As filed with the Securities and Exchange Commission on July 28, 2016

Registration No. 333-______

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

______________________________________________________________________________________________________

FORM S-8

REGISTRATION STATEMENT

Under

The Securities Act of 1933

______________________________________________________________________________________________________

FALCONSTOR SOFTWARE, INC.

|

|

|

|

|

|

|

|

|

|

Delaware

(State or other jurisdiction of incorporation or organization)

|

|

77-0216135

(I.R.S. Employer Identification No.)

|

|

|

|

|

|

|

|

|

|

2 Huntington Quadrangle

Suite 2S01

Melville, New York

(Address of principal executive offices)

|

|

11747

(Zip Code)

|

|

2016 Incentive Stock Plan

2016 Outside Directors Equity Compensation Plan

(Full title of the plan)

Gary Quinn

President and Chief Executive Officer

FalconStor Software, Inc.

2 Huntington Quadrangle

Suite 2S01

Melville, New York 11747

(Name and address of agent for service)

631-777-5188

(Telephone number, including area code, of agent for service)

With a copy to:

Steven Wolosky, Esq.

Olshan Frome Wolosky LLP

Park Avenue Tower

65 E. 55

th

Street

New York, New York 10022

(212) 451-2300

CALCULATION OF REGISTRATION FEE

|

|

|

|

|

|

|

|

|

Title of Securities to be Registered

|

Amount to be Registered

(1)

|

Proposed Maximum Offering Price Per Share

|

Proposed Maximum Aggregate Offering Price

|

Amount of Registration Fee

|

|

Common Stock, par value $0.001 per share

|

70,000 (2)

|

$1.06 (4)

|

$74,200 (4)

|

$7.47

|

|

Common Stock, par value $0.001 per share

|

20,330,000 (3)

|

$1.06 (4)

|

$21,549,800 (4)

|

$2,170.07

|

|

TOTAL

|

|

|

|

$2,177.54

|

|

|

|

|

(1)

|

Pursuant to Rule 416(a) under the Securities Act of 1933, as amended (the “Securities Act”), this Registration Statement also covers such indeterminate number of shares of Common Stock, $0.001 par value (the “Common Stock”) of FalconStor Software, Inc. (the “Company”), as may become issuable under the Company’s 2016 Incentive Stock Plan (the “2016 Incentive Plan”) and 2016 Outside Directors Equity Compensation Plan (the “2016 Director Plan”) by reason of any stock dividend, stock split, recapitalization or other similar transaction.

|

|

|

|

|

(2)

|

Represents shares of restricted Common Stock issued and outstanding, granted under the 2016 Director Plan.

|

|

|

|

|

(3)

|

Represents up to 20,000,000 shares of Common Stock reserved for future issuance under the 2016 Incentive Plan and up to 330,000 shares of Common Stock reserved for future issuance under the 2016 Director Plan.

|

|

|

|

|

(4)

|

This estimate is made pursuant to Rule 457(h) under the Securities Act of 1933, as amended (the “Securities Act”), solely for the purposes of calculating the registration fee and is based on the average high and low price of the Common Stock as reported on the Nasdaq Global Market on July 22, 2016 of $1.06 per share.

|

EXPLANATORY NOTE

FalconStor Software, Inc. (the “Company”) has prepared this Registration Statement in accordance with the requirements of Form S-8 under the Securities Act of 1933, as amended (the “Securities Act”), to register 20,400,000 shares of Common Stock, $0.001 par value (the “Common Stock”), of the Company issuable or issued pursuant to the 2016 Incentive Stock Plan (the “2016 Incentive Plan”) and 2016 Outside Directors Equity Compensation Plan (the “2016 Director Plan”). The Company previously registered 400,000 shares of Common Stock (Registration No. 333-192173) under the Company’s 2013 Outside Directors Equity Compensation Plan (the “2013 Plan”), an aggregate of 400,000 shares of Common Stock (Registration No. 333-175175) under the Company’s 2010 Outside Directors Equity Compensation Plan (the “2010 Plan”), an aggregate of 18,800,000 shares of Common Stock (Registration No. 333-145475) under the Company’s 2006 Incentive Stock Plan (the “2006 Plan”) and 2007 Outside Directors Equity Compensation Plan (the “2007 Plan”), 1,500,000 shares of Common Stock (Registration No. 333-139032) under the Company’s 2006 Plan, 8,662,296 shares of Common Stock (Registration No. 333-69834) under the Company’s 2000 Stock Option Plan (the “2000 Plan”), an aggregate of 3,800,000 shares of Common Stock (Registration No. 333-125126) under the 2000 Plan and the Company’s 2004 Outside Directors Stock Option Plan (the “2004 Plan”) and an aggregate of 2,000,000 shares of Common Stock (Registration No. 333-103925) under the 2000 Plan. Pursuant to General Instruction E to Form S-8, the contents of the prior registration statements relating to the 2000 Plan, the 2004 Plan, the 2006 Plan, the 2007 Plan, the 2010 Plan and the 2013 Plan and all periodic reports that the Company filed after such Registration Statements to maintain current information about the Company are hereby incorporated by reference.

This Form S-8 also includes a reoffer prospectus (the “Reoffer Prospectus”) prepared in accordance with Part I of Form S-3 under the Securities Act. The Reoffer Prospectus may be utilized for reofferings and resales of shares of Common Stock acquired pursuant to the 2000 Plan, 2004 Plan, 2006 Plan, 2007 Plan, 2010 Plan, 2013 Plan, 2016 Incentive Plan and 2016 Director Plan, that may be deemed to be “control securities” and/or “restricted securities” under the Securities Act.

PART I

INFORMATION REQUIRED IN THE SECTION 10(a) PROSPECTUS

The documents containing the information concerning the Plans required by Item 1 of this Registration Statement on Form S-8, and the statement of availability of registrant information, employee benefit plan annual reports and other information required by Item 2 of Form S-8, will be sent or given to persons eligible to participate in the Plans as specified by Rule 428(b)(1) under the Securities Act. We will maintain a file of such documents in accordance with the provisions of Rule 428 and, upon request, shall furnish to the Commission or its staff a copy or copies of documents included in such file. Pursuant to the instructions to Form S-8, these documents are not required to be and are not being filed either as part of this Registration Statement or as prospectuses or prospectus supplements pursuant to Rule 424 under the Securities Act. These documents and the documents incorporated by reference in this Registration Statement pursuant to Item 3 of Part II of Form S-8, taken together, constitute part of a prospectus that meets the requirements of Section 10(a) of the Securities Act.

|

|

|

|

Item 2.

|

Registrant Information and Employee Plan Annual Information

|

Any of the documents incorporated by reference in Item 3 of Part II of this Registration Statement (which documents are incorporated by reference in this Section 10(a) prospectus) and the other documents required to be delivered to employees pursuant to Rule 428(b) will be available without charge to participants in the Plans upon written or oral request by contacting:

FalconStor Software, Inc.

