Coeur Mining, Inc. (the “Company” or “Coeur”) (NYSE: CDE)

reported second quarter 2016 revenue of $182.0 million, net income

of $14.5 million, or $0.09 per share, and adjusted net income1 of

$17.3 million, or $0.11 per share.

Continued cost reductions resulted in a 16% decline in costs

applicable to sales ("CAS") per silver equivalent ounce1

("AgEqOz"), a 21% decrease in CAS per gold equivalent ounce1

("AuEqOz"), and an 11% reduction in all-in sustaining costs

("AISC") per AgEqOz1, all compared to the same quarter last

year.

Cash flow from operating activities was $45.9 million, almost a

$40 million increase quarter-over-quarter. Free cash flow1 totaled

$12.2 million in the second quarter, approximately $37 million

higher than the first quarter.

Highlights

- Silver production was 4.0 million

ounces and gold production was 92,727 ounces, or 9.6 million silver

equivalent ounces1, representing a 19% increase over the first

quarter

- Silver and gold sales were 4.0 million

ounces and 88,543 ounces, respectively, or 9.3 million silver

equivalent ounces1, representing a 12% increase over the first

quarter

- CAS and adjusted CAS were $10.15 and

$10.05 per realized AgEqOz1, representing decreases of 11% and 9%,

respectively, compared to the first quarter. Using a 60:1

equivalence ratio, CAS and adjusted CAS were $10.82 and $10.71 per

AgEqOz1, representing quarter-over-quarter decreases of 12% and

11%, respectively

- CAS and adjusted CAS per AuEqOz1 were

$649 and $644, each representing a decrease of 11% compared to the

first quarter

- AISC and adjusted AISC were $13.36 and

$13.27 per realized AgEqOz1, representing quarter-over-quarter

decreases of 4% and 3%, respectively. Using a 60:1 equivalence

ratio, AISC and adjusted AISC were $14.92 and $14.82 per AgEqOz1,

each representing a quarter-over-quarter decrease of 8%

- Net income and adjusted net income1

were $14.5 million and $17.3 million, or $0.09 and $0.11 per share,

respectively

- EBITDA1 and adjusted EBITDA1 were $62.1

million and $72.4 million, respectively, with EBITDA increasing

almost threefold and adjusted EBITDA nearly doubling compared to

the first quarter

- Capital expenditures totaled $23.3

million, driven by underground development of Guadalupe and

Independencia at Palmarejo and the Jualin deposit at

Kensington

- Cash and equivalents were $257.6

million at June 30, 2016, which includes proceeds from a $75.0

million "at-the-market" stock offering completed during the

quarter

- Completed sales of non-core assets for

total consideration of $12.9 million during the second quarter and

$23.8 million year-to-date, including the sale of a 2.5% net

smelter returns royalty on the Correnso mine in New Zealand on July

25, 2016

- Received regulatory approval for the

construction of an additional 120 million tons of leach pad

capacity at Rochester; preliminary construction activities have now

begun

- Subsequent to quarter-end, satisfied

the minimum ounce obligation on the Franco-Nevada royalty,

triggering a shift to improved terms which are expected to result

in a significant increase in free cash flow1 at Palmarejo

(previously announced June 23, 2014)

- On July 15, 2016, repaid $99 million

remaining principal on term loan plus a $4.4 million prepayment

premium, for a total of $103.4 million, reducing total debt by

nearly 20% and eliminating approximately $9 million of annual

interest expense

"In addition to strong production increases, we again delivered

industry-leading cost reductions during the second quarter.

Combined with higher realized silver and gold prices, our quarterly

adjusted EBITDA nearly doubled to $72.4 million, and we generated

positive free cash flow of $12.2 million during the quarter," said

Mitchell J. Krebs, Coeur's President and Chief Executive

Officer.

"Along with our strong operating and financial performance, we

achieved two significant milestones subsequent to quarter-end: the

satisfaction of the minimum ounce obligation on Palmarejo's

Franco-Nevada royalty and the repayment of the $100 million term

loan. The transition to the improved Franco-Nevada terms represents

a watershed event, positioning Palmarejo to be a significant

contributor to free cash flow going forward. Combined with the debt

repayment and the commensurate reduction to interest expense, our

operations are poised to generate significant free cash flow in the

second half of 2016.

"During the second half of the year, we plan to increase our

exploration budget by approximately $8 million, primarily to

upgrade resources to reserves at Palmarejo, Kensington, and

Rochester. Nearly half of the $8 million increase will go toward

expensed exploration activities and results in an increase to our

full-year expensed exploration guidance range to $14 - $16 million.

The other half of the $8 million increase will go toward

capitalized exploration, resulting in an increase to our full-year

guidance range to $16 - $18 million. In addition to this

high-return incremental investment in exploration activities, we

anticipate increasing our capital expenditure budget by an

additional $10 million during the second half, bringing the total

increase to $15 million for full-year guidance of $105 - $115

million. These additional funds will support additional underground

development at Guadalupe and Jualin and will allow us to accelerate

the construction of incremental leach pad capacity at Rochester now

that all permits have been received.” (see "Non-U.S. GAAP

Measures")

Financial

Highlights (Unaudited)

(Amounts in millions, except per share amounts, gold

ounces produced & sold, and per-ounce metrics)

2Q 2016 1Q 2016 4Q 2015

3Q 2015 2Q 2015

Revenue $

182.0 $ 148.4 $ 164.2

$ 162.6 $ 166.3

Costs Applicable to

Sales $ 100.5 $ 101.6 $ 125.3 $ 120.2 $ 119.1

General and Administrative Expenses $ 7.4 $

8.3 $ 8.8 $ 6.7 $ 8.5

Net Income (Loss) $ 14.5

$ (20.4 ) $ (303.0 ) $ (14.2 ) $ (16.7 )

Net Income (Loss) Per

Share $ 0.09 $ (0.14 ) $ (2.28 ) $ (0.11 ) $

(0.12 )

Adjusted Net Income (Loss)1 $

17.3 $ (11.0 ) $ (44.0 ) $ (18.1 ) $ (18.1 )

Adjusted Net

Income (Loss)1 Per Share $ 0.11 $

(0.07 ) $ (0.31 ) $ (0.13 ) $ (0.13 )

