The First of Long Island Corporation (Nasdaq:FLIC), the parent

company of The First National Bank of Long Island, reported

increases in net income and earnings per share for the three and

six months ended June 30, 2016. In the highlights that

follow, all comparisons are of the current three or six month

period to the same period last year unless indicated otherwise.

SECOND QUARTER HIGHLIGHTS

- Net Income increased 21.4% to $7.6 million from $6.3

million

- EPS increased 13.6% to $.50 from $.44

- Cash Dividends Per Share increased 5.3% to $.20 from

$.19

- Raised $35.3 million of Capital in a Public Offering to

support continued growth

- The Mortgage Loan Pipeline at quarter end was strong at

$170 million

- The Credit Quality of the Bank’s loan and securities

portfolios remains excellent

SIX MONTH HIGHLIGHTS

- Net Income increased 17.9% to $15.1 million from $12.8

million

- EPS increased 13.3% to $1.02 from $.90

- Cash Dividends Per Share increased 5.3% to $.40 from

$.38

- Tangible Book Value Per Share increased 10.3% to $19.59

from $17.76 at year end 2015

- 21.4% growth in the average balance of

Loans

- 19.6% growth in the average balance of Total

Deposits

- 13.3% growth in the average balance of

Noninterest-Bearing Checking Deposits

- 14.2% growth in average Stockholders’

Equity

Analysis of Earnings – Six Months Ended

June 30, 2016

Net income for the first six months of 2016 was

$15.1 million, an increase of $2.3 million, or 17.9%, over the same

period last year. The increase is primarily attributable to

an increase in net interest income of $5.7 million, or 15.6%, and a

decrease in the provision for loan losses of $961,000. The

impact of these items was partially offset by increases in

noninterest expense, before debt extinguishment costs, of $3.4

million and income tax expense of $678,000 and a decrease in

noninterest income, before securities gains, of

$265,000.

The increase in net interest income was

primarily driven by growth in average interest-earning assets of

$423.3 million, or 15.6%. Average interest-earning assets

grew mostly because of increases in the average balances of loans

of $402.5 million, or 21.4%, and nontaxable securities of $24.9

million, or 5.7%, partially offset by a decrease in the average

balance of taxable securities of $26.7 million, or 7.2%.

While most of the loan growth occurred in mortgage loans,

commercial and industrial loans also grew partially because of the

Bank’s small business credit scored loan initiative. The growth in

loans and nontaxable securities was primarily funded by growth in

the average balances of noninterest-bearing checking deposits of

$90.9 million, or 13.3%, and interest-bearing deposits of $322.3

million, or 22.7%.

Intermediate and long-term interest rates are

significantly lower now than they were at year-end 2015 and have

been low and volatile for an extended period of time. In a

low interest rate environment: (1) loans are sometimes originated

and investments are sometimes made at yields lower than existing

portfolio yields; (2) some loans prepay in full resulting in the

immediate writeoff of deferred costs; (3) prepayment speeds on

mortgage securities can be elevated resulting in accelerated

amortization of purchase premiums; (4) the benefit of no cost

funding in the form of noninterest-bearing checking deposits and

capital is suppressed; and (5) the Bank’s ability to reduce deposit

rates diminishes. Despite the downward pressure that these

factors exert on net interest income, the Bank’s net interest

margin of 2.91% for the first six months of 2016 was only down 3

basis points from the same period last year. This is because

a significant portion of the Bank’s loan portfolio was originated

in a low rate environment at yields not significantly different

than those available in 2015 and thus far in 2016.

The decrease in the provision for loan losses

for the current six month period versus the same period last year

is largely due to lesser loan growth, the absence of an increase in

specific reserves, a decrease in historical loss rates and net

recoveries on loans previously charged off.