2 Huntington Quadrangle

Suite 2S01

Melville, New York 11747

Attention: Chief Financial Officer

(631) 777-5188

PROSPECTUS

2,994,000 SHARES

FALCONSTOR SOFTWARE, INC.

Common Stock ($0.001 par value)

This prospectus relates to the reoffer and resale by certain selling stockholders of shares of common stock, $0.001 par value, of FalconStor Software, Inc. (“FalconStor,” the “Company,” “we,” “our” or “us”) that may be issued by us to the selling stockholders upon the exercise of stock options granted under our 2000 Stock Option Plan, 2004 Outside Directors Stock Option Plan, 2006 Incentive Stock Plan, 2007 Outside Directors Equity Compensation Plan, 2010 Outside Directors Equity Compensation Plan, and 2013 Outside Directors Equity Compensation Plan. In addition, this prospectus relates to shares of restricted stock held by the selling stockholders and which were issued under our 2010 Outside Directors Equity Compensation Plan, 2013 Outside Directors Equity Compensation Plan and 2016 Outside Directors Equity Compensation Plan. We previously registered the offer and sale of shares of common stock to the selling stockholders. This prospectus also relates to certain underlying options and shares of restricted stock that have not as of this date been granted under the 2016 Incentive Stock Plan and 2016 Outside Directors Equity Compensation Plan. If and when such options or shares of restricted stock are granted to persons required to use the prospectus to reoffer and resell the shares underlying such options or the shares of restricted stock, we will distribute a prospectus supplement. The shares are being reoffered and resold for the account of the selling stockholders and we will not receive any of the proceeds from the resale of the shares.

The selling stockholders have advised us that the resale of their shares may be effected from time to time in one or more transactions on the Nasdaq Global Market, in negotiated transactions or otherwise, at market prices prevailing at the time of the sale or at prices otherwise negotiated. See “Plan of Distribution.” We will bear all expenses in connection with the preparation of this prospectus.

Our Common Stock is listed on the Nasdaq Global Market. On July 27, 2016, the closing price for the Common Stock, as reported by the Nasdaq Global Market, was $1.10.

|

|

|

|

|

This investment involves risk. See “Risk Factors” beginning at page 4.

|

NEITHER THE SECURITIES AND EXCHANGE COMMISSION NOR ANY STATE SECURITIES COMMISSION HAS DETERMINED WHETHER THIS PROSPECTUS IS TRUTHFUL OR COMPLETE. THEY HAVE NOT MADE, NOR WILL THEY MAKE, ANY DETERMINATION AS TO WHETHER ANYONE SHOULD BUY THESE SECURITIES. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

The date of this prospectus is July 28, 2016.

|

|

|

|

|

|

TABLE OF CONTENTS

|

PAGE

|

|

|

iii

|

|

|

3

|

|

|

3

|

|

|

4

|

|

|

4

|

|

|

4

|

|

|

5

|

|

|

5

|

|

|

7

|

|

|

9

|

|

|

9

|

|

|

9

|

|

|

9

|

|

|

II-1

|

WHERE YOU CAN FIND MORE INFORMATION

We have filed a registration statement on Form S-8 with the SEC for our common stock offered in this offering. This prospectus does not contain all the information set forth in the Registration Statement. You should refer to the Registration Statement and its exhibits for additional information. Whenever we make references in this prospectus to any of our contracts, agreements or other documents, the references are not necessarily complete and you should refer to the exhibits to the Registration Statement for copies of the actual contracts, agreements or other documents.

We file annual, quarterly and special reports, proxy statements and other information with the Securities and Exchange Commission (the “SEC”). You may read and copy any document we file at the SEC’s public reference room located at 100 F Street, N.E., Washington, D.C. 20549. You may obtain further information on the operation of the public reference room by calling the SEC at 1-800-SEC-0330. Our SEC filings are also available to the public over the Internet at the SEC’s Web site at http://www.sec.gov. You may also request copies of such documents, upon payment of a duplicating fee, by writing to the SEC at 100 F Street, N.E., Washington, D.C. 20549. Reports, proxy statements and other information concerning us can also be inspected at the Nasdaq Global Market Operations, 1735 K Street, N.W., Washington, D.C. 20006. You may also find recent documents we filed on our website at www.falconstor.com.

INCORPORATION BY REFERENCE

The SEC allows us to incorporate by reference the information we file with it, which means that we can disclose important information to you by referring you to those documents. The information we incorporate by reference is considered to be part of this prospectus, and information that we file later with the SEC will automatically update and supersede this information. We incorporate by reference the documents listed below and any future filings made by us with the SEC under Sections 13(a), 13(c), 14 or 15(d) of the Securities Exchange Act of 1934, until the sale of all the shares of common stock that are part of this offering. The documents we are incorporating by reference are as follows:

|

|

|

|

(1)

|

Our Annual Report on Form 10-K for the year ended December 31, 2015, as amended;

|

|

|

|

|

(2)

|

Our Quarterly Reports on Form 10-Q for the quarter ended March 31, 2016 and June 30,2016;

|

|

|

|

|

(3)

|

Our Current Reports on Form 8-K filed with the SEC on March 11, 2016 and April 7, 2016; and

|

|

|

|

|

(4)

|

The description of our common stock contained in our registration statement on Form 8-A declared effective by the SEC on June 28, 1994, including any amendments or reports filed for the purpose of updating that description.

|

All documents filed pursuant to Section 13(a), 13(c), 14 or 15(d) of the Exchange Act, after the date of this registration statement and prior to the filing of a post-effective amendment which indicates that all securities offered hereby have been sold or which deregisters all securities then remaining unsold shall be deemed to be incorporated by reference into this registration statement and to be a part hereof from the date of filing of such documents, provided, however, that the Registrant is not incorporating any information furnished under either Item 2.02 or Item 7.01 of any Current Report on Form 8-K.