Weighted Average

Shares 157.9 150.2 145.0 135.5 135.0

EBITDA1 $ 62.1 $ 20.8 $ (272.9 ) $ 25.5

$ 32.8

Adjusted EBITDA1 $ 72.4 $ 36.8 $

32.9 $ 33.6 $ 36.4

Cash Flow from Operating Activities

$ 45.9 $ 6.6 $ 44.4 $ 36.2 $ 36.9

Capital

Expenditures $ 23.3 $ 22.2 $ 30.0 $ 23.9 $ 23.7

Free Cash Flow1 $ 12.2 $ (24.7 ) $ 5.4

$ 2.2 $ 3.4

Cash, Equivalents & Short-Term Investments

$ 257.6 $ 173.4 $ 200.7 $ 205.7 $ 205.9

Total

Debt2 $ 511.1 $ 511.1 $ 490.4 $ 546.0 $

547.7

Average Realized Price Per Ounce – Silver $

17.38 $ 15.16 $ 14.27 $ 14.66 $ 16.23

Average Realized

Price Per Ounce – Gold $ 1,255 $ 1,178 $ 1,093 $

1,116 $ 1,179

Silver Ounces Produced 4.0 3.4 4.0 3.8

4.3

Gold Ounces Produced 92,727 78,072 91,551 85,769

80,855

Silver Equivalent Ounces Produced1 9.6

8.1 9.5 9.0 9.1

Silver Ounces Sold 4.0 3.5 4.4 4.0

4.0

Gold Ounces Sold 88,543 79,091 92,032 91,118

84,312

Silver Equivalent Ounces Sold1 9.3 8.3

9.9 9.5 9.1

Silver Equivalent Ounces Sold (Realized)1

10.4 9.7 11.3 10.9 10.1

Adjusted CAS per

AgEqOz1 $ 10.71 $ 12.05 $ 12.65 $ 12.07 $

12.56

Adjusted CAS per Realized AgEqOz1 $

10.05 $ 11.08 $ 11.71 $ 11.00 $ 11.75

Adjusted CAS per

AuEqOz1 $ 644 $ 721 $ 663 $ 783 $ 816

Adjusted AISC per AgEqOz1 $ 14.82 $

16.05 $ 15.66 $ 15.17 $ 16.60

Adjusted AISC per Realized

AgEqOz1 $ 13.27 $ 13.73 $ 13.55 $

13.14 $ 14.81

Financial Results

Second quarter revenue increased 23% quarter-over-quarter and 9%

year-over-year to $182.0 million based on average realized silver

and gold prices of $17.38 and $1,255, respectively. Silver

contributed 38% of metal sales and gold contributed 62% during the

second quarter. Costs applicable to sales declined 1%

quarter-over-quarter and 16% year-over-year to $100.5 million

during the second quarter.

Net income was $14.5 million, or $0.09 per share, in the second

quarter, compared to net losses of $20.4 million, or $0.14 per

share, in the first quarter, and $16.7 million, or $0.12, in the

second quarter 2015. Adjusted net income1 was $17.3 million, or

$0.11 per share, compared to adjusted net losses1 of $11.0 million,

or $0.07 per share, in the first quarter and $18.1 million, or

$0.13 per share, in the second quarter 2015. Adjusted net income

for the second quarter primarily excludes foreign exchange losses,

fair value adjustments to royalty obligations, and gains on sales

of non-core assets. Second quarter cash flow from operating

activities was $45.9 million, nearly $40 million higher than the

prior quarter, despite a $1.6 million increase in working capital,

resulting from higher production and average realized metal prices

as well as lower costs applicable to sales on a per ounce

basis.

Second quarter adjusted EBITDA1 was $72.4 million, nearly

doubling both quarter-over-quarter and year-over-year. At June 30,

2016, LTM adjusted EBITDA1 totaled $170.9 million, a 26% increase

over the first quarter and 81% higher than the same period last

year.

Second quarter general and administrative expenses were $7.4

million, decreasing 11% quarter-over-quarter and 12%

year-over-year. Second quarter capital expenditures of $23.3

million were 5% higher compared to the first quarter, driven by

development of the Guadalupe and Independencia deposits at

Palmarejo and the Jualin deposit at Kensington, and 2% lower

compared to the same period last year. For the first six months of

2016, general and administrative expenses were $15.7 million and

capital expenditures totaled $45.5 million.

Operations

Highlights of second quarter 2016 results for each of the

Company's operating segments are provided below.

Palmarejo, Mexico

(Dollars in millions, except per ounce

amounts) 2Q 2016 1Q 2016

4Q 2015 3Q 2015

2Q 2015 Underground Operations: Tons mined

283,971 215,642 189,383 190,399 172,730

Average silver

grade (oz/t) 5.40 4.21 3.96 4.11 3.90

Average gold

grade (oz/t) 0.08 0.07 0.06 0.10 0.09

Surface

Operations: Tons mined 1,695 35,211 102,018

247,071 257,862

Average silver grade (oz/t) 7.77 4.18

3.86 3.56 3.47

Average gold grade (oz/t) 0.07 0.04

0.03 0.03 0.03

Processing: Total tons milled

270,142 246,533 301,274 427,635 435,841

Average recovery

rate – Ag 89.5% 89.1% 95.4% 87.9% 78.5%

Average

recovery rate – Au 86.4% 92.1% 88.8% 84.7% 76.2%

Silver ounces produced (000's) 1,307 933 1,126 1,422

1,247

Gold ounces produced 18,731 14,668 14,326

22,974 18,127

Silver equivalent ounces produced1

(000's) 2,431 1,813 1,985 2,800 2,335

Silver

ounces sold (000's) 1,350 928 1,465 1,425 1,228

Gold

ounces sold 19,214 12,899 18,719 25,000 15,706

Silver

equivalent ounces sold1 (000's) 2,502

1,702 2,588 2,925 2,170

Silver equivalent ounces

sold1 (realized) (000's) 2,737 1,930 2,840

3,325 2,374

Metal sales $48.3 $29.8 $41.6 $49.2 $38.9

Costs applicable to sales $22.9 $21.0 $39.8 $34.1

$30.1

Adjusted CAS per AgEqOz1 $9.02

$11.54 $13.48 $11.40 $13.21

Adjusted CAS per realized

AgEqOz1 $8.24 $10.18 $12.04 $10.01 $12.07

Exploration expense $0.6 $0.8 $0.5 $1.1 $1.8

Cash

flow from operating activities $11.3 $3.4 $20.3 $22.9

$9.7

Sustaining capital expenditures $5.5 $6.6 $(1.4)

$1.1 $2.7

Development capital expenditures $3.4 $2.2

$7.0 $9.4 $8.0

Total capital expenditures $8.9 $8.8

$5.6 $10.5 $10.7

Gold production royalty payments

$10.5 $9.1

$9.0

$10.2 $9.8

Free cash flow1 $(8.1) $(14.5)

$5.7

$2.2 $(10.8)

- Silver equivalent1 production increased

34% compared to the first quarter as a result of higher grades and

a 32% increase in tons mined from underground operations

- Metal sales of $48.3 million increased

62% quarter-over-quarter and 24% year-over-year

- Second quarter adjusted CAS per

realized AgEqOz1 were $8.24 and adjusted CAS per AgEqOz1 (60:1

equivalence) were $9.02, representing declines of 19% and 22%,

respectively, compared to the first quarter

- Transition to lower-tonnage,

higher-grade, higher-margin underground operations at Guadalupe and

Independencia remains on track

- Open pit mining operations were

completed in mid-April while limited mining of the legacy

underground area has extended into the third quarter

- Development and mining activities at

Independencia continue on schedule; mining rate of 1,000 tons per

day expected to be reached by year-end

- Subsequent to quarter-end, the minimum

royalty ounce obligation was met, resulting in the new, more

favorable Franco-Nevada stream agreement becoming effective, which

is expected to significantly improve Palmarejo's cash flows going

forward

- Maintaining full-year 2016 guidance of

3.9 - 4.4 million ounces of silver and 67,000 - 72,000 ounces of

gold at CAS per AgEqOz1 of $12.50 - $13.50

Rochester, Nevada

(Dollars in millions, except per ounce

amounts) 2Q 2016 1Q 2016

4Q 2015 3Q 2015

2Q 2015 Ore tons placed 6,402,013 4,374,459

4,411,590 4,128,868 3,859,965

Average silver grade (oz/t)

0.54 0.64 0.60 0.59 0.61

Average gold grade (oz/t)

0.003 0.004 0.003 0.003 0.003

Silver ounces produced

(000's) 1,197 929 1,107 1,086 1,294

Gold ounces

produced 13,940 10,460 11,564 10,892 16,411

Silver

equivalent ounces produced1 (000's) 2,033

1,557 1,800 1,740 2,279

Silver ounces sold (000's)