The increase in noninterest expense, before debt

extinguishment costs, of $3.4 million, or 15.6%, is primarily

attributable to increases in salaries of $1.0 million, or 10.3%,

employee benefits expense of $710,000, or 25.9%, consulting expense

of $765,000, computer and telecommunications expense of $386,000

and marketing expense of $173,000. The increase in salaries

is primarily due to new branch openings, additions to staff in the

back office, higher stock-based compensation expense and normal

annual salary adjustments. The increase in employee benefits

expense is largely due to an increase in group health insurance

expense of $230,000 resulting from increases in staff count and the

rates being paid for group health insurance, higher incentive

compensation costs of $132,000 and an increase in pension expense

of $254,000. The increase in pension expense is primarily

attributable to the 2015 return on plan assets falling short of

expectation and an increase in the number of plan

participants. The increase in consulting expense is due to a

one-time charge of $800,000 in the second quarter of 2016 for

advisory services relating to a vendor contract

renegotiation. The Corporation expects that the cost savings

negotiated by the consultant over the life of the contract will far

exceed the one-time consulting charge. The increase in

computer and telecommunications expense is mainly attributable to a

growth-related increase in telecommunications capacity and one-time

expenses of approximately $126,000 related to changes in the

Corporation’s network and security systems.

The $265,000 decrease in noninterest income,

before securities gains, is primarily attributable to a $177,000

decrease in real estate tax refunds and a $91,000 sales tax refund

in the first quarter of 2015.

The $678,000 increase in income tax expense is

attributable to higher pre-tax earnings in the current six-month

period partially offset by additional New York State income tax

benefits derived from the Corporation’s captive REIT.

Analysis of Earnings – Second Quarter

2016 Versus Second Quarter 2015

Net income for the second quarter of 2016 was

$7.6 million, representing an increase of $1.3 million, or

21.4%, over $6.3 million earned in the second quarter of last

year. The increase is primarily attributable to an increase

in net interest income of $2.8 million and a decrease in the

provision for loan losses of $803,000. The positive impact of

these items was partially offset by increases in salaries of

$503,000, employee benefits expense of $404,000, consulting expense

of $766,000 and computer and telecommunications expense of

$258,000. The increases in net interest income, salaries, employee

benefits, consulting and computer and telecommunications expense

occurred for substantially the same reasons discussed above with

respect to the six-month periods. The decrease in the

provision for loan losses was largely due to lesser loan growth and

the absence of an increase in specific reserves in the current

quarter versus the same quarter last year.

Analysis of Earnings – Second Quarter

Versus First Quarter 2016

Net income for the second quarter of 2016

increased $190,000 over $7.4 million earned in the first

quarter. The increase was primarily attributable to an

increase in net interest income of $572,000 and decreases in

occupancy and equipment expense of $175,000 and provision for loan

losses of $114,000, partially offset by higher consulting expense

of $819,000. The increases in net interest income and

consulting expense occurred for substantially the same reasons

discussed above with respect to the six-month periods. The

decline in occupancy and equipment expense reflects lower equipment

maintenance and repair costs.

Asset Quality

The Bank’s allowance for loan losses to total

loans decreased 3 basis points from 1.21% at year-end 2015 to 1.18%

at June 30, 2016. The decrease is primarily due to improved

economic conditions and a reduction in the historical loss

component of the allowance for loan losses. The provision for

loan losses was $392,000 and $1.4 million in the first six months

of 2016 and 2015, respectively. The $392,000 provision in the

first half of 2016 is primarily attributable to loan growth

partially offset by improved economic conditions and the

aforementioned reduction in historical losses. The $1.4

million provision in the first half of 2015 was primarily

attributable to loan growth and the establishment of a $332,000

specific reserve on one loan deemed to be impaired, partially

offset by improved economic conditions.

The credit quality of the Bank’s loan portfolio

remains excellent. Nonaccrual loans amounted to $5.1 million,

or .22% of total loans outstanding, at June 30, 2016, compared to

$1.4 million, or .06%, at December 31, 2015. The increase in

nonaccrual loans is primarily attributable to two related mortgage

loans transferred to nonaccrual status, partially offset by loan

sales and paydowns. These two mortgage loans are current on

principal and interest payments and, based on new appraisals, have

loan-to-value ratios of less than 50%. Troubled debt

restructurings were essentially unchanged during the first half of

2016 amounting to $4.4 million, or .19% of total loans outstanding

at June 30, 2016. Of the troubled debt restructurings, $3.5

million are performing in accordance with their modified terms and

$860,000 are nonaccrual and included in the aforementioned amount

of nonaccrual loans. Loans past due 30 through 89 days

amounted to $1.3 million, or .06% of total loans outstanding, at

June 30, 2016, compared to $1.0 million, or .04%, at December 31,

2015.

