Statoil Agrees on $2.5 Billion Deal for Brazil Oil License -- Update

July 29 2016 - 5:28AM

Dow Jones News

By Kjetil Malkenes Hovland

OSLO--Norway's Statoil ASA said Friday it will acquire a 66%

stake in a Brazil offshore license from Petróleo Brasileiro SA for

$2.5 billion to strengthen its production into the next decade.

Statoil said the BM-S-8 offshore license includes a substantial

part of the Carcará oil field in the Santos basin, one of the

world's largest discoveries in recent years. The company estimated

the license covers recoverable volumes of 700 million to 1.3

billion barrels of oil equivalent.

Brazil's Petrobras, the most indebted oil firm in the world, has

pledged to divest more than $15 billion in assets by the end of

this year in an effort to pay down its debts, but ahead of today's

announcement it had only managed to raise about $2 billion.

The acquisition also comes at a time of rising debt for 67%

state-owned Statoil, which continues to pay dividends to

shareholders and invest in new production. Its debt ratio--debt as

a share of its capital--stood at 31.2% at the end of the first

quarter, up from 22.4% a year earlier.

Statoil said its debt would rise to 32.7% after the transaction,

but it had achieved a competitive price. Brent crude is trading

slightly below $43 a barrel, less than half its levelof two years

ago, and many companies are divesting assets to fund capital

spending and dividends, or to service debt.

"Our balance sheet is still strong, and the timing for such a

transaction is very good in our minds. It's countercyclical," said

Tim Dodson, Statoil's head of exploration. "The value of this asset

will only increase as the oil price recovers."

Statoil shares dropped 0.4% in early trading after the

announcement.

"Although we find Statoil's increase in Brazilian exposure

appealing, we do not believe the market will applaud a $2.5 billion

increase in net debt at this point," said Arctic Securities analyst

Christian Yggeseth.

Statoil said it would pay half the acquisition amount on closing

the transaction, and the remainder when certain milestones have

been met, mainly related to a future agreement on the ownership of

the Carcará field.

Brazil's offshore oil business fits well with the Norwegian oil

and gas producer's wide experience from drilling offshore fields on

the Norwegian continental shelf. Statoil has been in Brazil for 15

years and is the operator and 60% owner of the Peregrino field

which is currently pumping 100,000 barrels a day.

Write to Kjetil Malkenes Hovland at

kjetilmalkenes.hovland@wsj.com

(END) Dow Jones Newswires

July 29, 2016 05:13 ET (09:13 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

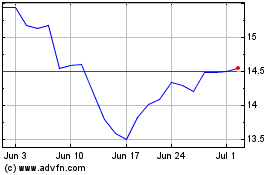

Petroleo Brasileiro ADR (NYSE:PBR)

Historical Stock Chart

From Mar 2024 to Apr 2024

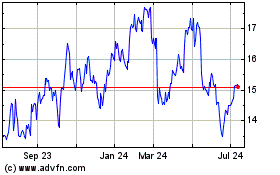

Petroleo Brasileiro ADR (NYSE:PBR)

Historical Stock Chart

From Apr 2023 to Apr 2024