1,137 1,079 1,125 1,304 1,120

Gold ounces sold

12,909 11,672 11,587 13,537 15,085

Silver equivalent

ounces sold1 (000's) 1,912 1,779 1,821

2,116 2,025

Silver equivalent ounces sold1

(realized) (000's) 2,070 1,986 2,004 2,333 2,221

Metal sales $35.8 $30.0 $29.0 $34.6 $36.3

Costs

applicable to sales $21.7 $22.5 $22.8 $25.4 $24.4

Adjusted CAS per AgEqOz1 $11.30 $12.61

$12.37 $12.01 $12.01

Adjusted CAS per realized

AgEqOz1 $10.43 $11.29 $11.19 $10.89 $10.94

Exploration expense $0.2 $0.1 $0.1 $— $0.5

Cash

flow from operating activities $9.2 $2.1 $0.4 $6.5 $8.8

Sustaining capital expenditures $2.6 $2.5 $5.3 $1.8

$2.4

Development capital expenditures $1.3 $0.8 $5.5

$3.5 $3.5

Total capital expenditures $3.9 $3.3 $10.8

$5.3 $5.9

Free cash flow1 $5.3 $(1.2) $(10.4)

$1.2 $2.9

- Silver equivalent production1 increased

31% in the second quarter due mostly to a 46% increase in tons

placed quarter-over-quarter. The relatively higher portion of tons

placed from run-of-mine led to a temporary decrease in grades for

the quarter

- Elevated crushing rates and tons placed

in the second quarter are expected to drive further production

increases in the second half of the year

- Metal sales of $35.8 million increased

19% quarter-over-quarter and declined 2% year-over-year

- Second quarter adjusted CAS per

realized AgEqOz1 were $10.43 and adjusted CAS per AgEqOz1 (60:1

equivalence) were $11.30, representing declines of 8% and 10%,

respectively, compared to the prior quarter

- The Record of Decision was received

from the Bureau of Land Management on June 30, allowing for the

construction of an additional 120 million tons of leach pad

capacity to begin in the second half of 2016

- Maintaining full-year 2016 guidance of

4.8 - 5.3 million ounces of silver and 48,000 - 55,000 ounces of

gold at CAS per AgEqOz1 of $11.25 - $12.25

Kensington, Alaska

(Dollars in millions, except per ounce

amounts) 2Q 2016 1Q 2016

4Q 2015 3Q 2015

2Q 2015 Tons milled 157,117 159,360 159,666

165,198 170,649

Average gold grade (oz/t) 0.22 0.21

0.22 0.19 0.18

Average recovery rate 94.1% 95.8%

96.0% 93.9% 94.9%

Gold ounces produced 32,210 31,974

33,713 28,799 29,845

Gold ounces sold 30,178 31,648

29,989 28,084 36,607

Metal sales $36.5 $35.7 $31.7

$30.5 $42.5

Costs applicable to sales $22.6 $24.4

$23.7 $25.0 $27.5

Adjusted CAS per AuOz1 $740

$761 $777 $842 $745

Exploration expense $1.0 $— $0.3

$0.2 $0.4

Cash flow from operating activities $7.7

$13.7 $4.5 $8.9 $12.0

Sustaining capital expenditures

$4.3 $4.4 $5.5 $1.0 $4.2

Development capital

expenditures $3.2 $3.7 $4.0 $4.5 $0.5

Total capital

expenditures $7.5 $8.1 $9.5 $5.5 $4.7

Free cash

flow1 $0.2 $5.6 $(5.0) $3.4 $7.3

- Consistent production and costs

achieved in the second quarter with 32,210 gold ounces produced at

an historical low adjusted CAS per AuOz1 of $740

- Metal sales of $36.5 million increased

2% quarter-over-quarter and declined 14% year-over-year due to

fewer ounces sold

- Development of the high-grade Jualin

deposit is now 50% complete with an initial reserve estimate

expected at year-end

- Maintaining full-year 2016 production

guidance of 115,000 - 125,000 ounces of gold at CAS per AuOz1 of

$825 - $875

Wharf, South Dakota

(Dollars in millions, except per ounce

amounts) 2Q 2016 1Q 2016

4Q 2015 3Q 2015

2Q 2015 Ore tons placed 915,631 974,663

1,147,130 1,149,744 887,409

Average silver grade (oz/t)

0.28 0.30 0.21 0.21 0.30

Average gold grade (oz/t)

0.037 0.031 0.032 0.035 0.025

Average plant recovery rate

– Au 89.6% 96.6% 97.3% 92.8% 76.7%

Gold ounces

produced 27,846 20,970 31,947 23,104 16,472

Silver

ounces produced (000's) 35 13 18 19 19

Gold

equivalent ounces produced1 28,433 21,186 32,231

23,427 16,794

Silver ounces sold (000's) 33 15 17 19

13

Gold ounces sold 26,242 22,872 31,202 24,815

17,131

Gold equivalent ounces sold1 26,786

23,122 31,485 25,132 17,348

Metal sales $34.0 $27.9

$35.7 $28.0 $20.4

Costs applicable to sales $14.3

$15.5 $17.8 $17.8 $16.6

Adjusted CAS per AuEqOz1

$534 $667 $556 $716 $970

Exploration expense

$— $— $0.1 $— $—

Cash flow from operating activities

$16.2 $9.7 $18.1 $12.9 $8.2

Sustaining capital

expenditures $1.5 $1.4 $1.2 $0.7 $1.2

Development

capital expenditures $— $— $— $— $—

Total capital

expenditures $1.5 $1.4 $1.2 $0.7 $1.2

Free cash

flow1 $14.7 $8.3 $16.9 $12.2 $7.0

- Gold equivalent production1 increased

34% compared to the prior quarter due to higher grades and timing

of recoveries, driving a 20% decrease quarter-over-quarter in

adjusted CAS per AuEqOz1 to $534

- Metal sales of $34.0 million increased

22% quarter-over-quarter and 67% year-over-year

- Higher production levels expected in

the second half of 2016 as a result of seasonal mining in the

higher-grade Golden Reward pit

- Recovery rates, which were lower in the

second quarter as a result of plant maintenance, are expected to

return to the high-90% level in the third quarter

- Maintaining full-year 2016 guidance of

90,000 - 95,000 ounces of gold at CAS per AuEqOz1 of $650 -

$750

San Bartolomé, Bolivia

(Dollars in millions, except per ounce

amounts) 2Q 2016 1Q 2016

4Q 2015 3Q 2015

2Q 2015 Tons milled 440,441 407,806 475,695

373,201 457,232

Average silver grade (oz/t) 3.79 3.64

3.84 3.76 3.73

Average recovery rate 87.4% 93.1%

84.9% 84.0% 87.6%

Silver ounces produced (000's)