The credit quality of the Bank’s securities

portfolio also remains excellent. The Bank’s mortgage

securities are backed by mortgages underwritten on conventional

terms, with 57% of these securities being full faith and credit

obligations of the U.S. government and the balance being

obligations of U.S. government sponsored entities. The

remainder of the Bank’s securities portfolio principally consists

of high quality, general obligation municipal securities rated AA

or better by major rating agencies. In selecting municipal

securities for purchase, the Bank uses credit agency ratings for

screening purposes only and then performs its own credit

analysis. On an ongoing basis, the Bank periodically assesses

the credit strength of the municipal securities in its portfolio

and makes decisions to hold or sell based on such assessments.

Capital

The Corporation’s Tier 1 leverage, Common Equity

Tier 1 risk-based, Tier 1 risk-based and Total risk-based capital

ratios were approximately 8.9%, 14.9%, 14.9% and 16.1%,

respectively, at June 30, 2016. During the second quarter of 2016,

the Corporation raised $35.3 million of capital in a public

offering of 1.3 million shares of common stock. In addition, the

Bank completed a deleveraging transaction in April 2016 that

involved the sale of $40.3 million of mortgage securities at a gain

of $1,795,000 and prepayment of $30 million of long-term debt at a

cost of $1,756,000. The capital raise and, to a much lesser extent,

the deleveraging transaction and retained net income were the

primary drivers of a 100 basis point increase in the

Corporation’s Tier 1 leverage capital ratio during the second

quarter. The strength of the Corporation’s balance sheet

positions the Corporation for continued growth in a measured and

disciplined fashion.

On June 30, 2016, the Corporation increased the

per investor limitation on quarterly stock purchases under its

Dividend Reinvestment and Stock Purchase Plan from $20,000 to

$50,000. This change is expected to provide additional

capital that can be used to accommodate future growth.

Key Strategic Initiatives

Key strategic initiatives will continue to

include loan and deposit growth through effective relationship

management, targeted solicitation efforts, new product offerings

and continued expansion of the Bank’s branch distribution system,

particularly in the New York City boroughs of Queens and

Brooklyn. With respect to loan growth, the Bank plans to

continue to prudently manage concentration risk and further develop

its broker and correspondent relationships. All loans

originated through such relationships are underwritten by Bank

personnel. The Bank’s branch distribution system currently

consists of forty-four branches in Nassau and Suffolk Counties,

Long Island and the boroughs of Queens and Manhattan. The

Bank anticipates opening new branches in Bay Ridge, Brooklyn,

College Point, Queens and East Islip, Long Island during the next

twelve months and continues to evaluate sites for further branch

expansion. In addition to loan and deposit growth, management

is also focused on growing noninterest income from existing and

potential new sources, which may include the acquisition of

fee-based businesses.

Challenges We Face

The federal funds target rate increased by

twenty-five basis points in December 2015. Further increases

could exert upward pressure on non-maturity deposit rates.

Intermediate and long-term interest rates are impacted by national

and global forces and have been low and volatile for an extended

period of time. They declined significantly since year-end

2015 and could remain low for the foreseeable future. This

could cause investing and lending rates to be suboptimal.

There is significant price competition for loans in the Bank’s

marketplace and little room for the Bank to further reduce its

deposit rates. These factors will make it difficult to

improve net interest margin and could result in a decline in net

interest margin from its current level and inhibit earnings growth

for the foreseeable future.

