Report of Foreign Issuer (6-k)

July 22 2016 - 6:05AM

Edgar (US Regulatory)

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 OF THE

SECURITIES EXCHANGE ACT OF 1934

For the month of July, 2016

(Commission File No. 001-33356),

Gafisa S.A.

(Translation of Registrant's name into English)

Av. Nações Unidas No. 8501, 19th floor

São Paulo, SP, 05425-070

Federative Republic of Brazil

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file

annual reports under cover Form 20-F or Form 40-F.

Form 20-F ___X___ Form 40-F ______

Indicate by check mark if the registrant is submitting

the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1)

Yes ______ No ___X___

Indicate by check mark if the registrant is submitting

the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7):

Yes ______ No ___X___

Indicate by check mark whether by furnishing the information contained in this Form,

the Registrant is also thereby furnishing the information to the Commission pursuant

to Rule 12g3-2(b) under the Securities Exchange Act of 1934:

Yes ______ No ___X___

If “Yes” is marked, indicate below the file number assigned

to the registrant in connection with Rule 12g3-2(b):

N/A

PREVIEW OF OPERATIONAL RESULTS 2Q16

Consolidated launches totaled R$545.0 million in 2Q16,

with gross sales reaching R$644.9 million.

Net sales were R$454.5 million in 2Q16, totaling R$ 787.9 miilion in the 1S16.

FOR IMMEDIATE RELEASE

- São Paulo, July 21, 2016 – Gafisa S.A. (Bovespa: GFSA3; NYSE: GFA), one of Brazil’s leading diversified homebuilders focused on the residential market, today announced operational results for the second quarter ended June 30, 2016. These operating results are preliminary, unaudited, and still subject to audit review.

Consolidated Launches

Second quarter launches totaled R$545.0 million, up by 13.1% compared to 2Q15, and of 76.6% compared to 2Q16. Launched volume for the 6M16 reached R$853.7 million.

In the quarter, 14 projects/phases were launched in the states of São Paulo, Rio de Janeiro, Minas Gerais, Bahia and Rio Grande do Sul. The Gafisa segment accounted for 23.9% of this quarter’s launches, while the Tenda segment accounted for the remaining 76.1%.

Tablel 1. Gafisa Group Launches (R$ thousand)

|

Launches

|

2Q16

|

1Q16

|

Q/Q (%)

|

2Q15

|

Y/Y (%)

|

6M16

|

6M15

|

Y/Y (%)

|

|

Gafisa Segment

|

130,360

|

80,104

|

63%

|

252,585

|

-48%

|

210,464

|

327,812

|

-36%

|

|

Tenda Segment

|

414,678

|

228,544

|

81%

|

229,366

|

81%

|

643,221

|

467,720

|

38%

|

|

Total

|

545,038

|

308,648

|

77%

|

481,951

|

13%

|

853,685

|

795,532

|

7%

|

Consolidated Pre-Sales

Net consolidated pre-sales totaled R$454.5 million during 2Q16, reflecting a decrease of 14.6% y-o-y and an increase of 36.4% when compared to 1Q16. Sales from launches represented 36.4% of total sales, while inventory sales comprised the remaining 63.6%.

Until June, net consolidated pre-sales reached R$787.9 million, down 17.5% when compared to 2Q15. Sales from launches represented 24.8% in the first six months of the year.

In the 2Q16, the Gafisa segment accounted for 28.5% of the year’s net pre-sales, while the Tenda segment accounted for the remaining 71.5%.

Table 2. Gafisa Group Pre-Sales (R$ thousand)

|

Pre-Sales

|

2Q16

|

1Q16

|

Q/Q (%)

|

2Q15

|

Y/Y (%)

|

6M16

|

6M15

|

Y/Y (%)

|

|

Gafisa Segment

|

129,519

|

66,842

|

94%

|

242,185

|

-47%

|

196,361

|

421,992

|

-53%

|

|

Tenda Segment

|

324,992

|

266,497

|

22%

|

289,946

|

12%

|

591,489

|

533,483

|

11%

|

|

Total

|

454,511

|

333,339

|

36%

|

532,131

|

-15%

|

787,850

|

955,475

|

-18%

|

Consolidated Sales over Supply (SoS)

Consolidated sales over supply reached 13.9% in 2Q16, lower than the 15.9% recorded in 2Q15, but higher than the 10.6% posted in 1Q16. The consolidated speed of sales for 2Q16 launches reached 15.5% while in the last twelve months it reached 38.5%.

Table 3. Gafisa Group Sales over Supply (SoS)

|

SoS

|

2Q16

|

1Q16

|

Q/Q (%)

|

2Q15

|

Y/Y (%)

|

6M16

|

6M15

|

Y/Y (%)

|

|

Gafisa Segment

|

6.3%

|

3.3%

|

300 bps

|

10.5%

|

-420 bps

|

9.3%

|

16.9%

|

-760 bps

|

|

Tenda Segment

|

26.4%

|

23.9%

|

250 bps

|

28.2%

|

-180 bps

|

39.5%

|

41.9%

|

-240 bps

|

|

Total

|

13.9%

|

10.6%

|

330 bps

|

15.9%

|

-200 bps

|

21.8%

|

25.4%

|

-360 bps

|

Delivered Projects

During the second quarter of 2016, the Company delivered 14 projects/phases accounting for 3,136 units and representing a total of R$687.7 million in PSV. Delivery date is based on the date of the “Delivery Meeting” that takes place with customers, rather than physical completion, which occurs prior to the Delivery Meeting.

