Sallie Mae Raises Profit Forecast

July 20 2016 - 6:20PM

Dow Jones News

SLM Corp., better known as Sallie Mae, on Wednesday raised its

profit projection for the year, citing its improved performance as

it enters the peak season for student lending.

The firm now projects 51 cents to 52 cents in core profit, up

from 49 cents to 51 cents a share. It affirmed its guidance for

$4.6 billion in loan originations.

Founded in 1973 as the Student Loan Marketing Association, a

government-sponsored enterprise, Sallie Mae was split in 2014 into

two publicly traded firms: a consumer banking business that carried

on the Sallie Mae brand and an education-loan manager, Navient

Corp.

During the second quarter, Sallie Mae originated $423 million in

private student loans, up 10% from the year earlier, while its

private student-loan portfolio rose 32% to $12.2 billion.

Over all, Sallie Mae reported net income of $57.2 million, or 12

cents a share, compared with $91 million, or 20 cents a share, a

year earlier.

The year-ago results had been skewed by the sale of

private-education loans to Navient ahead of the spinoff. In

addition, Sallie Mae this year set aside $26 million more for bad

loans.

Net interest income, meanwhile, rose 26% to $212.8 million.

Analysts surveyed by Thomson Reuters had projected 11 cents a

share in earnings on $214.5 million in net interest income.

Operating expenses rose 5.5% to $94.8 million.

Shares closed Wednesday at $7.27, up 12% this year.

Write to Maria Armental at maria.armental@wsj.com

(END) Dow Jones Newswires

July 20, 2016 18:05 ET (22:05 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

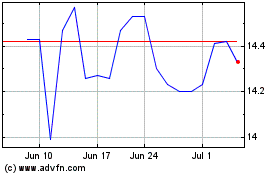

Navient (NASDAQ:NAVI)

Historical Stock Chart

From Mar 2024 to Apr 2024

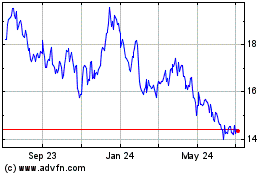

Navient (NASDAQ:NAVI)

Historical Stock Chart

From Apr 2023 to Apr 2024