Hovnanian Enterprises, Inc. (NYSE:HOV) (the “Company”) announced

today that its wholly-owned subsidiary, K. Hovnanian Enterprises,

Inc. (“K. Hovnanian”), has commenced a tender offer (the “Tender

Offer”) to purchase for cash any and all of its 8.625% Senior Notes

due 2017 (the “Notes”) on the terms and subject to the conditions

set forth in an Offer to Purchase and Consent Solicitation

Statement, dated July 29, 2016 (as it may be amended or

supplemented from time to time, the “Statement”), and in the

related Letter of Transmittal and Consent (as it may be amended or

supplemented from time to time, the “Letter of Transmittal” and

collectively with the Statement, the “Tender Offer

Documents”). Concurrently with the Tender Offer, and on the

terms and subject to the conditions set forth in the Statement, K.

Hovnanian is soliciting consents (the “Consent Solicitation”) of

holders of the Notes to proposed amendments to the indenture

governing the Notes (the “Notes Indenture”), providing for the

elimination of most of the restrictive covenants and certain events

of default contained therein. Holders that tender Notes must

also consent to such proposed amendments to the Notes Indenture in

order to tender their Notes.

The Tender Offer will expire at 8:30 a.m., New York City time,

on September 7, 2016, unless extended or earlier terminated (the

“Expiration Time”). Holders of the Notes must validly tender

their Notes at or before 5:00 p.m., New York City time, on August

11, 2016, unless extended or earlier terminated (the “Early Tender

Deadline”) in order to be eligible to receive the Total

Consideration (as defined below), which includes the Early Tender

Payment (as defined below). Notes tendered may be withdrawn

at any time at or before 5:00 p.m., New York City time on August

11, 2016 unless extended (the “Withdrawal Deadline”), but not

thereafter, unless required by applicable law.

The total consideration for each $1,000 principal amount of

Notes validly tendered and not withdrawn at or before the Early

Tender Deadline and purchased pursuant to the Tender Offer will be

$1,010.00 (the “Total Consideration”). The Total

Consideration includes a payment of $30.00 per $1,000 principal

amount of Notes (the “Early Tender Payment”) payable only in

respect of Notes tendered with consents at or before the Early

Tender Deadline. Holders validly tendering Notes after the

Early Tender Deadline but at or before the Expiration Time will be

eligible to receive only the tender offer consideration of $980.00

per $1,000 principal amount of Notes (the “Tender Offer

Consideration”), namely an amount equal to the Total Consideration

less the Early Tender Payment. In addition to the Total

Consideration or Tender Offer Consideration, as applicable, all

holders whose Notes are purchased in the Tender Offer will receive

accrued and unpaid interest in respect of their purchased Notes

from the most recent interest payment date to, but not including,

the payment date for Notes purchased in the Tender Offer.

Subject to the terms and conditions of the Tender Offer being

satisfied or waived (if applicable), K. Hovnanian will, after the

Expiration Time (the “Acceptance Date”), accept for purchase all

Notes validly tendered at or prior to the Expiration Time (and not

validly withdrawn before the Withdrawal Deadline). K.

Hovnanian will pay the Total Consideration or Tender Offer

Consideration, as the case may be, for, and accrued and unpaid

interest on, the Notes accepted for purchase at the Acceptance Date

on a date that is on or promptly following the Acceptance Date.

K. Hovnanian’s obligation to accept for purchase, and to pay

for, Notes validly tendered and not validly withdrawn pursuant to

the Tender Offer is conditioned upon the satisfaction or, if

applicable, waiver of certain conditions, which are more fully

described in the Tender Offer Documents, including, among others,

K. Hovnanian’s receipt (1) of consents of holders of at least a

majority in principal amount of the outstanding Notes to the

proposed amendments to the Notes Indenture, (2) of Notes tenders in

the Tender Offer in an amount equal to at least 90% of the

aggregate outstanding principal amount of the outstanding Notes as

of the date of the Statement and (3) of aggregate net cash proceeds

from certain privately placed financings described below to fund

the aggregate Total Consideration plus accrued and unpaid interest

in respect of all Notes.