Any document, and any statement contained in a document, incorporated or deemed to be incorporated by reference herein shall be deemed to be modified or superseded for purposes of this prospectus to the extent that a statement contained herein, or in any other subsequently filed document that also is incorporated on deemed to be incorporated by reference herein, modifies on supersedes such document or statement. Any such document or statement so modified or superseded shall not be deemed, except as so modified or superseded, to constitute a part of this prospectus.

The documents incorporated by reference in this prospectus may be obtained from us without charge and will be provided to each person, including any beneficial owner, to whom a prospectus is delivered. You may obtain a copy of the documents at no cost by submitting an oral or written request to:

FalconStor Software, Inc.

2 Huntington Quadrangle

Suite 2S01

Melville, New York 11747

Attention: Chief Financial Officer

(631) 777-5188

ABOUT THIS PROSPECTUS

This prospectus is part of a registration statement we filed with the SEC on Form S-8. You should rely only on the information provided or incorporated by reference in this prospectus or any related supplement. We have not authorized anyone else to provide you with different information. The Selling Stockholders will not make an offer of these shares in any state where the offer is not permitted. You should not assume that the information in this prospectus or any supplement is accurate as of any other date than the date on the front of those documents.

RISK FACTORS

Before making an investment decision, you should carefully consider the risks uncertainties described below and discussed under the section titled “Risk Factors” contained in our Annual Report on Form 10-K for the year ended December 31, 2015, and our Form 10‑Q for the six months ended June 30, 2016, which are incorporated by reference into this prospectus in their entirety, as updated or superseded by the risks and uncertainties described under similar headings in the other documents that are filed after the date hereof and incorporated by reference into this prospectus, together with the other information in this prospectus, the documents incorporated by reference and any free writing prospectus that we may authorize for use in connection with this offering. The risks described in these documents are not the only ones we face, but those that we consider to be material. There may be other unknown or unpredictable economic, business, competitive, regulatory or other factors that could have material adverse effects on our future results. Past financial performance may not be a reliable indicator of future performance, and historical trends should not be used to anticipate results or trends in future periods. If any of these risks actually occurs, our business, financial condition, results of operations or cash flow could be seriously harmed. This could cause the trading price of our common stock to decline, resulting in a loss of all or part of your investment.

THE COMPANY

FalconStor is a leading Software-Defined Storage company offering a converged data services software platform that is hardware agnostic. Founded in 2000, FalconStor celebrated its 15th year in business with the launch of its new flagship platform, FreeStor®, which was made generally available in May 2015. As a global company, our vision is to deliver enterprise class, software-defined, intelligent data services combined with predictive analytics across any primary or secondary storage hardware; in the cloud or on premise. Our mission is to help IT organizations realize more economic value out of existing environments and any future storage investments while reducing complexity, maximizing flexibility and improving operational efficiency. Our award-winning solutions are available and supported worldwide by OEMs as well as leading service providers, system integrators, resellers and FalconStor.

FalconStor was incorporated in Delaware as Network Peripherals, Inc., in 1994. Pursuant to a merger with FalconStor Inc., in 2001, the former business of Network Peripherals, Inc., was discontinued, and the newly re-named FalconStor Software, Inc., continued the storage software business started in 2000 by FalconStor, Inc.

FalconStor’s headquarters are located at 2 Huntington Quadrangle, Suite 2S01, Melville, NY 11747. Our telephone number is (631) 777-5188. The Company also maintains offices throughout Europe and Asia Pacific.

USE OF PROCEEDS

The shares of common stock offered hereby are being registered for the account of the selling stockholders identified in this prospectus. See “Selling Stockholders.” All net proceeds from the sale of the common stock will go to the stockholders who offer and sell their shares. We will not receive any part of the proceeds from such sales of common stock. We will, however, receive the exercise price of the options at the time of their exercise. Such proceeds will be contributed to working capital and will be used for general corporate purposes.

SELLING STOCKHOLDERS

This prospectus relates to the reoffer and resale of shares issued or that may be issued to the selling stockholders under our 2000 Stock Option Plan, 2004 Outside Directors Stock Option Plan, 2006 Incentive Stock Plan, 2007 Outside Directors Equity Compensation Plan, 2010 Outside Directors Equity Compensation Plan, 2013 Outside Directors Equity Compensation Plan 2016 Outside Directors Equity Compensation Plan and 2016 Incentive Stock Plan.

The following table sets forth (i) the number of shares of common stock beneficially owned by each selling stockholder at June 30, 2016, (ii) the number of shares to be offered for resale by each selling stockholder (i.e., the total number of shares underlying options and Restricted Stock awards held by each selling stockholder irrespective of whether such options are presently exercisable or exercisable within sixty days of June 30, 2016), and (iii) the number and percentage of shares of our common stock to be held by each selling stockholder after completion of the offering.

|

|

|

|

|

|

|

|

|

|

|

|

Name

|

Number of shares of Common Stock Beneficially Owned at June 30, 2016

(1)

|

Number of Shares to be Offered for Resale

(2)

|

Number of shares of Common Stock After Completion of the Offering

(3)

|

Percentage of Class to be Owned After Completion of the Offering

(4)

|

|

Barry Rubenstein (5)

|

2,825,538

|

|

70,100

|

|

2,755,438

|

|

6.35%

|

|

Eli Oxenhorn (6)

|

1,116,000

|

|

70,100

|

|

1,045,900

|

|

2.41%

|

|

Irwin Lieber (7)

|

1,987,827

|

|

70,100

|

|

1,917,727

|

|

4.42%

|

|

Steven R. Fischer (8)

|

130,000

|

|

55,100

|

|

74,900

|

|

*

|

|

Alan W. Kaufman (9)

|

125,000

|

|

50,100

|

|

74,900

|

|

*

|

|

Michael Kelly (10)

|

70,000

|

|

23,400

|

|

46,600

|

|

*

|

|

Martin Hale (11)

|

9,884,835

|

|

20,100

|

|

9,864,735

|

|

22.77%

|

|

Gary Quinn (12)

|

2,050,000

|

|

1,550,500

|

|

499,500

|

|

1.15%

|

|

Louis J. Petrucelly (13)

|

837,500

|

|

772,500

|

|

65,000

|

|

*

|

|

Alan Komet(14)

|

245,015

|

|

312,000

|

|

33,015

|

|

*

|

|

|

|

|

(1)

|

A person is deemed to be the beneficial owner of voting securities that can be acquired by such person within 60 days after June 30, 2016 upon the exercise of options, warrants or convertible securities. Each beneficial owner’s percentage ownership is determined by assuming that options, warrants or convertible securities that are held by such person (but not those held by any other person) and that are currently exercisable (i.e., that are exercisable within 60 days from June 30, 2016) have been exercised. Unless otherwise noted, we believe that all persons named in the table have sole voting and investment power with respect to all shares beneficially owned by them.

