UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the

Registrant

x

Filed by

a Party other than the Registrant

¨

Check the appropriate box:

|

|

|

|

|

¨

|

|

Preliminary Proxy Statement

|

|

|

|

|

¨

|

|

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

|

|

|

|

|

¨

|

|

Definitive Proxy Statement

|

|

|

|

|

x

|

|

Definitive Additional Materials

|

|

|

|

|

¨

|

|

Soliciting Material Pursuant to Section 240.14a-12

|

JAZZ

PHARMACEUTICALS PUBLIC LIMITED COMPANY

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant)

Payment of Filing Fee (Check the appropriate box):

|

|

|

|

|

|

|

|

|

|

x

|

|

No fee required.

|

|

|

|

|

¨

|

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

|

|

|

|

|

|

|

|

1)

|

|

Title of each class of securities to which transaction applies:

|

|

|

|

2)

|

|

Aggregate number of securities to which transaction applies:

|

|

|

|

3)

|

|

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing

fee is calculated and state how it was determined):

|

|

|

|

4)

|

|

Proposed maximum aggregate value of transaction:

|

|

|

|

5)

|

|

Total fee paid:

|

|

|

|

|

¨

|

|

Fee paid previously with preliminary materials.

|

|

|

|

|

¨

|

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement

number, or the Form or Schedule and the date of its filing.

|

|

|

|

|

|

|

|

1)

|

|

Amount Previously Paid:

|

|

|

|

2)

|

|

Form, Schedule or Registration Statement No.:

|

|

|

|

3)

|

|

Filing Party:

|

|

|

|

4)

|

|

Date Filed:

|

The following communication was sent or made available to shareholders of Jazz Pharmaceuticals plc commencing

on July 22, 2016

JAZZ PHARMACEUTICALS PUBLIC LIMITED COMPANY

Annual General Meeting of Shareholders

August 4, 2016

Supplemental Information Regarding Proposals 6, 7 and 8

Dear Shareholders:

We would like to underscore

the importance of your independent analysis of the proposals presented for your consideration at our 2016 Annual General Meeting of Shareholders (“AGM”). The proposals are described in detail in our proxy statement, which has been made

available to you and filed with the U.S. Securities and Exchange Commission (the “SEC”). We encourage you to read our proxy statement as well as the additional soliciting material we have filed with the SEC, including the presentation we

filed on July 5, 2016.

Our board of directors recommends that you vote your shares “FOR” the election of each of the

director nominees up for re-election at the AGM, and “FOR” each of the other proposals up for a shareholder vote at the AGM. We would like to draw you attention specifically to Proposal 6—Renew Directors’ Authority to Issue

Shares, Proposal 7—Renew Directors’ Authority to Issue Shares for Cash Without First Offering Shares to Existing Shareholders, and Proposal 8—Adjournment. We refer to Proposals 6 and 7 together as our share issuance proposals.

Glass Lewis & Co. has recommended that its clients vote “FOR” our share issuance proposals, partially in recognition that

our ordinary shares are listed solely on the NASDAQ Global Select Market, which provides its own separate restrictions on share issuances for the protection of shareholders. Institutional Shareholder Services (“ISS”) has recommended voting

against our share issuance and adjournment proposals. For the reasons set forth below, we disagree with the approach ISS has taken in its analysis.

While we recognize that our shareholders make their voting decisions independently, and often apply their own internal guidelines, we also

understand that the advisory reports are utilized as research tools by many of our shareholders. In this regard, we believe it is imperative that such reports be supplemented with more complete information.

Background of Our Share Issuance and Adjournment Proposals

We are listed in the U.S. and incorporated in Ireland.

As further described in our proxy statement, we are incorporated in

Ireland and our ordinary shares are listed exclusively on the NASDAQ Global Select Market. We are a U.S. domestic reporting company under SEC rules—we are not a foreign private issuer.

Because we are incorporated in Ireland, we follow the corporate legal rules of Ireland, which require us to seek shareholder approval to

renew our share issuance authorities.

