Statoil Sheds US Marcellus Assets to Free Up Cash

August 01 2016 - 3:42AM

Dow Jones News

By Kjetil Malkenes Hovland

OSLO--Norway's Statoil ASA (STO) said Monday it had sold onshore

assets in the U.S. Marcellus shale formation to Antero Resources

Corp. for $96 million in cash, to free up capital for other uses,

its third divestment in the Marcellus in two years.

The 67% state-owned Norwegian oil and gas producer said the

assets were operated by Southwestern Energy Co., which sold its

share in the same assets to Antero two months ago.

The divested area of 11,500 acres is mainly located in the

Wetzel, Tyler and Doddridge counties, and Statoil's average working

interest is 19%, Statoil said.

Since December 2014, Statoil has divested nearly $900 million

worth of Marcellus assets, including a $394 million sale of a stake

in the southwestern Marcellus to Southwestern Energy Co. and a $407

million sale of operated properties in West Virginia to EQT

Corp.

Statoil said the transaction would increase its financial

flexibility and free up cash for core activities. The company

retains its operated assets in the Marcellus, it said.

Statoil entered Marcellus and the U.S. shale industry through a

2008 joint venture with Chesapeake Energy Corp. and in 2012 became

an operator in the area through the acquisition of additional

acreage in a liquids-rich part of the formation.

Write to Kjetil Malkenes Hovland at

kjetilmalkenes.hovland@wsj.com

(END) Dow Jones Newswires

August 01, 2016 03:27 ET (07:27 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

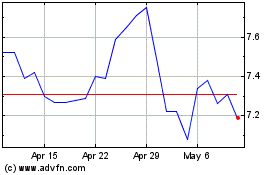

Southwestern Energy (NYSE:SWN)

Historical Stock Chart

From Mar 2024 to Apr 2024

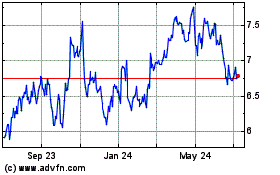

Southwestern Energy (NYSE:SWN)

Historical Stock Chart

From Apr 2023 to Apr 2024