1,458 1,382 1,550 1,178 1,495

Silver ounces sold

(000's) 1,418 1,384 1,564 1,202 1,439

Metal sales

$25.2 $21.3 $22.4 $17.4 $23.4

Costs applicable to

sales $18.6 $17.5 $20.0 $17.5 $19.2

Adjusted CAS per

AgOz1 $12.97 $12.56 $12.48 $14.41 $13.26

Exploration expense $— $— $— $0.1 $—

Cash flow

from operating activities $11.2 $5.5 $10.0 $5.7 $5.4

Sustaining capital expenditures $1.3 $0.5 $2.5 $1.8

$1.0

Development capital expenditures $— $— $— $— $—

Total capital expenditures $1.3 $0.5 $2.5 $1.8 $1.0

Free cash flow1 $9.9 $5.0 $7.5 $3.9 $4.4

- Adjusted CAS per AgOz1 were $12.97, 3%

higher quarter-over-quarter but down 2% year-over-year

- Metal sales of $25.2 million increased

18% quarter-over-quarter and 8% year-over-year

- Purchases of high grade ore continue to

contribute approximately one-third of production, supplementing

cash flow generated from mined ore

- Maintaining full-year 2016 guidance of

5.8 - 6.1 million ounces of silver at CAS per AgOz1 of $13.50 -

$14.25

Coeur Capital

(Dollars in millions, except per ounce

amounts) 2Q 2016 1Q 2016

4Q 2015 3Q 2015

2Q 2015 Tons milled 37,521 86,863 198,927

191,913 191,175

Average silver grade (oz/t) 1.66 3.17

2.05 1.39 2.35

Average recovery rate 52.5% 41.9%

42.1% 45.4% 45.4%

Silver ounces produced (000's) 33

115 171 121 204

Silver ounces sold (000's) 35 123 193

95 209

Metal sales $0.5 $1.9 $2.4 $1.3 $3.1

Royalty revenue $1.8 $1.8 $1.5 $1.6 $1.8

Costs

applicable to sales (Endeavor silver stream) $0.3 $1.0

$1.0 $0.5 $1.4

CAS per AgOz1 $7.94 $5.35 $5.50

$4.99 $6.46

Cash flow from operating activities

$(3.2) $0.8 $0.8 $3.1 $2.1

Free cash flow1

$(3.2) $0.8 $0.8 $3.1 $2.1

- Completed the sale of a number of Coeur

Capital's assets in the second quarter for total consideration of

approximately $9.9 million

- Completed the sale of a 2.5% net

smelter returns royalty on the Correnso mine in New Zealand in July

2016 bringing total consideration for non-core asset sales to $23.8

million year-to-date

- Coeur Capital's primary remaining asset

is a silver stream on the Endeavor mine in New South Wales,

Australia

- Silver production received from the

stream on the Endeavor mine continued to decline in the second

quarter following a curtailment of production by the operator due

to lower lead and zinc prices

- Coeur is maintaining its revised 2016

production guidance for Endeavor of 175,000 - 200,000 silver

ounces

Exploration

Costs associated with exploration in the second quarter totaled

$6.1 million, including $2.2 million (expensed) for discovery of

new silver and gold mineralization and $3.9 million (capitalized)

for definition and expansion of mineralized material. Coeur's

exploration program ramped up to 11 active drill rigs late in the

second quarter: six at Palmarejo, two at Kensington, two at

Rochester, and one at Wharf. A total of 139,501 feet (42,520

meters) of combined core and reverse circulation drilling was

completed during the quarter.

Coeur's 2016 exploration program gained significant momentum in

the second quarter with a continued focus on brownfield exploration

as well as a ramp up of greenfield exploration programs. Second

quarter priorities included:

- Expanding the Guadalupe-Independencia

corridor, including deeper areas of the Guadalupe and Independencia

deposits and the Los Bancos and Nación veins

- Underground infill and expansion

drilling of the high-grade Jualin deposit at Kensington, as well as

four zones within the Kensington Main deposit and the Raven

vein

- Infill and expansion drilling of the

higher-grade East Rochester deposit, which is expected to be the

focus of a revised economic analysis in 2016

- Ramp up of early-stage exploration

projects in the U.S. and in north-central Mexico; drilling will

commence on two projects in the second half of 2016

In-line with Coeur's success-based exploration strategy, the

exploration guidance has been revised higher for 2016 to $14 - 16

million in 2016 (from $11 - $13 million), with an additional $16 -

$18 million of capital allocated to resource conversion (from $11 -

$13 million).

Full-Year 2016 Outlook

Full-year 2016 production and cost guidance remain unchanged. In

light of positive exploration results in the first half of the year

as well as an improved metal price environment, Coeur's exploration

budget has increased by $8 million, nearly half of which has been

added to exploration expense guidance and the balance of which has

been earmarked for capitalized exploration and added to capital

expenditures guidance. The $15 million increase to capital

expenditures guidance also includes additional funds being allotted

for development at Guadalupe and Jualin and to accelerate

construction of incremental leach pad capacity at Rochester.

2016 Production Outlook

(silver and silver equivalent ounces in thousands)

Silver Gold

Silver Equivalent1 Palmarejo

3,875 - 4,400 67,000 - 72,000 7,895 -

8,720

Rochester 4,750 - 5,250 48,000 - 55,000 7,630 - 8,550

San Bartolomé 5,750 - 6,050 — 5,750 - 6,050

Endeavor

175 - 200 — 175 - 200

Kensington — 115,000 - 125,000 6,900 -

7,500

Wharf 80 - 100 90,000 -

95,000 5,480 - 5,800

Total

14,630 - 16,000 320,000 - 347,000

33,830 - 36,820

2016 Cost Outlook

(dollars in millions, except per ounce amounts)

2016 Guidance

2015 Result CAS per AgEqOz1 –

Palmarejo $12.50 - $13.50

$13.03

CAS per AgEqOz1 –

Rochester $11.25 - $12.25 $12.36

CAS per AgOz1

– San Bartolomé $13.50 - $14.25 $13.63

CAS per

AuOz1 – Kensington $825 - $875 $798

CAS per

AuEqOz1 – Wharf $650 - $750 $706

Capital

Expenditures $105 - $115 $95.2

General and Administrative

Expenses $28 - $32 $32.8

Exploration Expense $14 - $16

$11.6

AISC per AgEqOz1 $16.00 - $17.25 $16.16

Conference Call

Information

Coeur will report its full operational and financial results for

second quarter 2016 on July 27, 2016 after the New York Stock

Exchange closes for trading. There will be a conference call on

July 28, 2016 at 11:00 a.m. Eastern time.

Dial-In Numbers: (855) 560-2581 (US) (855) 669-9657

(Canada) (412) 542-4166 (International) Conference ID: Coeur

Mining A replay of the call will be available through August

11, 2016. Replay numbers: (877) 344-7529 (US) (855) 669-9658

(Canada) (412) 317-0088 (International) Conference ID: 100

88 894

About Coeur

Coeur Mining is a well-diversified, growing precious metals

producer with five precious metals mines in the Americas employing

approximately 2,000 people. Coeur produces from its wholly owned

operations: the Palmarejo silver-gold complex in Mexico, the

Rochester silver-gold mine in Nevada, the Kensington gold mine in

Alaska, the Wharf gold mine in South Dakota, and the San Bartolomé

silver mine in Bolivia. The Company also has a non-operating

interest in the Endeavor mine in Australia as well as royalty

interests in Ecuador and New Zealand. In addition, the Company has

two silver-gold exploration stage projects - the La Preciosa

project in Mexico and the Joaquin project in Argentina. Coeur

conducts ongoing exploration activities in Alaska, Nevada, Mexico,

Bolivia and Argentina.

