U.K. Bank Shares Slip as Regulator Proposes Later Compensation Deadline

August 02 2016 - 5:19AM

Dow Jones News

By Max Colchester

LONDON--A U.K. regulator proposed to put a deadline on a

multibillion U.K. bank customer compensation program in 2019, a

year later than planned.

The Financial Conduct Authority said Tuesday that banks who had

sold customers insurance they didn't need would continue

compensating people until June 2019. So far banks have forked over

GBP24.5 billion ($32.34 billion) to people who bought the insurance

product, known as Payment Protection Insurance.

PPI was sold to cover mortgage, auto and other loan payments if

the borrower lost a job or fell ill. Many people didn't need the

insurance or could actually claim on it. U.K. bank shares dropped

in morning trading Tuesday amid investors' concerns that banks will

have to put aside hundreds of millions of pounds to cover the extra

compensation. Lloyds Banking Group PLC, for instance, only

provisioned for the claims until mid-2018.

Lloyds said it was "disappointed" that the deadline won't come

into force until 2017 adding that its guidance for provision

remained unchanged.

For years banks have lobbied regulators to stop the vast

payouts. Last year the FCA said the deadline could be at the end of

2018, but this has now been pushed back. The FCA on Tuesday

confirmed it will put in place a time bar but will continue to

consult on how it should be applied. A final decision is expected

in October.

"Putting a deadline on PPI complaints will bring the issue to an

orderly conclusion," said Andrew Bailey, chief executive of the

FCA.

Banks will also have to payout extra compensation for not being

transparent about the commissions involved in product sales. A

supreme court ruled in November 2014 that a loans company unfairly

sold a PPI policy because it didn't disclose the large commission

it and a broker received.

A rule on how that compensation will be paid out will be

outlined by the end of the year and implemented by March 2017. An

ad campaign will herald the deadline which would then come into

force end of June 2019.

Such is the scale of the payouts that some economists credited

it with bolstering the U.K.'s economy and boosting household

spending on items like cars and vacations. It also created an

industry with thousands of people employed by claims management

firms who offer to file complaints on customers' behalf.

Write to Max Colchester at max.colchester@wsj.com

(END) Dow Jones Newswires

August 02, 2016 05:04 ET (09:04 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

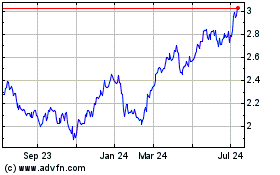

Lloyds Banking (NYSE:LYG)

Historical Stock Chart

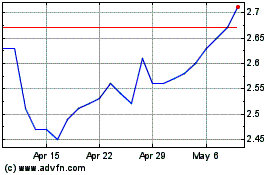

From Mar 2024 to Apr 2024

Lloyds Banking (NYSE:LYG)

Historical Stock Chart

From Apr 2023 to Apr 2024