Diageo Profit Hit by Currency Volatility -- Update

July 28 2016 - 4:11AM

Dow Jones News

By Saabira Chaudhuri

LONDON-- Diageo PLC reported weaker profit for the year amid

currency volatility but the world's largest spirits maker's key

U.S. business delivered strong second-half revenue and executives

signaled they expect the growth to continue.

The maker of Johnnie Walker whiskey and Smirnoff vodka reported

a net profit of GBP2.24 billion ($2.94 billion) for the year ended

June 30, down from GBP2.38 a year earlier. Operating profit,

excluding one-time items, fell 1.9% to GBP3 billion on the back of

unfavorable currency movements.

Diageo had billed the past year as a transition period, laying

the groundwork for better sales growth as the company attempts to

turn around its performance in North America, its largest market.

The spirits maker has shifted its focus to more closely tracking

what is sold to retailers rather than what is shipped to

distributors.

Chief Executive Ivan Menezes on Thursday said Diageo's six

global brands--Johnnie Walker, Smirnoff, Baileys, Captain Morgan,

Tanqueray and Guinness--and its U.S. spirits business are back in

growth while scotch and beer have improved.

In the U.S., organic sales were up 3% from a year ago as Diageo

delivered a 10% jump in sales in the second half buoyed by North

American whiskey brands such as Crown Royal and Bulleit. The

results offer a respite to investors after declines in the U.S.

pulled down overall results last year, sparking concerns that

consumers had fallen out of love with Diageo's mainstream brands

like Smirnoff.

"While this is not exactly a brilliant set of results, it's a

start," said Exane BNP Paribas analyst Eamonn Ferry.

The company said that "depletions" in the U.S., which is the

amount retailers actually sell as opposed to the amount Diageo

ships to them, grew by 3%. Chief Financial Officer Kathryn Mikells

on a call with reporters said that figure gives Diageo confidence

that its stronger performance in the U.S. can continue.

Overall, net sales were down to GBP10.49 billion from GBP10.81

billion. But on an organic basis, which strips out currency

movements and acquisitions, net sales were up 2.8%.

The company said it expects net sales to get a GBP1.1 billion

lift and net profit to benefit by GBP370 million from exchange rate

movements for fiscal 2017 following the recent weakness of the U.K.

pound after Britain voted to leave the European Union.

Ms. Mikells said Diageo's business hadn't yet seen any impact

from Brexit apart from the currency lift.

The company posted flat sales in Scotch, its largest and most

profitable category. Scotch has taken a beating over the past two

years as the emerging-markets-heavy business was hit by currency

fluctuations, political instability and destocking, while

competition from Japanese whiskies and bourbon climbed. On

Thursday, the company said declines in Africa, China and Korea

offset rises in North America, Europe and Latin America.

Ciroc sales fell 3% for the year after a tough first half in

which sales of the high-end flavored vodka plummeted. Ms. Mikells

said Diageo is working to broaden Ciroc's appeal beyond its core

drinkers who are urban, affluent and black.

In the Asia-Pacific region, organic sales rose 2% from a year

earlier although volumes declined 3% as Diageo raised prices.

In Latin America and the Caribbean, organic sales edged up 1%

from a year earlier. Diageo in May disclosed that its Latin America

sales would take a 2% hit in fiscal 2016 from sales that the

company accidentally double booked.

Diageo expects to log mid-single digit revenue growth in fiscal

2017 and will deliver a percentage point of improvement on an

organic basis to its operating margin in the next three years.

Write to Saabira Chaudhuri at saabira.chaudhuri@wsj.com

(END) Dow Jones Newswires

July 28, 2016 03:56 ET (07:56 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

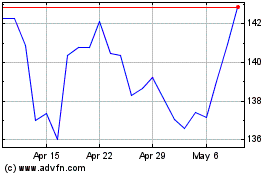

Diageo (NYSE:DEO)

Historical Stock Chart

From Mar 2024 to Apr 2024

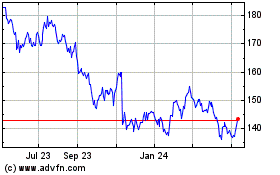

Diageo (NYSE:DEO)

Historical Stock Chart

From Apr 2023 to Apr 2024