Expedia Revenue Misses Analysts' Estimates

July 28 2016 - 5:30PM

Dow Jones News

Online travel company Expedia Inc. on Thursday said it was

considering taking Trivago public.

The disclosure came as the company reported second-quarter

results that missed analysts' projections, sending shares down 4%

in after-hours trading to $114.

Expedia bought a majority stake in German startup Trivago in

2012. Trivago, which in the most recent period reported a 42%

increase in revenue to $201 million, focuses on metasearch,

allowing consumers to quickly compare rates and availability across

booking sites.

Launched in 1996 by a small division of Microsoft Corp., Expedia

went public in 1999. Billionaire Barry Diller, who's served as

chairman and senior executive since the company's 2005 spinoff from

his media conglomerate IAC/InterActiveCorp., retains voting control

through a proxy agreement with John Malone's Liberty Interactive

Corp. In March, Mr. Malone's company filed to spin off its position

in Expedia, paving the way for Expedia to buy the stake.

Over all, Expedia reported a profit of $31.6 million, or 21

cents a share, compared with $449.6 million, or $3.38 a share, a

year earlier. Excluding stock-based compensation and other items,

profit was 83 cents a share, down from 89 cents a year earlier.

The year-ago results had been even bolstered by the sale of its

equity stake in eLong Inc.

Revenue rose to $2.2 billion, with HomeAway adding $172

million.

Analysts surveyed by Thomson Reuters had projected 78 cents a

share in adjusted profit on $2.25 billion in revenue.

Gross bookings rose 25%, driven by room rentals even as the

company made less money on average from each rental. The amount of

money Expedia makes from each room rental is expected to continue

to fall on a year-over-year basis for the rest of the year.

Hotel revenue, which accounts for 61% of overall revenue, rose

14%. Meanwhile, air revenue rose 50% and advertising and media

revenue rose 42%.

Write to Maria Armental at maria.armental@wsj.com

(END) Dow Jones Newswires

July 28, 2016 17:15 ET (21:15 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

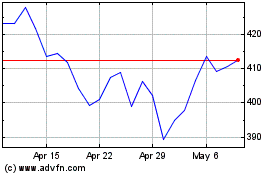

Microsoft (NASDAQ:MSFT)

Historical Stock Chart

From Mar 2024 to Apr 2024

Microsoft (NASDAQ:MSFT)

Historical Stock Chart

From Apr 2023 to Apr 2024