Southwestern Energy Posts Narrower Loss, Boost Production View

July 21 2016 - 7:41PM

Dow Jones News

By Josh Beckerman

Southwestern Energy Co. posted a narrower second-quarter loss as

it exceeded production guidance by 5%.

The oil and gas company said in January that it would lay off or

reduce the roles of about 45% of its workforce as the entire

industry contends with a severe and lengthy pricing downturn.

Southwestern said Thursday that it is increasing 2016 production

guidance by about 5%, citing a strong first-half performance and to

a lesser extent, improved commodity prices and the capital from a

stock sale.

Southwestern said July 5 that net proceeds from an upsized stock

offering totaled about $1.25 billion. The sale was one of the

factors Moody's Investors Service noted in a recent upgrade.

Southwestern's larger operations include activity in the

Northeast Appalachia, Southwest Appalachia and Fayetteville Shale

areas.

Including the effect of hedges, Southwestern's average realized

gas price in the quarter was $1.32 per thousand cubic feet, down

from $2.23 a year earlier.

For the quarter ended June 30, Southwestern posted a net loss of

$620 million, or $1.61 a share, compared with a loss of $815

million, or $2.13 a share, a year earlier.

Excluding items such as impairment of gas and oil properties,

the loss was 9 cents a share, compared with a loss of 2 cents a

share a year earlier.

Revenue fell to $522 million from $764 million.

Analysts polled by Thomson Reuters had expected a loss excluding

items of 10 cents a share on revenue of $534.4 million.

On June 9, Southwestern said it would sell about 55,000 net

acres in West Virginia for $450 million to Antero Resources

Corp.

Write to Josh Beckerman at josh.beckerman@wsj.com

(END) Dow Jones Newswires

July 21, 2016 19:26 ET (23:26 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

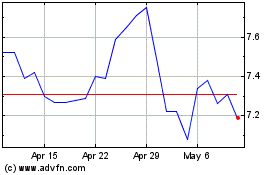

Southwestern Energy (NYSE:SWN)

Historical Stock Chart

From Mar 2024 to Apr 2024

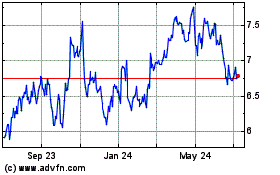

Southwestern Energy (NYSE:SWN)

Historical Stock Chart

From Apr 2023 to Apr 2024