Stronger Yen Dents Profit of Japan Inc. -- WSJ

July 26 2016 - 3:04AM

Dow Jones News

By Megumi Fujikawa

TOKYO -- Under pressure from a stronger yen, many Japanese

companies face further downgrades to their earnings projections for

the year, after a surge in the currency this past quarter eroded

profits.

Major Japanese businesses from Sony Corp. to Nintendo Co. will

this week release results for the quarter ended in June, in which

the yen strengthened more than 8% against the U.S. dollar. The

increase hit exporters that had earlier enjoyed the benefits of a

currency weakened by Prime Minister Shinzo Abe's aggressive

policies to revitalize Japan's economy.

The yen has been rising since late last year, posing a major

challenge to the so-called Abenomics program and the Bank of

Japan's efforts to cheapen the yen, which supports corporate

profits earned abroad. The dollar fell briefly below Yen100 last

month on the vote by the U.K. to leave the European Union.

"Because many companies made their full-year earnings guidance

based on a yen rate that is weaker than the current market rate, we

cannot expect boosts from foreign-exchange rates like we saw in the

past few years," said Kazuhito Yasumura, a senior quantitative

analyst at Mitsubishi UFJ Morgan Stanley Securities Co.

A stronger yen makes the products Japanese firms sell overseas

more expensive while eroding those profits when they are

repatriated.

The yen weakened in the past few weeks on hopes that the

government and the BOJ will introduce further fiscal and monetary

stimulus, although the movement won't be reflected in the

April-June results.

The negative impact of the yen's strength has been apparent in

results released this month.

Fast Retailing Co. Ltd. lowered its profit forecast for its

fiscal year ending Aug. 31. The owner of the Uniqlo brand has cut

its profit expectations by more than 60% since the start of the

year.

For Toyota Motor Corp., a weakening yen had been the

single-biggest contributor to profit growth for nearly three years.

Now the currency has changed course, "the tide has greatly

shifted," President Akio Toyoda said in May. The company said it

loses Yen40 billion ($377 million) in operating profit every time

Japan's currency strengthens by one yen against the dollar.

Toyota earlier this year said it expected profit to decline by

more than a third in the current financial year, which ends March

2017, based on an average rate for the period of Yen105 to the

dollar. On Monday, the yen was at about 106 to the dollar.

Daiwa Securities chief economist Kazuhiro Takahashi said the

auto sector likely was hit hard in the April-June quarter, and

estimates pretax profits of Japan's six major auto makers declined

by about 30% for the period.

In reports released earlier this year, nearly half of the 200

companies Daiwa Securities monitors made their projections based on

a rate of Yen110 to the dollar, according to the brokerage. It was

around Yen120 in early January.

If the dollar averages Yen105 or Yen100 for the financial year

that began April 1, ordinary profits by major Japanese

manufacturers are estimated to decline by up to about 20% or 26%,

respectively, according to a calculation made by SMBC Nikko

Securities chief market economist Yoshimasa Maruyama.

"The estimate is large enough to cause an extremely negative

impact, even after taking into account any expected cost-cutting

measures by the companies," Mr. Maruyama said.

A stronger yen deals a blow to an electronics sector already

struggling with tepid demand, according to Nomura Securities'

analysts. Many Japanese electronics companies have operations in

the U.K. and Brexit concerns could lead to currency fluctuations,

Nomura said.

The British pound fell sharply last month after the result of

the U.K. referendum increased uncertainties over the course of the

country's economy. The currency fell 15% against the yen between

April and June.

Hitachi Ltd. has a manufacturing site in the U.K. for a

high-speed railway contract it won in 2012. As the British plant

imports key components from Japan, the yen's appreciation against

sterling would be a concern, Nomura said.

Hitachi said it was fully hedged against foreign-exchange moves

on materials it ships to the U.K. from Japan, but sales earned in

the country could be affected by a higher yen when converted back

into the home currency.

Profits at Nintendo may be hit by the yen's appreciation as the

company holds ample cash in dollar and euro terms. Any impact from

the smash-hit smartphone game "Pokémon Go" launched earlier this

month won't be reflected in the results expected to be announced on

Wednesday.

For Sony, the yen's appreciation against the dollar and euro is

expected to have a muted effect. Sony said for every one yen of

strengthening against the dollar, it gains Yen5 billion in

operating profit, while every one yen of strengthening against the

euro takes away Yen5.5 billion.

A stronger yen isn't bad news for all companies. Japanese

furniture maker Nitori Holdings Co. Ltd. reported a record 43%

increase in profit for its March-May quarter. Nitori produces 90%

of its furniture overseas and imports it to sell in Japan.

Write to Megumi Fujikawa at megumi.fujikawa@wsj.com

(END) Dow Jones Newswires

July 26, 2016 02:49 ET (06:49 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

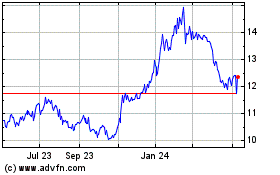

Nintendo (PK) (USOTC:NTDOY)

Historical Stock Chart

From Mar 2024 to Apr 2024

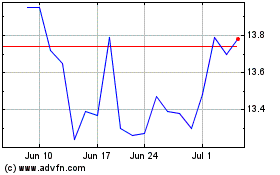

Nintendo (PK) (USOTC:NTDOY)

Historical Stock Chart

From Apr 2023 to Apr 2024