Current Report Filing (8-k)

July 29 2016 - 8:32AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 8-K

CURRENT REPORT

PURSUANT

TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): July 27, 2016

McKesson Corporation

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

Delaware

|

|

1-13252

|

|

94-3207296

|

|

(State or other jurisdiction

of incorporation)

|

|

(Commission

File Number)

|

|

(I.R.S. Employer

Identification No.)

|

|

|

|

|

|

One Post Street, San Francisco, California

|

|

94104

|

|

(Address of principal executive offices)

|

|

(Zip Code)

|

Registrant’s telephone number, including area code: (415) 983-8300

Not Applicable

(Former

name or former address, if changed since last report.)

Check the appropriate box below

if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

¨

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

¨

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

¨

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

¨

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Item 5.07 Submission of Matters to a Vote of Security Holders.

On July 27, 2016, the following five items were voted on at the 2016 Annual Meeting of Stockholders (the “2016 Annual Meeting”) of McKesson

Corporation (the “Company”), and the stockholder votes on each such matter, as certified by the Inspector of Election, are set forth below.

Item

1

. The Board of Directors’ nominees for directors, as listed in Company’s definitive proxy statement filed with the

U.S. Securities and Exchange Commission on June 17, 2016 (the “Definitive Proxy Statement”), were each elected to serve a one-year term. The votes were as follows:

1

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Director Nominee

|

|

Votes For

|

|

|

Votes Against

|

|

|

Abstentions

|

|

|

Broker Non-Votes

|

|

|

Andy D. Bryant

|

|

|

179,111,164

|

|

|

|

3,630,157

|

|

|

|

647,163

|

|

|

|

17,827,608

|

|

|

Wayne A. Budd

|

|

|

178,603,191

|

|

|

|

3,489,742

|

|

|

|

1,295,551

|

|

|

|

17,827,608

|

|

|

N. Anthony Coles, M.D.

|

|

|

179,495,798

|

|

|

|

3,226,646

|

|

|

|

666,040

|

|

|

|

17,827,608

|

|

|

John H. Hammergren

|

|

|

176,061,621

|

|

|

|

6,309,114

|

|

|

|

1,017,749

|

|

|

|

17,827,608

|

|

|

M. Christine Jacobs

|

|

|

177,056,758

|

|

|

|

5,637,493

|

|

|

|

694,233

|

|

|

|

17,827,608

|

|

|

Donald R. Knauss

|

|

|

181,749,864

|

|

|

|

970,207

|

|

|

|

668,413

|

|

|

|

17,827,608

|

|

|

Marie L. Knowles

|

|

|

180,300,480

|

|

|

|

2,430,160

|

|

|

|

657,844

|

|

|

|

17,827,608

|

|

|

Edward A. Mueller

|

|

|

178,263,980

|

|

|

|

4,444,976

|

|

|

|

679,528

|

|

|

|

17,827,608

|

|

|

Susan R. Salka

|

|

|

182,132,943

|

|

|

|

584,392

|

|

|

|

671,149

|

|

|

|

17,827,608

|

|

Item

2

. The appointment of Deloitte & Touche LLP as the Company’s independent registered

public accounting firm for the fiscal year ending March 31, 2017 was ratified, having received the following votes:

2

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Votes For

|

|

Votes Against

|

|

|

Abstentions

|

|

|

Broker Non-Votes

|

|

|

197,825,680

|

|

|

2,376,563

|

|

|

|

1,013,849

|

|

|

|

—

|

|

Item

3

. The proposal to approve, on an advisory basis, the compensation of the Company’s named

executive officers was approved, having received the following votes:

2

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Votes For

|

|

Votes Against

|

|

|

Abstentions

|

|

|

Broker Non-Votes

|

|

|

147,295,872

|

|

|

34,891,957

|

|

|

|

1,200,655

|

|

|

|

17,827,608

|

|

Item

4

. The stockholder-submitted proposal on accelerated vesting of equity awards was not approved,

having received the following votes:

2

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Votes For

|

|

Votes Against

|

|

|

Abstentions

|

|

|

Broker Non-Votes

|

|

|

50,361,445

|

|

|

132,071,176

|

|

|

|

955,863

|

|

|

|

17,827,608

|

|

Item 5

. The stockholder-submitted proposal on disclosure of political contributions and expenditures was not approved,

having received the following votes:

2

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Votes For

|

|

Votes Against

|

|

|

Abstentions

|

|

|

Broker Non-Votes

|

|

|

64,654,850

|

|

|

80,951,553

|

|

|

|

37,782,081

|

|

|

|

17,827,608

|

|

Each of the items considered at the 2016 Annual Meeting is described in further detail in the Definitive Proxy

Statement. No item other than the five items addressed above and described in the Definitive Proxy Statement was submitted at the 2016 Annual Meeting for stockholder action.

1

Under the Company’s majority voting standard, the election of a nominee required that the nominee

receive a majority of the votes cast (that is, the number of votes cast “for” each nominee had to exceed the number of votes cast “against” such nominee). Therefore, abstentions and broker non-votes were required to be

disregarded and had no effect on the vote results.

2

Approval of each proposal with this footnote

designation required the affirmative vote of a majority of the shares present, in person or by proxy, and entitled to vote on the proposal at the 2016 Annual Meeting. Therefore, abstentions, which represented shares present and entitled to vote, had

the same effect as a vote against the proposal. Broker non-votes, if any, were required to be disregarded and had no effect on the vote results.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned

hereunto duly authorized.

|

|

|

|

|

|

|

|

|

Date: July 29, 2016

|

|

McKesson Corporation

|

|

|

|

|

|

|

|

|

By:

|

|

|

|

/s/ Lori A. Schechter

|

|

|

|

|

|

|

|

Lori A. Schechter

|

|

|

|

|

|

|

|

Executive Vice President, General Counsel and

|

|

|

|

|

|

|

|

Chief Compliance Officer

|

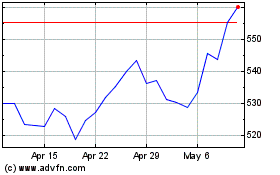

McKesson (NYSE:MCK)

Historical Stock Chart

From Mar 2024 to Apr 2024

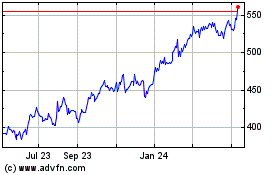

McKesson (NYSE:MCK)

Historical Stock Chart

From Apr 2023 to Apr 2024