Japan Shares Lead Asia Higher

July 27 2016 - 1:20AM

Dow Jones News

Positive economic news from China and Australia helped lift

Asian stock markets early Wednesday, while Taiwan's technology

firms got a boost from Apple earnings overnight.

The Nikkei Stock Average was up 1.4%, while Hong Kong's Hang

Seng Index gained 0.4% and the Shanghai Composite Index edged up

0.1%.

The Australian dollar rose against the U.S. dollar after benign

domestic consumer-price data. The S&P/ASX 200 rose on the news,

but has since given up its gains to trade 0.1% lower.

Australian consumer prices rose 1.0% from a year earlier,

missing economists' expectations of a 1.1% rise. The Reserve Bank

of Australia targets an inflation rate of between 2% and 3%.

Analysts expect the benign inflation data will give the central

bank room to cut rates when it meets in August to stoke growth.

"We believe that continued low underlying inflation will prompt

the RBA to eventually reduce rates to 1.0% versus 1.75% now," said

Paul Dales, chief economist at Capital Economics.

In China, government data showed industrial companies' profits

rose 5.1% in June from a year earlier, 1.4 percentage points faster

than the pace recorded in May, while debt-to-asset ratio fell.

Taiwan's benchmark Taiex rose 0.5% as Apple's shipments for the

just-ended quarter met expectations. Apple on Tuesday released

better-than-expected third-quarter revenue and net income, and

projected better-than-expected revenue for the next quarter.

Among Apple suppliers in Taiwan, heavyweight chip producer

Taiwan Semiconductor Manufacturing rose to a record high, while

lens maker Largan Precision advanced 2.6%. Hon Hai and case maker

Catcher each gained more than 1%.

In Japan, a pullback in the yen helped the Japanese stock market

lead gains in Asia even as investors wait for rate guidance from

the U.S. Federal Reserve.

The yen was down versus the dollar Wednesday, paring some of its

gains a day earlier. Asian currency pairs are hovering around their

previous closing levels, awaiting a trigger from the Fed's rate

decision later Wednesday.

The potential effect of the Fed meeting on Asian currencies will

show up on Thursday when markets reopen. Analysts don't expect the

Fed to adjust interest rates yet, but it may strike a more hawkish

stance given the recent string of improved U.S. economic data and

the consecutive highs seen in the U.S. stock market.

Ewen Chew, James Glynn, Rachel Pannett, and John Wu contributed

to this article.

Write to Kenan Machado at kenan.machado@wsj.com

(END) Dow Jones Newswires

July 27, 2016 01:05 ET (05:05 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

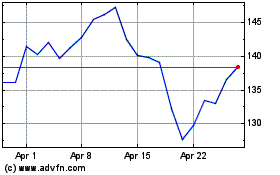

Taiwan Semiconductor Man... (NYSE:TSM)

Historical Stock Chart

From Mar 2024 to Apr 2024

Taiwan Semiconductor Man... (NYSE:TSM)

Historical Stock Chart

From Apr 2023 to Apr 2024