Credit Suisse Securities (USA) LLC and Merrill Lynch, Pierce,

Fenner & Smith Incorporated are serving as dealer managers for

the Tender Offer and the solicitation agents for the Consent

Solicitation. Global Bondholder Services Corporation is

serving as the depositary and the information agent for the Tender

Offer and Consent Solicitation. Any question regarding

procedures for tendering Notes may be directed to Global Bondholder

Services by phone at 866-470-4300 (toll free) or

212-430-3774. Questions regarding the terms of the Tender

Offer and Consent Solicitation may be directed to Credit Suisse

Securities (USA) LLC by phone toll free at 800-820-1653 or collect

at 212-325-2476 and Merrill Lynch, Pierce, Fenner & Smith

Incorporated by phone toll free at 888-292-0070 or collect at

646-855-2464.

Concurrently with the Tender Offer and Consent Solicitation, the

Company and K. Hovnanian are entering into financing commitments

with affiliates of a certain investment manager (collectively, the

“Investor”) pursuant to which the Investor will fund a $75.0

million senior secured term loan facility (the “Term Loan

Facility”) with a scheduled maturity in August 2019 and bearing

interest at a rate equal to LIBOR plus an applicable margin of

7.00% or, at K. Hovnanian’s option, a base rate plus an applicable

margin of 6.00% and $75.0 million aggregate principal amount of

10.00% senior secured second lien notes due October 2018 (the

“Second Lien Notes”) and the Investor will exchange $75.0 million

aggregate principal amount of its existing 9.125% senior secured

second lien notes due November 2020 for $75.0 million of K.

Hovnanian’s newly issued 9.50% senior secured first priority notes

due November 2020 (the “Exchange Notes”).

All of K. Hovnanian’s obligations under the Term Loan Facility

and the Second Lien Notes will be guaranteed by the Company and

substantially all of its subsidiaries, other than its home mortgage

subsidiaries, certain of its title insurance subsidiaries, joint

ventures, subsidiaries holding interests in joint ventures and its

foreign subsidiary. The Term Loan Facility and the guarantees

thereof will be secured on a first lien super priority basis in

relation to K. Hovnanian’s existing 7.25% senior secured first lien

notes due October 2020, and the Second Lien Notes and the

guarantees thereof will be secured on a pari passu second lien

basis with K. Hovnanian’s existing 9.125% senior secured second

lien notes due November 2020, by substantially all of the assets

owned by K. Hovnanian and the guarantors, in each case subject to

permitted liens and certain exceptions.

The Exchange Notes will be guaranteed by the Company and all of

its subsidiaries that will guarantee the Term Loan Facility and the

Second Lien Notes as well as K. Hovnanian JV Holdings, L.L.C. and

its subsidiaries, except for certain joint ventures and joint

venture holding companies (the “Secured Group”). The Exchange

Notes will be secured on a pari passu first lien basis with K.

Hovnanian’s 2.0% senior secured first lien notes due November 2021

and 5.0% senior secured first lien notes due November 2021, by

substantially all of the assets of the members of the Secured

Group, subject to permitted liens and certain exceptions.

The closing of the financings is subject to certain terms and

conditions, including requiring K. Hovnanian to use the net cash

proceeds from the financings in excess of the aggregate amount of

funds needed to consummate the Tender Offer and Consent

Solicitation to repurchase or otherwise retire, discharge or

defease K. Hovnanian’s debt securities with maturities in 2017 or,

as agreed between the Investor and K. Hovnanian, its other

indebtedness. The closing of the financings is expected to

occur on the date of closing of the Tender Offer and Consent

Solicitation.

This press release is neither an offer to purchase or sell nor a

solicitation of an offer to sell or buy the Notes or any other

securities of the Company, including the securities to be issued in

the new financings. This press release also is not a

solicitation of consents to the proposed amendments to the Notes

Indenture. The Tender Offer and Consent Solicitation are

being made solely on the terms and subject to the conditions set

forth in the Tender Offer Documents and the information in this

press release is qualified by reference to such Tender Offer

Documents.

The Second Lien Notes and the Exchange Notes have not been and

will not be registered under the Securities Act of 1933, as amended

(the “Securities Act”), or any state securities laws. The

Second Lien Notes and the Exchange Notes may not be offered or sold

within the United States or to U.S. persons, except pursuant to an

exemption from, or in a transaction not subject to, the

registration requirements of the Securities Act and applicable

state securities laws. This press release does not constitute

an offer to sell or the solicitation of an offer to buy the Second

Lien Notes, the Exchange Notes or any other securities of K.

