Local suppliers Huawei, Oppo race to release products first with

newer features

By Eva Dou

BEIJING -- Apple has a China problem, and it may only worsen as

Chinese smartphone makers offer better products and appeal to

consumers to buy homegrown hardware.

Sales in Greater China, which includes mainland China, Hong Kong

and Taiwan, fell 33% to $8.8 billion in the quarter ending in June,

compared with 112% growth a year earlier. It was Apple's steepest

regional drop, and helped drag global revenue down 14.6% -- a

second consecutive quarter of decline.

Apple Chief Executive Tim Cook said in an interview that after

taking out currency impacts, sales in mainland China were only down

2% for the quarter. Mr. Cook said he was "very bullish" on China in

the long run.

But Apple is facing growing challenges in China, a key market

contributing a fifth of its revenue. Local rivals including Huawei

Technologies Co., Xiaomi Corp. and Oppo Electronics Corp. are

increasingly moving from the budget phone market to the high-end

segment. Market leader Samsung Electronics Co. has moved to slash

phone prices in China in a bid to claw back lost market share in

the country.

In recent months, Chinese smartphone makers have scrambled to

pre-empt the next iPhone by beating Apple to the punch on features

such as dual-lens cameras and brighter organic light-emitting diode

or OLED screens.

"This quarter will still be a challenge for Apple," said Canalys

analyst Nicole Peng. "Local vendors are very, very strong this

quarter."

A prime example is an event scheduled to take place at China's

national convention center in Beijing, just hours after the iPhone

maker's earnings conference. One of China's most valuable startups,

Xiaomi Corp., plans to launch a new smartphone Wednesday with

advanced features including a dual-lens camera and an OLED screen,

both of which Apple is developing for future iPhones but has yet to

bring to market, according to people familiar with iPhone

development plans.

Xiaomi has launched a patriotic ad campaign to accompany the

phone launch, with posters proclaiming "Made-in-China Smartphones"

in bold red characters.

Xiaomi isn't even Apple's biggest problem in China. The

smartphone startup's China sales have been eclipsed this year by

Huawei and Oppo, which have both launched sleek high-end

smartphones in recent months aimed at taking on the iPhone.

Huawei's P9 sports a dual-lens camera and a slimmer profile than

the iPhone 6s, while Oppo's R9 touts the fastest battery charging

on the market. Both devices come in luxury colors: gold and rose

gold.

Huawei said Tuesday that it shipped 60.6 million smartphones in

the six months through June, up 25% from a year earlier. Apple said

it sold 40.4 million iPhones during its quarter, down 15% from a

year earlier.

"Huawei and Oppo are recognized as brands as good as Apple,"

said C.K. Lu, a smartphone analyst at Gartner. "Or not quite as

good as Apple, but people don't feel less superior using them."

Apple's China smartphone market share slid to 9% in the second

quarter from 12% in the first quarter, landing it in fifth place

behind Huawei, Oppo, Vivo and Xiaomi, according to Canalys. The

cheaper iPhone SE has done little to boost Apple's sales in China,

due to strong domestic alternatives for price-sensitive consumers

and as more brand-conscious buyers are likely to wait for the next

flagship, the research firm said.

Apple is also facing geopolitical and regulatory challenges in

China. Chinese social media circulated reports this month of

consumers smashing their iPhones in anti-U.S. protests after China

lost a territorial ruling in the South China Sea. China's official

Xinhua news service urged calm last week, saying that crushing

iPhones was "really not the right method to express patriotic

sentiments."

Analysts say such actions will likely have a limited impact on

Apple's sales. But they do come amid other political challenges for

Apple, such as Beijing's recent efforts to flex its regulatory

might, resulting in the shutdown of Apple's mobile book and movie

services in China.

China's growing focus on cybersecurity has also damped sales for

iPhones and other foreign gadgets, especially among government

buyers. Chinese brands such as Gionee have seen this as an

opportunity to win security-conscious local buyers. Gionee on

Tuesday launched a smartphone running a chip that is encrypted and

designed by a Chinese chip maker.

IDC China Managing Director Kitty Fok said part of Apple's

recent sales decline in China was due to consumers awaiting the

next iPhone, and the true test will be whether Apple can return

China sales to year-over-year growth after the launch of its new

models, expected in September.

"Apple has very loyal users," she said. "Once you are an Apple

user, you usually stay an Apple user."

Meanwhile, it was a different story in India, where iPhone sales

rose 51% in the past three quarters compared with a year earlier,

Mr. Cook said on the call.

India accounts for a small part of Apple's business, but it

represents a huge engine for potential growth. It is set to become

the world's second-largest smartphone market behind China, with

consumers increasingly upgrading from basic feature phones to

smartphones, though most sold are much cheaper than Apple's

models.

"India is now one of our fastest growing markets," Mr. Cook

said.

--Daisuke Wakabayashi in San Francisco and Newley Purnell in New

Delhi contributed to this article.

Write to Eva Dou at eva.dou@wsj.com

(END) Dow Jones Newswires

July 28, 2016 02:48 ET (06:48 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

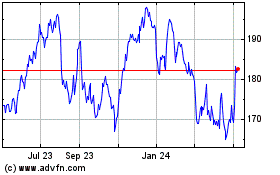

Apple (NASDAQ:AAPL)

Historical Stock Chart

From Mar 2024 to Apr 2024

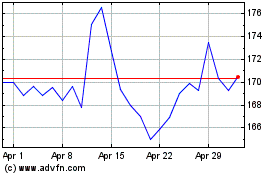

Apple (NASDAQ:AAPL)

Historical Stock Chart

From Apr 2023 to Apr 2024