Suncor Energy Swings to Loss on Impact of Wildfires, Low Oil Prices

July 27 2016 - 11:20PM

Dow Jones News

CALGARY, Alberta—Suncor Energy Inc., Canada's largest crude-oil

producer, blamed a second-quarter net loss on lower crude oil

prices and production cuts from wildfires in May that forced a

shutdown of its oil-sands operations.

Global energy producers have been hit hard by a slide in oil

prices below $50 a barrel, and many oil-sands operators in Western

Canada suffered an additional blow when out-of-control forest fires

forced them to suspend production for several weeks.

The Calgary company reported a net loss of 735 million Canadian

dollars ($559.3 million), or 46 Canadian cents a share, for the

three months to June 30, compared with a net profit of C$729

million, or 50 Canadian cents a share, in the year-earlier period.

That was exacerbated by charges for early repayment of debt and

losses on derivatives and U.S. dollar-denominated debt, Suncor said

Wednesday.

The massive wildfire in May forced the evacuation of the

business hub of Fort McMurray, Alberta, and led to the temporary

closure of Suncor's mainstay oil-sands mines and wells located to

the north of the town. No facilities were damaged by the blaze, but

the company said the disruption forced it to forgo production of

some 20 million barrels of oil until full operations resumed in

mid-July.

Restart costs of C$50 million were more than offset by cost

reductions during the shutdown of C$180 million, it said.

"The forest fires in the Fort McMurray area significantly

impacted the region," Steve Williams, Suncor's chief executive,

said in a statement. "We shut in our oil-sands production and

focused on the safe evacuation of employees, their families and the

community."

Suncor said its oil-sands output sank to 177,500 barrels of oil

a day in the April to June quarter, well below the 423,800 barrels

of oil a day produced a year ago and the 453,000 barrels a day

logged in the first quarter.

On an operating, or adjusted, basis that excludes one-time

items, Suncor lost C$565 million, or 36 Canadian cents a share for

the period, compared with a profit of C$906 million, or 63 Canadian

cents a share, in the second quarter of 2015. That was larger than

an average forecast of financial analysts for a loss of 25 Canadian

cents a share, according to RBC Dominion Securities.

Cash flow from operations in the April to June quarter came to

C$916 million, down from C$2.2 billion a year ago.

In addition to the oil-price slump and lost production, Suncor

said routine maintenance at a partial refining unit and higher

operating expenses from its increased stake in the Syncrude

oil-sands consortium contributed to weaker earnings.

The company boosted its ownership in Syncrude to 53.74% in the

first quarter after buying a 5% share held by Murphy Oil Corp. and

earlier acquiring Canadian Oil Sands Ltd., which owned 36.74% of

the oil-sands mining consortium.

Total production at Suncor fell to 330,700 barrels of oil

equivalent a day in the second quarter, down from 559,900 barrels

of oil equivalent a day in the year earlier period and 691,400

barrels of oil equivalent a day in the first three months of the

year.

The company left unchanged its latest full-year production

guidance of 585,000 to 620,000 barrels of oil equivalent a day. In

June, Suncor lowered its production forecast from a previous

estimate of 620,000 to 665,000 barrels of oil equivalent a day.

(END) Dow Jones Newswires

July 27, 2016 23:05 ET (03:05 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

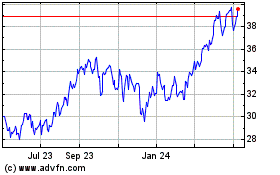

Suncor Energy (NYSE:SU)

Historical Stock Chart

From Mar 2024 to Apr 2024

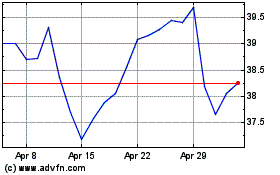

Suncor Energy (NYSE:SU)

Historical Stock Chart

From Apr 2023 to Apr 2024