|

|

|

|

|

(2)

|

Includes both vested and non-vested stock options and Restricted Stock awards.

|

|

|

|

|

(3)

|

Includes the aggregate ownership of the Company’s Common Stock assuming all of the shares of Common Stock offered for resale pursuant to their offering have been sold.

|

|

|

|

|

(4)

|

Assumes that none of the Series A convertible preferred stock has been converted into common stock. Based upon shares of common stock outstanding as of June 30, 2016 of 43,332,111.

|

|

|

|

|

(5)

|

Based upon information contained in Forms 4 and a report on Schedule 13D, as amended, filed jointly by Barry Rubenstein, Marilyn Rubenstein, Brookwood Partners, L.P. (“Brookwood”), Seneca Ventures (“Seneca”), Woodland Partners (“Woodland Partners”), and Woodland Venture Fund (“Woodland Fund”) with the SEC, and certain other information. Consists of (i) 880,900 shares of common stock held directly by Mr. Rubenstein, (ii) 187,900 shares of common stock held by Brookwood, (iii) 131,323 shares of common stock held by Seneca, (iv) 957,257 shares of common stock held by Woodland Partners, (v) 496,800 shares of common stock held by Woodland Venture, (vi) 100,000 shares of common stock held in a joint account by Barry Rubenstein and Marilyn Rubenstein, Mr. Rubenstein’s spouse, (vii) 20,100 shares of unvested restricted stock that Mr. Rubenstein has voting power, (viii) 50,000 shares of common stock held by Barry Rubenstein issuable upon exercise of options that are currently exercisable or that will be exercisable within 60 days of June 30, 2016 and (ix) 1,258 shares of common stock held by Marilyn Rubenstein. Mr. Rubenstein disclaims beneficial ownership of the securities held by Brookwood, Seneca, Woodland Partners, Woodland Fund and Mr. Rubenstein’s spouse, Marilyn Rubenstein, except to the extent of his respective equity interest therein. Mr. Rubenstein has been a Director of the Company since November 2009.

|

|

|

|

|

(6)

|

Based on information contained in Forms 3 and 4 filed by Mr. Oxenhorn and certain other information. Consists of (i) 1,045,900 shares of common stock held by Mr. Oxenhorn, (ii) 20,100 shares of unvested restricted stock that Mr. Oxenhorn has voting power over, and (iv) 50,000 shares of Common stock issuable upon exercise of options that are currently exercisable or that will be exercisable within 60 days of June 30, 2016. Mr. Oxenhorn has been a Director of the Company since November 2009 and Chairman of the Board since September 2010.

|

|

|

|

|

(7)

|

Based on information contained in Forms 3, 4 and 5 filed by Mr. Lieber and certain other information. Consists of (i) 1,753,727 shares of common stock held by Mr. Lieber, (ii) 164,000 shares of common stock held by Buckland Focus Fund (“Buckland”) of which Mr. Lieber is a General Partner, (iv) 20,100 shares of unvested restricted stock that Mr. Lieber has voting power over, and (v) 50,000 shares of common stock issuable upon exercise of options that are currently exercisable or that will be exercisable within 60 days of June 30, 2016. Mr. Lieber disclaims beneficial ownership of the securities held by Buckland, except to the extent of his respective equity interests therein. Mr. Lieber has been a Director of the Company since November 2009.

|

|

|

|

|

(8)

|

Based on information contained in Forms 4 filed by Mr. Fischer and certain other information. Consists of (i) 74,900 shares of common stock held by Mr. Fisher, (ii) 20,100 shares of restricted stock that Mr. Fischer has voting power over, and (iii) 35,000 shares of common stock issuable upon exercise of options that are currently exercisable or that will be exercisable within 60 days of June 30, 2016. Mr. Fisher has been a Director of the Company since August 2001.

|

|

|

|

|

(9)

|

Based on information contained in Forms 4 filed by Mr. Kaufman and certain other information. Consists of (i) 74,900 shares of common stock held by Mr. Kaufman, (ii) 20,100 shares of unvested restricted stock that Mr. Kaufman has voting power over and (iii) 30,000 shares of common stock issuable upon exercise of options that are currently exercisable or that will be exercisable within 60 days of June 30, 2016. Mr. Kaufman has been a Director of the Company since May 2005.

|

|

|

|

|

(10)

|

Based on information contained in Forms 3 and 4 filed by Mr. Kelly and certain other information. Consists of (i) 46,600 shares of common stock held by Mr. Kelly, and (ii) 23,400 shares of unvested restricted stock that Mr. Kelly has voting power over. Mr. Kelly has been a Director of the Company since October 2014.

|

|

|

|

|

(11)

|

Based on information contained in Forms 4 and a report on Schedule 13D filed by Mr. Hale, Hale Fund Management, LLC (“Fund Management”), Hale Capital Management, LP (“Capital Management”), Hale Capital Partners, LP (“Hale Capital”), and HCP-FVA, LLC (“HCP-FVA”). Consists of (i) 1,053,319 shares of common stock held by Hale Capital and HCP-FVA and 30,000 shares of common stock held by Mr. Hale for the benefit of Hale Capital, (ii) 20,100 shares of restricted stock held by Mr. Hale for the benefit of Hale Capital, and (iii) 900,000 shares of Series A convertible preferred stock held by HCP-FVA, which equates to 8,781,516 shares of common stock on an as-converted basis (without giving effect to the 9.99% blocker contained in the Certificate of Designations, Preferences and Rights of the Series A convertible preferred stock ("Certificate of Designations")), held by HCP-FVA, and equates to 7,317,073 shares of common stock on an as-converted voting basis. Each of Mr. Hale, Fund Management, Capital Management and Hale Capital disclaims beneficial ownership of such shares of common stock except to the extent of his or its pecuniary interest. The address of Mr. Hale, Fund Management, Capital Management, Hale Capital and HCP-FVA is 17 State Street, Suite 3230, New York, NY 10004.

