Preferred Bank (NASDAQ:PFBC), an independent

commercial bank, today reported results for the quarter ended June

30, 2016. Preferred Bank (“the Bank”) reported net income of $8.6

million or $0.61 per diluted share for the second quarter of 2016.

This compares to net income of $7.6 million or $0.55 per diluted

share for the second quarter of 2015 and compares to net income of

$7.8 million or $0.56 per diluted share for the first quarter of

2016.

Highlights from the second quarter of 2016:

| |

|

|

|

|

|

|

|

|

|

| Total assets |

|

|

|

|

|

|

|

|

$2.92 billion |

| Linked quarter loan growth

|

|

|

|

|

|

|

|

|

$114.2 million or 5.3% |

| Linked quarter deposit

growth |

|

|

|

|

|

|

|

|

$158.0 million or 6.7% |

| Return on average

assets |

|

|

|

|

|

|

|

|

|

1.26 |

% |

| Return on beginning

equity |

|

|

|

|

|

|

|

|

|

12.62 |

% |

| Efficiency ratio |

|

|

|

|

|

|

|

|

|

39.4 |

% |

| Net interest margin |

|

|

|

|

|

|

|

|

|

3.87 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

Li Yu, Chairman and CEO commented, “The Bank recently completed

a $72.5 million private placement of subordinated debentures.

$62.5 million was received on June 13, 2016 and an additional $10

million was received on July 8, 2016. This new capital has

substantially improved our tier 2 capital ratio and significantly

reduced our CRE concentration ratio which allows for the growth

momentum to continue. The interest expense on the debt was

approximately $186,000 for the quarter and so in order to minimize

the overall cost to the Bank going forward, we have deployed $34

million of these funds in early July to purchase a home mortgage

portfolio. Further purchases like this one are under

consideration, as they allow for continued diversification of our

loan portfolio.

“Preferred Bank’s second quarter loan growth was strong at $114

million, or 5.3%. We are very pleased with these results as

market conditions are favorable and our staff’s effort has been

consistent.

“Deposit growth was even more significant for the quarter.

Total deposits have increased $158 million or 6.7% on a linked

quarter basis. The large deposit growth is partly the result

of public recognition of Preferred Bank’s performance.

Recently, S&P Global Market Intelligence ranked Preferred Bank

3rd best in the nation among all banks with $1 to $10 billion

in assets, with the top two being privately held. Preferred

Bank is therefore considered the top publicly-traded bank in the $1

to $10 billion asset group. Our deposits were recently rated

“A-” by Kroll Bond Rating Agency.

“Net income for the quarter was $8.6 million or $0.61 per

diluted share, which compares favorably with the $7.8 million

earned in the first quarter of this year. An improved net

interest margin and higher average outstanding loans were the main

reasons. During the quarter, our efficiency ratio of 39.4%

was also an improvement from the 44.1% for the first quarter of

2016. As in the past few years, we plan to continue

increasing our compliance staff in order to meet new and more

complex laws and regulations. Meanwhile, we also continue to

add front line staff on an opportunistic basis to sustain our

growth. Our Bank maintains a highly asset sensitive balance

sheet which will benefit from an increase in short term rates when

it occurs.

“Amid all of the positive results of the quarter, there was one

setback. A Syndicated National Credit (“SNiC”) loan was

downgraded to non-accrual status during the quarter. We have

determined the event was an isolated case as we have underwritten

the loan in accordance with our standards based upon the

information provided. A larger than normal provision for loan

loss was made in addition to the loan loss recovery we received

during the quarter. The silver lining here is that it serves

as a reminder that we need to be even more cautious going

forward.”

Net Interest Income and Net Interest Margin. Net interest income

before provision for loan and lease losses was $25.7 million for

the second quarter of 2016. This compares favorably to the $20.6

million recorded in the second quarter of 2015 and to the $23.9

million recorded in the first quarter of 2016. The increase over

both comparable periods is due primarily to growth in interest

income on loans partially offset by an increase in interest expense

on deposits and borrowings. The Bank’s taxable equivalent net

interest margin was 3.87% for the second quarter of 2016, a 14

basis point decrease from the 4.01% achieved in the second quarter

of 2015 but was an 8 basis point increase from the 3.79% recorded

in the first quarter of 2016.

Noninterest Income. For the second quarter of 2016, noninterest

income was $1,660,000 compared with $1,131,000 for the same quarter

last year and compared to $1,163,000 for the first quarter of 2016.

The increase over both periods is primarily due to trade finance

income as letter of credit activity has increased. Service charges

on deposits were primarily flat compared to the same period last

year but were up by $44,000 over the first quarter of 2016. Trade

finance income was $835,000 for the second quarter of 2016, an

increase of $344,000 compared to the same period last year and an

increase of $418,000 compared to the first quarter of 2016. Other

income was $398,000, an increase of $178,000 over the second

quarter of 2015 and an increase of $67,000 over the first quarter

of 2016. The increase over both comparable periods was due to an

increase in unutilized line fees on loans.

Noninterest Expense. Total noninterest expense was $10.8 million

for the second quarter of 2016, an increase of $2.3 million over

the same period last year and down from the $11.0 million recorded

in the first quarter of 2016. Salaries and benefits expense totaled

$6.1 million for the second quarter of 2016, an increase over the

$5.5 million recorded for the same period last year and a decrease

from the $7.0 million recorded in the first quarter of 2016. The

increase over the same period last year was due primarily to

staffing/merit increases, much of that due to the acquisition of

United International Bank (“UIB”), and the decrease from the first

quarter of 2016 was due to heightened payroll taxes in the first

quarter of 2016 as well as a higher level of capitalized loan

origination costs. Occupancy expense totaled $1.3 million compared

to the $899,000 recorded in the same period in 2015 and the $1.2

million recorded in the first quarter of 2016. The increase over

the prior year was due mainly to the addition of the New York

office with the UIB acquisition as well as a new administrative

office which the Bank opened in November 2015 in El Monte,

California. Professional services expense was $1.4 million for the

second quarter of 2016 compared to $1.2 million for the same

quarter of 2015 and $962,000 recorded in the first quarter of 2016.