Cautionary Statement

This news release contains forward-looking statements within the

meaning of securities legislation in the United States and Canada,

including statements regarding anticipated cash flow, production,

costs, capital expenditures, expenses, mining rates, recovery

rates, operations at Palmarejo, development activity at Palmarejo

and Kensington, expansion projects at Rochester, ore purchases at

San Bartolomé, and exploration efforts. Such forward-looking

statements involve known and unknown risks, uncertainties and other

factors which may cause Coeur's actual results, performance or

achievements to be materially different from any future results,

performance or achievements expressed or implied by the

forward-looking statements. Such factors include, among others, the

risk that anticipated production, cost and expense levels are not

attained, the risks and hazards inherent in the mining business

(including risks inherent in developing large-scale mining

projects, environmental hazards, industrial accidents, weather or

geologically related conditions), changes in the market prices of

gold and silver and a sustained lower price environment, the

uncertainties inherent in Coeur's production, exploratory and

developmental activities, including risks relating to permitting

and regulatory delays, ground conditions, grade variability, any

future labor disputes or work stoppages (including those involving

third parties), the uncertainties inherent in the estimation of

gold and silver reserves and resources, changes that could result

from Coeur's future acquisition of new mining properties or

businesses, the absence of control over and reliance on third

parties to operate mining operations in which Coeur or its

subsidiaries hold royalty or streaming interests and risks related

to these mining operations including results of mining and

exploration activities, environmental, economic and political risks

of the jurisdiction in which the mining operations are located, the

loss of access to any third-party smelter to which Coeur markets

silver and gold, the effects of environmental and other

governmental regulations, the risks inherent in the ownership or

operation of or investment in mining properties or businesses in

foreign countries, Coeur's ability to raise additional financing

necessary to conduct its business, make payments or refinance its

debt, as well as other uncertainties and risk factors set out in

filings made from time to time with the United States Securities

and Exchange Commission, and the Canadian securities regulators,

including, without limitation, Coeur's most recent reports on Forms

10-K and 10-Q. Actual results, developments and timetables could

vary significantly from the estimates presented. Readers are

cautioned not to put undue reliance on forward-looking statements.

Coeur disclaims any intent or obligation to update publicly such

forward-looking statements, whether as a result of new information,

future events or otherwise. Additionally, Coeur undertakes no

obligation to comment on analyses, expectations or statements made

by third parties in respect of Coeur, its financial or operating

results or its securities.

Dana Willis, Coeur's Director, Resource Geology and a qualified

person under Canadian National Instrument 43-101, supervised the

preparation of the scientific and technical information concerning

Coeur's mineral projects in this news release. For a description of

the key assumptions, parameters and methods used to estimate

mineral reserves and resources, as well as data verification

procedures and a general discussion of the extent to which the

estimates may be affected by any known environmental, permitting,

legal, title, taxation, socio-political, marketing or other

relevant factors, Canadian investors should refer to the Technical

Reports for each of Coeur's properties as filed on SEDAR at

www.sedar.com.

Non-U.S. GAAP Measures

We supplement the reporting of our financial information

determined under United States generally accepted accounting

principles (U.S. GAAP) with certain non-U.S. GAAP financial

measures, including EBITDA, adjusted EBITDA, adjusted net income

(loss), costs applicable to sales per silver equivalent ounce (or

per gold equivalent ounce), adjusted costs applicable to sales per

silver equivalent ounce, all-in sustaining costs, and adjusted

all-in sustaining costs. We believe that these adjusted measures

provide meaningful information to assist management, investors and

analysts in understanding our financial results and assessing our

prospects for future performance. We believe these adjusted

financial measures are important indicators of our recurring

operations because they exclude items that may not be indicative

of, or are unrelated to our core operating results, and provide a

better baseline for analyzing trends in our underlying businesses.

We believe EBITDA, adjusted EBITDA, adjusted net income (loss),

costs applicable to sales per silver equivalent ounce (or per gold

equivalent ounce), adjusted costs applicable to sales per silver

equivalent ounce, all-in sustaining costs, and adjusted all-in

sustaining costs are important measures in assessing the Company's

overall financial performance.

Notes

1. EBITDA, adjusted EBITDA, adjusted net income (loss), all-in

sustaining costs, adjusted all-in sustaining costs, costs

applicable to sales per silver equivalent ounce (or per gold

equivalent ounce), and adjusted costs applicable to sales per

silver equivalent ounce are non-GAAP measures. Please see tables in

the Appendix for the reconciliation to U.S. GAAP. For purposes of

silver and gold equivalence, a 60:1 silver to gold ratio is assumed

except where noted as average realized prices. Free cash flow is

defined as cash flow from operating activities less capital

expenditures and gold production royalty payments. Please see table

in Appendix for the calculation of consolidated free cash flow.

2. Includes capital leases. Net of debt issuance costs and

premium received.

Coeur Mining, Inc. and Subsidiaries Condensed

Consolidated Statements of Comprehensive Income (Loss)

Three months ended Six months

ended June 30, June 30, 2016

2015 2016 2015 In

thousands, except share data Revenue $ 182,007 $ 166,263

$ 330,394 $ 319,219 COSTS AND EXPENSES Costs applicable to

sales(1) 100,465 119,097 202,020 234,160 Amortization 37,505 38,974

65,470 72,064 General and administrative 7,400 8,451 15,676 17,286

Exploration 2,233 3,579 3,963 7,845 Write-downs — — 4,446 —

Pre-development, reclamation, and other 4,364 2,267

8,568 9,030 Total costs and expenses 151,967 172,368

300,143 340,385 OTHER INCOME (EXPENSE), NET Fair value adjustments,

net (3,579 ) 2,754 (12,274 ) (2,130 ) Interest expense, net of

capitalized interest (10,875 ) (10,734 ) (21,995 ) (21,499 ) Other,

net (1,857 ) (2,852 ) (543 ) (5,362 ) Total other income (expense),

net (16,311 ) (10,832 ) (34,812 ) (28,991 ) Income (loss) before

income and mining taxes 13,729 (16,937 ) (4,561 ) (50,157 ) Income

and mining tax (expense) benefit 768 260 (1,338 ) 192

NET INCOME (LOSS) $ 14,497 $ (16,677 ) $ (5,899 ) $

(49,965 ) OTHER COMPREHENSIVE INCOME (LOSS), net of tax: Unrealized

gain (loss) on equity securities, net of tax of $(1,164) and

$(2,174) for the three and six months ended June 30, 2016,

respectively, and $7 for the three months June 30, 2015 2,103

(1,312 ) 3,146 (2,813 ) Reclassification adjustments for impairment

of equity securities 20 31 20 1,545 Reclassification adjustments

for realized (gain) loss on sale of equity securities (314 ) 904

273 904 Other comprehensive income (loss)

1,809 (377 ) 3,439 (364 ) COMPREHENSIVE INCOME (LOSS)

$ 16,306 $ (17,054 ) $ (2,460 ) $ (50,329 ) NET

INCOME (LOSS) PER SHARE Basic $ 0.09 $ (0.12 ) $ (0.04 ) $

(0.42 ) Diluted $ 0.09 $ (0.12 ) $ (0.04 ) $ (0.42 )

Coeur Mining, Inc. and Subsidiaries Condensed

Consolidated Statements of Cash Flows

Three months ended June 30, Six months

ended June 30, 2016 2015 2016

2015 In thousands CASH FLOWS FROM OPERATING

ACTIVITIES: Net income (loss) $ 14,497 $ (16,677 ) $ (5,899 )

(49,965 ) Adjustments: Amortization 37,505 38,974 65,470 72,064

Accretion 2,848 3,526 6,017 6,676 Deferred income taxes (15,170 )

(5,053 ) (17,275 ) (7,237 ) Fair value adjustments, net 3,579

(2,754 ) 12,274 2,130 Stock-based compensation 2,307 2,604 5,222

4,754 Impairment of equity securities 20 31 20 1,545 Write-downs —

— 4,446 — Other 1,910 4,224 474 5,303 Changes in operating assets

and liabilities: Receivables (12,402 ) (2,342 ) (8,921 ) 214

Prepaid expenses and other current assets (898 ) 160 381 (1,167 )

