By Ellie Ismailidou and Barbara Kollmeyer, MarketWatch

Ford slumps more than 7% as earnings miss view; Facebook extends

gains on strong results

Wall Street was on track for small losses Thursday, following

disappointing earnings reports from heavyweights Ford and

ConocoPhillips and mixed economic data from the U.S.

The number of people who applied for unemployment benefits

(http://www.marketwatch.com/story/jobless-claims-climb-14000-to-266000-2016-07-28)last

week rose from historical lows, while the nation's trade gap

widened in June to $63.3 billion, as imports rose faster than

exports. Meanwhile, while wholesale inventories were unchanged and

retail inventories inched higher.

After trading with a gain of 64 points earlier, the Dow Jones

Industrial Average futures were off 21 points, or 0.1%, at 18,370,

while S&P 500 futures declined by less than 2 points, or 0.1%

to 2,159. Nasdaq-100 futures were 5.75 points, or 0.1%, lower at

4,702.

Thursday's moves follow a volatile session Wednesday

(http://www.marketwatch.com/story/us-stock-futures-rise-led-higher-by-apple-2016-07-27),

when stocks closed lower after the Federal Reserve hinted at a

September rate increase in its policy statement

(http://www.marketwatch.com/story/fed-appears-more-open-to-september-rate-hike-2016-07-27),

saying near-term risks to the economic outlook have diminished. The

S&P 500 index pulled back 2.6 points to 2,166.58, as losses for

consumer staple such as Coca-Cola (KO) and utilities weighed on the

index.

But on Thursday, market observers were rethinking the Fed

language from that meeting.

"The FOMC minutes do appear to have struck a dovish tone with

investors despite offering a more upbeat assessment of the economy

and highlighting the diminishing near-term risks. This could be

helping to lift sentiment ahead of the open today," said Craig

Erlam, senior market analyst with Oanda, in emailed comments.

Economic data on the calendar include rental vacancy rates for

the second quarter at 10 a.m. Eastern.

Stocks to watch: Shares of ConocoPhilips (COP) erased earlier

losses to trade up 0.7% premarket, despite the fact that the oil

company reported a bigger loss than expected.

(http://www.marketwatch.com/story/conocophillip-loss-widens-as-revenue-slumps-36-2016-07-28)

Ford Motor Co.(F)slumped 7.2% following an earnings miss

(http://www.marketwatch.com/story/fords-stock-tumbles-after-profit-misses-expectations-2016-07-28),

while Dow Chemicals Co.(DOW) inched up 0.9% after earnings and

revenue came in better than forecast by Wall Street.

Colgate-Palmolive Co.(CL) rose 0.9% after the consumer products

firm said profit rose in the second quarter.

(http://www.marketwatch.com/story/colgate-palmolive-shares-rise-after-earnings-beat-estimates-2016-07-28)

Harley-Davidson Inc.(HOG) also beat on both profit and revenue

(https://www.google.com/url?sa=t&rct=j&q=&esrc=s&source=web&cd=6&cad=rja&uact=8&ved=0ahUKEwjY3P-mkZbOAhUDTCYKHVGmBs8QqQIILTAF&url=http%3A%2F%2Fwww.marketwatch.com%2Fstory%2Fharley-davidson-beats-on-earnings-revenue-lowers-2016-motorcycle-shipment-guidance-2016-07-28&v6u=https%3A%2F%2Fs-v6exp1-ds.metric.gstatic.com%2Fgen_204%3Fip%3D205.203.130.22%26ts%3D1469708091514619%26auth%3Dol6dpt42mbijwgltfzjjxqkdfopmhwzt%26rndm%3D0.7774477069103305&v6s=2&v6t=5112&usg=AFQjCNG1hOjwMybsdl4OL7kojLkSNvrvaw&sig2=KsifhvXI0hzUzuk2isGAhQ&bvm=bv.128450091,bs.2,d.dmo),

but shares didn't move premarket.

Hershey(HSY) swung to a profit in the second quarter.

(https://www.google.com/url?sa=t&rct=j&q=&esrc=s&source=web&cd=8&cad=rja&uact=8&ved=0ahUKEwjUqaiykZbOAhWD3SYKHWGQAVsQqQIIMTAH&url=http%3A%2F%2Fwww.marketwatch.com%2Fstory%2Fhershey-co-beats-second-quarter-earnings-expectations-2016-07-28&usg=AFQjCNG6tO8gVxg-k6yqBqTCEYiDGTeLfg&sig2=b8nvyO71rUAmRmkBzu0qXA&bvm=bv.128450091,bs.2,d.dmo)

(https://www.google.com/url?sa=t&rct=j&q=&esrc=s&source=web&cd=8&cad=rja&uact=8&ved=0ahUKEwjUqaiykZbOAhWD3SYKHWGQAVsQqQIIMTAH&url=http%3A%2F%2Fwww.marketwatch.com%2Fstory%2Fhershey-co-beats-second-quarter-earnings-expectations-2016-07-28&usg=AFQjCNG6tO8gVxg-k6yqBqTCEYiDGTeLfg&sig2=b8nvyO71rUAmRmkBzu0qXA&bvm=bv.128450091,bs.2,d.dmo)Shares

of MasterCard Inc. (MA) climbed 1.6% premarket, after the payments

processing and credit card company beat second-quarter profit and

revenue expectations

(http://www.marketwatch.com/story/mastercards-stock-jumps-after-profit-sales-beat-expectations-2016-07-28).