The Bank incurred $243,000 in costs related to its one OREO

property. This compares to a gain of $552,000 in the second quarter

of 2015 and expense of $199,000 in the first quarter of 2016. Other

expenses were $1.3 million for the second quarter of 2016 compared

to $1.0 million for the same period last year and $1.1 million for

the first quarter of 2016.

Income Taxes

The Bank recorded a provision for income taxes of $5.7 million

for the second quarter of 2016. This represents an effective tax

rate (“ETR”) of 40.0% for the quarter. This is down from the ETR of

40.4% for the second quarter of 2015 and down from the 40.6% ETR

recorded in the first quarter of 2016. The difference between the

statutory rate (Federal and State combined) of 42.05% and the ETR

is due to tax deductible items as well as the Bank’s investments in

various Low Income Housing Income Tax Credit (“LIHTC”) funds.

Balance Sheet Summary

Total gross loans and leases at June 30, 2016 were $2.27

billion, an increase of $212.8 million or 10.3% over the total of

$2.06 billion as of December 31, 2015. Total deposits reached $2.52

billion, an increase of $229.3 million or 10.0% over the total of

$2.29 billion as of December 31, 2015. Total assets reached $2.92

billion as of June 30, 2016, an increase of $316.8 million or 12.2%

over the total of $2.60 billion as of December 31, 2015.

Asset Quality

As of June 30, 2016 nonaccrual loans totaled $3.3 million, an

increase of $1.3 million over the $2.0 million total as of December

31, 2015. Total net charge-offs for the second quarter of 2016 were

$2.0 million compared to a net recovery of $223,000 in the first

quarter of 2016 and compared to a net charge off of $130,000 for

the second quarter of 2015. The Bank recorded a provision for loan

loss of $2.3 million for the second quarter of 2016 which was

impacted by the new nonaccrual loan which was deemed such in the

second quarter. Although this is a new nonperforming loan, all

trends and all other factors relative to the quality of the loan

portfolio, as well as the economic conditions in the areas in which

we operate, continue to remain strong and thrive. The $2.3 million

provision is an increase from the $500,000 provision recorded in

the same quarter last year and to the $800,000 provision recorded

in the first quarter of 2016. The allowance for loan loss at June

30, 2016 was $24.0 million or 1.06% of total loans compared to

$22.7 million or 1.10% of total loans at December 31, 2015.

OREO

As of June 30, 2016 and December 31, 2015, the Bank held one

OREO property, a $4.1 million multi-family property located outside

of California.

CapitalizationAs of June 30, 2016, the Bank’s

leverage ratio was 10.05%, the common equity tier 1 capital ratio

was 10.41% and the total capital ratio was 13.65%. As of December

31, 2015, the Bank’s leverage ratio was 10.46%, the common equity

tier 1 ratio was 11.03% and the total risk based capital ratio was

12.00%.

Conference Call and WebcastA

conference call with simultaneous webcast to discuss Preferred

Bank’s second quarter 2016 financial results will be held tomorrow,

July 21st at 2:00 p.m. Eastern / 11:00 a.m. Pacific. Interested

participants and investors may access the conference call by

dialing 866-652-5200 (domestic) or 412-317-6060 (international) and

referencing “Preferred Bank.” There will also be a live webcast of

the call available at the Investor Relations section of Preferred

Bank's website at www.preferredbank.com. Web participants are

encouraged to go to the website at least 15 minutes prior to the

start of the call to register, download and install any necessary

audio software.

Preferred Bank's Chairman and CEO Li Yu, President and COO

Wellington Chen, Chief Financial Officer Edward J. Czajka, and

Chief Credit Officer Nick Pi will be present to discuss Preferred

Bank's financial results, business highlights and outlook. After

the live webcast, a replay will remain available in the Investor

Relations section of Preferred Bank's website. A replay of the

call will also be available at 877-344-7529 (domestic) or

412-317-0088 (international) through August 4, 2016; the passcode

is 10089672.

About Preferred Bank

Preferred Bank is one of the larger independent commercial banks

in California. The bank is chartered by the State of California,

and its deposits are insured by the Federal Deposit Insurance

Corporation, or FDIC, to the maximum extent permitted by law. The

Company conducts its banking business from its main office in Los

Angeles, California, and through eleven full-service branch banking

offices in the California cities of Alhambra, Century City,

City of Industry, Torrance, Arcadia, Irvine, Diamond Bar, Anaheim,

Pico Rivera, Tarzana and San Francisco, and one office in Flushing

New York. Preferred Bank offers a broad range of deposit and loan

products and services to both commercial and consumer customers.

The bank provides personalized deposit services as well as real

estate finance, commercial loans and trade finance to small and

mid-sized businesses, entrepreneurs, real estate developers,

professionals and high net worth individuals. Although originally

founded as a Chinese-American Bank, Preferred Bank now derives most

of its customers from the diversified mainstream market but does

continue to benefit from the significant migration to California of

ethnic Chinese from China and other areas of East Asia.

Forward-Looking StatementsThis press release

contains forward-looking statements within the meaning of the

Private Securities Litigation Reform Act of 1995. Such statements

include, but are not limited to, statements about the Bank’s future

financial and operating results, the Bank's plans, objectives,

expectations and intentions and other statements that are not

historical facts. Such statements are based upon the current

beliefs and expectations of the Bank’s management and are subject

to significant risks and uncertainties. Actual results may differ

from those set forth in the forward-looking statements. The

following factors, among others, could cause actual results to

differ from those set forth in the forward-looking statements:

changes in economic conditions; changes in the California real

estate market; the loss of senior management and other employees;

natural disasters or recurring energy shortage; changes in interest

rates; competition from other financial services companies;

ineffective underwriting practices; inadequate allowance for loan

and lease losses to cover actual losses; risks inherent in

construction lending; adverse economic conditions in Asia; downturn

in international trade; inability to attract deposits; inability to

raise additional capital when needed or on favorable terms;

inability to manage growth; inadequate communications, information,

operating and financial control systems, technology from fourth

party service providers; the U.S. government’s monetary policies;

government regulation; environmental liability with respect to

properties to which the bank takes title; and the threat of

terrorism. Additional factors that could cause the Bank's results

to differ materially from those described in the forward-looking

statements can be found in the Bank’s 2015 Annual Report on Form

10-K filed with the Federal Deposit Insurance Corporation which can

be found on Preferred Bank’s website. The forward-looking

statements in this press release speak only as of the date of the

press release, and the Bank assumes no obligation to update the

forward-looking statements or to update the reasons why actual

results could differ from those contained in the forward-looking

statements. For additional information about Preferred Bank, please

visit the Bank’s website at www.preferredbank.com.

