C&J Energy Services Files for Bankruptcy

July 20 2016 - 4:40PM

Dow Jones News

C&J Energy Services Ltd. filed for bankruptcy Wednesday

after reaching a deal on a $1.4 billion debt-for-equity swap with

its lenders.

C&J, an oil-field servicer that builds and services wells in

the U.S. and Canada, filed for chapter 11 protection in the U.S.

Bankruptcy Court in Houston with a debt-restructuring deal with

senior lenders.

The restructuring is a debt-for-equity swap under which lenders

have agreed to forgive all the debt they are owed in exchange for

100% ownership of the restructured company. The agreement has the

support of more than half of C&J's debtholders, who have agreed

to back the new financing that is included in the agreement.

C&J joins dozens of other oil-field servicers brought down

by the oil bust. Since the beginning of last year, more than 70

North American oil-field servicers have filed for bankruptcy

protection, according to law firm Haynes and Boone.

The Bermuda-based company was founded by Josh Comstock in Corpus

Christi, Texas, in 1997. Under his leadership, the company went

public in 2011 and completed a $2.8 billion merger with Nabors

Industries Ltd.

The company's growth was fueled by acquisitions and debt, made

possible by hydraulic fracking boom. Two years ago, when oil prices

were more than $100 a barrel, C&J's stock was trading at more

than $32 a share. But when oil prices plummeted, so did C&J's

fortunes. On Wednesday afternoon, the company's stock was trading

at 31 cents a share

The company posted losses of $872.5 million for 2015 and $428.4

million during the first quarter of 2016, causing it to fall out of

compliance with its debt agreements and triggering talks with its

lenders.

The restructuring deal includes $100 million in bankruptcy

financing, a $100 million bankruptcy-exit facility and a $200

million rights offering, all of which will refresh the company's

dwindling liquidity. The company will also issue new seven-year

warrants, convertible for up to 6% of new common stock at a $1.55

billion strike price.

C&J will continue operating during its chapter 11 case. Its

deal with lenders requires it to make a quick trip through

bankruptcy.

The law firms Loeb & Loeb LLP, Kirkland & Ellis LLP and

Fried, Frank, Harris, Shriver & Jacobson LLP are advising

C&J on its debt restructuring. Investment bank Evercore ISI is

the company's financial adviser and AlixPartners is C&J's

restructuring adviser.

Write to Patrick Fitzgerald at patrick.fitzgerald@wsj.com

(END) Dow Jones Newswires

July 20, 2016 16:25 ET (20:25 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

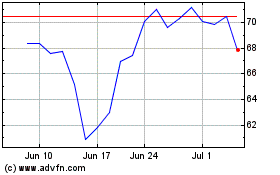

Nabors Industries (NYSE:NBR)

Historical Stock Chart

From Mar 2024 to Apr 2024

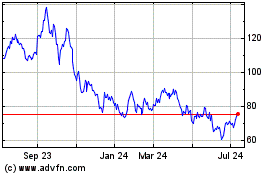

Nabors Industries (NYSE:NBR)

Historical Stock Chart

From Apr 2023 to Apr 2024