Hovnanian or the Company.

About Hovnanian Enterprises

Hovnanian Enterprises, Inc., founded in 1959 by Kevork S.

Hovnanian, is headquartered in Red Bank, New Jersey. The Company is

one of the nation’s largest homebuilders with operations in

Arizona, California, Delaware, Florida, Georgia, Illinois,

Maryland, New Jersey, Ohio, Pennsylvania, South Carolina, Texas,

Virginia, Washington, D.C. and West Virginia. The Company’s homes

are marketed and sold under the trade names K. Hovnanian® Homes,

Brighton Homes® and Parkwood Builders. As the developer of K.

Hovnanian’s® Four Seasons communities, the Company is also one of

the nation’s largest builders of active lifestyle communities.

Forward-Looking Statements

All statements in this press release that are not historical

facts should be considered as “Forward-Looking Statements”. Such

statements involve known and unknown risks, uncertainties and other

factors that may cause actual results, performance or achievements

of the Company to be materially different from any future results,

performance or achievements expressed or implied by the

forward-looking statements. Although we believe that our plans,

intentions and expectations reflected in, or suggested by, such

forward-looking statements are reasonable, we can give no assurance

that such plans, intentions or expectations will be achieved. By

their nature, forward-looking statements: (i) speak only as of the

date they are made, (ii) are not guarantees of future performance

or results and (iii) are subject to risks, uncertainties and

assumptions that are difficult to predict or quantify. Therefore,

actual results could differ materially and adversely from those

forward-looking statements as a result of a variety of factors.

Such risks, uncertainties and other factors include, but are not

limited to, (1) changes in general and local economic, industry and

business conditions and impacts of the sustained homebuilding

downturn; (2) adverse weather and other environmental conditions

and natural disasters; (3) levels of indebtedness and restrictions

on the Company’s operations and activities imposed by the

agreements governing the Company’s outstanding indebtedness; (4)

the Company's sources of liquidity; (5) changes in credit ratings;

(6) changes in market conditions and seasonality of the Company’s

business; (7) the availability and cost of suitable land and

improved lots; (8) shortages in, and price fluctuations of, raw

materials and labor; (9) regional and local economic factors,

including dependency on certain sectors of the economy, and

employment levels affecting home prices and sales activity in the

markets where the Company builds homes; (10) fluctuations in

interest rates and the availability of mortgage financing; (11)

changes in tax laws affecting the after-tax costs of owning a home;

(12) operations through joint ventures with third parties; (13)

government regulation, including regulations concerning development

of land, the home building, sales and customer financing processes,

tax laws and the environment; (14) product liability litigation,

warranty claims and claims made by mortgage investors; (15) levels

of competition; (16) availability and terms of financing to the

Company; (17) successful identification and integration of

acquisitions; (18) significant influence of the Company’s

controlling stockholders; (19) availability of net operating loss

carryforwards; (20) utility shortages and outages or rate

fluctuations; (21) geopolitical risks, terrorist acts and other

acts of war; (22) increases in cancellations of agreements of sale;

(23) loss of key management personnel or failure to attract

qualified personnel; (24) information technology failures and data

security breaches; (25) legal claims brought against us and not

resolved in our favor; and (26) certain risks, uncertainties and

other factors described in detail in the Company’s Annual Report on

Form 10-K for the fiscal year ended October 31, 2015 and subsequent

filings with the Securities and Exchange Commission. Except as

otherwise required by applicable securities laws, we undertake no

obligation to publicly update or revise any forward-looking

statements, whether as a result of new information, future events,

changed circumstances or any other reason.

Contact: J. Larry Sorsby

Executive Vice President & CFO

732-747-7800

Jeffrey T. O’Keefe

Vice President of Investor Relations

732-747-7800

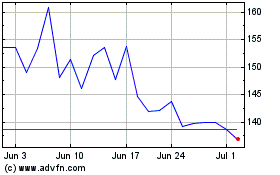

Hovnanian Enterprises (NYSE:HOV)

Historical Stock Chart

From Mar 2024 to Apr 2024

Hovnanian Enterprises (NYSE:HOV)

Historical Stock Chart

From Apr 2023 to Apr 2024