Capital One Profit Rises But Lags Wall Street View

July 21 2016 - 7:10PM

Dow Jones News

Capital One Financial Corp. said its profit rose 9% in the

second quarter as revenue ticked higher and operating expenses

declined.

But results missed Wall Street estimates, pushing shares down

2.9% to $66.02 in after-hours trading Thursday.

Capital One, of the country's largest credit-card lenders, also

offers traditional bank accounts, mortgages, auto loans and

commercial loans.

In all, Capital One reported a profit of $942 million, or $1.69

a share, compared with $863 million, or $1.50 a share, a year

earlier. Excluding items, earnings were $1.76 a share. Revenue

improved to $6.25 billion from $5.67 billion.

Analysts polled by Thomson Reuters expected a per-share profit

of $1.86 on revenue of $6.28 billion.

Noninterest expenses fell 0.4% to $3.3 billion.

Provision for credit losses increased to $1.59 billion from

$1.13 billion.

DA Davidson upgraded Capital One earlier this month, saying

credit risks have overly pressured the stock. "We acknowledge that

we are in an extended positive credit cycle for credit cards, but

we see no evidence of material deterioration in credit conditions,"

the investment bank said.

In June, shares of several credit-card companies declined when

store-card specialist Synchrony Financial increased its forecast

for credit losses over the next year.

At the end of June, Capital One announced a capital plan that

included the repurchase of up to $2.5 billion of stock through the

second quarter of 2017. The company said it intended to maintain

its quarterly dividend of 40 cents.

Write to Josh Beckerman at josh.beckerman@wsj.com

(END) Dow Jones Newswires

July 21, 2016 18:55 ET (22:55 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

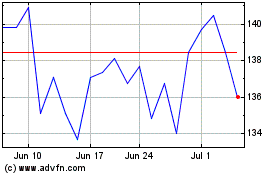

Capital One Financial (NYSE:COF)

Historical Stock Chart

From Mar 2024 to Apr 2024

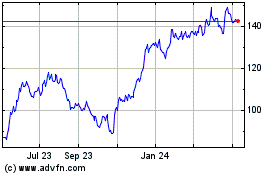

Capital One Financial (NYSE:COF)

Historical Stock Chart

From Apr 2023 to Apr 2024