Ameriprise Operating Earnings Decline 13%

July 26 2016 - 5:38PM

Dow Jones News

By Josh Beckerman

Ameriprise Financial Inc. (AMP) said second-quarter operating

earnings fell 13%, reflecting equity-market volatility and low

interest rates.

The financial-services company said clients "remain cautious,

which is reflected in slower activity and high cash balances" but

said retail client assets increased to an all-time high and adviser

recruiting remained strong.

For the quarter ended June 30, net income was $335 million, or

$1.97 a share, compared with $415 million, or $2.23 a share, a year

earlier. Revenue fell 8% to $2.87 billion.

Operating earnings, which exclude realized gains and losses,

market effects on variable annuity benefits and other items, fell

to $379 million, or $2.23 a share, from $434 million, or $2.33 a

share.

Analysts polled by Thomson Reuters expected per-share operating

profit of $2.26 a share on revenue of $2.87 billion.

At the end of the period, total assets under management and

administration were $773 billion and the company had 9,766 total

advisers.

In after-hours trading, Ameriprise shares were flat at

$96.60.

The company's Columbia Threadneedle Investments business said in

May that it would buy Emerging Global Advisors LLC, which runs

emerging-markets exchange-traded funds. Columbia Threadneedle was

one of several firms that suspended investor redemptions at a U.K.

property fund after the Brexit vote.

Ameriprise was spun off from American Express Co. in September

2005.

Write to Josh Beckerman at josh.beckerman@wsj.com

(END) Dow Jones Newswires

July 26, 2016 17:23 ET (21:23 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

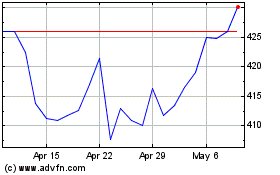

Ameriprise Financial (NYSE:AMP)

Historical Stock Chart

From Mar 2024 to Apr 2024

Ameriprise Financial (NYSE:AMP)

Historical Stock Chart

From Apr 2023 to Apr 2024