By Hannah Karp, Shalini Ramachandran and David Benoit

Liberty Media Corp. Chief Executive Greg Maffei, whose company

controls satellite-radio operator Sirius XM Holdings Inc. hasn't

been very complimentary about music-streaming services in recent

months.

"We have looked at the business models on a bunch of the

streaming companies and found it very hard to see them [as]

attractive," Mr. Maffei told investors at a March conference.

Behind the scenes, however, the story is more complex. In recent

months, Mr. Maffei floated an offer to acquire internet-radio

company Pandora Media Inc. for roughly $15 a share, several dollars

above where the shares traded at the time, said people familiar

with the matter. The offer valued the company at over $3.4

billion.

Mr. Maffei's approach didn't have the characteristics of a

formal bid, one of the people said, appearing to be more of "a

fishing expedition." Pandora's board rebuffed the advance because

it believed the company's true value was closer to what it was in

the fall, when the stock traded around $20, this person said.

Pandora shopped itself to other potential buyers, including

Apple Inc. and Amazon.com Inc., earlier this year, said other

people familiar with the matter said.

Later, in June, at a private meeting with investors in Denver,

Mr. Maffei talked up the benefits of a potential Sirius XM-Pandora

tie-up, according to people who were there. Asked during the

meeting why a deal had yet to be sealed, he told attendees, "You'd

have to ask the Pandora board."

Now investors are wondering whether Mr. Maffei will raise his

bid -- and what he might do if he won Pandora.

In an interview, Sirius XM Chief Executive Jim Meyer declined to

comment on any takeover approach to Pandora, But he said that since

his company represents a $5 billion part of the $25 billion radio

business, he often kicks around whether he would like to have a

bigger presence in the business.

Liberty Media could combine Pandora with Sirius XM, which it

controls with a 64% stake. Sirius XM has built a profitable

subscription business on strong partnerships with car makers. But

the rise of streaming media and internet-connected cars raises

questions about whether customers will continue paying $15 a month

when they can easily stream music in their cars through cheaper or

free services on their dashboards.

Pandora would instantly give Sirius XM scale in streaming, with

80 million listeners who mostly tune in on their mobile phones. But

the company, whose revenue comes largely from advertising, has an

entirely different business model and far higher content costs than

Sirius XM.

The satellite-radio company pays less than 11% of revenue on

recorded music royalties through next year, in accordance with

federal licensing rules. Pandora, by contrast, spent 52% of its

revenue last year on music costs since internet-radio firms pay

royalties on a per-stream basis.

Sirius XM already has its own mobile app, though few subscribers

use it, and it is working to offer a satellite-streaming hybrid

next year with personalized recommendations and customization.

"I don't need any streaming partner to do that," said Mr. Meyer,

the Sirius XM CEO. But, he said, "We will do whatever we need to

for our customers to keep paying us."

Some analysts and investors say that if Liberty Media acquires

Pandora, it could house the internet-radio service separately from

Sirius XM. Indeed, it could pair the streaming service with the

concert and ticketing business of Live Nation Entertainment Inc.,

in which Liberty Media holds a 34% stake.

Pandora, meanwhile, has been going through a tumultuous period.

Its shares tumbled last October when it announced a $90 million

settlement with record labels over its unpaid use of pre-1972

music. It also reported a decline in listening because of the

launch of rival streaming service Apple Music.

The company's cost outlook brightened in December when the

Copyright Royalty Board announced that Pandora would pay far lower

rates for music than record labels and artists had sought.

In March, Pandora replaced CEO Brian McAndrews with its

charismatic founder, Tim Westergren, who has since played down sale

rumors.

On Thursday, Pandora reported a wider loss of $76.3 million, or

33 cents a share, and the loss of over a million subscribers for

the most recent quarter. The company's shares, which traded as high

as $40 in 2014, sank 6.3% after hours, to $11.24.

Sirius XM management recently has praised Pandora over on-demand

services such as Spotify, which have to strike direct deals with

record labels and, as a result, generally fork over at least 70% of

their revenues to the music industry.

Asked about interest in buying Pandora at a June investor

conference, Sirius XM Chief Financial Officer David Frear said:

"Among the streaming companies, Pandora has a better opportunity

for a solid business model."

--Ryan Knutson contributed to this article.

Write to Hannah Karp at hannah.karp@wsj.com, Shalini

Ramachandran at shalini.ramachandran@wsj.com and David Benoit at

david.benoit@wsj.com

(END) Dow Jones Newswires

July 22, 2016 02:48 ET (06:48 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

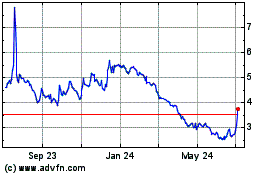

Sirius XM (NASDAQ:SIRI)

Historical Stock Chart

From Mar 2024 to Apr 2024

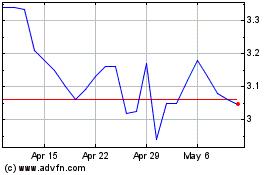

Sirius XM (NASDAQ:SIRI)

Historical Stock Chart

From Apr 2023 to Apr 2024