Brexit Surprise: A Loss and Gain For U.K.'s Glaxo -- WSJ

July 28 2016 - 3:03AM

Dow Jones News

By Denise Roland

LONDON -- While Brexit provided an expected boost to core

earnings for GlaxoSmithKline PLC, it also led to a big write-down

-- the latest in a series of surprises stemming from Britain's vote

to leave the European Union.

The U.K.-based drug giant said it recorded a GBP1.8 billion

pound ($2.4 billion) charge to earnings, resulting in a net loss

for the second quarter. The charge came after the company revalued

its liabilities in line with the steeply lower pound. Sterling fell

sharply after the Brexit vote last month and hasn't recovered

much.

Investors and analysts shrugged off the big charge and net loss,

with the stock finishing up 1.8% in London. They had been expecting

the lower pound to sharply boost the company's so-called core

earnings, which strip out one-time items. It did -- increasing core

earnings by 21 percentage points for the second quarter. Revenue

rose seven percentage points.

Glaxo also narrowed its earnings guidance for the full year to

the upper end of its previous range.

The company separately said it would invest GBP275 million to

increase capacity at three of its U.K. factories, which Chief

Executive Andrew Witty said was a vote of confidence in the face of

the Brexit vote.

Mr. Witty said Wednesday that going forward the company was

"reasonably insulated" from any Brexit fallout. He said his U.K.

investment decision, taken after the June 23 referendum, was a sign

that Glaxo believed Britain was just as competitive today as it was

before the vote.

The big charge was the latest in a series of unexpected Brexit

consequences that have roiled boardrooms. Most have stemmed from

the steep slide in sterling.

Earlier this week, Anheuser-Busch InBev NV boosted its offer for

SABMiller PLC in their $100-billion-plus proposed beer megamerger.

The move was an attempt to quell some angry investors who say pound

weakness has made the deal less attractive. It came after the two

have spent months trying to win regulatory approval around the

world, agreeing to sell off big chunks of their businesses in the

process.

Shares have soared for companies like Glaxo, which report in

sterling but derive most of their sales in other currencies. After

the steep fall in the pound, analysts have been expecting a big

currency tailwind in profit for these firms, as those overseas

sales translated into more pounds than they would have before the

vote.

Glaxo's core operating profit, boosted by the currency tailwind,

increased 36% to GBP1.8 billion. Revenue climbed 11% to GBP6.5

billion, beating analyst forecasts of GBP1.6 billion and GBP6.3

billion, respectively. Adjusting for currency effects, core

operating profit climbed 15%, and revenue rose 4%.

But the falling pound also increases the value of Glaxo's

liabilities, forcing the company to take the GBP1.8 billion

write-down and post a net loss of GBP435 million for the three

months to June 30. That compared with a GBP149 million net profit

reported a year earlier.

Those liabilities include a put option held by Novartis AG

giving the Swiss drug giant the right to sell its stake in the

pair's jointly owned consumer-health-care business to Glaxo. With a

weaker pound, that stake is worth more, so it would cost Glaxo more

to acquire.

Glaxo also narrowed its full-year guidance to the upper end of

earlier estimates. It now expects core earnings per share to

increase 11% to 12% in 2016, compared with 10% to 12%

previously.

Write to Denise Roland at Denise.Roland@wsj.com

(END) Dow Jones Newswires

July 28, 2016 02:48 ET (06:48 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

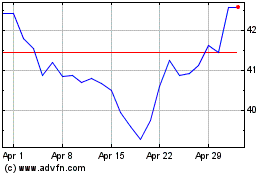

GSK (NYSE:GSK)

Historical Stock Chart

From Mar 2024 to Apr 2024

GSK (NYSE:GSK)

Historical Stock Chart

From Apr 2023 to Apr 2024