Caterpillar Slashes Guidance, Announces More Job Cuts--Update

July 26 2016 - 9:42AM

Dow Jones News

By Lisa Beilfuss

Caterpillar Inc. slashed its outlook and said it would cut more

jobs this year as the industrial giant continues to try to steady

its business amid depressed demand from the oil and gas industries

and increased global uncertainty.

The company now expects to earn $3.55 a share this year,

excluding restructuring costs. Caterpillar in April cut its

forecast for the year, predicting $3.70 a share without

restructuring costs.

Like many U.S. manufacturers that do significant business

abroad, the Peoria, Ill., based company has been hurt by the strong

U.S. dollar that makes its equipment more expensive in foreign

currencies. Brexit gave the dollar another lift, and uncertainty

over the U.K.'s decision to leave the European Union has further

reduced some firms' investment spending. Meanwhile, many customers

connected to the energy industry remain under pressure and have

significantly pulled in spending.

Fellow manufacturer 3M Co. also reported second-quarter results

Tuesday. That company missed sales expectations and pulled in the

high-end of its full-year guidance.

"We're cautious as we enter the second half of the year," said

Caterpillar Chief Executive Doug Oberhelman. "We're not expecting

an upturn in important industries like mining, oil and gas and rail

to happen this year," he said. The company added that global growth

isn't sufficient to drive improvement in most of its markets, with

commodity prices stabilized but at low levels and turmoil from

Brexit and Turkey adding to risks across Europe.

As such, Caterpillar said it would further reduce its ranks by

an unspecified number that adds to previously announced layoffs of

10,000. As of June 30, the company employed about 113,000 workers.

Caterpillar has also said it would shut or consolidate 20 plants by

the end of the 2018. So far, Caterpillar has cut about 5,300

positions and announced the closing of a handful of smaller

plants.

Rising restructuring costs will cut into earnings this year,

while sales are also expected to be weaker than previously thought.

Caterpillar now sees full-year revenue coming in between $40 and

$40.5 billion versus its April forecast of $40 billion to $42

billion.

In the latest period, revenue fell across all segments, paced by

a 31% drop across Latin America, where Brazilian and Mexican

economies remain particular soft spots. Sales across North America

fell 16%, largely because of the energy price collapse, while

Caterpillar's Europe, Africa and Middle East and Asia Pacific

businesses also posted double-digit declines.

In all for the June quarter, the company reported a profit of

$550 million, or 93 cents a share, down from $802 million, or $1.31

a share, a year earlier. Excluding restructuring costs, earnings

per share fell to $1.09 from $1.40.

Revenue slid 16% to $10.34 billion.

Analysts predicted 96 cents in adjusted per-share profit on

$10.11 billion in revenue, according to Thomson Reuters.

Caterpillar shares, up 16% this year through Monday's close,

declined 1.2% in premarket trading.

Write to Lisa Beilfuss at lisa.beilfuss@wsj.com

(END) Dow Jones Newswires

July 26, 2016 09:27 ET (13:27 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

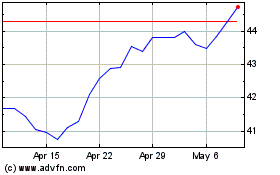

Altria (NYSE:MO)

Historical Stock Chart

From Mar 2024 to Apr 2024

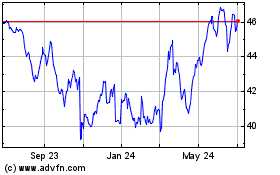

Altria (NYSE:MO)

Historical Stock Chart

From Apr 2023 to Apr 2024