By Tatyana Shumsky

U.S. corporations are spending more for sound advice. Finance

chiefs at companies including Baxter International Inc., Northern

Trust Corp. and Alaska Air Group Inc. are turning to outside

consultants as they grapple with increasingly complex challenges

ranging from shareholder activism to merger integration.

The U.S. consulting market, the world's largest, grew by $3.9

billion, or 7.7%, in 2015 to $54.7 billion, according to Source

Global Research. That was on top of a $4.2 billion increase the

year before. The market research firm, which focuses on large and

midsize consultants, expects U.S. fees to grow another 10% this

year.

In an era of slow economic growth, chief financial officers are

looking for ways to expand revenue and profit while keeping head

count low. Finance chiefs must weigh the steep costs of consulting

services against the potential benefits that expert outside advice

can deliver.

Fast-paced technological innovation, increased regulation and

new competition are among the factors contributing to the demand

for outside advice, according to consultants and market

researchers.

"Consultants are like plumbers; they're hired when there's

something wrong with your heating system and it's not economically

worth you training to be a plumber," said Fiona Czerniawska,

co-founder of Source Global.

For medical-equipment maker Baxter, the decision to call for

expert help came last August, when executives were notified that

activist hedge fund Third Point LLC had purchased a stake in the

company that soon rose to nearly 10%.

"We brought in a number of advisers to ensure that we were

taking the right steps at the right time," said Baxter CFO Jay

Saccaro.

The consultants helped Baxter's team evaluate how management

strategy and governance practices were perceived by shareholders,

and identified key concerns, he said. They also helped Baxter craft

and execute an agreement with the fund that included scrapping the

board's staggered structure and adding Third Point partner Munib

Islam to the board.

Since then, Mr. Islam has become a valuable asset to the Baxter

team, Mr. Saccaro said. Mr. Islam helped the company hire José

Almeida as chief executive officer and advised Baxter on the

regulatory complexities of selling stock in spinoff Baxalta Inc.,

he said.

"In our case, the situation has worked out quite well," Mr.

Saccaro said.

To be sure, shoveling money at consultants raises the hackles of

some experts who say such reliance on outside advisers prompts

questions about management's competence. Top executives should have

the tools and techniques to cut costs, evaluate strategy or lead a

restructuring, said Lawrence Hrebiniak, emeritus professor of

management at the Wharton School of the University of

Pennsylvania.

"The C-suite should know how to do most of these things. They

should know how to do strategic thinking," he said.

However, sudden change may require temporary expertise.

"Situations sometimes call for a surge of qualified, capable people

that you need for a period of time but not forever," said Fred

Crawford, senior vice chairman at consulting firm AlixPartners LLP.

Mr. Crawford said the benefit of hiring consultants for a project

is that after a defined period of time, CFOs can "then ask them to

leave."

Northern Trust sought consulting help with Federal Reserve

regulations that, beginning in 2014, required it to pass so-called

stress tests, which are designed to show how the asset-custodian

company would fare in an economic downturn.

"It's not like we've been doing this for 20 years," said Joyce

St. Clair, chief capital management officer, who oversees Northern

Trust's stress-test process. "One reason we work with outside

consultants is so we have a solid understanding of best practices

and to stay abreast with what our peers are doing."

Steve Sadove, CEO of retailer Saks Inc. from 2006 to 2013, said

he engaged consultants on a variety of projects targeting

cost-savings, strategy and technology. He said consultants often

bring expertise that help companies save far more than they

cost.

"I don't think you automatically bring in consultants unless you

think the value added is going to be substantially more than the

cost or when you absolutely don't believe you have the resources,"

Mr. Sadove said.

When considering the cost of engaging a consultant for a

particular task, CFOs should evaluate whether the project makes

economic sense once the fees are accounted for, said Christian

Campagna, leader of Accenture Strategy's CFO & Enterprise Value

group. Many consulting companies, including Accenture, now offer to

link their fees to the realized cost reductions or benefits.

CFOs appreciate how this aligns consultants' interests with

their own. "It gives them a better feeling that the consultants are

really worth what they're spending on them," Mr. Campagna said.

Keeping costs down is a focus for Alaska Air CFO Brandon

Pedersen as his team prepares to merge with Virgin America Inc. The

company plans to use consultants in a variety of roles including

the integration of technology systems and getting regulatory

approval for the two carriers to operate as one, according to a

company spokeswoman.

"Price matters a lot," Mr. Pedersen told investors on the

company's earnings call in April. "While there will be consultants,

the budget for consultants is going to be tightly controlled."

Write to Tatyana Shumsky at tatyana.shumsky@wsj.com

(END) Dow Jones Newswires

July 25, 2016 13:51 ET (17:51 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

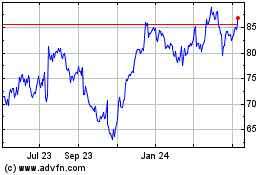

Northern (NASDAQ:NTRS)

Historical Stock Chart

From Mar 2024 to Apr 2024

Northern (NASDAQ:NTRS)

Historical Stock Chart

From Apr 2023 to Apr 2024