Oracle to Buy NetSuite for $9.3 Billion--3rd Update

July 28 2016 - 11:24AM

Dow Jones News

By Jay Greene

Oracle Corp. agreed to buy NetSuite Inc. for $9.3 billion,

bolstering the software maker's cloud-computing offerings as it

races to catch up to rivals.

Oracle said is paying $109 in cash, a 19% premium to NetSuite's

closing price Wednesday of $91.57. The deal is expected to close in

2016, subject to regulatory and shareholder approval.

The deal, among the largest in Oracle's history, reunites

Chairman Larry Ellison with Zach Nelson, NetSuite's chief

executive, who ran Oracle's marketing operations in the 1990s. Mr.

Ellison is NetSuite's largest investor; entities owned by Mr.

Ellison and his family held nearly 40% of NetSuite's shares,

according to NetSuite's annual proxy statement filed in April. Much

of his net worth is also tied up in Oracle, which he co-founded in

1977.

Mr. Ellison's position on both sides of a deal between two

publicly traded companies raises questions about potential

conflicts of interest. While Oracle declined to address the matter,

it said in its press release the deal will only close if a majority

of NetSuite shares not owned by Mr. Ellison and his family approve

the deal.

The Ellison family's stake in NetSuite means chances for a rival

bidder to emerge are "slim to none," said Stifel Nicolaus Co.

analyst Brad Reback. Given the multiple Oracle offered -- about

nine times the next 12 months' projected revenue -- shareholders

may be hard-pressed to demand a better deal, he said.

The acquisition had been rumored for weeks, pushing NetSuite's

shares up from $72.19 just a month ago. The deal represents a

premium, though it is still below NetSuite's closing price of

$115.57 in February 2014.

In morning trading, NetSuite rose 18% to $108.17, while Oracle

shares was up less than a percent to $41.04.

Both companies provide business applications called

enterprise-resource planning software. NetSuite, though, is among

the leaders in providing those offerings to customers via

subscription-based, on-demand computing.

Oracle said it plans to invest heavily in both products, and

that the deal would immediately add to its earnings, on an adjusted

basis. In a statement provided to The Wall Street Journal, Chief

Executive Mark Hurd said Oracle would "accelerate the pace of

innovation" and "expand the global reach" of NetSuite.

Oracle declined to say whether the deal would lead to any

executive changes or layoffs. NetSuite didn't immediately respond

to a request for comment.

While the companies offer some overlapping products, NetSuite

has made inroads with smaller corporate customers, where Oracle

hasn't been as strong, Mr. Reback said. NetSuite, whose

international sales are modest, will benefit from Oracle's global

sales operation, he said.

While Oracle has improved its homegrown cloud products, it is

battling companies such as Salesforce.com Inc. and Workday Inc.,

which deliver software and storage solely on the web. Oracle also

is fighting to keep pace with giants including Microsoft Corp. and

Amazon.com Inc., which have built large businesses running

customers' computing operations in the cloud.

Separately, NetSuite also reported its quarterly results.

Revenue in the second quarter rose 30% to $230.8 million, but its

loss widened to $37.7 million from $32.3 million in the year-ago

period. Excluding certain costs, such as expenses related to

stock-based compensation, NetSuite's earnings rose to $6.6 million,

or 8 cents a share, from $1.7 million, or 2 cents a share.

Analysts surveyed by Thomson Reuters were expecting earnings of

3 cents a share on revenue of $231 million.

Oracle is an aggressive acquirer. spending more than $1 billion

in recent months to buy Opower Inc., which makes cloud software for

the utility industry, and Textura Corp., which provides similar

services for construction businesses.

The largest recent multibillion deal was Oracle's $5.3 billion

purchase in 2014 of Micros Systems Inc., which sells

internet-connected cash registers.

Oracle's other big acquisitions include its acrimonious hostile

takeover of PeopleSoft Inc. for $10.3 billion in 2004, another

hostile purchase of BEA Systems Inc. for $8.5 billion in 2008, and

its 2009 deal to buy Sun Microsystems Inc. for $7.4 billion.

Write to Jay Greene at Jay.Greene@wsj.com

(END) Dow Jones Newswires

July 28, 2016 11:09 ET (15:09 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

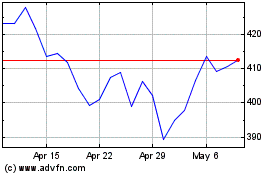

Microsoft (NASDAQ:MSFT)

Historical Stock Chart

From Mar 2024 to Apr 2024

Microsoft (NASDAQ:MSFT)

Historical Stock Chart

From Apr 2023 to Apr 2024