Financial Tables to Follow

| |

| |

| PREFERRED

BANK |

| Condensed Consolidated

Statements of Operations |

|

(unaudited) |

| (in thousands, except

for net income per share and

shares) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

For the

Quarter Ended |

|

|

|

|

|

|

June 30, |

|

March 31, |

|

June 30, |

|

|

|

|

|

|

|

2016 |

|

|

|

2016 |

|

|

|

2015 |

|

|

Interest income: |

|

|

|

|

|

|

| |

Loans, including fees |

|

$ |

27,892 |

|

|

$ |

25,460 |

|

|

$ |

21,276 |

|

| |

Investment securities |

|

|

1,722 |

|

|

|

1,784 |

|

|

|

1,731 |

|

| |

Fed

funds sold |

|

|

109 |

|

|

|

77 |

|

|

|

46 |

|

| |

|

Total

interest income |

|

|

29,723 |

|

|

|

27,321 |

|

|

|

23,053 |

|

| |

|

|

|

|

|

|

|

|

|

|

Interest expense: |

|

|

|

|

|

|

| |

Interest-bearing demand |

|

|

1,051 |

|

|

|

1,050 |

|

|

|

709 |

|

| |

Savings |

|

|

18 |

|

|

|

18 |

|

|

|

15 |

|

| |

Time certificates |

|

|

2,660 |

|

|

|

2,315 |

|

|

|

1,727 |

|

| |

FHLB

borrowings |

|

|

67 |

|

|

|

59 |

|

|

|

35 |

|

| |

Subordinated debt issuance |

|

|

186 |

|

|

|

- |

|

|

|

- |

|

| |

|

Total

interest expense |

|

|

3,982 |

|

|

|

3,442 |

|

|

|

2,486 |

|

| |

|

Net

interest income |

|

|

25,741 |

|

|

|

23,879 |

|

|

|

20,567 |

|

|

Provision for loan losses |

|

|

2,300 |

|

|

|

800 |

|

|

|

500 |

|

| |

|

Net

interest income after provision for |

|

|

|

|

|

|

| |

|

|

loan

losses |

|

|

23,441 |

|

|

|

23,079 |

|

|

|

20,067 |

|

| |

|

|

|

|

|

|

|

|

|

|

Noninterest income: |

|

|

|

|

|

|

| |

Fees

& service charges on deposit accounts |

|

|

338 |

|

|

|

294 |

|

|

|

336 |

|

| |

Trade

finance income |

|

|

835 |

|

|

|

417 |

|

|

|

491 |

|

| |

BOLI

income |

|

|

89 |

|

|

|

85 |

|

|

|

84 |

|

| |

Net

gain on sale of investment securities |

|

|

- |

|

|

|

36 |

|

|

|

- |

|

| |

Other

income |

|

|

398 |

|

|

|

331 |

|

|

|

220 |

|

| |

|

Total

noninterest income |

|

|

1,660 |

|

|

|

1,163 |

|

|

|

1,131 |

|

| |

|

|

|

|

|

|

|

|

|

|

Noninterest expense: |

|

|

|

|

|

|

| |

Salary and employee benefits |

|

|

6,065 |

|

|

|

7,021 |

|

|

|

5,507 |

|

| |

Net

occupancy expense |

|

|

1,267 |

|

|

|

1,203 |

|

|

|

899 |

|

| |

Business development and promotion expense |

|

|

152 |

|

|

|

222 |

|

|

|

124 |

|

| |

Professional services |

|

|

1,409 |

|

|

|

962 |

|

|

|

1,175 |

|

| |

Office supplies and equipment expense |

|

|

376 |

|

|

|

351 |

|

|

|

263 |

|

| |

Other real estate owned related (income) expense

and valuation allowance on LHFS |

|

|

243 |

|

|

|

199 |

|

|

|

(552 |

) |

| |

Other |

|

|

|

1,279 |

|

|

|

1,080 |

|

|

|

1,046 |

|

| |

|

Total

noninterest expense |

|

|

10,791 |

|

|

|

11,038 |

|

|

|

8,462 |

|

| |

|

Income before provision for income taxes |

|

|

14,310 |

|

|

|

13,204 |

|

|

|

12,736 |

|

|

Income tax expense |

|

|

5,724 |

|

|

|

5,361 |

|

|

|

5,147 |

|

| |

|

Net

income |

|

$ |

8,586 |

|

|

$ |

7,843 |

|

|

$ |

7,589 |

|

| |

|

|

|

|

|

|

|

|

|

|

Income per share available to common shareholders |

|

|

|

|

|

|

| |

|

Basic |

|

$ |

0.61 |

|

|

$ |

0.56 |

|

|

$ |

0.55 |

|

| |

|

Diluted |

|

$ |

0.61 |

|

|

$ |

0.56 |

|

|

$ |

0.55 |

|

| |

|

|

|

|

|

|

|

|

|

|

Weighted-average common shares outstanding |

|

|

|

|

|

|

| |

|

Basic |

|

|

13,851,081 |

|

|

|

13,796,892 |

|

|

|

13,480,609 |

|

| |

|

Diluted |

|

|

13,957,117 |

|

|

|

13,911,195 |

|

|

|

13,659,167 |

|

| |

|

|

|

|

|

|

|

|

|

|

Dividends per share |

|

$ |

0.15 |

|

|

$ |

0.15 |

|

|

$ |

0.12 |

|

| |

|

|

|

|

|

|

|

|

|

| PREFERRED

BANK |

| Condensed Consolidated

Statements of Operations |

|

(unaudited) |

| (in thousands, except

for net income per share and

shares) |

| |

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

For the Six Months

Ended |

|

|

|

|

|

|

|

|

June 30, |

|

June 30, |

|

Change |

|

|

|

|

|

|

|

2016 |

|

|

|

2015 |

|

|

% |

|

Interest income: |

|

|

|

|

|

|

| |

Loans, including fees |

|

$ |

53,352 |

|

|

$ |

41,631 |

|

|

|

28.2 |

% |

| |

Investment securities |

|

|

3,506 |

|

|

|

3,188 |

|

|

|

10.0 |

% |

| |

Fed

funds sold |

