Current Report Filing (8-k)

August 02 2016 - 4:32PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): August 1, 2016

Palatin Technologies, Inc.

(Exact name of registrant as specified in its charter)

|

Delaware

|

001-15543

|

95-4078884

|

|

(State or other jurisdiction

|

(Commission

|

(IRS employer

|

|

of incorporation)

|

File Number)

|

identification number)

|

|

4B Cedar Brook Drive, Cranbury, NJ

|

08512

|

|

(Address of principal executive offices)

|

(Zip Code)

|

Registrant's telephone number, including area code:

(609) 495-2200

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

[ ] Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

[ ] Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

[ ] Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

[ ] Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Item 1.01 Entry into a Material Definitive Agreement.

On August 1, 2016, Palatin Technologies, Inc. (the “

Company

”) entered into an underwriting agreement (the “

Underwriting Agreement

”) with Canaccord

Genuity Inc., on behalf of itself and as representative of the underwriters named therein (the “

Underwriters

”) relating to the public offering (the “

Offering

”) of $9.225 million aggregate principal amount of Series A Units and Series B Units. Each Series A Unit consists of (i) one share of the Company’s

common stock, par value $0.01 per share (“

Common Stock”),

and (ii) one Series H Warrant to purchase 0.75 of a share of Common Stock (the “

Series H Warrants

”). The Company also offered to those purchasers whose purchase of Series A Units in this offering would result in the purchaser, together with its affiliates

and certain related parties, beneficially owning more than 9.99% of the Company’s outstanding Common Stock following the consummation of the offering, in lieu of Series A Units that would otherwise result in ownership in excess of 9.99% of the Company’s outstanding Common Stock, Series B units (the “

Series B

Units

”

and together with the Series A Units, the “

Units

”), with each Series B Unit consisting of (i) one pre-funded Series I Warrant to purchase one share of Common Stock (the “

Series I Warrants

” and together with the Series H Warrants, the “

Warrants

”)

and (ii) one Series H Warrant.

The Series A Units will be sold at a price to the public of $0.675, and the Series B Units will be sold at a price to the public of $0.665. The net proceeds to the Company from the sale of the Units, after deducting the Underwriters’ discounts and commissions and other estimated offering expenses payable by the Company, are expected to be approximately

$8.5 million. The Offering is expected to close on or about August 4, 2016, subject to the satisfaction of customary closing conditions.

The Series I Warrants are immediately exercisable at an exercise price of $0.01 per share, subject to adjustment, and expire ten years from the date of issuance. The Series I Warrants are subject to

an initial limitation on exercise if the holder and its affiliates would beneficially own more than 9.99% of the total number of shares of

our Common Stock of the Company

.

The holder may increase or decrease this beneficial ownership limitation to any other percentage of the number of our Common Shares outstanding immediately after the exercise not in excess of 9.99% upon, in the case of an increase, not less than 61 days’ prior written notice.

The Series H Warrants are exercisable beginning six months following the date of issuance at an exercise price of $0.70 per share, subject to adjustment, and expire five years from the date of issuance. The Series H Warrants are subject to the same beneficial ownership limitations on exercise as the Series I Warrants.

The foregoing descriptions of the Underwriting Agreement and the Units are not complete and are qualified in their entireties by reference to the full text of the Underwriting Agreement, the Series H Warrant and the Series I Warrant, copies of which are filed as Exhibit 1.1, Exhibit 4.1, Exhibit 4.2, respectively, to this report and are incorporated by reference

herein.

The Units are being offered and sold pursuant to a prospectus, dated August 18, 2015, and a prospectus supplement relating to the Units, dated August 1, 2016, in connection with a takedown from the Company’s shelf registration statement on Form S-3 (File No. 333-206047), declared effective by the United States Securities and Exchange

Commission on August 18, 2015.

Item 8.01 Other Events.

On August 1, 2016, the Company issued a press release announcing the pricing of the Offering. A copy of the press release is filed as Exhibit 99.1 to this Current Report on Form 8-K and is incorporated herein by reference.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits:

|

1.1

|

Underwriting Agreement, dated August 1, 2016, by and between Palatin Technologies, Inc. and Canaccord Genuity Inc., on behalf of itself and as representative of the underwriters named therein.

|

|

4.1

|

Form of Series H Warrant.

|

|

4.2

|

Form of Series I Warrant.

|

|

5.1

|

Opinion of Thompson Hine LLP, dated August 1, 2016.

|

|

23.1

|

Consent of Thompson Hine LLP (including in Exhibit 5.1 above).

|

|

99.1

|

Press Release, dated August 1, 2016.

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

PALATIN TECHNOLOGIES, INC.

|

|

|

|

|

|

|

Date: August 2, 2016

|

By:

|

/s/ Stephen T. Wills

|

|

|

|

|

Stephen T. Wills, CPA, MST

Executive Vice President, Chief Financial Officer and Chief Operating Officer

|

|

EXHIBIT INDEX

|

1.1

|

Underwriting Agreement, dated August 1, 2016, by and between Palatin Technologies, Inc. and Canaccord Genuity Inc., on behalf of itself and as representative of the underwriters named therein.

|

|

4.1

|

Form of Series H Warrant.

|

|

4.2

|

Form of Series I Warrant.

|

|

5.1

|

Opinion of Thompson Hine LLP, dated August 1, 2016.

|

|

23.1

|

Consent of Thompson Hine LLP (including in Exhibit 5.1 above).

|

|

99.1

|

Press Release, dated August 1, 2016.

|

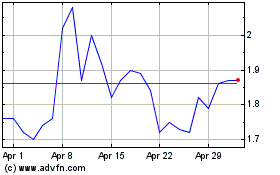

Palatin Technologies (AMEX:PTN)

Historical Stock Chart

From Mar 2024 to Apr 2024

Palatin Technologies (AMEX:PTN)

Historical Stock Chart

From Apr 2023 to Apr 2024