HCA Holdings Inc.(HCA) lost 1.3% after its earnings missed

expectations.

Facebook

(http://www.marketwatch.com/story/facebook-posts-huge-revenue-beat-2016-07-27)(FB)

rose 3.8% ahead of the bell, adding to Wednesday's late-session

gains after soundly beating on earnings and revenue. But the

social-media network's Chief Financial Officer Dave Wehner said the

company expects lower ad revenue growth in the next two quarters

and just modest growth in its ad load.

Read:Facebook's rapid growth is about to slow down

(http://www.marketwatch.com/story/facebooks-rapid-growth-is-about-to-slow-down-2016-07-27)

Shares of Whole Foods Market Inc

(http://www.marketwatch.com/story/whole-foods-profit-falls-sales-slip-2016-07-27-18485051).(WFM)

looked set to add to a nearly 5% late-session drop. That move came

after the upmarket grocer gave a weak forecast for the current

quarter as it booked a fourth-straight quarterly profit fall on

Wednesday.

GoPro Inc

(http://www.marketwatch.com/story/gopro-reports-loss-but-results-beat-estimates-2016-07-27).(GPRO)

swung to a loss, but results still beat expectations, and shares

rose 2.7% in Thursday's premarket session. Groupon Inc

(http://www.marketwatch.com/story/groupon-shares-surge-as-results-top-expectations-2016-07-27-174852644).(GRPN)

soared 25.4% before the open after posting better-than-expected

results late on Wednesday.

Weight Watchers International Inc

(http://www.marketwatch.com/story/weight-watchers-boosts-membership-by-nearly-5-2016-05-04).(WTW)

shares also exploded overnight, with a 13% gain after increasing

its membership rolls for the first time in four years.

After Thursday's close, Alphabet Inc.(GOOGL), Amazon.com

Inc.(AMZN), Expedia Inc.(EXPE) CBS Corp.(CBSA) are expected to

report earnings.

Read:Alphabet earnings bring concern about Google search growth,

revenue

(http://www.marketwatch.com/story/alphabet-earnings-bring-concern-about-google-search-growth-revenue-2016-07-26)

And: Here's what to expect from Amazon earnings

(http://www.marketwatch.com/story/what-to-watch-for-in-amazon-earnings-2016-07-25).

Other markets: The Nikkei 225 index

(http://www.marketwatch.com/story/asian-markets-fall-ahead-of-bank-of-japan-meeting-2016-07-27)

slipped 1.1% as investors stayed cautious about a potential

stimulus plan. The Bank of Japan will wrap up its policy meeting

Friday, and some investors expect it to join forces with the

government to announce a big batch of stimulus measures the same

day.

As the Nikkei fell, the yen moved up against rival currencies,

pushing the dollar to Yen104.70 from Yen105.41 late Wednesday in

New York.

Gold prices surged $16.30, or 1.1%, to $1,343 as some investors

took the view that the Fed really doesn't have the option to raise

interest rates in September.

Check out: Why gold prices spiked after the Fed decision

(http://www.marketwatch.com/story/why-gold-prices-spiked-after-the-fed-decision-2016-07-27)

European stocks struggled amid a batch of big earnings

(http://www.marketwatch.com/story/european-stocks-wobble-as-avalanche-of-earnings-reports-rolls-in-2016-07-28).

Read:Do the math--Brexit really is starting to bite at European

companies

(http://www.marketwatch.com/story/brexit-beats-oil-low-growth-as-hot-topic-during-europes-earnings-season-2016-07-28)

(http://www.marketwatch.com/story/brexit-beats-oil-low-growth-as-hot-topic-during-europes-earnings-season-2016-07-28)--Sara

Sjolin contributed to this article.

(END) Dow Jones Newswires

July 28, 2016 09:01 ET (13:01 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

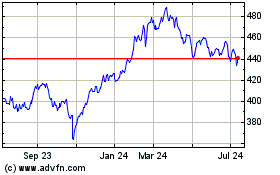

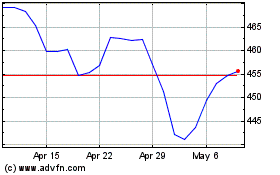

MasterCard (NYSE:MA)

Historical Stock Chart

From Mar 2024 to Apr 2024

MasterCard (NYSE:MA)

Historical Stock Chart

From Apr 2023 to Apr 2024