Coke Cuts Revenue Outlook -- WSJ

July 28 2016 - 3:03AM

Dow Jones News

Volume stalled in quarter, hit by weaker sales in China and

developing markets

By Mike Esterl and Anne Steele

Coca-Cola Co. lowered its 2016 revenue outlook Wednesday after

second-quarter volumes stalled for the first time in more than a

decade, hurt by falling sales in China and other developing

markets.

The beverage giant also gave full-year guidance for comparable

earnings per share below Wall Street expectations, saying it

anticipates the metric to decline 4% to 7% from a year earlier,

implying a range of $1.86 to $1.92. Analysts polled by Thomson

Reuters had forecast $1.94.

Not all the news was bad. Coke said it increased prices 3%

globally in the second quarter, partly by selling smaller items

that cost more per ounce, as it increasingly focuses on revenue

instead of volume for growth.

The Atlanta-based maker of Sprite, Minute Maid and Smartwater

reported its operating margin rose 3.93 percentage points to

24.78%, lifted by bottling divestments and a $3 billion

cost-cutting program.

"The macro headwinds are putting pressure on our top line, but

they are cyclical in nature and we're taking the right actions,"

Chief Executive Muhtar Kent told analysts during an earnings

call.

Still, the company now expects organic revenue, which strips out

foreign-exchange swings and structural items, to increase just 3%

this year. That is down from its earlier forecast of 4% to 5%.

The most recent quarter represented the first time that Coke's

volumes didn't grow since 1999. Noncarbonated beverages rose 2% but

soda dipped 1%, the first time soda volume declined since the first

quarter of 2014.

Coke's share price was down 3.3% at $43.40 in late afternoon

trading on the New York Stock Exchange.

Management singled out China, Argentina and Venezuela as the

biggest drags on results, but sales also slumped in other big

developing markets, including Russia, Turkey and Brazil.

Chief Operating Officer James Quincey said Coke expects its

China unit, which posted a high-single-digit percentage decline in

volume, to remain under pressure for the rest of the year as

consumers rein in spending. Coke owns about a third of its bottling

and distribution in China, more than in most other countries,

exacerbating the impact of the downturn.

The company posted growth in several developed markets. Volumes

rose 1% in North America and 4% in Japan, in addition to a

mid-single-digit percentage increase in Mexico.

Volumes were flat in Europe, with the company citing poor

weather and security concerns after recent terrorist attacks.

"People respond to some of these tragic events by perhaps staying

at home a little bit more, " Mr. Quincey told analysts.

Coke continues to make headway in refranchising its U.S. soda

bottling and distribution by the end of 2017, part of a strategy to

focus on its more profitable concentrate business.

The company announced new deals Wednesday to transfer territory

in Washington state and North Carolina to two small bottling

partners. It said it currently has divestment agreements for 65% of

bottler volume and 43 of 51 cold-fill production facilities in the

U.S.

Coca-Cola Femsa SAB, Coke's biggest Mexican bottler, also said

Wednesday it had secured "preferential" rights to potentially buy

Coke bottling assets in the U.S., Latin America and elsewhere.

In all for the quarter, Coke posted a profit of $3.45 billion,

or 79 cents a share, up from $3.11 billion, or 71 cents a share, a

year earlier. Excluding certain items, per-share earnings were 60

cents, topping the 58 cents that analysts had forecast. The company

said weaker foreign currencies shaved 10 percentage points off its

per-share earnings.

Revenue slipped 5.1% to $11.54 billion, below analysts'

prediction for $11.64 billion.

Write to Mike Esterl at mike.esterl@wsj.com and Anne Steele at

Anne.Steele@wsj.com

Corrections & Amplifications: Coke's soda volume declined in

the latest quarter. An earlier version of this article incorrectly

stated that it was flat. (July 27, 2016)

(END) Dow Jones Newswires

July 28, 2016 02:48 ET (06:48 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

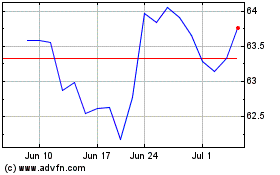

Coca Cola (NYSE:KO)

Historical Stock Chart

From Mar 2024 to Apr 2024

Coca Cola (NYSE:KO)

Historical Stock Chart

From Apr 2023 to Apr 2024