|

|

|

|

|

(12)

|

Based on information contained in Forms 3 and 4 filed by Mr. Quinn and certain other information. Consists of (i) 499,500 shares of common stock held by Mr. Quinn, (ii) 1,325,500 shares of unvested restricted stock that Mr. Quinn has voting power over, and (iii) 225,000 shares of common stock issuable upon exercise of options that are currently exercisable or that will be exercisable within 60 days of June 30,2016. Mr. Quinn has been President and Chief Executive Officer of the Company since July 23, 2013 and a Director of the Company since August 8, 2013. From June 28, 2013 to July 23, 2013, Mr. Quinn served as the Company’s Interim Chief Executive Officer. From April 8, 2013 to June 28, 2013, Mr. Quinn served as the Company’s Chief Operating Officer. From April 2012 through April 8, 2013, Mr. Quinn served as the Company’s vice president of sales and marketing for North America.

|

|

|

|

|

(13)

|

Based on information contained in Forms 3 and 4 filed by Mr. Petrucelly and certain other information. Consists of (i) 65,000 shares of common stock held by Mr. Petrucelly, (ii) 515,500 shares of unvested restricted stock that Mr. Petrucelly has voting power over, and (iii) 257,000 shares of common stock issuable upon exercise of options that are currently exercisable or that will be exercisable within 60 days of June 30, 2016. Mr. Petrucelly has served as Executive Vice President and Chief Financial Officer since August 8, 2012. From May 25, 2012 to August 8, 2012, Mr. Petrucelly served as Acting Chief Financial Officer, Vice President of Finance, and Treasurer. Prior thereto, Mr. Petrucelly was the Director of Financial Reporting of the Company from March 2007 to March 2008 and the Company’s Director of Finance from March 2008 through April 2012.

|

|

|

|

|

(14)

|

Based on information contained in Forms 3 and 4 filed by Mr. Komet and certain other information. Consists of (i) 33,015 shares of common stock held by Mr. Komet, (ii) 192,000 shares of unvested restricted stock that Mr. Komet has voting power over, and (iii) 20,000 shares of common stock issuable upon exercise of options that are currently exercisable or that will be exercisable within 60 days of June 30, 2016. On October 28, 2015, Mr. Komet was named Executive Vice President, Worldwide Field Operations.

|

PLAN OF DISTRIBUTION

This offering is self-underwritten; neither we nor the selling stockholders have employed an underwriter for the sale of common stock by the selling stockholders. We will bear all expenses in connection with the preparation of this prospectus. The selling stockholders will bear all expenses associated with the sale of the common stock.

The selling stockholders may offer their shares of common stock directly or through pledgees, donees, transferees or other successors in interest in one or more of the following transactions:

|

|

|

|

•

|

On any stock exchange on which the shares of common stock may be listed at the time of sale

|

|

|

|

|

•

|

In negotiated transactions

|

|

|

|

|

•

|

In the over-the-counter market

|

|

|

|

|

•

|

In a combination of any of the above transactions

|

The selling stockholders may offer their shares of common stock at any of the following prices:

|

|

|

|

•

|

Fixed prices which may be changed

|

|

|

|

|

•

|

Market prices prevailing at the time of sale

|

|

|

|

|

•

|

Prices related to such prevailing market prices

|

The selling stockholders may effect such transactions by selling shares to or through broker-dealers, and all such broker-dealers may receive compensation in the form of discounts, concessions, or commissions from the selling stockholders and/or the purchasers of shares of common stock for whom such broker-dealers may act as agents or to whom they sell as principals, or both (which compensation as to a particular broker-dealer might be in excess of customary commissions).

Any broker-dealer acquiring common stock from the selling stockholders may sell the shares either directly, in its normal market-making activities, through or to other brokers on a principal or agency basis or to its customers. Any such sales may be at prices then prevailing on the Nasdaq Global Market or at prices related to such prevailing market prices or at negotiated prices to its customers or a combination of such methods. The selling stockholders and any broker-dealers that act in connection with the sale of the common stock hereunder might be deemed to be “underwriters” within the meaning of Section 2(11) of the Securities Act; any commissions received by them and any profit on the resale of shares as principal might be deemed to be underwriting discounts and commissions under the Securities Act. Any such commissions, as well as other expenses incurred by the selling stockholders and applicable transfer taxes, are payable by the selling stockholders.

The selling stockholders reserve the right to accept, and together with any agent of the selling stockholder, to reject in whole or in part any proposed purchase of the shares of common stock. The selling stockholders will pay any sales commissions or other seller’s compensation applicable to such transactions.

We have not registered or qualified offers and sales of shares of the common stock under the laws of any country, other than the United States. To comply with certain states’ securities laws, if applicable, the selling stockholders will offer and sell their shares of common stock in such jurisdictions only through registered or licensed brokers or dealers. In addition, in certain states the selling stockholders may not offer or sell shares of common stock unless we have registered or qualified such shares for sale in such states or we have complied with an available exemption from registration or qualification.

The selling shareholders have represented to us that any purchase or sale of shares of common stock by them will comply with Regulation M promulgated under the Securities Exchange Act of 1934, as amended. In general, Rule 102 under Regulation M prohibits any person connected with a distribution of our common stock (a “Distribution”) from directly or indirectly bidding for, or purchasing for any account in which he or she has a beneficial interest, any of our common stock or any right to purchase our common stock, for a period of one business day before and after completion of his or her participation in the distribution (we refer to that time period as the “Distribution Period”).

During the Distribution Period, Rule 104 under Regulation M prohibits the selling shareholders and any other persons engaged in the Distribution from engaging in any stabilizing bid or purchasing our common stock except for the purpose of preventing or retarding a decline in the open market price of our common stock. No such person may effect any stabilizing transaction to facilitate any offering at the market. Inasmuch as the selling shareholders will be reoffering and reselling our common stock at the market, Rule 104 prohibits them from effecting any stabilizing transaction in contravention of Rule 104 with respect to our common stock.