The banking industry continues to be faced with

new and complex regulatory requirements and enhanced supervisory

oversight. Banking regulators are increasingly concerned

about, among other things, growth, commercial real estate

concentrations, underwriting of commercial real estate and

commercial and industrial loans, capital levels and cyber

security. These factors are exerting downward pressure on

revenues and upward pressure on required capital levels and the

cost of doing business.

| |

|

| CONSOLIDATED BALANCE SHEETS |

|

| (Unaudited) |

|

|

|

|

|

|

|

|

|

|

|

6/30/16 |

|

12/31/15 |

|

|

|

|

(in thousands) |

|

|

|

|

|

|

| Assets: |

|

|

|

|

|

| Cash and cash equivalents |

|

$ |

51,026 |

|

|

$ |

39,635 |

|

|

| |

|

|

|

|

|

| Investment securities: |

|

|

|

|

|

| Held-to-maturity, at amortized cost

(fair value of $12,637 and $14,910) |

|

|

12,206 |

|

|

|

14,371 |

|

|

| Available-for-sale, at fair

value |

|

|

862,001 |

|

|

|

737,700 |

|

|

|

|

|

|

874,207 |

|

|

|

752,071 |

|

|

|

|

|

|

|

|

|

| Loans held-for-sale |

|

|

- |

|

|

|

105 |

|

|

| |

|

|

|

|

|

| Loans: |

|

|

|

|

|

| Commercial and industrial |

|

|

105,106 |

|

|

|

93,056 |

|

|

| Secured by real estate: |

|

|

|

|

|

| Commercial mortgages |

|

|

1,043,560 |

|

|

|

1,036,331 |

|

|

| Residential mortgages |

|

|

1,110,977 |

|

|

|

1,025,215 |

|

|

| Home equity lines |

|

|

87,971 |

|

|

|

87,848 |

|

|

| Consumer and other |

|

|

5,998 |

|

|

|

5,733 |

|

|

| |

|

|

2,353,612 |

|

|

|

2,248,183 |

|

|

| Allowance for loan losses |

|

|

(27,677 |

) |

|

|

(27,256 |

) |

|

|

|

|

|

2,325,935 |

|

|

|

2,220,927 |

|

|

|

|

|

|

|

|

|

| Restricted stock, at cost |

|

|

23,074 |

|

|

|

28,435 |

|

|

| Bank premises and equipment,

net |

|

|

31,527 |

|

|

|

30,330 |

|

|

| Bank-owned life insurance |

|

|

32,914 |

|

|

|

32,447 |

|

|

| Pension plan assets, net |

|

|

14,451 |

|

|

|

14,337 |

|

|

| Other assets |

|

|

14,154 |

|

|

|

12,056 |

|

|

| |

|

$ |

3,367,288 |

|

|

$ |

3,130,343 |

|

|

| Liabilities: |

|

|

|

|

|

| Deposits: |

|

|

|

|

|

| Checking |

|

$ |

765,392 |

|

|

$ |

777,994 |

|

|

| Savings, NOW and money market |

|

|

1,562,740 |

|

|

|

1,195,968 |

|

|

| Time, $100,000 and over |

|

|

190,606 |

|

|

|

198,147 |

|

|

| Time, other |

|

|

106,117 |

|

|

|

112,566 |

|

|

| |

|

|

2,624,855 |

|

|

|

2,284,675 |

|

|

| |

|

|

|

|

|

| Short-term borrowings |

|

|

57,666 |

|

|

|

211,502 |

|

|

| Long-term debt |

|

|

359,212 |

|

|

|

365,712 |

|

|

| Accrued expenses and other

liabilities |

|

|

9,497 |

|

|

|

12,313 |

|

|

| Deferred income taxes payable |

|

|

10,406 |

|

|

|

5,205 |

|

|

|

|

|

|

3,061,636 |

|

|

|

2,879,407 |

|

|

|

Stockholders' Equity: |

|

|

|

|

|

| Common stock, par value $.10 per

share: |

|

|

|

|

|

| Authorized, 40,000,000 shares |

|

|

|

|

|

| Issued and outstanding, 15,590,694

and 14,116,677 shares |

|

|

1,559 |

|

|

|

1,412 |

|

|

| Surplus |

|

|

96,273 |

|

|

|

56,931 |

