KeyCorp Profit Falls on Merger-Related Expenses

July 26 2016 - 10:10AM

Dow Jones News

Regional lender KeyCorp said its second-quarter profit declined

as expenses increased on its coming acquisition of First Niagara

Financial Group Inc.

The Ohio-based regional bank, which outlined plans in October to

buy First Niagara for about $4.1 billion, said it still expects the

deal to close in August. Merger-related costs cut earnings by 4

cents a share in the quarter.

In all, the Cleveland-based bank reported a profit of $202

million, or 23 cents a share, down from $238 million, or 27 cents a

share, a year earlier.

Revenue fell 0.1% to $1.08 billion. Analysts projected 27 cents

in per-share profit on $1.09 billion in revenue, according to

Thomson Reuters.

Noninterest income fell 3.1% to $473 million, hurt by lower

investment banking and debt placement fees and by a decline in

operating lease income.

The bank said average loans grew 5.5% and deposits increased

5.2% from a year earlier.

Like many other lenders, Key has moved to cut costs and has

closed some branches. Still, noninterest expenses rose 5.6% from

the year-earlier period as it spent more on salaries and other

costs related to the First Niagara deal. Deal-related costs added

up to $45 million in the quarter.

KeyCorp's net-interest margin, a gauge of lending profitability

that measures how much a bank earns from the difference between

what it pays on deposits and what it takes in on loans and

investments, declined. The metric fell to 2.74%, down from 2.83% in

the prior quarter and from 2.85% a year prior.

KeyCorp shares, down 7% over the past three months, were

inactive in premarket trading.

Write to Austen Hufford at austen.hufford@wsj.com

(END) Dow Jones Newswires

July 26, 2016 09:55 ET (13:55 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

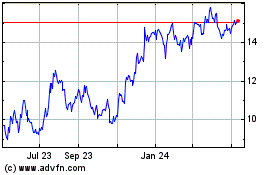

KeyCorp (NYSE:KEY)

Historical Stock Chart

From Mar 2024 to Apr 2024

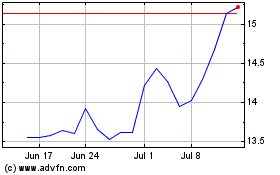

KeyCorp (NYSE:KEY)

Historical Stock Chart

From Apr 2023 to Apr 2024