For the 6M16, 19 projects/phases were delivered, accounting for 3,791 units and representing a total of R$854.2 million in PSV.

Inventory (Properties for Sale)

In the 2Q16, the market value of consolidated inventory remained stable vs. 1Q16, at R$2.8 billion. In regards to 2Q16 sales, 63.6% related to remaining units, comprised of R$195.6 million from the Tenda segment and R$93.7 million from the Gafisa segment.

The market value of Gafisa inventory, which represents 67.9 % of total inventory, was R$1.9 billion at the end of 2Q16, down by 3.1% q-o-q and by 7.8% y-o-y. Tenda’s inventory was valued at R$906.3 million at the end of 2Q16, compared to R$849.1 million at the end of 1Q16, up by 6.7%.

Table 4. Inventory at Market Value 2Q16 x 1Q16 (R$)

|

|

1Q16

|

Launches

|

Dissolutions

|

Gross Sales

|

Adjustments

|

2Q16

|

Q/Q(%)

|

|

Gafisa Segment

|

1,974,926

|

130,360

|

132,463

|

(261,982)

|

(62,142)

|

1,913,624

|

-3.1%

|

|

Tenda Segment

|

849,083

|

414,678

|

57,934

|

(382,927)

|

(32,445)

|

906,323

|

6.7%

|

|

Total

|

2,824,009

|

545,038

|

190,397

|

(644,909)

|

(94,587)

|

2,819,947

|

0.0%

|

¹Adjustments of the period reflect updates related to the project’s scope, date of launch and prices.

|

|

GAFISA SEGMENT

Focus on residential projects in the Middle, Medium-High and High income segments, with average unit sales price exceeding R$250,000.

|

Gafisa Launches

Second quarter launches totaled R$130.4 million and consisted of 2 projects/phases in São Paulo. The sales speed of these launches reached 21.0%. In the 6M16, the Gafisa segment launches reached R$210.4 million or 23.9% of consolidated launches.

Gafisa Pre-Sales

Second quarter gross sales in the Gafisa segment totaled R$262.0 million. Dissolutions in 2Q16 were R$132.5 million, yielding total net pre-sales of R$129.5 million, up 93.8% q-o-q and down 46.5% y-o-y. Residential projects accounted for 78.5% of total dissolutions, while commercial projects accounted for the remaining 21.5%. In the first half of the year, net pre-sales totaled R$196.4 million.

The Gafisa segment’s SoS for the last twelve months reached 26.5%, compared to 27.7% in the past 12-month period. In the 2Q16, SoS was 6.3%, compared to 3.3% in the previous quarter and 10.5% in 2Q15.

Despite the continued challenging economic environment, the segment outperformed 1Q16 results. Improved sales performance in the second quarter may signal an initial recovery in buyers’ confidence. In addition to the strongest sales performance, with gross sales increasing 10.5% to R$262.0 million from 1Q16, the level of dissolutions declined to the previous year’s average.

In keeping with prior periods and the Company’s operational strategy, Gafisa continues to focus its efforts on the sale of remaining units. As a result, 72.3 % of net sales for the quarter related to projects launched before 2016. Dissolutions, in turn, were concentrated in projects launched until 2013, with more advanced construction work undertaken.

Out of the 500 Gafisa segment units cancelled and returned to inventory during the semester, 51.8%, or 259 units were resold during the same period.

Gafisa Delivered Projects

In 2Q16, 4 projects/phases were delivered, accounting for 1,241 units and representing a total of R$412.3 million in PSV. In 6M16, 6 projects/phases were delivered, accounting for 1,432 units and representing a total of R$517.1 million in PSV.

|

|

TENDA SEGMENT

Focus on residential projects in the economic segment, targeted within the range II of the Minha Casa Minha Vida (MCMV) program.

|

Tenda Launches

Second quarter launches from the Tenda segment totaled R$414.7 million, which included 12 projects/ phases in the states of São Paulo, Rio de Janeiro, Minas Gerais, Bahia and Rio Grande do Sul. The Tenda brand accounted for 76.1% of the 2Q16 consolidated launches. For the 6M16, the Tenda segment reached R$643.2 million in launches, accounting for 75.3% of the period’s consolidated launches.

Tenda Pre-Sales

During 2Q16, gross sales reached R$382.9 million, and dissolutions totaled R$57.9 million, yielding R$325.0 million of net pre-sales. This figure represents a 21.9% increase when compared to that of 1Q16 and of 12.1% compared to 2Q15. In the 6M16, dissolutions reached R$104.2 million and net pre-sales reached R$591.5 million.

Sales from units launched during 2Q16 represented 39.8% of total segment sales. Tenda’s SoS reached 26.4% in the quarter.

