AIG posted net income of $1.91 billion, or $1.68 a share, up

from $1.8 billion, or $1.32 a share, in the year-earlier quarter.

The most-recent results included $928 million of gains from the

sale of shares in PICC Property & Casualty Co., in China.

Operating income clocked in at $1.11 billion, or 98 cents a

share, down from $1.89 billion, or $1.39 a share, in the

year-earlier period. Analysts were expecting 93 cents a share.

AIG Chief Executive Peter Hancock said in the earnings release

that the results "show strong improvement towards all the goals the

board and I announced in January," adding that their confidence "is

high" in hitting financial targets set for 2017.

The concept behind the three-way split advocated by Messrs.

Icahn and Paulson before they joined the board is that AIG could

escape its current designation as a "systemically important"

institution by federal regulators, subject to to-be-determined

capital and other rules.

Mr. Hancock maintains a split isn't in shareholders' best

interests. He promised in the January update to reorganize AIG's

property-casualty and life-insurance operations into nine units,

more sharply cut costs, return more capital to shareholders and

potentially sell any business that underperforms.

--Joann S. Lublin contributed to this article.

Write to Leslie Scism at leslie.scism@wsj.com

(END) Dow Jones Newswires

August 02, 2016 16:44 ET (20:44 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

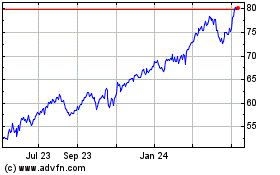

American (NYSE:AIG)

Historical Stock Chart

From Mar 2024 to Apr 2024

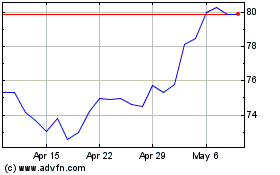

American (NYSE:AIG)

Historical Stock Chart

From Apr 2023 to Apr 2024