Moody's Tops Expectations but Offers Cautious Outlook

July 22 2016 - 8:30AM

Dow Jones News

Moody's Corp. said revenue edged up in the second quarter as

bond issuance recovered, though the ratings firm said heightened

market uncertainty outside of the U.S. would pressure full-year

results.

The New York-based company, the world's second-biggest ratings

firm behind Standard & Poor's, relies on activity in global

credit markets as corporations and lenders pay firms like Moody's

to rate the debt they issue. In April, Chief Executive Raymond

McDaniel said he expected activity to pick up in the second half of

the year after a rocky first half owed to growing fears stemming

from the Chinese economy, turbulent financial markets and concerns

over the sturdiness of the domestic economy.

On Friday, he said profit this year would come in at the low-end

of the downbeat guidance Moody's offered in April, which pegged

per-share earnings between $4.55 to $4.65 and revenue to grow by a

low single-digit percentage.

Aside from rating debt, the company sells financial data and

other types of market intelligence to investors and banks. In that

segment, sales climbed 8.7% to $303.3 million and offset a 2.1%

decline in the bigger investors service business.

Over all, Moody's posted a profit of $255.5 million, down from

year-earlier earnings of $261.7 million. The company's per-share

earnings, though, rose to $1.32 from $1.28 because of fewer shares

outstanding.

Revenue edged up 1.2% to $928.9 million.

Analysts projected $1.27 in adjusted earnings per share on

$909.1 million in revenue, according to Thomson Reuters.

Write to Lisa Beilfuss at lisa.beilfuss@wsj.com

(END) Dow Jones Newswires

July 22, 2016 08:15 ET (12:15 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

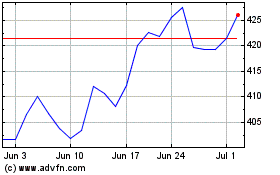

Moodys (NYSE:MCO)

Historical Stock Chart

From Mar 2024 to Apr 2024

Moodys (NYSE:MCO)

Historical Stock Chart

From Apr 2023 to Apr 2024