Inventory and ore on leach pads (7,686 ) 4,649 (15,508 ) 5,333

Accounts payable and accrued liabilities 19,429 9,662

5,855 (6,095 ) CASH PROVIDED BY OPERATING ACTIVITIES 45,939

37,004 52,556 33,555 CASH FLOWS FROM

INVESTING ACTIVITIES: Capital expenditures (23,288 ) (23,677 )

(45,460 ) (41,297 ) Acquisitions, net — (9,152 ) — (111,170 )

Proceeds from the sale assets 7,293 8 11,302 165 Purchase of

investments (92 ) (1,597 ) (99 ) (1,873 ) Sales and maturities of

investments 648 399 1,645 469

Other

(1,446

)

(111

)

(2,919

)

(1,841

)

CASH USED IN INVESTING ACTIVITIES (16,885 ) (34,130 ) (35,531 )

(155,547 ) CASH FLOWS FROM FINANCING ACTIVITIES: Issuance of common

stock 73,071 — 73,071 — Issuance of notes and bank borrowings —

100,000 — 153,500 Payments on debt, capital leases, and associated

costs (6,712 ) (66,626 ) (12,683 ) (75,220 ) Gold production

royalty payments (10,461 ) (9,754 ) (19,592 ) (20,122 ) Other (448

) (72 ) (728 ) (495 ) CASH PROVIDED (USED IN) BY FINANCING

ACTIVITIES 55,450 23,548 40,068 57,663

Effect of exchange rate changes on cash and cash equivalents (302 )

(141 ) (216 ) (664 ) INCREASE (DECREASE) IN CASH AND CASH

EQUIVALENTS 84,202 26,281 56,877 (64,993 ) Cash and cash

equivalents at beginning of period 173,389 179,587

200,714 270,861 Cash and cash equivalents at end of

period $ 257,591 $ 205,868 $ 257,591 $ 205,868

Coeur Mining, Inc. and Subsidiaries

Condensed Consolidated Balance Sheets

June 30, December 31, 2016

2015 ASSETS In thousands, except share data

CURRENT ASSETS Cash and cash equivalents $ 257,591 $ 200,714

Receivables 79,932 85,992 Inventory 84,074 81,711 Ore on leach pads

76,335 67,329 Prepaid expenses and other 11,614 10,942

509,546 446,688 NON-CURRENT ASSETS Property, plant and

equipment, net 217,345 195,999 Mining properties, net 552,035

589,219 Ore on leach pads 52,885 44,582 Restricted assets 14,792

11,633 Equity securities 11,250 2,766 Receivables 39,739 24,768

Deferred tax assets 1,370 1,942 Other 12,893 14,892

TOTAL ASSETS $ 1,411,855 $ 1,332,489

LIABILITIES

AND STOCKHOLDERS’ EQUITY CURRENT LIABILITIES Accounts payable $

49,219 $ 48,732 Accrued liabilities and other 50,169 53,953 Debt

108,809 10,431 Royalty obligations 12,915 24,893 Reclamation 1,790

2,071 222,902 140,080 NON-CURRENT LIABILITIES Debt

402,257 479,979 Royalty obligations 7,069 4,864 Reclamation 85,048

83,197 Deferred tax liabilities 131,459 147,132 Other long-term

liabilities 66,961 55,761 692,794 770,933

STOCKHOLDERS’ EQUITY Common stock, par value $0.01 per share;

authorized 300,000,000 shares, issued and outstanding 162,370,864

at June 30, 2016 and 151,339,136 at December 31, 2015 1,624 1,513

Additional paid-in capital 3,101,493 3,024,461 Accumulated other

comprehensive income (loss) (283 ) (3,722 ) Accumulated deficit

(2,606,675 ) (2,600,776 ) 496,159 421,476 TOTAL

LIABILITIES AND STOCKHOLDERS’ EQUITY $ 1,411,855 $ 1,332,489

Adjusted EBITDA Reconciliation

LTM 2Q

(Dollars in thousands except per share amounts)

2016

2Q 2016 1Q 2016 4Q 2015 3Q

2015 2Q 2015 Net income (loss)

$ (323,118

) $ 14,497 $ (20,396 ) $ (303,000 ) $ (14,219

) $ (16,677 ) Interest expense, net of capitalized interest

46,199 10,875 11,120 11,758 12,446 10,734 Income tax

provision (benefit)

(24,733 ) (768 )

2,106 (17,811 ) (8,260 ) (260 ) Amortization

137,156

37,505 27,964 36,190

35,497 38,974

EBITDA (164,496 )

62,109 20,794 (272,863 ) 25,464 32,771 Fair value

adjustments, net

4,942 3,579 8,695 (1,546 ) (5,786 )

(2,754 ) Impairment of equity securities

820 20 — 317

483 31 Foreign exchange loss

17,326 5,655 164 2,597

8,910 2,056 (Gain) loss on sale of assets

(4,964 )

(2,812 ) (1,673 ) (146 ) (333 ) (107 ) (Gain) loss on

debt extinguishment

(16,187 ) — — (16,187 ) —

524 Corporate reorganization costs

647 — — 133 514 —

Transaction-related costs

1,271 792 380 99 — 38 Asset

retirement obligation accretion

8,530 2,066 2,060

2,288 2,116 2,078 Inventory adjustments

5,208 946

1,944 4,901 2,280 1,805 Write-downs

317,783 —

4,446 313,337 — —

Adjusted EBITDA $ 170,880 $

72,355 $ 36,810 $ 32,930

$ 33,648 $ 36,442

Adjusted Net Income (Loss)

Reconciliation

(Dollars in thousands except per share amounts)

2Q 2016 1Q 2016

4Q 2015 3Q 2015 2Q 2015 Net

income (loss)

$ 14,497 $ (20,396 ) $ (303,000 ) $

(14,219 ) $ (16,677 ) Fair value adjustments, net

3,579

8,695 (1,546 ) (5,786 ) (2,754 ) Impairment of equity securities

20 — 317 483 31 Write-downs

— 4,446 313,337 — —

(Gain) loss on sale of assets

(2,812 ) (1,673 ) (146

) (333 ) (107 ) (Gain) loss on debt extinguishments

— —

(16,187 ) — 524 Corporate reorganization costs

— — 133 514 —

Transaction-related costs

792 380 99 — 38 Tax effect of

adjustments

3,996 (1,375 ) (37,727 ) 2,402 136 Foreign

exchange (gain) loss

(2,810 ) (1,124 ) 753

(1,182 ) 751

Adjusted net income (loss) $

17,262 $ (11,047 ) $ (43,967 ) $ (18,121 ) $ (18,058

)

Adjusted net income (loss) per share $

0.11 $ (0.07 ) $ (0.31 ) $ (0.13 ) $ (0.13 )

Consolidated Free Cash Flow

Reconciliation

(Dollars in thousands)

2Q 2016 1Q 2016

4Q 2015 3Q 2015 2Q

2015 Cash flow from operating activities

$ 45,939

$ 6,617 $ 44,414 $ 36,237 $ 36,863 Capital expenditures

(23,288 ) (22,172 ) (30,035 ) (23,861 ) (23,677 )

Gold production royalty payments

(10,461 ) (9,131 )