As a matter of Irish law, directors of an Irish public limited company must have specific authority from shareholders to issue any of the company’s ordinary shares (other than pursuant to employee

equity plans). In addition, when the directors of an Irish public limited company determine that it is in the best interests of the company to issue shares for cash, the company must first offer those shares on the same or more favorable terms

to existing shareholders of the company on a pro-rata basis (commonly referred to as the statutory pre-emption right), unless this statutory pre-emption right is dis-applied, or opted-out of, by approval of the shareholders.

While we are legally required to seek shareholder approval to renew our share issuance

authorities because we are incorporated in Ireland, our share issuance proposals are fully consistent with capital markets practice and governance standards in the U.S

.

Companies that are incorporated and listed in the U.S. are not

generally required to—and do not—seek shareholder approval to renew their authority to issue shares. Most companies who are incorporated and publicly-traded in the U.S.—many of the companies with which we compete—are not required

to and generally do not grant all existing shareholders pre-emptive rights on new issuances of shares.

Because our ordinary shares

are listed exclusively in the U.S., we follow the NASDAQ rules and listing standards that provide separate restrictions on share issuances for the protection of shareholders.

To be clear, shareholder approval of the share issuance proposals

would not mean that we would have no limits on future share issuances. We are and will continue to be subject to all of the shareholder approval and other requirements that arise from our ordinary shares being listed on the NASDAQ Global Select

Market and our being a U.S. domestic reporting company under SEC rules. For example, NASDAQ rules generally require shareholder approval prior to our issuing shares in connection with acquisitions, other than in public offerings for cash, when the

number of shares to be issued is or will be equal to or in excess of 20% of the number of our ordinary shares outstanding before the issuance. Our board of directors has focused and will continue to focus on and satisfy its fiduciary duties to

our shareholders with respect to any share issuances we undertake.

We are asking our shareholders to renew, for an additional five

years, the same share issuance authorities that have been in place and that we have been operating under since we effectively re-domiciled in Ireland in 2012

.

Approval of these proposals extends—but does not expand—the

current share issuance authorities of our board of directors. We are

not

asking you to approve an

increase

to our authorized share capital.

Given the high vote threshold associated with Proposal 7 (as well as Proposals 4A and 4B—Amendments to our Memorandum of

Association and Articles of Association), we are proposing to have the ability to adjourn the AGM to solicit additional proxies if there are insufficient votes at the time of the AGM to approve any of these proposals.

If you support

Proposals 4A, 4B and 7, we believe that a vote for the adjournment proposal also warrants your support. As further described in our 2016 proxy statement, Proposals 4A and 4B relate to administrative adjustments and minor housekeeping changes to our

constitutional documents.

Why You Should Support Our Share Issuance and Adjournment Proposals

Renewal of our share issuance authorities is fundamental to the way we intend to advance our business and increase shareholder

value

.

Our growth strategy depends in part on our ability to identify, acquire, in-license and/or develop additional products or product candidates. Our management and board of directors rely on having the flexibility to quickly take

advantage of strategic opportunities, including potential acquisitions and other capital-intensive transactions. Many of these opportunities are highly competitive, with multiple parties offering comparable or even the same economics. If our share

issuance proposals are not approved, we would be required to obtain shareholder approval prior to issuing any shares in connection with new strategic opportunities after January 17, 2017, even if we would not otherwise be required to obtain

shareholder approval under NASDAQ rules. This could put us at a distinct disadvantage vis-à-vis many of our peers in competing for acquisitions and similar transactions (particularly since many of the companies with which we compete

strategically are listed and incorporated in the U.S. and are not subject to similar share issuance restrictions), and might make it difficult for us to complete such transactions, thus potentially limiting our ability to further our growth strategy

by deploying capital to meet strategic goals that are in the best interests of our shareholders.

Our past actions demonstrate our deliberately disciplined use of equity in furtherance of

our growth strategy

.