Table 5. SoS Gross Sales (Ex-Dissolutions)

|

SoS

|

1Q15

|

2Q15

|

3Q15

|

4Q15

|

1Q16

|

2Q16

|

|

New Model

|

32.7%

|

37.4%

|

29.6%

|

27.4%

|

29.7%

|

32.2%

|

|

Legacy

|

20.1%

|

24.3%

|

19.4%

|

13.3%

|

20.7%

|

25.0%

|

|

Total

|

28.6%

|

33.4%

|

26.9%

|

24.4%

|

28.0%

|

31.1%

|

Table 6. SoS Net Sales

|

SoS

|

1Q15

|

2Q15

|

3Q15

|

4Q15

|

1Q16

|

2Q16

|

|

New Model

|

30.9%

|

35.2%

|

27.1%

|

24.9%

|

26.9%

|

28,9%

|

|

Legacy

|

7.0%

|

12.0%

|

11.4%

|

5.2%

|

10.7%

|

11,9%

|

|

Total

|

23.3%

|

28.2%

|

23.0%

|

20.9%

|

23.9%

|

26,4%

|

In keeping with its policy of dissolving contracts with ineligible clients in order to sell the units to qualified customers, dissolutions increased by 7.7% in 2Q16 when compared to 2Q15 and increased by 25.3% when compared to 1Q16, in line with a higher volume of gross sales recorded this quarter, ending the period at

R$382.9 million.

Also, based on its policy of immediate transfer after the sale and reduction in the legacy projects portfolio, the Tenda segment keeps experiencing a lower volume of dissolutions, with dissolutions representing only 15.1% of gross sales in the quarter. Out of the 706 Tenda units cancelled and returned to inventory in the 6M16, 65.9% were resold to qualified customers during the same period.

Table 7. Cancelled PSV Tenda Segment (R$ thousand and % over Gross Sales per Model)

|

|

2Q15

|

% VB

|

3Q15

|

% VB

|

4Q15

|

% VB

|

1Q16

|

% VB

|

2Q16

|

%VB

|

|

New Model

|

15,648

|

4.5%

|

19,576

|

6.8%

|

22,201

|

8.0%

|

20,490

|

6.6%

|

24,030

|

6.3%

|

|

Legacy

|

38,115

|

11.1%

|

22,447

|

7.8%

|

17,686

|

6.4%

|

25,736

|

8.2%

|

33,905

|

8.9%

|

|

Total

|

53,763

|

15.6%

|

42,023

|

14.6%

|

39,887

|

14.4%

|

46,226

|

14.8%

|

57,934

|

15.1%

|

Tenda Delivered Projects

10 projects/phases, accounting for 1,895 units were delivered in the quarter, representing R$275.4 million in PSV. In the 6M16, 13 projects/phases, accounting for 2,359 units were delivered, totaling R$337.1 million in PSV.

|

|

About Gafisa

Gafisa is a leading diversified national homebuilder serving the Brazilian market. Established more than 60 years ago, the Company focuses on growth and innovation to bring well-being, comfort and safety to more and more people. We have completed and delivered more than 1,100 developments and built more than 15 million square meters of housing under the Gafisa brand, more than any other residential development company in Brazil. Recognized as one of the foremost professionally managed homebuilders, Gafisa is also one of the most respected and best-known brands in the real estate market for its quality, consistency, and professionalism. Our pre-eminent brands, in addition to Gafisa, which is focused on the medium and high-income segments, also include Tenda, serving the affordable/entry-level housing segment, and a 30% stake in Alphaville, one of leading urban development companies operating in the sale of residential lots across the country. Gafisa S.A. is a corporation traded on the Novo Mercado of the BM&FBovespa (BOVESPA:GFSA3) and is the only Brazilian real estate company traded at the New York Stock Exchange (NYSE:GFA) with a Level III ADR program, which guarantees the best practices of corporate governance and transparence

.

This release contains forward-looking statements relating to the prospects of the business, estimates for operating and financial results, and those related to growth prospects of Gafisa. These are merely projections and, as such, are based exclusively on the expectations of management concerning the future of the business and its continued access to capital to fund the Company’s business plan. Such forward-looking statements depend, substantially, on changes in market conditions, government regulations, competitive pressures, the performance of the Brazilian economy and the industry, among other factors; therefore, they are subject to change without prior notice.

|

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

Date: July 21, 2016

|

Gafisa S.A.

|

|

|

|

|

|

By:

|

|

|

|

Name: Sandro Gamba

Title: Chief Executive Officer

|

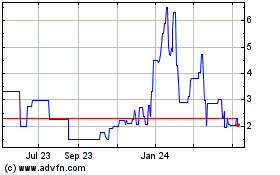

Gafisa (PK) (USOTC:GFASY)

Historical Stock Chart

From Mar 2024 to Apr 2024

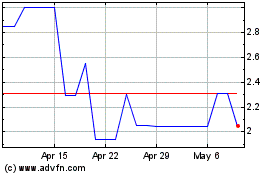

Gafisa (PK) (USOTC:GFASY)

Historical Stock Chart

From Apr 2023 to Apr 2024