(8,954 ) (10,159 ) (9,754 ) Free cash flow

12,190

(24,686 ) 5,425 2,217 3,432

Reconciliation of All-in Sustaining Costs per Silver Equivalent

Ounce for Three Months Ended June 30, 2016

Silver Gold

Total

In thousands except per ounce

amounts

Palmarejo Rochester

San Bartolomé

Endeavor Total Kensington

Wharf Total Costs applicable to sales,

including amortization (U.S. GAAP) $ 37,630 $ 27,158

$ 20,498 $ 365 $ 85,651 $ 32,419 $ 19,470 $

51,889 $ 137,540

Amortization 14,765 5,437

1,853 84 22,139 9,808 5,128

14,936 37,075

Costs applicable to sales $

22,865 $ 21,721 $ 18,645 $ 281 $ 63,512 $ 22,611 $ 14,342 $ 36,953

$ 100,465

Silver equivalent ounces sold 2,502,442 1,911,885

1,418,455 35,411 5,868,193 9,286,033

Gold equivalent ounces

sold 30,178 26,786

56,964

Costs applicable to sales per

ounce $ 9.14 $ 11.36 $ 13.14 $ 7.94 $ 10.82 $ 749 $ 535 $ 649 $

10.82

Inventory adjustments (0.12 ) (0.06 ) (0.17 ) —

(0.11 ) (9 ) (1 ) (5 ) (0.10 )

Adjusted costs applicable to

sales per ounce $ 9.02 $ 11.30 $ 12.97 $ 7.94

$

10.71 $ 740 $ 534

$ 644 $ 10.72

Costs applicable to sales per realized ounce $ 8.35 $

10.49 $ 10.15 $ 9.69

Inventory adjustments (0.11 ) (0.06 )

(0.10 ) (0.09 )

Adjusted costs applicable to sales per realized

ounce $ 8.24 $ 10.43

$ 10.05 $ 9.60

Costs applicable to sales $ 100,465

Treatment and

refining costs 1,128

Sustaining capital 21,019

General and administrative 7,400

Exploration 2,233

Reclamation 4,170

Project/pre-development costs 2,098

All-in sustaining costs $ 138,513

Silver equivalent ounces sold 5,868,193

Kensington and

Wharf silver equivalent ounces sold 3,417,840

Consolidated silver equivalent ounces sold 9,286,033

All-in sustaining costs per silver equivalent ounce $

14.92 Inventory adjustments $ (0.10 )

Adjusted all-in sustaining costs per silver equivalent ounce

$ 14.82 All-in sustaining costs per

realized silver equivalent ounce $ 13.36

Inventory adjustments $ (0.09 )

Adjusted all-in

sustaining costs per realized silver equivalent ounce $

13.27 Reconciliation of All-in Sustaining

Costs per Silver Equivalent Ounce for Three Months Ended

March 31, 2016 Silver

Gold Total In thousands except per

ounce amounts Palmarejo Rochester

San Bartolomé

Endeavor Total Kensington

Wharf Total Costs applicable to sales,

including amortization (U.S. GAAP) $ 28,327 $ 27,798

$ 19,251 $ 955 $ 76,331 $ 32,767 $ 19,512 $

52,279 $ 128,610

Amortization 7,289 5,313

1,754 299 14,655 8,349 4,051

12,400 27,055

Costs applicable to sales $

21,038 $ 22,485 $ 17,497 $ 656 $ 61,676 $ 24,418 $ 15,461 $ 39,879

$ 101,555

Silver equivalent ounces sold 1,702,290 1,779,377

1,384,391 122,694 4,988,752 8,274,952

Gold equivalent ounces

sold 31,648 23,122

54,770

Costs applicable to sales per

ounce $ 12.36 $ 12.64 $ 12.64 $ 5.35 $ 12.36 $ 772 $ 669 $ 728

$ 12.27

Inventory adjustments (0.82 ) (0.03 ) (0.08 ) —

(0.31 ) (11 ) (2 ) (7 ) (0.23 )

Adjusted costs applicable

to sales per ounce $ 11.54 $ 12.61 $ 12.56 $ 5.35

$

12.05 $ 761 $ 667

$ 721 $ 12.04

Costs applicable to sales per realized ounce $ 10.90

$ 11.32 $ 11.37 $ 10.50

Inventory adjustments (0.72 ) (0.03

) (0.29 ) (0.20 )

Adjusted costs applicable to sales per

realized ounce $ 10.18 $ 11.29

$ 11.08 $

10.30

Costs applicable to sales $ 101,555

Treatment and refining costs 1,158

Sustaining capital

16,710

General and administrative 8,276

Exploration

1,731

Reclamation 3,759

Project/pre-development costs

1,558

All-in sustaining costs $ 134,747

Silver equivalent ounces sold 4,988,752

Kensington and

Wharf silver equivalent ounces sold 3,286,200

Consolidated silver equivalent ounces sold 8,274,952

All-in sustaining costs per silver equivalent ounce $

16.28 Inventory adjustments $ (0.23 )

Adjusted all-in sustaining costs per silver equivalent ounce

$ 16.05 All-in sustaining costs per

realized silver equivalent ounce $ 13.93

Inventory adjustments $ (0.20 )

Adjusted all-in

sustaining costs per realized silver equivalent ounce $

13.73 Reconciliation of All-in Sustaining

Costs per Silver Equivalent Ounce for Three Months Ended

December 31, 2015 Silver

Gold Total In thousands

except per ounce amounts Palmarejo

Rochester

San Bartolomé

Endeavor Total Kensington

Wharf Total Costs applicable to sales,

including amortization (U.S. GAAP) $ 47,207 $ 27,716

$ 24,372 $ 2,579 $ 101,874 $ 33,298 $ 25,033 $

58,331 $ 160,205

Amortization 7,426 4,944

4,311 1,519 18,200 9,503 7,246

16,749 34,949

Costs applicable to sales $

39,781 $ 22,772 $ 20,061 $ 1,060 $ 83,674 $ 23,795 $ 17,787 $

41,582 $ 125,256

Silver equivalent ounces sold 2,588,185

1,820,471 1,564,155 192,768 6,165,579 9,885,699

Gold equivalent

ounces sold 29,988

32,014 62,002

Costs applicable to sales per

ounce $ 15.37 $ 12.51 $ 12.83 $ 5.50 $ 13.57 $ 793 $ 556 $ 671

$ 12.67

Inventory adjustments (1.89 ) (0.14 ) (0.35 ) —

(0.92 ) (16 ) — (8 ) (0.62 )

Adjusted costs

applicable to sales per ounce $ 13.48 $ 12.37 $ 12.48 $ 5.50

$ 12.65 $ 777 $ 556

$ 663 $

12.05

Costs applicable to sales per realized

ounce $ 13.73 $ 11.32 $ 12.56 $ 10.98

Inventory

adjustments (1.69 ) (0.13 ) (0.85 ) (0.54 )

Adjusted costs

applicable to sales per realized ounce $ 12.04 $ 11.19

$

11.71 $ 10.44

Costs applicable to

sales $ 125,256

Treatment and refining costs 964

Sustaining capital 16,567

General and administrative

8,855

Exploration 1,689

Reclamation 4,963

Project/pre-development costs 2,691

All-in

sustaining costs $ 160,985 Silver equivalent

ounces sold 6,165,579

Kensington and Wharf silver equivalent

ounces sold 3,720,120

Consolidated silver equivalent

ounces sold 9,885,699

All-in sustaining costs per

silver equivalent ounce $ 16.28

Inventory adjustments $ (0.62 )

Adjusted all-in

sustaining costs per silver equivalent ounce $

15.66 All-in sustaining costs per realized

silver equivalent ounce $ 14.09

Inventory adjustments $ (0.54 )