|

|

| Retained earnings |

|

|

194,128 |

|

|

|

185,069 |

|

|

| |

|

|

291,960 |

|

|

|

243,412 |

|

|

| Accumulated other comprehensive

income, net of tax |

|

|

13,692 |

|

|

|

7,524 |

|

|

|

|

|

|

305,652 |

|

|

|

250,936 |

|

|

| |

|

$ |

3,367,288 |

|

|

$ |

3,130,343 |

|

|

| |

|

|

|

|

|

|

|

|

|

| CONSOLIDATED STATEMENTS OF

INCOME |

|

| (Unaudited) |

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Six Months Ended |

|

Three Months Ended |

|

| |

|

6/30/16 |

|

6/30/15 |

|

6/30/16 |

|

6/30/15 |

|

| |

|

(dollars in thousands) |

|

| |

|

|

|

|

|

|

|

| Interest and dividend

income: |

|

|

|

|

|

|

|

|

|

| Loans |

|

$ |

40,055 |

|

|

$ |

33,691 |

|

|

$ |

20,241 |

|

|

$ |

17,140 |

|

|

| Investment securities: |

|

|

|

|

|

|

|

|

|

| Taxable |

|

|

3,910 |

|

|

|

4,242 |

|

|

|

2,020 |

|

|

|

2,124 |

|

|

| Nontaxable |

|

|

6,823 |

|

|

|

6,792 |

|

|

|

3,420 |

|

|

|

3,403 |

|

|

|

|

|

|

50,788 |

|

|

|

44,725 |

|

|

|

25,681 |

|

|

|

22,667 |

|

|

| Interest

expense: |

|

|

|

|

|

|

|

|

|

| Savings, NOW and money market

deposits |

|

|

2,343 |

|

|

|

1,150 |

|

|

|

1,410 |

|

|

|

605 |

|

|

| Time deposits |

|

|

2,674 |

|

|

|

3,070 |

|

|

|

1,299 |

|

|

|

1,489 |

|

|

| Short-term borrowings |

|

|

131 |

|

|

|

94 |

|

|

|

7 |

|

|

|

13 |

|

|

| Long-term debt |

|

|

3,666 |

|

|

|

4,111 |

|

|

|

1,692 |

|

|

|

2,066 |

|

|

| |

|

|

8,814 |

|

|

|

8,425 |

|

|

|

4,408 |

|

|

|

4,173 |

|

|

| Net interest income |

|

|

41,974 |

|

|

|

36,300 |

|

|

|

21,273 |

|

|

|

18,494 |

|

|

| Provision for loan

losses |

|

|

392 |

|

|

|

1,353 |

|

|

|

139 |

|

|

|

942 |

|

|

| Net interest income after provision

for loan losses |

|

|

41,582 |

|

|

|

34,947 |

|

|

|

21,134 |

|

|

|

17,552 |

|

|

| |

|

|

|

|

|

|

|

|

|

| Noninterest

income: |

|

|

|

|

|

|

|

|

|

| Investment Management Division

income |

|

|

990 |

|

|

|

1,039 |

|

|

|

514 |

|

|

|

532 |

|

|

| Service charges on deposit

accounts |

|

|

1,290 |

|

|

|

1,325 |

|

|

|

656 |

|

|

|

669 |

|

|

| Net gains on sales of

securities |

|

|

1,844 |

|

|

|

1,133 |

|

|

|

1,844 |

|

|

|

1,133 |

|

|

| Other |

|

|

1,361 |

|

|

|

1,542 |

|

|

|

717 |

|

|

|

749 |

|

|

| |

|

|

5,485 |

|

|

|

5,039 |

|

|

|

3,731 |

|

|

|

3,083 |

|

|

| Noninterest

expense: |

|

|

|

|

|

|

|

|

|

| Salaries |

|

|

11,049 |

|

|

|

10,020 |

|

|

|

5,471 |

|

|

|

4,968 |

|

|

| Employee benefits |

|

|

3,449 |

|

|

|

2,739 |

|

|

|

1,780 |

|

|

|

1,376 |

|

|

| Occupancy and equipment |

|

|

4,579 |

|

|

|

4,569 |

|

|

|

2,202 |

|

|

|

2,111 |

|

|

| Debt extinguishment |

|

|

1,756 |

|

|

|

1,084 |

|

|

|

1,756 |

|

|

|

1,084 |

|

|

| Other |

|

|

6,470 |

|

|

|

4,777 |

|

|

|

3,663 |

|

|

|

2,503 |

|

|

| |

|

|

27,303 |

|

|

|

23,189 |

|

|

|

14,872 |

|

|

|

12,042 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Income before income taxes |

