Statoil Cuts Spending After Posting a Net Loss

July 27 2016 - 5:50AM

Dow Jones News

OSLO—Norway's Statoil ASA said Wednesday it would cut capital

expenditure by 8% to $12 billion this year compared with previous

guidance, as the oil and gas producer swung to a second-quarter net

loss on the year amid weak prices and low refining margins.

Weaker-than-expected earnings across all its businesses sent the

company's shares down more than 3% in early trading.

Statoil said capital expenditure would be lower than previously

expected this year partly due to successful cost cuts, notably a

reduction in the average time required to drill an offshore

exploration well to 22 days from 46 days three years ago.

Like other Western oil companies, Statoil has delayed projects

while slashing costs and capital expenditure following a plunge in

oil prices over the last two years. The company has posted a net

loss in six out of the latest eight quarters, written down the

value of its assets and taken on more debt to finance its

operations.

The company's gearing—or debt as a percentage of its

capital—rose to 31.2% at the end of the second quarter, from 28.1%

at the end of the first quarter and 22.4% a year ago. Statoil has

previously been reluctant to exceed 30% gearing but now says the

higher debt is acceptable.

"We are comfortable with a debt ratio well above 30% because we

have a big toolbox, including significant flexibility in our

investment portfolio," said Chief Executive Eldar Saetre. "We

expect to be cash flow neutral at $60 a barrel in 2017 and $50 a

barrel in 2018."

The 67% state-owned company said its net loss for the three

months through June was $307 million compared with a net profit of

$861 million a year earlier. Analysts had expected a net profit of

$264 million. Revenue fell 33% on the year to $10.81 billion

against expectations of $11.71 billion.

The company's adjusted earnings before interest and taxes, which

excludes one-off effects and is seen as a key performance measure,

dropped 68% on the year to $913 million against expectations of

$1.31 billion. The company maintained its dividend at $0.2201 a

share.

U.K. oil giant BP PLC on Tuesday posted its third straight

quarterly loss, mainly due to charges related to the 2010 Deepwater

Horizon spill in the Gulf of Mexico. Royal Dutch Shell PLC and

Total SA are reporting on Thursday, and Exxon Mobil Corp., Chevron

Corp. and Eni SpA are to publish results on Friday.

Write to Kjetil Malkenes Hovland at

kjetilmalkenes.hovland@wsj.com

(END) Dow Jones Newswires

July 27, 2016 05:35 ET (09:35 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

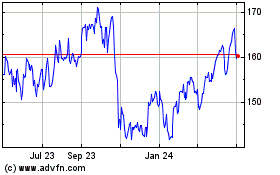

Chevron (NYSE:CVX)

Historical Stock Chart

From Mar 2024 to Apr 2024

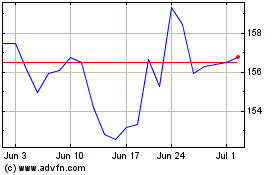

Chevron (NYSE:CVX)

Historical Stock Chart

From Apr 2023 to Apr 2024