Adjusted all-in

sustaining costs per realized silver equivalent ounce $

13.55 Reconciliation of All-in

Sustaining Costs per Silver Equivalent Ounce for Three

Months Ended September 30, 2015

Silver Gold Total

In thousands except per ounce amounts Palmarejo

Rochester

San Bartolomé

Endeavor Total Kensington

Wharf Total Costs applicable to sales,

including amortization (U.S. GAAP) $ 42,710 $ 32,167

$ 21,009 $ 1,384 $ 97,270 $ 33,472 $ 23,419 $

56,891 $ 154,161

Amortization 8,617 6,731

3,526 909 19,783 8,499 5,642

14,141 33,924

Costs applicable to sales $

34,093 $ 25,436 $ 17,483 $ 475 $ 77,487 $ 24,973 $ 17,777 $ 42,750

$ 120,237

Silver equivalent ounces sold 2,924,947 2,116,353

1,201,959 95,260 6,338,519 9,512,459

Gold equivalent ounces

sold 28,084 24,815

52,899

Costs applicable to sales per

ounce $ 11.66 $ 12.02 $ 14.55 $ 4.99 $ 12.22 $ 889 $ 716 $ 808

$ 12.64

Inventory adjustments (0.26 ) (0.01 ) (0.14 ) —

(0.15 ) (47 ) — (25 ) (0.24 )

Adjusted costs

applicable to sales per ounce $ 11.40 $ 12.01 $ 14.41 $ 4.99

$ 12.07 $ 842 $ 716

$ 783 $

12.40

Costs applicable to sales per realized

ounce $ 10.25 $ 10.90 $ 11.14 $ 10.95

Inventory

adjustments (0.24 ) (0.01 ) (0.14 ) (0.21 )

Adjusted costs

applicable to sales per realized ounce $ 10.01 $ 10.89

$

11.00 $ 10.74

Costs applicable to

sales $ 120,237

Treatment and refining costs 820

Sustaining capital 8,565

General and administrative

6,694

Exploration 2,112

Reclamation 4,493

Project/pre-development costs 3,648

All-in

sustaining costs $ 146,569 Silver equivalent

ounces sold 6,338,519

Kensington and Wharf silver equivalent

ounces sold 3,173,940

Consolidated silver equivalent

ounces sold 9,512,459

All-in sustaining costs per

silver equivalent ounce $ 15.41

Inventory adjustments $ (0.24 )

Adjusted all-in

sustaining costs per silver equivalent ounce $

15.17 All-in sustaining costs per realized

silver equivalent ounce $ 13.35

Inventory adjustments $ (0.21 )

Adjusted all-in

sustaining costs per realized silver equivalent ounce $

13.14 Reconciliation of All-in

Sustaining Costs per Silver Equivalent Ounce for Three

Months Ended June 30, 2015 Silver

Gold In thousands except per

ounce amounts Palmarejo Rochester

San Bartolomé

Endeavor

Total Silver

Kensington Wharf Total Gold

Total Combined

Costs applicable to sales, including amortization (U.S.

GAAP) $ 39,158 $ 29,779 $ 24,428 $ 3,204

$ 96,569 $ 40,136 $ 20,123 $ 60,259 $ 156,828

Amortization 9,046 5,387 5,271 1,852

21,556 12,684 3,491 16,175

37,731

Costs applicable to sales $ 30,112 $ 24,392 $

19,157 $ 1,352 $ 75,013 $ 27,452 $ 16,632 $ 44,084 $ 119,097

Silver equivalent ounces sold 2,169,960 2,024,856 1,439,388

209,130 5,843,334 9,067,614

Gold equivalent ounces sold

36,607 17,131

53,738

Costs applicable to sales per ounce $

13.88 $ 12.05 $ 13.31 $ 6.46 $ 12.84 $ 750 $ 971 $ 820 $ 13.13

Inventory adjustments (0.67 ) (0.04 ) (0.05 ) — (0.28

) (5 ) (1 ) (4 ) (0.20 )

Adjusted costs applicable to sales per

ounce $ 13.21 $ 12.01 $ 13.26 $ 6.46

$ 12.56

$ 745 $ 970

$ 816 $ 12.93

Costs applicable to sales per realized ounce $ 12.68 10.98

12.01 $ 11.72

Inventory adjustments (0.61 ) (0.04 ) (0.26 )

(0.18 )

Adjusted costs applicable to sales per realized

ounce $ 12.07 $ 10.94

$ 11.75 $ 11.54

Costs applicable to sales $ 119,097

Treatment and refining costs 1,526

Sustaining capital

13,625

General and administrative 8,451

Exploration

3,579

Reclamation 4,036

Project/pre-development costs

2,030

All-in sustaining costs $ 152,344

Silver equivalent ounces sold 5,843,334

Kensington and

Wharf silver equivalent ounces sold 3,224,280

Consolidated silver equivalent ounces sold 9,067,614

All-in sustaining costs per silver equivalent ounce $

16.80 Inventory adjustments $ (0.20 )

Adjusted all-in sustaining costs per silver equivalent ounce

$ 16.60 All-in sustaining costs per

realized silver equivalent ounce $ 14.99

Inventory adjustments $ (0.18 )

Adjusted all-in

sustaining costs per realized silver equivalent ounce $

14.81

Reconciliation of All-in Sustaining

Costs per Silver Equivalent Ounce for 2016 Guidance

Silver

Gold In thousands except per ounce amounts

Palmarejo Rochester

San Bartolomé

Endeavor

Total Silver

Kensington Wharf

Total Gold

Total Combined

Costs applicable to sales, including amortization (U.S.

GAAP) $ 142,000 $ 122,000 $ 90,000 $ 2,500

$ 356,500 $ 141,000

$

80,000 $ 221,000 $ 577,500

Amortization 37,000

29,000 8,000 1,000

75,000 37,000

18,000 55,000

130,000

Costs applicable to sales $ 105,000 $ 93,000

$ 82,000 $ 1,500 $ 281,500 $ 104,000 $ 62,000 $ 166,000 $ 447,500

Silver equivalent ounces sold 8,301,500 8,090,000 5,900,000

188,000 22,479,500 35,619,500

Gold equivalent ounces sold

125,000 94,000

219,000

Costs

applicable to sales per ounce guidance $12.50-$13.50

$11.25-$12.25 $13.50-$14.25 $825-$875

$650-$750 Costs applicable to sales $

447,500

Treatment and refining costs 5,000

Sustaining

capital, including capital lease payments 75,000

General and

administrative 30,000

Exploration 15,000

Reclamation 16,000

Project/pre-development costs

5,000

All-in sustaining costs $ 593,500

Silver equivalent

ounces sold 22,479,500

Kensington and Wharf silver

equivalent ounces sold 13,140,000

Consolidated silver

equivalent ounces sold 35,619,500

All-in sustaining costs

per silver equivalent ounce guidance $16.00-$17.25

View source

version on businesswire.com: http://www.businesswire.com/news/home/20160727006560/en/

Coeur Mining, Inc.Courtney Lynn, Vice President, Investor

Relations and Treasurer(312) 489-5837orRebecca Hussey, Manager,

Investor Relations(312) 489-5827www.coeur.com

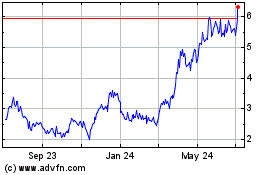

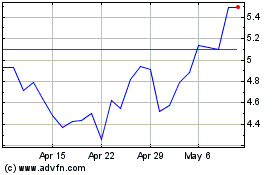

Coeur Mining (NYSE:CDE)

Historical Stock Chart

From Mar 2024 to Apr 2024

Coeur Mining (NYSE:CDE)

Historical Stock Chart

From Apr 2023 to Apr 2024