|

|

186 |

|

|

|

80 |

|

|

|

131.9 |

% |

| |

|

Total

interest income |

|

|

57,044 |

|

|

|

44,899 |

|

|

|

27.1 |

% |

| |

|

|

|

|

|

|

|

|

|

|

Interest expense: |

|

|

|

|

|

|

| |

Interest-bearing demand |

|

|

2,101 |

|

|

|

1,495 |

|

|

|

40.5 |

% |

| |

Savings |

|

|

36 |

|

|

|

30 |

|

|

|

19.9 |

% |

| |

Time certificates |

|

|

4,975 |

|

|

|

3,377 |

|

|

|

47.3 |

% |

| |

FHLB

borrowings |

|

|

126 |

|

|

|

66 |

|

|

|

90.1 |

% |

| |

Subordinated debt issuance |

|

|

186 |

|

|

|

- |

|

|

|

100.0 |

% |

| |

|

Total

interest expense |

|

|

7,424 |

|

|

|

4,968 |

|

|

|

49.4 |

% |

| |

|

Net

interest income |

|

|

49,620 |

|

|

|

39,931 |

|

|

|

24.3 |

% |

|

Provision for credit losses |

|

|

3,100 |

|

|

|

1,000 |

|

|

|

210.0 |

% |

| |

|

Net

interest income after provision for |

|

|

|

|

|

|

| |

|

loan

losses |

|

|

46,520 |

|

|

|

38,931 |

|

|

|

19.5 |

% |

| |

|

|

|

|

|

|

|

|

|

|

Noninterest income: |

|

|

|

|

|

|

| |

Fees

& service charges on deposit accounts |

|

|

632 |

|

|

|

635 |

|

|

|

-0.5 |

% |

| |

Trade

finance income |

|

|

1,252 |

|

|

|

797 |

|

|

|

57.0 |

% |

| |

BOLI

income |

|

|

174 |

|

|

|

168 |

|

|

|

3.3 |

% |

| |

Net

gain on sale of investment securities |

|

|

36 |

|

|

|

- |

|

|

|

100.0 |

% |

| |

Other

income |

|

|

729 |

|

|

|

399 |

|

|

|

82.8 |

% |

| |

|

Total

noninterest income |

|

|

2,823 |

|

|

|

1,999 |

|

|

|

41.2 |

% |

| |

|

|

|

|

|

|

|

|

|

|

Noninterest expense: |

|

|

|

|

|

|

| |

Salary and employee benefits |

|

|

13,086 |

|

|

|

10,819 |

|

|

|

21.0 |

% |

| |

Net

occupancy expense |

|

|

2,470 |

|

|

|

1,749 |

|

|

|

41.2 |

% |

| |

Business development and promotion expense |

|

|

374 |

|

|

|

233 |

|

|

|

60.3 |

% |

| |

Professional services |

|

|

2,371 |

|

|

|

2,259 |

|

|

|

5.0 |

% |

| |

Office supplies and equipment expense |

|

|

727 |

|

|

|

517 |

|

|

|

40.6 |

% |

| |

Other real estate owned related expense (income) and

valuation allowance on LHFS |

|

|

442 |

|

|

|

(463 |

) |

|

|

-195.5 |

% |

| |

Other |

|

|

|

2,359 |

|

|

|

1,966 |

|

|

|

20.0 |

% |

| |

|

Total

noninterest expense |

|

|

21,829 |

|

|

|

17,080 |

|

|

|

27.8 |

% |

| |

|

Income before provision for income taxes |

|

|

27,514 |

|

|

|

23,850 |

|

|

|

15.4 |

% |

|

Income tax expense |

|

|

11,085 |

|

|

|

9,571 |

|

|

|

15.8 |

% |

| |

|

Net

income |

|

$ |

16,429 |

|

|

$ |

14,279 |

|

|

|

15.1 |

% |

| |

|

|

|

|

|

|

|

|

|

|

Income per share available to common shareholders |

|

|

|

|

|

|

| |

|

Basic |

|

$ |

1.17 |

|

|

$ |

1.04 |

|

|

|

12.5 |

% |

| |

|

Diluted |

|

$ |

1.16 |

|

|

$ |

1.03 |

|

|

|

12.7 |

% |

| |

|

|

|

|

|

|

|

|

|

| Weighted-average common shares outstanding |

|

|

|

|

|

|

| |

|

Basic |

|

|

13,823,986 |

|

|

|

13,290,258 |

|

|

|

4.0 |

% |

| |

|

Diluted |

|

|

13,933,721 |

|

|

|

13,620,027 |

|

|

|

2.3 |

% |

| |

|

|

|

|

|

|

|

|

|

|

Dividends per share |

|

$ |

0.30 |

|

|

$ |

0.24 |

|

|

|

25.0 |

% |

| |

| PREFERRED

BANK |

| Condensed Consolidated

Statements of Financial

Condition |

|

(unaudited) |

| (in

thousands) |

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

June 30, |

|

December 31, |

|

|

|

|

|

|

|

|

2016 |

|

|

|

2015 |

|

|

|

|

|

|

|

|

(Unaudited) |

|

(Audited) |

|

|

Assets |

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

| Cash and

due from banks |

$ |

316,985 |

|

|

$ |

296,175 |

|

|

| Fed funds

sold |

|

59,500 |

|

|

|

13,000 |

|

|

| Cash and cash

equivalents |

|

376,485 |

|

|

|

309,175 |

|

|

| |

|

|

|

|

|

|

|

|

| Securities

held to maturity, at amortized cost |

|

5,143 |

|

|

|

5,830 |

|

|

| Securities

available-for-sale, at fair value |

|

201,256 |

|

|

|

169,502 |

|

|

| Loans and

leases |

|

2,272,230 |

|

|

|

2,059,392 |

|

|

| Less

allowance for loan and lease losses |

|

(23,983 |

) |

|

|

(22,658 |

) |

|

| Less net

deferred loan fees |

|

(3,682 |

) |

|

|

(3,012 |

) |

|

| Net loans and

leases |

|

2,244,565 |

|

|

|

2,033,722 |

|

|

| |

|

|

|

|

|

|

|

|

| Other real

estate owned |

|

4,112 |

|

|

|

4,112 |

|

|

| Customers'

