Komatsu Makes U.S. Acquisition -- WSJ

July 22 2016 - 3:03AM

Dow Jones News

Japanese company to pay $2.9 billion for mining-equipment maker

Joy Global

By Bob Tita

The struggling mining equipment industry will soon be dominated

by two large companies: Japan's Komatsu Ltd. and its larger U.S.

rival, Caterpillar Inc.

Tokyo-based Komatsu said on Thursday it would buy U.S. equipment

manufacturer Joy Global Inc. for $2.9 billion in a bet that the

mining-equipment market will grow again starting in 2019.

Tumbling prices for mined commodities, such as iron ore, copper

and coal, have driven down demand for mining equipment, roughly a

$50 billion-a-year global industry, according to analysts'

estimates. Equipment makers have downsized operations and cut

costs, while mining companies have indicated that their capital

spending on equipment and mine expansions will continue to decrease

next year.

But Komatsu, which already makes supersize dump trucks used in

mining, said the acquisition would yield innovations that customers

will want to buy as the market recovers and allow it to sell more

complete lines of equipment.

The deal, which would be the largest in Komatsu's history, needs

the approval of Joy's shareholders and has to be reviewed by

antitrust regulators. Komatsu said it expects it to be completed by

the middle of next year.

Komatsu is Japan's leading seller of construction equipment and

the world's second-largest, behind Caterpillar, and already

generates more than 80% of its sales outside Japan. Once the deal

is completed, Komatsu and Caterpillar together would account for at

least a quarter of the world's mining equipment sales,analysts

say.

The Joy acquisition makes "excellent strategic sense," according

to Stephen Volkmann, an analyst for Jefferies & Co. "The

company will be able to provide the full line of mining equipment

to compete with Caterpillar at all levels."

But the success of the deal will largely depend on the recovery

of the equipment market.

Caterpillar pursued a similar strategy when it bought mining

equipment manufacturer Bucyrus International in 2011 for about $8

billion. The deal looked like a shrewd move at the time -- when

mined commodity markets were booming -- but equipment sales have

collapsed in recent years.

Milwaukee-based Joy Global has long been seen as an acquisition

target for a larger company. But more than half of Joy Global's

annual sales come from the coal-mining industry, which has been

hurt by low prices for natural gas and stricter environmental

standards that reduced coal usage for generating electricity.

Komatsu said it plans to operate Joy, which currently has about

12,000 employees, as a separate subsidiary. Thursday's announcement

didn't offer specifics about plants or the size of the Joy

workforce going forward.

A smaller coal industry in the U.S. could have a lasting effect

on Joy's business. Its sales last year were $3.1 billion, down 44%

from a recent high in 2012.

In its most recent quarterly report, Joy said orders for new

machinery were down 9%. Orders for service and repairs on machinery

already in use -- a key revenue source for Joy -- dropped 14%.

Joy said in a statement that the decision to sell the company

was based on "challenging market conditions the company believes

are likely to persist." Joy executives declined to comment

further.

Komatsu said it would pay $28.30 a share in cash for Joy's

stock, a 20% premium to Wednesday's closing price. Joy Global's was

recently trading up nearly 20% at $28.19.

Tokyo-based Komatsu is increasingly looking to acquisitions to

propel sluggish sales of its machinery. Other companies could step

up with higher bids for Joy, but the pool of potential candidates

appears small, given the consolidation that has already occurred in

the machinery sector, analysts say.

--Atsuko Fukase contributed to this article.

Write to Bob Tita at robert.tita@wsj.com

(END) Dow Jones Newswires

July 22, 2016 02:48 ET (06:48 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

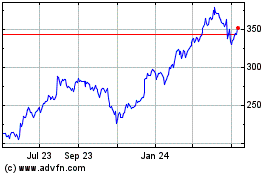

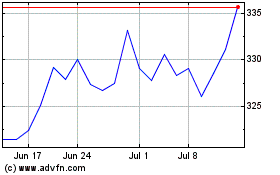

Caterpillar (NYSE:CAT)

Historical Stock Chart

From Mar 2024 to Apr 2024

Caterpillar (NYSE:CAT)

Historical Stock Chart

From Apr 2023 to Apr 2024