Ahead of the Tape: Facebook Rally Too Much of a Good Thing -- WSJ

July 27 2016 - 3:02AM

Dow Jones News

By Steven Russolillo

Facebook Inc. is firing on all cylinders, but even fine-tuned

machines make pit stops.

The social-networking giant's past two quarterly reports were

nearly as close to perfection as possible. Facebook is earning more

money from each one of its 1.6 billion users, a base that is still

growing at a healthy clip. It has become a mobile-advertising

powerhouse, with video being the latest growth area. And its

stock's annualized appreciation of more than 30% from its initial

public offering has pushed it to records.

Already one of America's most valuable companies at nearly $350

billion, it would reach the $1 trillion mark at its current pace by

2020.

Its rapid ascent so far is unmatched by other tech behemoths.

After a little more than four years on the public markets, its

market value is already approaching a level that took Google parent

Alphabet Inc. nine years and Cisco Systems Inc. 10 years from their

respective IPOs to achieve. Microsoft Corp. did it in 13 years.

Amazon.com Inc. reached it in 18 years. Apple Inc. needed over

three decades.

Just how much longer can Facebook keep rallying in this nearly

unabated fashion? Wednesday's earnings report might be just the

catalyst for shares to take a breather.

For one, the bar is set incredibly high. Even the slightest of

missteps could be punished. Analysts estimate adjusted

second-quarter earnings rose 62% to 81 cents a share. That same

estimate was 61 cents a year ago. Revenue is anticipated to have

risen by 49% to $6.01 billion.

Wall Street analysts, usually an upbeat bunch, are particularly

optimistic. Only one of the 49 brokers that cover the social

network has a "sell" recommendation on it, according to FactSet.

That unanimity is unsettling.

More competition could ultimately be the thing that dents

Facebook's earnings. Snapchat's rising popularity among both young

and older users is the latest concern. Snapchat could prompt users

to spend less time and activity on Facebook's properties, such as

Instagram. Analysts at Jefferies project Snapchat could eventually

deny Instagram as much as $150 million in advertising spending.

Minus a stumble immediately following its IPO, Facebook's ascent

has been phenomenal. This all just might be too much to like.

(END) Dow Jones Newswires

July 27, 2016 02:47 ET (06:47 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

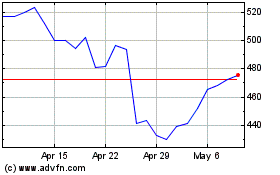

Meta Platforms (NASDAQ:META)

Historical Stock Chart

From Mar 2024 to Apr 2024

Meta Platforms (NASDAQ:META)

Historical Stock Chart

From Apr 2023 to Apr 2024