There can be no assurance that the selling shareholders will sell any or all of the shares offered by them hereunder or otherwise.

LEGAL MATTERS

Certain legal matters in connection with the issuance of the shares of common stock offered hereby have been passed upon for the Company by Olshan Frome Wolosky LLP, New York, New York.

EXPERTS

The consolidated financial statements of the Company and subsidiaries as of December 31, 2014, and for the years ended December 31, 2014 and 2013, have been incorporated by reference herein in reliance on the report of KPMG LLP, independent registered public accounting firm, incorporated by reference herein, and upon the authority of said firm as experts in accounting and auditing.

The financial statements as of December 31, 2015 and for year ended December 31, 2015 and management’s assessment of the effectiveness of internal control over financial reporting as of December 31, 2015 incorporated by reference in this prospectus have been so incorporated in reliance on the reports of BDO USA, LLP, an independent registered public accounting firm, incorporated herein by reference, given upon the authority of said firm as experts in auditing and accounting.

ADDITIONAL INFORMATION

We have filed with the SEC seven Registration Statements on Form S-8 under the Securities Act with respect to the Shares offered hereby. For further information with respect to the Company and the securities offered hereby, reference is made to the Registration Statements. Statements contained in this prospectus as to the contents of any contract or other document are not necessarily complete, and in each instance, reference is made to the copy of such contract or document filed as an exhibit to the Registration Statements, each such statement being qualified in all respects by such reference.

DISCLOSURE OF COMMISSION POSITION ON

INDEMNIFICATION FOR SECURITIES ACT LIABILITIES

Insofar as indemnification for liabilities arising under the Securities Act may be permitted to directors, officers or persons controlling the Company, the Company has been advised that it is the SEC’s opinion that such indemnification is against public policy as expressed in the Securities Act and is, therefore, unenforceable.

PART II

INFORMATION REQUIRED IN THE REGISTRATION STATEMENT

|

|

|

|

Item 3.

|

Incorporation of Certain Documents by Reference

|

The SEC allows us to incorporate by reference the information we file with it, which means that we can disclose important information to you by referring you to those documents. The information we incorporate by reference is considered to be part of this prospectus, and information that we file later with the SEC will automatically update and supersede this information. We incorporate by reference the documents listed below and any future filings made by us with the SEC under Sections 13(a), 13(c), 14 or 15(d) of the Securities Exchange Act of 1934, until the sale of all the shares of Common Stock that are part of this offering. The documents we are incorporating by reference are as follows:

|

|

|

|

(1)

|

Our Annual Report on Form 10-K for the year ended December 31, 2015, as amended;

|

|

|

|

|

(2)

|

Our Quarterly Reports on Form 10-Q for the quarters ended March 31, 2016 and June 30,2016;

|

|

|

|

|

(3)

|

Our Current Reports on Form 8-K filed with the SEC on March 11, 2016 and April 7, 2016; and

|

|

|

|

|

(4)

|

The description of our common stock contained in our registration statement on Form 8-A declared effective by the SEC on June 28, 1994, including any amendments or reports filed for the purpose of updating that description.

|

All documents filed pursuant to Section 13(a), 13(c), 14 or 15(d) of the Exchange Act, after the date of this registration statement and prior to the filing of a post-effective amendment which indicates that all securities offered hereby have been sold or which deregisters all securities then remaining unsold shall be deemed to be incorporated by reference into this registration statement and to be a part hereof from the date of filing of such documents, provided, however, that the Registrant is not incorporating any information furnished under either Item 2.02 or Item 7.01 of any Current Report on Form 8-K

|

|

|

|

Item 4.

|

Description of Securities

|

Not applicable.

|

|

|

|

Item 5.

|

Interest of Named Experts and Counsel

|

FalconStor Software Inc. has agreed to indemnify and hold KPMG LLP ("KPMG") harmless against and from any and all legal costs and expenses incurred by KPMG in successful defense of any legal action or proceeding that arises as a result of KPMG’s consent to the inclusion (or incorporation by reference) of its audit report on the Company’s past financial statements incorporated by reference in this registration statement.

|

|

|

|

Item 6.

|

Indemnification of Officers and Directors

|

As permitted by the Delaware General Corporation Law (“DGCL”), the Company’s Restated Certificate of Incorporation, as amended, limits the personal liability of a director or officer to the Company for monetary damages for breach of fiduciary duty of care as a director. Liability is not eliminated for (i) any breach of the director’s duty of loyalty to the Company or its stockholders, (ii) acts or omissions not in good faith or which involve intentional misconduct or a knowing violation of law, (iii) unlawful payment of dividends or stock purchase or redemptions pursuant to Section 174 of the DGCL, or (iv) any transaction from which the director derived an improper personal benefit.

Delaware Law

The Company is subject to Section 203 of the DGCL, which prevents an “interested stockholder” (defined in Section 203, generally, as a person owning 15% or more of a corporation’s outstanding voting stock) from engaging in a “business combination” with a publicly-held Delaware corporation for three years following the date such person became an interested stockholder, unless: (i) before such person became an interested stockholder, the board of directors of the corporation approved the transaction in which the interested stockholder became an interested stockholder or approved the business combination; (ii) upon consummation of the transaction that resulted in the interested stockholder’s becoming an interested stockholder, the interested stockholder owns at least 85% of the voting stock of the corporation outstanding at the time the transaction commenced (subject to certain exceptions), or (iii) following the transaction in which such person became an interested stockholder, the business combination is approved by the board of directors of the corporation and authorized at a meeting of stockholders by the affirmative vote of the holders of 66% of the outstanding voting stock of the corporation not owned by the interested stockholder. A “business combination” includes mergers, stock or asset sales and other transactions resulting in a financial benefit to the interested stockholder.

The provisions of Section 203 of the DGCL could have the effect of delaying, deferring or preventing a change in the control of the Company.