liability on acceptances |

|

108 |

|

|

|

897 |

|

|

| Bank

furniture and fixtures, net |

|

5,572 |

|

|

|

5,601 |

|

|

| Bank-owned

life insurance |

|

8,709 |

|

|

|

8,763 |

|

|

| Accrued

interest receivable |

|

8,220 |

|

|

|

8,128 |

|

|

| Investment

in affordable housing |

|

24,886 |

|

|

|

16,052 |

|

|

| Federal

Home Loan Bank stock |

|

9,332 |

|

|

|

7,162 |

|

|

| Deferred

tax assets |

|

23,049 |

|

|

|

23,802 |

|

|

| Income tax

receivable |

|

- |

|

|

|

299 |

|

|

| Other

asset |

|

4,204 |

|

|

|

5,801 |

|

|

| Total assets |

$ |

2,915,641 |

|

|

$ |

2,598,846 |

|

|

| |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

Liabilities and Shareholders'

Equity |

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

Liabilities: |

|

|

|

|

|

|

| Deposits: |

|

|

|

|

|

|

| Demand |

$ |

540,374 |

|

|

$ |

558,906 |

|

|

| Interest-bearing

demand |

|

855,661 |

|

|

|

748,918 |

|

|

| Savings |

|

29,031 |

|

|

|

30,703 |

|

|

| Time certificates of

$250,000 or more |

|

398,736 |

|

|

|

321,537 |

|

|

| Other time

certificates |

|

692,063 |

|

|

|

626,495 |

|

|

| Total deposits |

$ |

2,515,865 |

|

|

$ |

2,286,559 |

|

|

| Acceptances

outstanding |

|

108 |

|

|

|

897 |

|

|

| Advances from Federal

Home Loan Bank |

|

26,573 |

|

|

|

26,635 |

|

|

| Subordinated debt

issuance |

|

61,475 |

|

|

|

- |

|

|

| Commitments to fund

investment in affordable housing partnership |

|

11,199 |

|

|

|

3,958 |

|

|

| Accrued interest

payable |

|

2,562 |

|

|

|

1,919 |

|

|

| Other liabilities |

|

15,507 |

|

|

|

14,733 |

|

|

| Total liabilities |

|

2,633,289 |

|

|

|

2,334,701 |

|

|

| |

|

|

|

|

|

|

|

|

| Commitments and

contingencies |

|

|

|

|

|

|

|

|

| Shareholders'

equity: |

|

|

|

|

|

|

|

|

| Preferred stock.

Authorized 25,000,000 shares; no issued and outstanding |

|

|

|

|

| shares at

June 30, 2016 and December 31, 2015 |

|

- |

|

|

|

- |

|

|

| Common stock, no par

value. Authorized 100,000,000 shares; issued |

|

|

|

|

| and

outstanding 14,116,474 and 13,884,942 shares at June 30, 2016

and December 31, 2015, respectively |

|

167,892 |

|

|

|

166,560 |

|

|

| Treasury stock |

|

(19,115 |

) |

|

|

(19,115 |

) |

|

| Additional

paid-in-capital |

|

38,435 |

|

|

|

34,672 |

|

|

| Accumulated income |

|

93,119 |

|

|

|

81,046 |

|

|

| Accumulated other

comprehensive income: |

|

|

|

|

| Unrealized gain on

securities, available-for-sale, net of tax of $1,467 and $713 at

June 30, 2016 and December 31, 2015, respectively

|

|

2,021 |

|

|

|

982 |

|

|

| Total shareholders'

equity |

|

282,352 |

|

|

|

264,145 |

|

|

| Total liabilities and

shareholders' equity |

$ |

2,915,641 |

|

|

$ |

2,598,846 |

|

|

| |

|

|

|

|

|

|

|

|

| PREFERRED

BANK |

| Selected Consolidated

Financial Information |

|

(unaudited) |

| (in thousands, except

for ratios) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For the Quarter Ended |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

