Wynn Resorts Tops Wall Street Views, Helped by Strong Macau Revenue -- Update

July 28 2016 - 6:16PM

Dow Jones News

By Josh Beckerman

Wynn Resorts Ltd. posted second-quarter results above Wall

Street estimates as revenue from Macau operations increased

following seven quarterly declines.

More than half of Wynn's revenue has been from Macau, where the

gambling industry has suffered in recent years as a corruption

crackdown in China has been linked to a decline in business.

Wynn's total net revenue increased to $1.06 billion from $1.04

billion, while analysts polled by Thomson Reuters had projected

$1.02 billion.

Macau revenue rose 3.6% to $639.3 million from $617 million.

Still, revenue from the company's Las Vegas operations fell 1.1% to

$419 million from $423.5 million.

Over all, the company posted a profit of $70.4 million, up from

$56.5 million a year earlier. On a per-share basis, earnings

increased to 69 cents from 56 cents. On an adjusted basis, earnings

were $1.07 a share, topping Wall Street's expectations of 91

cents.

Las Vegas table games drop was $427.4 million, down 16.1%. On

Monday, Las Vegas Sands said its own table games drop in the second

quarter fell 19.7% to $374.8 million.

Shares of the company fell 6.8% to $97.50 after hours.

Fitch Ratings affirmed Wynn's ratings in May and again in July,

then withdrew the ratings "for commercial reasons." Fitch said in

May that it had a favorable view of the company's development

pipeline, including Wynn Boston Harbor.

The company's Wynn Palace casino resort in Macau is scheduled to

open Aug. 22, following two delays for the $4 billion project.

Revenue per available room fell 5.2% to $294 in Macau and rose

3.1% to $263 in Las Vegas.

Write to Josh Beckerman at josh.beckerman@wsj.com

(END) Dow Jones Newswires

July 28, 2016 18:01 ET (22:01 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

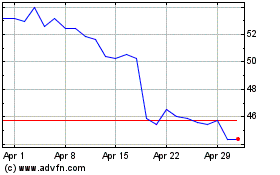

Las Vegas Sands (NYSE:LVS)

Historical Stock Chart

From Mar 2024 to Apr 2024

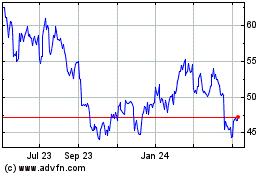

Las Vegas Sands (NYSE:LVS)

Historical Stock Chart

From Apr 2023 to Apr 2024