The Company maintains a directors and officers insurance and company reimbursement policy. The policy insures directors and officers against unindemnified loss arising from certain wrongful acts in their capacities and reimburses the Company for such loss for which the Company has lawfully indemnified the directors and officers. The policy contains various exclusions, none of which relate to the offering hereunder. The Company also has agreements with its directors and officers providing for the indemnification thereof under certain circumstances.

|

|

|

|

Item 7.

|

Exemption From Registration Claimed

|

Not applicable.

|

|

|

|

|

|

4.1

|

2016 Outside Directors Equity Compensation Plan, incorporated by reference to the Company’s Proxy Statement on Schedule 14a for the 2016 Annual Meeting of Stockholders, filed on March 18, 2016.

|

|

4.2

|

2016 Incentive Stock Plan, incorporated by reference to the Company’s Proxy Statement on Schedule 14a for the 2016 Annual Meeting of Stockholders, filed on March 18, 2016.

|

|

*5.1

|

Opinion of Olshan Frome Wolosky LLP as to the legality of the stock covered by this Registration Statement.

|

|

*23.1

|

Consent of BDO USA, LLP, independent registered public accounting firm.

|

|

*23.2

|

Consent of KPMG LLP, independent registered public accounting firm.

|

|

*23.3

|

Consent of Olshan Frome Wolosky LLP (included in exhibit 5.1).

|

|

24.1

|

Powers of Attorney, included on the signature page to this Registration Statement.

|

A. The undersigned registrant hereby undertakes:

|

|

|

|

(1)

|

To file, during any period in which offers or sales are being made, a post‑effective amendment to this registration statement:

|

|

|

|

|

(i)

|

To include any prospectus required by Section 10(a)(3) of the Securities Act of 1933;

|

|

|

|

|

(ii)

|

To reflect in the prospectus any facts or events arising after the effective date of this registration statement (or the most recent post-effective amendment thereof) which, individually or in the aggregate, represent a fundamental change in the information set forth in the registration statement. Notwithstanding the foregoing, any increase or decrease in volume of securities offered (if the total dollar value of securities offered would not exceed that which was registered) and any deviation from the low or high end of the estimated maximum offering range may be reflected in the form of prospectus filed with the SEC pursuant to Rule 424(b) promulgated under the Securities Act if, in the aggregate, the changes in volume and price represent no more than a 20% change in the maximum aggregate offering price set forth in the “Calculation of Registration Fee” table in the effective registration statement;

|

|

|

|

|

(iii)

|

To include any material information with respect to the plan of distribution not previously disclosed in the registration statement or any material change to such information in the registration statement; provided, however, that paragraphs (a)(1)(i) and (a)(1)(ii) do not apply if the registration statement is on Form S-8 and the information required to be included in a post-effective amendment by those paragraphs is contained in reports filed with or furnished to the SEC by the undersigned registrant pursuant to Section 13 or Section 15(d) of the Exchange Act that are incorporated by reference in the registration statement; and that paragraphs (a)(1)(i), (a)(1)(ii) and (a)(1)(iii) do not apply if the registration statement is on Form S-3 and the information required to be included in a post-effective amendment by those paragraphs is contained in reports filed with or furnished to the SEC by the undersigned registrant pursuant to Section 13 or Section 15(d) of the Exchange Act that are incorporated by reference in the registration statement, or is contained in a form of prospectus filed pursuant to Rule 424(b) that is deemed part of the registration statement. Provided further, however, that paragraphs (a)(1)(i) and (a)(1)(ii) do not apply if the registration statement is for an offering of asset-backed securities on Form S-1 or Form S-3, and the information required to be included in a post-effective amendment is provided pursuant to Item 1100(c) of Regulation AB;

|

|

|

|

|

(2)

|

That, for the purposes of determining any liability under the Securities Act of 1933, each such post‑effective amendment shall be deemed to be a new registration statement relating to the securities offered therein, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof; and

|

|

|

|

|

(3)

|

To remove from registration by means of a post‑effective amendment any of the securities being registered that remain unsold at the termination of the offering.

|

|

|

|

|

(4)

|

That, for the purpose of determining liability under the Securities Act to any purchaser:

|

|

|

|

|

(i)

|

If the registrant is relying on Rule 430B:

|

|

|

|

|

(A)

|

Each prospectus filed by the registrant pursuant to Rule 424(b)(3) shall be deemed to be part of the registration statement as of the date the filed prospectus was deemed part of and included in the registration statement; and

|

|

|

|

|

(B)

|

Each prospectus required to be filed pursuant to Rule 424(b)(2), (b)(5), or (b)(7) as part of a registration statement in reliance on Rule 430B relating to an offering made pursuant to Rule 415(a)(1)(i), (vii), or (x) for the purpose of providing the information required by section 10(a) of the Securities Act shall be deemed to be part of and included in the registration statement as of the earlier of the date such form of prospectus is first used after effectiveness or the date of the first contract of sale of securities in the offering described in the prospectus. As provided in Rule 430B, for liability purposes of the issuer and any person that is at that date an underwriter, such date shall be deemed to be a new effective date of the registration statement relating to the securities in the registration statement to which that prospectus relates, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof.

Provided

,

however

, that no statement made in a registration statement or prospectus that is part of the registration statement or made in a document incorporated or deemed incorporated by reference into the registration statement or prospectus that is part of the registration statement will, as to a purchaser with a time of contract of sale prior to such effective date, supersede or modify any statement that was made in the registration statement or prospectus that was part of the registration statement or made in any such document immediately prior to such effective date; or

|

|

|

|

|

(ii)

|

If the registrant is subject to Rule 430C, each prospectus filed pursuant to Rule 424(b) as part of a registration statement relating to an offering, other than registration statements relying on Rule 430B or other than prospectuses filed in reliance on Rule 430A, shall be deemed to be part of and included in the registration statement as of the date it is first used after effectiveness.