June 30, |

|

March 31, |

|

December 31, |

|

September 30, |

|

June 30, |

|

|

| |

|

|

|

|

2016 |

|

|

|

2016 |

|

|

|

2015 |

|

|

|

2015 |

|

|

|

2015 |

|

|

|

|

Unaudited historical quarterly operations

data: |

|

|

|

|

|

|

|

|

|

|

|

| |

Interest income |

$ |

29,723 |

|

|

$ |

27,321 |

|

|

$ |

25,423 |

|

|

$ |

24,380 |

|

|

$ |

23,053 |

|

|

|

| |

Interest expense |

|

3,982 |

|

|

|

3,442 |

|

|

|

3,105 |

|

|

|

2,783 |

|

|

|

2,486 |

|

|

|

| |

|

Interest income before

provision for credit losses |

|

25,741 |

|

|

|

23,879 |

|

|

|

22,318 |

|

|

|

21,597 |

|

|

|

20,567 |

|

|

|

| |

Provision for credit

losses |

|

2,300 |

|

|

|

800 |

|

|

|

300 |

|

|

|

500 |

|

|

|

500 |

|

|

|

| |

Noninterest income |

|

1,660 |

|

|

|

1,163 |

|

|

|

954 |

|

|

|

940 |

|

|

|

1,131 |

|

|

|

| |

Noninterest

expense |

|

10,791 |

|

|

|

11,038 |

|

|

|

9,890 |

|

|

|

8,740 |

|

|

|

8,462 |

|

|

|

| |

Income tax expense |

|

5,724 |

|

|

|

5,361 |

|

|

|

5,518 |

|

|

|

5,396 |

|

|

|

5,147 |

|

|

|

| |

|

Net income |

|

8,586 |

|

|

|

7,843 |

|

|

|

7,563 |

|

|

|

7,901 |

|

|

|

7,589 |

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Earnings

per share |

|

|

|

|

|

|

|

|

|

|

|

| |

|

Basic |

$ |

0.61 |

|

|

$ |

0.56 |

|

|

$ |

0.55 |

|

|

$ |

0.57 |

|

|

$ |

0.55 |

|

|

|

| |

|

Diluted |

$ |

0.61 |

|

|

$ |

0.56 |

|

|

$ |

0.54 |

|

|

$ |

0.57 |

|

|

$ |

0.55 |

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Ratios for the

period: |

|

|

|

|

|

|

|

|

|

|

|

| |

Return on average

assets |

|

1.26 |

% |

|

|

1.21 |

% |

|

|

1.28 |

% |

|

|

1.42 |

% |

|

|

1.44 |

% |

|

|

| |

Return on beginning

equity |

|

12.62 |

% |

|

|

11.94 |

% |

|

|

11.67 |

% |

|

|

12.55 |

% |

|

|

12.49 |

% |

|

|

| |

Net interest margin

(Fully-taxable equivalent) |

|

3.87 |

% |

|

|

3.79 |

% |

|

|

3.88 |

% |

|

|

4.00 |

% |

|

|

4.01 |

% |

|

|

| |

Noninterest expense to

average assets |

|

1.58 |

% |

|

|

1.70 |

% |

|

|

1.67 |

% |

|

|

1.58 |

% |

|

|

1.60 |

% |

|

|

| |

Efficiency ratio |

|

39.38 |

% |

|

|

44.08 |

% |

|

|

42.50 |

% |

|

|

38.78 |

% |

|

|

39.00 |

% |

|

|

| |

Net charge-offs

(recoveries) to average loans (annualized) |

|

0.36 |

% |

|

|

-0.04 |

% |

|

|

0.36 |

% |

|

|

0.05 |

% |

|

|

0.03 |

% |

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Ratios as of period

end: |

|

|

|

|

|

|

|

|

|

|

|

| |

Tier 1 leverage capital

ratio (1) |

|

10.05 |

% |

|

|

10.29 |

% |

|

|

10.46 |

% |

|

|

11.47 |

% |

|

|

11.59 |

% |

|

|

| |

Common equity tier 1

risk-based capital ratio (1) |

|

10.41 |

% |

|

|

10.74 |

% |

|

|

11.03 |

% |

|

|

11.80 |

% |

|

|

11.91 |

% |

|

|

| |

Tier 1 risk-based

capital ratio (1) |

|

10.41 |

% |

|

|

10.74 |

% |

|

|

11.03 |

% |

|

|

11.80 |

% |

|

|

11.91 |

% |

|

|

| |

Total risk-based

capital ratio (1) |

|

13.65 |

% |

|

|

11.70 |

% |

|

|

12.00 |

% |

|

|

12.93 |

% |

|

|

13.07 |

% |

|

|

| |

Allowances for credit

losses to loans and leases at end of period |

|

1.06 |

% |

|

|

1.10 |

% |

|

|

1.10 |

% |

|

|

1.31 |

% |

|

|

1.36 |

% |

|

|

| |

Allowance for credit

losses to non-performing |

|

|

|

|

|

|

|

|

|

|

|

| |

|

loans and leases |

|

722.47 |

% |

|

|

2346.18 |

% |

|

|

1140.29 |

% |

|

|

303.27 |

% |

|

|

299.06 |

% |

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Average

balances: |

|

|

|

|

|

|

|

|

|

|

|

| |

Total loans and

leases |

$ |

2,248,652 |

|

|

$ |

2,067,047 |

|

|

$ |

1,876,544 |

|

|

$ |

1,741,762 |

|

|

$ |

1,673,710 |

|

|

|

| |

Earning assets |

$ |

2,687,435 |

|

|

$ |

2,550,821 |

|

|

$ |

2,297,154 |

|

|

$ |

2,160,075 |

|

|

$ |

2,070,542 |

|

|

|

| |

Total assets |

$ |

2,746,031 |

|

|

$ |

2,605,907 |

|

|

$ |

2,345,319 |

|

|

$ |

2,201,060 |

|

|

$ |

2,117,610 |

|

|

|

| |

Total deposits |

$ |

2,400,756 |

|

|

$ |

2,291,764 |

|

|

$ |

2,039,567 |

|

|

$ |

1,907,719 |

|

|

$ |

1,832,688 |

|

|

|

| |

|

|

|

| |

(1) Risk-based capital ratios were calculated under

BASEL III rules, which became effective on January 1, 2015.

Ratios for the prior periods were calculated under Basel I

rules. |

|

|

|

|

|

|

| PREFERRED

BANK |

|

| Selected Consolidated

Financial Information |

|

| (in thousands, except

for ratios) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For the Six Months Ended |