|

|

19,764 |

|

|

|

16,797 |

|

|

|

9,993 |

|

|

|

8,593 |

|

|

| Income tax expense |

|

|

4,714 |

|

|

|

4,036 |

|

|

|

2,373 |

|

|

|

2,317 |

|

|

| Net Income |

|

$ |

15,050 |

|

|

$ |

12,761 |

|

|

$ |

7,620 |

|

|

$ |

6,276 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Per Share Data: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Basic EPS |

|

$ |

1.03 |

|

|

$ |

.91 |

|

|

$ |

.51 |

|

|

$ |

.45 |

|

|

| Diluted EPS |

|

$ |

1.02 |

|

|

$ |

.90 |

|

|

$ |

.50 |

|

|

$ |

.44 |

|

|

| Cash Dividends Declared |

|

$ |

.40 |

|

|

$ |

.38 |

|

|

$ |

.20 |

|

|

$ |

.19 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| FINANCIAL RATIOS |

|

| (Unaudited) |

|

| |

|

|

|

|

|

|

|

|

|

| ROA |

|

|

.94 |

% |

|

|

.92 |

% |

|

|

.93 |

% |

|

|

.88 |

% |

|

| ROE |

|

|

11.16 |

% |

|

|

10.83 |

% |

|

|

10.74 |

% |

|

|

10.53 |

% |

|

| Net

Interest Margin |

|

|

2.91 |

% |

|

|

2.94 |

% |

|

|

2.89 |

% |

|

|

2.96 |

% |

|

| Dividend

Payout Ratio |

|

|

39.22 |

% |

|

|

42.22 |

% |

|

|

40.00 |

% |

|

|

43.18 |

% |

|

| |

|

|

|

|

|

|

|

|

|

| PROBLEM AND POTENTIAL

PROBLEM LOANS AND ASSETS |

|

|

(Unaudited) |

|

|

|

|

|

|

|

|

|

|

|

|

|

6/30/16 |

|

12/31/15 |

|

|

|

|

|

(in thousands) |

|

|

|

|

|

|

|

|

|

|

| Loans, excluding

troubled debt restructurings: |

|

|

|

|

|

|

| Past due 30 through 89

days |

|

$ |

1,331 |

|

|

$ |

1,003 |

|

|

|

| Past due 90 days or more and still

accruing |

|

|

- |

|

|

|

- |

|

|

|

| Nonaccrual (includes $105,000 in

loans held-for-sale at 12/31/15) |

|

|

4,217 |

|

|

|

535 |

|

|

|

| |

|

|

5,548 |

|

|

|

1,538 |

|

|

|

| Troubled debt

restructurings: |

|

|

|

|

|

|

| Performing according to their

modified terms |

|

|

3,530 |

|

|

|

3,581 |

|

|

|

| Past due 30 through 89

days |

|

|

- |

|

|

|

- |

|

|

|

| Past due 90 days or more and still

accruing |

|

|

- |

|

|

|

- |

|

|

|

| Nonaccrual |

|

|

860 |

|

|

|

900 |

|

|

|

| |

|

|

4,390 |

|

|

|

4,481 |

|

|

|

| Total past due,

nonaccrual and restructured loans: |

|

|

|

|

|

|

| Restructured and performing

according to their modified terms |

|

|

3,530 |

|

|

|

3,581 |

|

|

|

| Past due 30 through 89

days |

|

|

1,331 |

|

|

|

1,003 |

|

|

|

| Past due 90 days or more and still

accruing |

|

|

- |

|

|

|

- |