Provided

,

however

, that no statement made in a registration statement or prospectus that is part of the registration statement or made in a document incorporated or deemed incorporated by reference into the registration statement or prospectus that is part of the registration statement will, as to a purchaser with a time of contract of sale prior to such first use, supersede or modify any statement that was made in the registration statement or prospectus that was part of the registration statement or made in any such document immediately prior to such date of first use.

|

|

|

|

|

(2)

|

That, for the purpose of determining liability of the registrant under the Securities Act to any purchaser in the initial distribution of the securities:

|

The undersigned registrant undertakes that in a primary offering of securities of the undersigned registrant pursuant to this registration statement, regardless of the underwriting method used to sell the securities to the purchaser, if the securities are offered or sold to such purchaser by means of any of the following communications, the undersigned registrant will be a seller to the purchaser and will be considered to offer or sell such securities to such purchaser:

|

|

|

|

(i)

|

Any preliminary prospectus or prospectus of the undersigned registrant relating to the offering required to be filed pursuant to Rule 424;

|

|

|

|

|

(ii)

|

Any free writing prospectus relating to the offering prepared by or on behalf of the undersigned registrant or used or referred to by the undersigned registrant;

|

|

|

|

|

(iii)

|

The portion of any other free writing prospectus relating to the offering containing material information about the undersigned registrant or its securities provided by or on behalf of the undersigned registrant; and

|

|

|

|

|

(iv)

|

Any other communication that is an offer in the offering made by the undersigned registrant to the purchaser.

|

B. The undersigned registrant hereby undertakes that, for purposes of determining any liability under the Securities Act of 1933, each filing of the registrant’s annual report pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934 (and, where applicable, each filing of an employee benefit plan’s annual report pursuant to Section 15(d) of the Securities Exchange Act of 1934) that is incorporated by reference in this registration statement shall be deemed to be a new registration statement relating to the securities offered therein, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof.

C. Insofar as indemnification for liabilities arising under the Securities Act of 1933 may be permitted to directors, officers and controlling persons of the registrant pursuant to the foregoing provisions, or otherwise, the registrant has been advised that in the opinion of the Securities and Exchange Commission such indemnification is against public policy as expressed in the Securities Act of 1933 and is, therefore, unenforceable. In the event that a claim for indemnification against such liabilities (other than the payment by the registrant of expenses incurred or paid by a director, officer or controlling person of the registrant in the successful defense of any action, suit or proceeding) is asserted by such director, officer or controlling person in connection with the securities being registered, the registrant will, unless in the opinion of its counsel the matter has been settled by a controlling precedent, submit to a court of appropriate jurisdiction the question whether such indemnification by it is against public policy as expressed in the Securities Act of 1933 and will be governed by the final adjudication of such issue.

SIGNATURES

Pursuant to the requirements of the Securities Act of 1933, the registrant certifies that it has reasonable grounds to believe that it meets all of the requirements for filing on Form S-8 and has duly caused this registration statement to be signed on its behalf by the undersigned, thereunto duly authorized, in the Town of Melville, State of New York, on the 28th day of July, 2016.

|

|

|

|

|

|

|

|

FALCONSTOR SOFTWARE, INC.

|

|

|

(Registrant)

|

|

|

|

|

|

By:

|

/

s/ Gary Quinn

|

|

|

|

Gary Quinn

President and Chief Executive Officer

|

POWER OF ATTORNEY

KNOW ALL MEN BY THESE PRESENTS, that each person whose signature appears below constitutes and appoints each of Gary Quinn and Louis J. Petrucelly his true and lawful attorneys-in-fact and agent, with full power of substitution and resubstitution, for and in his or her name, place and stead, in any and all capacities, to sign any or all amendments to this registration statement, and to file the same, with all exhibits thereto, and other documents in connection therewith, with the Securities and Exchange Commission, granting unto said attorney-in-fact and agent, full power and authority to do and perform each and every act and thing requisite necessary to be done in and about the premises, as fully to all intents and purposes as he or she might or could do in person, hereby ratifying and confirming all that said attorney-in-fact and agent, or his or her substitute, may lawfully do or cause to be done by virtue hereof.

Pursuant to the requirements of the Securities Act of 1933, this Registration Statement has been signed by the following persons in the capacities and on the date indicated.

|

|

|

|

|

|

|

Signature

|

Title

|

Date

|

|

/

s/ Gary Quinn

|

President, Chief Executive Officer and Director (Principal Executive Officer)

|

|

|

Gary Quinn

|

July 28, 2016

|

|

/s/ Louis J. Petrucelly

|

Executive Vice President, Chief Financial Officer, and Treasurer (Principal Financial Officer and Principal Accounting Officer)

|

|

|

Louis J. Petrucelly

|

July 28, 2016

|

|

/s/ Irwin Lieber

|

Director

|

|

|

Irwin Lieber

|

July 28, 2016

|

|

/s/ Steven R. Fischer

|

Director

|

|

|

Steven R. Fischer

|

July 28, 2016

|

|

/s/ Eli Oxenhorn

|

Chairman of the Board

|

|

|

Eli Oxenhorn

|

July 28, 2016

|

|

/s/ Barry Rubenstein

|

Director

|

|

|

Barry Rubenstein

|

July 28, 2016

|

|

/s/ Alan W. Kaufman

|

Director

|

|

|

Alan W. Kaufman

|

July 28, 2016

|

|

/s/ Martin Hale Jr.

|

Director

|

|

|

Martin Hale Jr.

|

July 28, 2016

|

|

/s/ Michael Kelly

|

Director

|

|

|

Michael Kelly

|

July 28, 2016

|

EXHIBIT INDEX

|

|

|

|

|

|

4.1

|

2016 Outside Directors Equity Compensation Plan, incorporated by reference to the Company’s Proxy Statement on Schedule 14a for the 2016 Annual Meeting of Stockholders, filed on March 18, 2016.

|

|

4.2

|

2016 Incentive Stock Plan, incorporated by reference to the Company’s Proxy Statement on Schedule 14a for the 2016 Annual Meeting of Stockholders, filed on March 18, 2016.

|

|

*5.1

|

Opinion of Olshan Frome Wolosky LLP as to the legality of the stock covered by this Registration Statement.

|

|

*23.1

|

Consent of BDO USA, LLP, independent registered public accounting firm.

|

|

*23.2

|

Consent of KPMG LLP, independent registered public accounting firm.

|

|

*23.3

|

Consent of Olshan Frome Wolosky LLP (included in exhibit 5.1).

|

|

24.1

|

Powers of Attorney, included on the signature page to this Registration Statement.

|

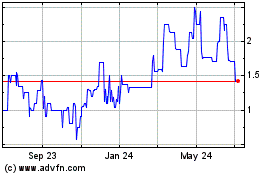

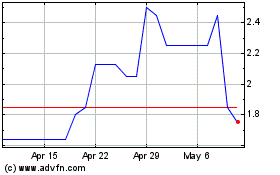

FalconStor Software (PK) (USOTC:FALC)

Historical Stock Chart

From Mar 2024 to Apr 2024

FalconStor Software (PK) (USOTC:FALC)

Historical Stock Chart

From Apr 2023 to Apr 2024