AMD Posts First Jump In Sales in Two Years -- WSJ

July 22 2016 - 3:03AM

Dow Jones News

By Don Clark and Maria Armental

Advanced Micro Devices Inc. on Thursday swung to a quarterly

profit and reported the first sales increase in nearly two years,

riding sales of customized chips for videogame makers and demand

for its latest graphics products.

The company's second-quarter net profit largely reflected

one-time gains, but AMD said it also posted an operating profit a

quarter sooner than expected. It projected further sales gains in

the current quarter and said annual revenue for the year should

grow by a low single-digit percentage.

AMD shares, which have nearly doubled in value over the past

three months and rallied to a four-year high, rose 5% in

after-hours trading.

The company, based in Sunnyvale, Calif., has been battered by a

shrinking market for personal computers and stiff competition in

microprocessor chips by larger rival Intel Corp. It has posted four

straight years of losses.

AMD's quarterly results follow Intel and Qualcomm Inc.'s reports

on Wednesday. Though Intel reported a 51% drop in profit, largely

tied to layoffs, the results indicated the PC market was

stabilizing as Intel reported a 3% revenue decline from its

"client" device business, which includes PCs.

AMD has been trying to reduce its reliance on processor sales

for PCs. Another specialty is graphics technology used to render

images in videogames and other software, which it sells in separate

chips or combined with other circuitry in customized chips for game

consoles from Sony Corp. and Microsoft Corp. and for other

products.

The company said second-quarter revenue from the segment that

includes such "semi-custom" chips rose 5% from the year-earlier

period and were up 59% from the first quarter. Lisa Su, AMD's chief

executive, said AMD would get revenue in 2017 from a forthcoming

Microsoft console called Project Scorpio.

In the current year, however, she expects semi-custom chip

revenue to peak in the third quarter and decrease in the fourth

period, following a recent pattern.

"We have been building up for a strong holiday season overall,"

she said during a conference call with analysts.

AMD has also been cutting joint ventures and other deals to help

the company make more money off its patents and other intellectual

property. Last quarter, AMD announced a server chip venture in

China that contributed one-time revenue in the second quarter, as

did an earlier partnership involving chip packaging.

Ms. Su said more such deals are being negotiated. "We have a

nice set of interesting opportunities," she said.

Including the one-time items, AMD reported a second-quarter

profit of $69 million, or 8 cents a share, compared with a loss in

the year-earlier period of $181 million, or 23 cents a share.

Revenue rose 9% to $1.03 billion.

On an adjusted basis that excludes those items, AMD reported a

loss of 5 cents a share. Analysts surveyed by Thomson Reuters on

that basis had predicted a loss of 8 cents a share on $951.3

million in revenue.

For the current quarter, AMD projected a 15% to 21% revenue

increase from the second quarter, compared with the 18% growth

projected by analysts surveyed by Thomson Reuters.

Write to Don Clark at don.clark@wsj.com and Maria Armental at

maria.armental@wsj.com

Corrections & Amplifications: AMD's revenue rose 9% to $1.03

billion in the second quarter. An earlier version of this article

incorrectly stated it was $1.03 million. (July 21)

(END) Dow Jones Newswires

July 22, 2016 02:48 ET (06:48 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

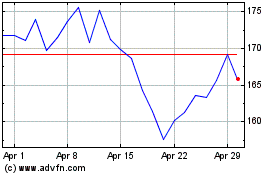

QUALCOMM (NASDAQ:QCOM)

Historical Stock Chart

From Mar 2024 to Apr 2024

QUALCOMM (NASDAQ:QCOM)

Historical Stock Chart

From Apr 2023 to Apr 2024