|

|

|

|

|

|

June 30, |

|

June 30, |

|

|

|

|

|

|

|

2016 |

|

|

|

2015 |

|

|

| |

Interest

income |

$ |

57,044 |

|

|

$ |

44,899 |

|

|

| |

Interest

expense |

|

7,424 |

|

|

|

4,968 |

|

|

| |

|

Interest income before

provision for credit losses |

|

49,620 |

|

|

|

39,931 |

|

|

| |

Provision

for credit losses |

|

3,100 |

|

|

|

1,000 |

|

|

| |

Noninterest

income |

|

2,823 |

|

|

|

1,999 |

|

|

| |

Noninterest

expense |

|

21,829 |

|

|

|

17,080 |

|

|

| |

Income tax

expense |

|

11,085 |

|

|

|

9,571 |

|

|

| |

|

Net income |

|

16,429 |

|

|

|

14,279 |

|

|

| |

|

|

|

|

|

|

|

| |

Earnings per share |

|

|

|

|

| |

|

Basic |

$ |

1.17 |

|

|

$ |

1.04 |

|

|

| |

|

Diluted |

$ |

1.16 |

|

|

$ |

1.03 |

|

|

| |

|

|

|

|

|

|

|

|

Ratios for the

period: |

|

|

|

|

| |

Return on average

assets |

|

1.23 |

% |

|

|

1.31 |

% |

|

| |

Return on beginning

equity |

|

12.51 |

% |

|

|

11.88 |

% |

|

| |

Net interest margin

(Fully-taxable equivalent) |

|

3.83 |

% |

|

|

3.89 |

% |

|

| |

Noninterest expense to

average assets |

|

1.64 |

% |

|

|

1.62 |

% |

|

| |

Efficiency ratio |

|

41.62 |

% |

|

|

40.76 |

% |

|

| |

Net charge-offs

(recoveries) to average loans |

|

0.17 |

% |

|

|

-0.01 |

% |

|

| |

|

|

|

|

|

|

|

|

Average

balances: |

|

|

|

|

| |

Total loans and

leases |

$ |

2,158,158 |

|

|

$ |

1,438,122 |

|

|

| |

Earning assets |

$ |

2,619,287 |

|

|

$ |

1,836,375 |

|

|

| |

Total assets |

$ |

2,676,158 |

|

|

$ |

1,880,019 |

|

|

| |

Total deposits |

$ |

2,346,462 |

|

|

$ |

1,620,709 |

|

|

| PREFERRED

BANK |

| Selected Consolidated

Financial Information |

|

(unaudited) |

| (in thousands, except

for ratios) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

As of |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

June 30, |

|

March 31, |

|

December 31, |

|

September 30, |

|

June 30, |

|

|

|

|

|

|

2016 |

|

|

|

2016 |

|

|

|

2015 |

|

|

|

2015 |

|

|

|

2015 |

|

|

Unaudited quarterly statement of

financial position data: |

|

|

|

|

|

|

|

|

|

|

Assets: |

|

|

|

|

|

|

|

|

|

|

| |

Cash and

cash equivalents |

$ |

376,485 |

|

|

$ |

293,547 |

|

|

$ |

309,175 |

|

|

$ |

232,707 |

|

|

$ |

208,015 |

|

| |

Securities

held-to-maturity, at amortized cost |

|

5,143 |

|

|

|

5,550 |

|

|

|

5,830 |

|

|

|

6,307 |

|

|

|

6,806 |

|

| |

Securities

available-for-sale, at fair value |

|

201,256 |

|

|

|

162,654 |

|

|

|

169,502 |

|

|

|

164,378 |

|

|

|

161,775 |

|

| |

Loans and

Leases: |

|

|

|

|

|

|

|

|

|

| |

|

Real estate

- Single and multi-family residential

|

$ |

393,076 |

|

|

$ |

401,708 |

|

|

$ |

415,003 |

|

|

$ |

328,124 |

|

|

$ |

290,186 |

|

| |

|

Real estate

- Land for housing |

|

14,817 |

|

|

|

14,838 |

|

|

|

14,408 |

|

|

|

14,429 |

|

|

|

13,102 |

|

| |

|

Real estate

- Land for income properties |

|

6,316 |

|

|

|

1,816 |

|

|

|

1,795 |

|

|

|

1,876 |

|

|

|

1,891 |

|

| |

|

Real estate

- Commercial |

|

995,213 |

|

|

|

924,913 |

|

|

|

861,317 |

|

|

|

770,494 |

|

|

|

712,383 |

|

| |

|

Real estate

- For sale housing construction |

|

95,519 |

|

|

|

82,153 |

|

|

|

73,858 |

|

|

|

79,406 |

|

|

|

71,945 |

|

| |

|

Real estate

- Other construction |

|

72,963 |

|

|

|

66,636 |

|

|

|

57,546 |

|

|

|

48,438 |

|

|

|

49,413 |

|

| |

|

Commercial

and industrial |

|

659,701 |

|

|

|

626,599 |

|

|

|

596,887 |

|

|

|

555,680 |

|

|

|

570,408 |

|

| |

|

Trade

finance and other |

|

34,625 |

|

|

|

39,323 |

|

|

|

38,578 |

|

|

|

38,602 |

|

|

|

40,403 |

|

| |

|

|

Gross loans |

|

2,272,230 |

|

|

|

2,157,986 |

|

|

|

2,059,392 |

|

|

|

1,837,049 |

|

|

|

1,749,731 |

|

| |

Allowance

for loan and lease losses |

|

(23,983 |

) |

|

|

(23,681 |

) |

|

|

(22,658 |

) |

|

|

(24,055 |

) |

|

|

(23,758 |

) |

| |

Net

deferred loan fees |

|

(3,682 |

) |

|

|

(3,065 |

) |

|

|

(3,012 |

) |

|

|

(2,476 |

) |

|

|

(2,179 |

) |

| |

|

Total

loans, net |

$ |

2,244,565 |

|

|

$ |

2,131,240 |

|

|

$ |

2,033,722 |

|

|

$ |

1,810,518 |

|

|

$ |

1,723,794 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

Other real estate

owned |

|

|

$ |

4,112 |

|

|

$ |

4,112 |

|

|

$ |

4,112 |

|

|

$ |

- |

|

|

$ |

- |

|

| |

Investment in

affordable housing |

|

|

|

24,886 |

|

|

|

25,499 |

|

|

|

16,052 |

|

|

|

16,589 |

|

|

|

17,059 |

|

| |

Federal Home Loan Bank

stock |

|

|

|

9,332 |

|

|

|

6,965 |

|

|

|

7,162 |

|

|

|

6,677 |

|

|

|

6,677 |

|

| |

Other assets |

|

|

|

49,862 |

|

|

|

53,783 |

|

|

|

53,291 |

|

|

|

45,370 |

|

|

|

46,030 |

|

| |

|

Total assets |

|

$ |

2,915,641 |

|

|

$ |

2,683,350 |

|

|

$ |

2,598,846 |

|

|

$ |

2,282,546 |

|

|

$ |

2,170,156 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Liabilities: |

|

|

|

|

|

|

|

