MasterCard Results Top Expectations as Transactions Grow -- Update

July 28 2016 - 11:22AM

Dow Jones News

By Austen Hufford and Robin Sidel

MasterCard Inc. said profit and revenue grew in the second

quarter as transactions increased at the credit card network.

Results topped expectations, and shares were up $1.72, or 1.83%,

to $95.47 in morning trading.

Like rival Visa Inc., MasterCard charges fees to financial

institutions for transactions that travel over its network.

Purchase, N.Y.-based MasterCard said transactions rose 14%

during the quarter but said that was partly offset by higher

rebates and incentives.

Operating expenses increased 15% to $1.31 billion in the

quarter, due to higher general and administrative, marketing and

legal expenses.

In all, MasterCard reported a profit of $983 million, or 89

cents a share, up from $921 million, or 81 cents, a year prior. On

an adjusted basis, earnings per share were 96 cents. Revenue rose

13% to $2.69 billion. Analysts polled by Thomson Reuters expected

90 cents in per-share profit on $2.59 billion in sales.

MasterCard is expanding from the traditional physical credit and

debit cards as its customers move to digital formats. Among other

things, it is overhauling its Masterpass digital payment platform

to let shoppers use the service on their mobile phones at store

check-out terminals, creating another rival to Apple Inc.'s Apple

Pay and a number of other mobile-payment products.

Chief Executive Officer Ajay Banga said the company is having a

"constructive dialogue" with PayPal Holdings Inc. to make

transactions more transparent. He didn't discuss details of those

talks, but said the companies have been holding conversations for

some time.

Last week, PayPal struck a deal with Visa Inc. in which

consumers can have an option to pay for purchases with PayPal when

they pay with their smartphones in a store. The deal also will

enable consumers to instantly withdraw money from PayPal's

person-to-Person Venmo service if they link the account to a Visa

debit card.

That deal came after years of tension between the two companies

and essentially may move more of PayPal's transactions to the Visa

network.

Mr. Banga said that MasterCard established rules for

digital-wallet operators like PayPal in 2013. Details of those

rules weren't immediately clear.

"PayPal is working to resolve some of the concerns we all had,"

Mr. Banga said, adding "I'm not saying there aren't hurdles along

the way."

Earlier this month, MasterCard said it was buying most of

VocaLink Holdings Ltd., a bank-owned technology company in the U.K.

that provides the backbone for non-card transactions such as

employer payroll deposits and consumer bill payments, for about

$920 million.

Write to Austen Hufford at austen.hufford@wsj.com and Robin

Sidel at robin.sidel@wsj.com

(END) Dow Jones Newswires

July 28, 2016 11:07 ET (15:07 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

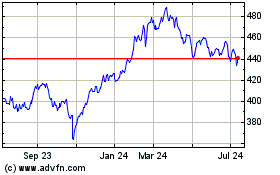

MasterCard (NYSE:MA)

Historical Stock Chart

From Mar 2024 to Apr 2024

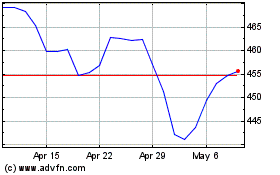

MasterCard (NYSE:MA)

Historical Stock Chart

From Apr 2023 to Apr 2024