Las Vegas Sands Profit Falls 30%, Hurt by Macau Declines

July 25 2016 - 6:26PM

Dow Jones News

By Josh Beckerman

Las Vegas Sands Corp. said second-quarter earnings fell 30% as

declines in Macau continued to drag on its results.

Macau, the company's largest market, "remained challenging

during the quarter; but we do see signs of stabilization,

particularly in the mass market," the company said.

A corruption crackdown and slowing economy in China have hurt

business for Macau casino operators. In the short term, the

European Football Cup was considered a potential rival for gambling

attention.

Although revenue declined at its Macau sites, including a 9.9%

decrease at the Venetian Macao, the company said strong cost

discipline helped its margins there.

At Las Vegas operations, which include the Venetian, revenue was

up 3%, while the Sands Bethlehem in Pennsylvania posted a 6.5%

increase. At the Marina Bay Sands property in Singapore, revenue

fell 2.9%.

Las Vegas Sands shares rose 5% to $50.20 in after-hours trading

Monday.

Over all, Las Vegas Sands reported a profit of $328 million, or

41 cents a share, down from $469.2 million, or 59 cents a share, a

year earlier. Earnings excluding items fell to 52 cents a share

from 60 cents. Revenue fell 9.3% to $2.65 billion.

Analysts polled by Thomson Reuters projected earnings excluding

items of 56 cents a share on revenue of $2.76 billion.

In June, Fitch Ratings affirmed its ratings for Las Vegas Sands,

citing a strong balance sheet and predicting eventual improvement

in Macau.

Write to Josh Beckerman at josh.beckerman@wsj.com

(END) Dow Jones Newswires

July 25, 2016 18:11 ET (22:11 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

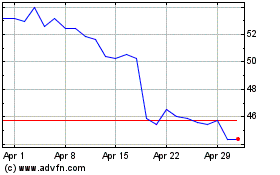

Las Vegas Sands (NYSE:LVS)

Historical Stock Chart

From Mar 2024 to Apr 2024

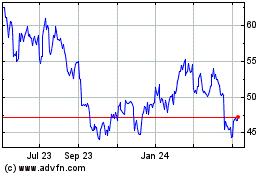

Las Vegas Sands (NYSE:LVS)

Historical Stock Chart

From Apr 2023 to Apr 2024