|

|

|

| Nonaccrual |

|

|

5,077 |

|

|

|

1,435 |

|

|

|

| |

|

|

9,938 |

|

|

|

6,019 |

|

|

|

| Other real estate

owned |

|

|

- |

|

|

|

- |

|

|

|

| |

|

$ |

9,938 |

|

|

$ |

6,019 |

|

|

|

| |

|

|

|

|

|

|

| Allowance for loan

losses |

|

$ |

27,677 |

|

|

$ |

27,256 |

|

|

|

| Allowance for loan

losses as a percentage of total loans |

|

|

1.18 |

% |

|

|

1.21 |

% |

|

|

| Allowance for loan

losses as a multiple of nonaccrual loans |

|

|

5.5x |

|

|

|

19.0x |

|

|

|

| |

|

|

|

|

|

|

| AVERAGE BALANCE SHEET, INTEREST RATES AND

INTEREST DIFFERENTIAL |

|

|

| (Unaudited) |

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Six Months Ended June 30, |

|

|

| |

|

2016 |

|

2015 |

|

|

| |

|

Average |

|

Interest/ |

|

Average |

|

Average |

|

Interest/ |

|

Average |

|

|

| |

|

Balance |

|

Dividends |

|

Rate |

|

Balance |

|

Dividends |

|

Rate |

|

|

|

Assets: |

|

(in thousands) |

|

|

|

Interest-earning bank balances |

|

$ |

43,242 |

|

|

$ |

111 |

|

|

.52 |

% |

$ |

20,662 |

|

|

$ |

25 |

|

|

.24 |

% |

|

|

|

Investment securities: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Taxable |

|

|

345,785 |

|

|

|

3,799 |

|

|

2.20 |

|

|

|

372,462 |

|

|

|

4,217 |

|

|

2.26 |

|

|

|

| Nontaxable (1) |

|

|

460,309 |

|

|

|

10,497 |

|

|

4.56 |

|

|

|

435,445 |

|

|

|

10,449 |

|

|

4.80 |

|

|

|

| Loans

(1) |

|

|

2,287,335 |

|

|

|

40,062 |

|

|

3.50 |

|

|

|

1,884,834 |

|

|

|

33,699 |

|

|

3.58 |

|

|

|

| Total

interest-earning assets |

|

|

3,136,671 |

|

|

|

54,469 |

|

|

3.47 |

|

|

|

2,713,403 |

|

|

|

48,390 |

|

|

3.57 |

|

|

|

|

Allowance for loan losses |

|

|

(27,711 |

) |

|

|

|

|

|

|

|

(23,704 |

) |

|

|

|

|

|

|

|

| Net

interest-earning assets |

|

|

3,108,960 |

|

|

|

|

|

|

|

|

2,689,699 |

|

|

|

|

|

|

|

|

| Cash and

due from banks |

|

|

30,165 |

|

|

|

|

|

|

|

|

28,404 |

|

|

|

|

|

|

|

|

| Premises

and equipment, net |

|

|

30,958 |

|

|

|

|

|

|

|

|

28,839 |

|

|

|

|

|

|

|

|

| Other

assets |

|

|

58,558 |

|

|

|

|

|

|

|

|

59,065 |

|

|

|

|

|

|

|

|

|

|

|

$ |

3,228,641 |

|

|

|

|

|

|

|

$ |

2,806,007 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Liabilities and Stockholders' Equity: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Savings, NOW & money market deposits |

