Reynolds American Sales Climb, Helped by Lorillard

July 26 2016 - 8:10AM

Dow Jones News

By Lisa Beilfuss

Reynolds American Inc. said sales climbed 33% in its latest

quarter as the tobacco company continues to benefit from last

year's acquisition of rival Lorillard Inc., though results fell

short of expectations.

Last year, the second- and third-biggest U.S. cigarette makers

agreed to a $25 billion tie up that would make it better able to

compete with industry leader and Marlboro owner Altria Group Inc.

Through the deal, Reynolds, maker of Camel and Pall Mall brands,

has folded in top-selling menthol cigarette Newport.

Chief Executive Susan Cameron said Reynolds finished the

integration during its June period, six months ahead of schedule

and as Newport gained a half-point of market share, to 13.9%. The

performance, driven by a sixfold increase in sales volume to 8.8

billion, helped boost Reynolds's overall market share to 34.5% from

34% a year earlier.

Total cigarette volume rose 57% to 18.9 billion as the Newport

brand offset a 2.8% decline in Camel and a 5.4% fall in Pall Mall

volume.

In all for the three months ended June 30, the company reported

a profit of $796 million, or 56 cents a share, down from $1.93

billion, or $1.69 a share, a year earlier. The decline was largely

due to a gain in the year-ago period on divestitures that the

company had to make to seal the Lorillard deal. Excluding that and

other items, earnings per share rose to 58 cents from 51 cents.

Revenue increased to $3.2 billion from $2.4 billion. Analysts

had projected 61 cents in per-share profit and $3.26 billion in

sales, according to Thomson Reuters.

Shares in the company, up 13% this year, were inactive during

premarket trading.

Write to Lisa Beilfuss at lisa.beilfuss@wsj.com

(END) Dow Jones Newswires

July 26, 2016 07:55 ET (11:55 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

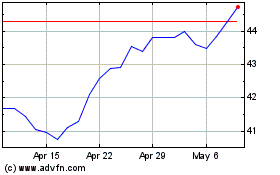

Altria (NYSE:MO)

Historical Stock Chart

From Mar 2024 to Apr 2024

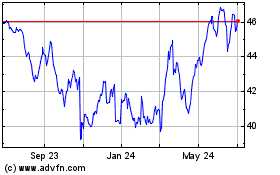

Altria (NYSE:MO)

Historical Stock Chart

From Apr 2023 to Apr 2024