We believe that we have been successful in executing on our long-term business plan and growth strategy, while also creating value for our shareholders. We have been engaged in targeted business development,

applying a disciplined approach to allocating our resources between investments in our current commercial and development portfolio and the acquisition or in-licensing of new assets. Since we effectively re-domiciled in Ireland in 2012, we have

completed company and asset acquisitions or in-licenses in transactions valued at over $3.5 billion in the aggregate, including our recently-completed acquisition of Celator Pharmaceuticals, Inc. Each of these transactions were funded with cash on

hand and/or borrowings under credit facilities, and we have otherwise been disciplined in our use of equity to provide funding for, or to complete, acquisitions or in-licensing of new assets. We have only issued equity or equity-linked securities

for capital-raising purposes since we effectively re-domiciled in Ireland in connection with our August 2014 offering of exchangeable senior notes. We also believe that we have appropriately balanced investment in our growth with managing dilution

through our share repurchase programs, under which we have repurchased approximately $375 million of our ordinary shares through March 31, 2016.

While we have been deliberately disciplined in our use of equity in our completed transactions, if our share issuance proposals are not

approved, we would potentially lose the flexibility to quickly take advantage of business development opportunities that would require the issuance of equity or equity-linked securities.

We believe that the loss of that flexibility

would negatively impact our ability execute on our business and growth strategy without competitive disadvantage.

Our Views on ISS’ Position on

Our Share Issuance Proposals

We believe that ISS inappropriately analyzed our share issuance proposals under its UK/Ireland

Voting Policy.

This policy generally applies to companies that are listed on an exchange in the UK or Ireland, but we believe it was applied to us due to the absence of an ISS US Voting Policy applicable to our share issuance proposals.

However, our ordinary shares are not, and never have been, listed on an exchange in the UK or Ireland, and we are not subject to share listing rules or governed by the corporate governance standards applicable to companies whose share capital is

listed on exchanges in the UK or Ireland. Notwithstanding this fact, ISS recommended a vote against our share issuance proposals because the proposed amounts and duration exceed or are contrary to its “recommended limits.” Accordingly, ISS

concluded that the requested authorities exceed “recommended best practice guidelines.”

We are asking our shareholders to

reject ISS’s approach to our share issuance proposals because we do not believe that ISS’s recommended limits associated with companies that are listed on an exchange in the UK or Ireland that are part of the market practice for

those

companies

, should apply to Jazz Pharmaceuticals.

The U.S. capital markets are the sole capital markets for our ordinary shares, and our ordinary shares are listed solely on the NASDAQ Global Select Market, which provides its own

restrictions on share issuances for the protection of shareholders. Accordingly, we believe that our shareholders expect us to follow, and we are committed to following, customary U.S. capital markets practices, U.S. corporate governance standards,

the rules and regulations of the SEC and the NASDAQ rules and listing standards. As an Irish company, we are also committed to complying with Irish law, and our share issuance proposals are consistent with Irish law. We believe that applying the

practices of a market where our ordinary shares

are not listed

is inappropriate and is simply not in the best interests of our company or our shareholders. We also believe that adhering to the limitations referenced in ISS’ report on our

share issuance proposals, which are derived from market practices for

companies listed on Irish and UK exchanges

, would leave us disadvantaged as compared with our U.S.-incorporated and exchange-listed peers. We believe it is necessary to

seek authority to issue new shares on a non-pre-emptive basis to the extent permissible under Irish law so that we can continue to execute on our business and growth strategy in a timely and competitive manner.

For the reasons set forth above, and in further detail in our 2016 proxy statement, we request

that our shareholders reject the recommendations contained in the ISS report and vote “FOR” our share issuance and adjournment proposals.

Sincerely,

/s/ Bruce Cozadd

Bruce C. Cozadd

Chairman and Chief Executive Officer

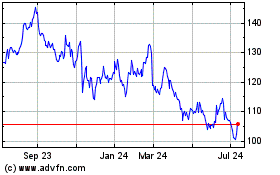

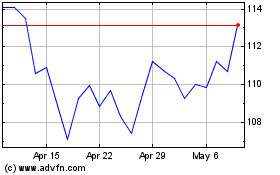

Jazz Pharmaceuticals (NASDAQ:JAZZ)

Historical Stock Chart

From Mar 2024 to Apr 2024

Jazz Pharmaceuticals (NASDAQ:JAZZ)

Historical Stock Chart

From Apr 2023 to Apr 2024