By Shalini Ramachandran and Cassandra Jaramillo

Despite fears of cord-cutting and competition from cheaper

streaming options, Comcast Corp. said it lost fewer video customers

in the second quarter and reported higher revenue from its

NBCUniversal cable channels and broadcast networks.

But that doesn't mean the cable giant is resting easy. On the

company's earnings call Wednesday, NBCUniversal Chief Executive

Steve Burke said that media giants, including NBCU, may seek to

cull their smaller cable channels in favor of marquee channels as

pressure grows in the pay-TV world.

"I think you'll see more of that with us and others as the

discussions with [pay-TV providers] get more and more contentious,"

Mr. Burke said. NBCUniversal will continue to "invest in the big

guys," such as the USA cable channel and NBC broadcast network, and

"try to trim some of the smaller ones."

"There's just too many channels and people are spending too much

programming channels that are not fully distributed" across

American pay-TV homes, Mr. Burke said.

He noted that NBCUniversal has already repurposed some of its

"marginal" channels like G4 and Style over the past few years.

"We've done some; I think there's more to do," he said.

Media companies long helped fuel their profits by using the

power of their popular channels to get wider carriage of many

smaller ones. Mr. Burke's comments suggest that those practices may

have to change due to tumult in the pay-TV business from

cord-cutting and cheaper streaming options.

His comments came as Comcast reported better-than-expected

financial results in the most recent quarter. Net income fell to

$2.03 billion, or 83 cents a share, compared with $2.14 billion, or

84 cents a share, a year ago, dragged down by a weaker performance

at the film studio without a major blockbuster release during the

period.

Revenue grew 2.8% to $19.27 billion. Both earnings and revenue

exceeded estimates from analysts. Comcast shares rose 1.2% to

$67.98 in midday trading Wednesday.

Comcast lost 4,000 video customers in the seasonally weak

second-quarter when many families move or customers cancel cable-TV

service during the summer months. It was an improvement from the

69,000 subscribers lost in the year-ago period and its best

second-quarter performance in a decade.

Cable companies are benefiting from investing more in their

cable-TV products and bundling them alongside fast broadband.

Comcast, in particular, is reaping rewards from rolling out its

next-generation X1 internet-connected set-top box and guide, which

the company has said increases the time customers spend watching TV

and makes them more likely to stick with Comcast. As of the second

quarter, 40% of customers now have X1 boxes.

Comcast also likely was helped by weakness at its rivals, as

AT&T focused on integrating DirecTV and Dish Network Corp.

faced blackouts amid carriage disputes, Wells Fargo analyst Marci

Ryvicker said in a research note earlier this month.

On the call, Comcast executives continued to say that despite

early success with the X1, they have no plans to roll out a

streaming TV service nationwide outside of their cable footprint.

Comcast CEO Brian Roberts said such "over the top" economic models

are "unproven to us" and "it's not clear that's the right strategy

for us."

Comcast executives struck an optimistic note about the Rio

Olympics, which kick off next week, despite some of the early

controversies and negative headlines about the Zika virus. Noting

that the company made $120 million in profit from the 2012 London

Olympics, NBCU's Mr. Burke said "we are going to make a lot more in

Rio."

Comcast's broadband and business services divisions reported

sales growth in the second quarter, boosting overall revenue at the

cable business. The cable unit, which accounts for the bulk of the

company's revenue, posted 6% sales growth to $12.44 billion.

Broadband revenue increased 8.6% to $3.37 billion, as the

company added 220,000 broadband customers in the quarter compared

with 180,000 a year earlier.

Video revenue grew 2.8% to $5.58 billion, while

business-services revenue jumped 17% to $1.36 billion. Voice

revenue fell 1.1% to $893 million.

At NBCUniversal, revenue fell 1.8% to $7.10 billion, as declines

in filmed entertainment offset growth at its television networks

and theme parks. Operating cash flow at NBCUniversal was relatively

flat at $1.69 billion.

Filmed entertainment posted a 40% drop in revenue and 87%

decline in operating cash flow as Universal Pictures lacked a major

blockbuster release in the second quarter. A year ago, the studio

had box-office hits including "Furious 7" and "Jurassic World."

Revenue grew 4.7% to $2.57 billion at the unit that includes

Comcast's cable TV channels, including Bravo, USA Network and Syfy,

and operating cash flow grew 8.3% to $944 million. Revenue at the

broadcast-TV segment, which includes the flagship NBC network,

increased 17% to $2.13 billion.

Revenue at NBCU's theme parks segment grew 47% to $1.14 billion,

thanks to the inclusion of Universal Studios Japan, which Comcast

bought control of last September, as well as Universal Studios

Hollywood's opening of the Wizarding World of Harry Potter.

Write to Shalini Ramachandran at shalini.ramachandran@wsj.com

and Cassandra Jaramillo at cassandra.jaramillo@wsj.com

(END) Dow Jones Newswires

July 27, 2016 12:59 ET (16:59 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

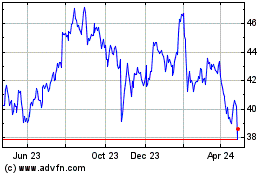

Comcast (NASDAQ:CMCSA)

Historical Stock Chart

From Mar 2024 to Apr 2024

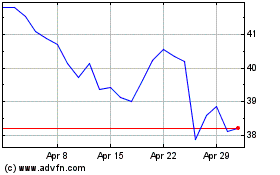

Comcast (NASDAQ:CMCSA)

Historical Stock Chart

From Apr 2023 to Apr 2024