Ryanair Posts 4% Profit Rise, Sticks With Forecasts

July 25 2016 - 1:40AM

Dow Jones News

LONDON—Ryanair Holdings PLC stuck to its earnings target for the

year after first-quarter profit rose 4%, bucking a trend for

European carriers.

Ryanair on Monday posted a €256 million ($281 million) net

profit for the April-June period, up from €245 million a year

earlier. Sales were up 2% to €1.687 billion.

Still, Europe's largest airline by passenger numbers said its

earnings outlook for full-year profit in the range of €1.375

billion to €1.425 billion bears risk. It now expects to carry 117

million passengers in the financial year ending March 31, up 1

million from its initial projection.

"We caution that post Brexit there are significant risks to the

downside during the remainder of the year," the carrier said.

Airline earnings have been hit by a sequence of shocks in recent

months. Terrorist attacks, repeated air-traffic-control strikes,

and the U.K.'s vote to leave the European Union have dented

consumer confidence and slowed bookings. Airlines have had to offer

steep discounts to fill planes.

British Airways parent International Consolidated Airlines Group

SA cut its forecast for profit growth immediately after the Brexit

vote. British budget airline easyJet PLC followed with a profit

warning and, last week, said this month's terrorist attack in Nice

and failed coup in Turkey could cause another demand slump.

Deutsche Lufthansa AG on Wednesday said profit would fall this

year, rather than rise slightly as previously forecast. The German

carrier said terrorist incidents had led to a sharp fall in

long-haul bookings.

Ryanair Chief Executive Michael O'Leary said "ongoing market

volatility" weakened fares on last-minute flights.

Winter is expected to be particular difficult for European

airlines, as they slash fares to try to win customers leery about

traveling. Ryanair, which stuck to its projection that fares in

that slow-travel period could fall 10% to 12%, said "if there is

any movement in these numbers it is likely to be toward the

downside."

Share prices of Europe's airlines have nose dived this year,

Ryanair down 27%, rival easyJet more than 40% and IAG 34%. Ryanair

used the slump to accelerate a previously announced share-buyback

program in June. The airline on Wednesday is seeking shareholder

approval for another repurchase program of as much as 10% of its

stock should the price swoon provide buying opportunities.

Mr. O'Leary lobbied hard for the U.K. to remain in the EU. The

airline called the outcome "both a surprise and a disappointment."

Since the Brexit vote, he said, the airline would deploy new planes

due for delivery elsewhere.

Ryanair said it would cut available seats on routes from its

busy London Stansted hub this winter, though without closing any

routes. It forecasts that uncertainty from Brexit will keep at

least the pound low and economic growth depressed in the U.K. and

Europe through at least the end of next year.

If Britain's ties to the European single-aviation market are

severed, it could jeopardize the few all-domestic U.K. routes

Ryanair operates, the budget airline said, and also hurt British

shareholders. It said such a severing could also provide

opportunities, though, as British rivals may be forced to retrench

from some intra-EU markets.

Ryanair said it is making contingency plans. EasyJet has said it

plans to seek a EU operating license, in addition to its British

and Swiss ones, to preserve traffic rights if those are in jeopardy

from post-Brexit trade agreements.

Write to Robert Wall at robert.wall@wsj.com

(END) Dow Jones Newswires

July 25, 2016 01:25 ET (05:25 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

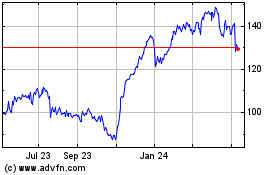

Ryanair (NASDAQ:RYAAY)

Historical Stock Chart

From Mar 2024 to Apr 2024

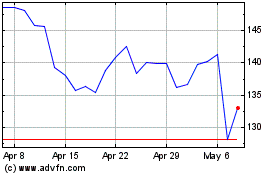

Ryanair (NASDAQ:RYAAY)

Historical Stock Chart

From Apr 2023 to Apr 2024