$ |

1,436,975 |

|

|

|

2,343 |

|

|

.33 |

|

|

$ |

1,097,823 |

|

|

|

1,150 |

|

|

.21 |

|

|

|

| Time

deposits |

|

|

306,485 |

|

|

|

2,674 |

|

|

1.75 |

|

|

|

323,352 |

|

|

|

3,070 |

|

|

1.91 |

|

|

|

| Total

interest-bearing deposits |

|

|

1,743,460 |

|

|

|

5,017 |

|

|

.58 |

|

|

|

1,421,175 |

|

|

|

4,220 |

|

|

.60 |

|

|

|

|

Short-term borrowings |

|

|

53,690 |

|

|

|

131 |

|

|

.49 |

|

|

|

61,307 |

|

|

|

94 |

|

|

.31 |

|

|

|

|

Long-term debt |

|

|

371,500 |

|

|

|

3,666 |

|

|

1.98 |

|

|

|

380,832 |

|

|

|

4,111 |

|

|

2.18 |

|

|

|

| Total

interest-bearing liabilities |

|

|

2,168,650 |

|

|

|

8,814 |

|

|

.82 |

|

|

|

1,863,314 |

|

|

|

8,425 |

|

|

.91 |

|

|

|

| Checking

deposits |

|

|

774,043 |

|

|

|

|

|

|

|

|

683,160 |

|

|

|

|

|

|

|

|

| Other

liabilities |

|

|

14,707 |

|

|

|

|

|

|

|

|

22,020 |

|

|

|

|

|

|

|

|

| |

|

|

2,957,400 |

|

|

|

|

|

|

|

|

2,568,494 |

|

|

|

|

|

|

|

|

|

Stockholders' equity |

|

|

271,241 |

|

|

|

|

|

|

|

|

237,513 |

|

|

|

|

|

|

|

|

|

|

|

$ |

3,228,641 |

|

|

|

|

|

|

|

$ |

2,806,007 |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net

interest income (1) |

|

|

|

$ |

45,655 |

|

|

|

|

|

|

|

$ |

39,965 |

|

|

|

|

|

|

| Net

interest spread (1) |

|

|

|

|

|

2.65 |

% |

|

|

|

|

|

2.66 |

% |

|

|

| Net

interest margin (1) |

|

|

|

|

|

2.91 |

% |

|

|

|

|

|

2.94 |

% |

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(1) Tax-equivalent basis. Interest income on a

tax-equivalent basis includes the additional amount of interest

income that would have been earned if the Corporation's investment

in tax-exempt loans and investment securities had been made in

loans and investment securities subject to Federal income taxes

yielding the same after-tax income. The tax-equivalent amount

of $1.00 of nontaxable income was $1.54 for each period presented

using the statutory Federal income tax rate.

Forward Looking Information

This earnings release contains various

“forward-looking statements” within the meaning of that term as set

forth in Rule 175 of the Securities Act of 1933 and Rule 3b-6 of

the Securities Exchange Act of 1934. Such statements are

generally contained in sentences including the words “may” or

“expect” or “could” or “should” or “would” or “believe”. The

Corporation cautions that these forward-looking statements are

subject to numerous assumptions, risks and uncertainties that could

cause actual results to differ materially from those contemplated

by the forward-looking statements. Factors that could cause

future results to vary from current management expectations

include, but are not limited to, changing economic conditions;

legislative and regulatory changes; monetary and fiscal policies of

the federal government; changes in interest rates; deposit flows

and the cost of funds; demands for loan products; competition;

changes in management’s business strategies; changes in accounting

principles, policies or guidelines; changes in real estate values;

and other factors discussed in the “risk factors” section of the

Corporation’s filings with the Securities and Exchange

Commission. The forward-looking statements are made as of the

date of this report, and the Corporation assumes no obligation to

update the forward-looking statements or to update the reasons why

actual results could differ from those projected in the

forward-looking statements.

For more detailed financial information please

see the Corporation’s quarterly report on Form 10-Q for the quarter

ended June 30, 2016. The Form 10-Q will be available through

the Bank’s website at www.fnbli.com on or about August 9,

2016, after it is electronically filed with the Securities and

Exchange Commission (“SEC”). Our SEC filings are also

available on the SEC’s website at www.sec.gov. You may also

read and copy any document we file with the SEC at the SEC’s public

reference room at 100 F Street, N.E., Room 1580, Washington, DC

20549. You should call 1-800-SEC-0330 for more information on

the public reference room.

For More Information Contact:

Mark D. Curtis, SEVP, CFO and Treasurer

(516) 671-4900, Ext. 7413

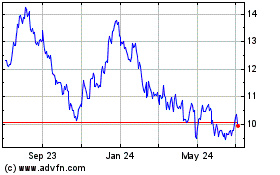

First of Long Island (NASDAQ:FLIC)

Historical Stock Chart

From Mar 2024 to Apr 2024

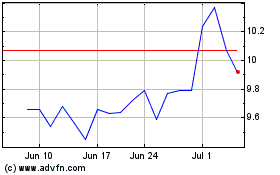

First of Long Island (NASDAQ:FLIC)

Historical Stock Chart

From Apr 2023 to Apr 2024