|

|

|

| |

Deposits: |

|

|

|

|

|

|

|

|

|

| |

|

Demand |

$ |

540,374 |

|

|

$ |

528,126 |

|

|

$ |

558,906 |

|

|

$ |

477,523 |

|

|

$ |

519,501 |

|

| |

|

Interest-bearing demand |

|

855,661 |

|

|

|

803,374 |

|

|

|

748,918 |

|

|

|

697,402 |

|

|

|

568,243 |

|

| |

|

Savings |

|

29,031 |

|

|

|

30,002 |

|

|

|

30,703 |

|

|

|

21,159 |

|

|

|

23,855 |

|

| |

|

Time

certificates of $250,000 or more |

|

398,736 |

|

|

|

339,971 |

|

|

|

321,537 |

|

|

|

263,949 |

|

|

|

260,205 |

|

| |

|

Other time

certificates |

|

692,063 |

|

|

|

656,386 |

|

|

|

626,495 |

|

|

|

527,602 |

|

|

|

510,394 |

|

| |

|

Total deposits |

$ |

2,515,865 |

|

|

$ |

2,357,859 |

|

|

$ |

2,286,559 |

|

|

$ |

1,987,635 |

|

|

$ |

1,882,198 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

Advances from Federal

Home Loan Bank |

|

|

$ |

26,573 |

|

|

$ |

26,601 |

|

|

$ |

26,635 |

|

|

$ |

20,000 |

|

|

$ |

20,000 |

|

| |

Subordinated debt issuance |

|

61,475 |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

| |

Commitments

to fund investment in affordable housing partnership |

|

11,454 |

|

|

|

11,454 |

|

|

|

3,958 |

|

|

|

4,139 |

|

|

|

4,139 |

|

| |

Other liabilities |

|

|

|

17,922 |

|

|

|

13,862 |

|

|

|

17,549 |

|

|

|

13,590 |

|

|

|

13,954 |

|

| |

|

Total

liabilities |

$ |

2,633,289 |

|

|

$ |

2,409,776 |

|

|

$ |

2,334,701 |

|

|

$ |

2,025,364 |

|

|

$ |

1,920,291 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Equity: |

|

|

|

|

|

|

|

|

|

|

|

| |

Net common

stock, no par value |

$ |

187,212 |

|

|

$ |

185,780 |

|

|

$ |

182,118 |

|

|

$ |

180,310 |

|

|

$ |

179,360 |

|

| |

Retained

earnings |

|

93,119 |

|

|

|

86,716 |

|

|

|

81,046 |

|

|

|

75,629 |

|

|

|

69,431 |

|

| |

Accumulated

other comprehensive income |

|

2,021 |

|

|

|

1,079 |

|

|

|

982 |

|

|

|

1,243 |

|

|

|

1,074 |

|

| |

|

Total

shareholders' equity |

$ |

282,352 |

|

|

$ |

273,574 |

|

|

$ |

264,145 |

|

|

$ |

257,182 |

|

|

$ |

249,865 |

|

| |

|

Total

liabilities and shareholders' equity |

$ |

2,915,641 |

|

|

$ |

2,683,350 |

|

|

$ |

2,598,846 |

|

|

$ |

2,282,546 |

|

|

$ |

2,170,156 |

|

|

|

| Preferred Bank |

|

|

|

| Loan and Credit Quality

Information |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Allowance For Credit Losses & Loss

History |

|

|

|

| |

|

|

|

|

Six Months Ended |

|

Year Ended |

|

|

|

| |

|

|

|

|

June 30, 2016 |

|

December 31, 2015 |

|

|

|

| |

|

|

|

|

(Dollars in 000's) |

|

|

|

| Allowance

For Credit Losses |

|

|

|

|

|

|

|

| Balance at

Beginning of Period |

|

$ |

22,658 |

|

|

$ |

22,974 |

|

|

|

|

| |

Charge-Offs |

|

|

|

|

|

|

|

| |

|

Commercial

& Industrial |

|

|

2,663 |

|

|

|

1,475 |

|

|

|

|

| |

|

Mini-perm

Real Estate |

|

|

- |

|

|

|

1,793 |

|

|

|

|

| |

|

Construction - Residential |

|

|

- |

|

|

|

- |

|

|

|

|

| |

|

Construction - Commercial |

|

|

- |

|

|

|

- |

|

|

|

|

| |

|

Land -

Residential |

|

|

- |

|

|

|

- |

|

|

|

|

| |

|

Land -

Commercial |

|

|

- |

|

|

|

- |

|

|

|

|

| |

|

Others |

|

|

- |

|

|

|

- |

|

|

|

|

| |

|

Total Charge-Offs |

|

|

2,663 |

|

|

|

3,268 |

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

| |

Recoveries |

|

|

|

|

|

|

|

| |

|

Commercial

& Industrial |

|

|

198 |

|

|

|

131 |

|

|

|

|

| |

|

Mini-perm

Real Estate |

|

|

- |

|

|

|

144 |

|

|

|

|

| |

|

Construction - Residential |

|

|

- |

|

|

|

- |

|

|

|

|

| |

|

Construction - Commercial |

|

|

- |

|

|

|

20 |

|

|

|

|

| |

|

Land -

Residential |

|

|

- |

|

|

|

100 |

|

|

|

|

| |

|

Land -

Commercial |

|

|

690 |

|

|

|

757 |

|

|

|

|

| |

|

Total Recoveries |

|

|

888 |

|

|

|

1,152 |

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

| |

Net Loan

Charge-Offs |

|

|

1,775 |

|

|

|

2,116 |

|

|

|

|

| |

Provision

for Credit Losses |

|

|

3,100 |

|

|

|

1,800 |

|

|

|

|

| Balance at

End of Period |

|

$ |

23,983 |

|

|

$ |

22,658 |

|

|

|

|

| Average

Loans and Leases |

|

$ |

2,158,158 |

|

|

$ |

1,731,871 |

|

|

|

|

| Loans and

Leases at end of Period |

|

$ |

2,272,230 |

|

|

$ |

2,059,392 |

|

|

|

|

| Net

Charge-Offs to Average Loans and Leases |

|

|

0.17 |

% |

|

|

0.12 |

% |

|

|

|

| Allowances

for credit losses to loans and leases at end of period

|

|

|

1.06 |

% |

|

|

1.10 |

% |

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

AT THE COMPANY:

Edward J. Czajka

Executive Vice President

Chief Financial Officer

(213) 891-1188

AT FINANCIAL PROFILES:

Kristen Papke

General Information

(310) 663-8007

kpapke@finprofiles.com

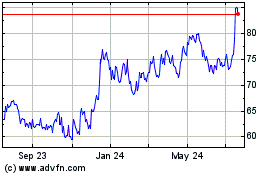

Preferred Bank (NASDAQ:PFBC)

Historical Stock Chart

From Mar 2024 to Apr 2024

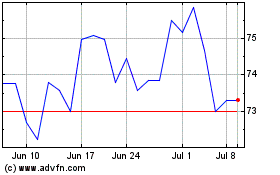

Preferred Bank (NASDAQ:PFBC)

Historical Stock Chart

From Apr 2023 to Apr 2024