Newmont Mining Corporation (NYSE:NEM) (Newmont or the Company)

announced second quarter results.

- Net income: Reported GAAP net

income attributable to shareholders from continuing operations of

$50 million, or $0.09 per share, compared to $63 million, or $0.13

per share in the prior year quarter; achieved adjusted net income1

of $231 million, or $0.44 per basic share, compared to $131 million

or $0.26 per share in the prior year quarter

- EBITDA: Achieved adjusted

EBITDA2 of $804 million in the second quarter, compared to $692

million in the prior year quarter

- Cash flow: Generated net cash

from continuing operating activities of $780 million and free cash

flow3 of $486 million, compared to $441 million and $119 million in

the prior year quarter

- Attributable production:

Produced 1.3 million ounces and 38,000 tonnes of attributable gold

and copper, respectively, compared to 1.2 million ounces and 42,000

tonnes in the prior year quarter

- Costs applicable to sales (CAS):

Improved gold CAS to $637 per ounce4 compared to $642 per ounce in

the prior year quarter, and reported copper CAS of $1.21 per pound

unchanged from the prior year quarter

- All-in sustaining costs

(AISC)5: Improved gold AISC to $876 per ounce compared

to $909 per ounce in the prior year quarter, and improved copper

AISC to $1.53 per pound compared to $1.61 per pound in the prior

year quarter

- Outlook: Improved 2016 outlook

and long term cost outlook; updated outlook excludes Batu

Hijau

- Portfolio: Merian, Long Canyon,

Cripple Creek & Victor (CC&V) and Tanami projects

progressing on schedule and at or below budget. Northwest Exodus

has been approved and is expected to reach first gold production in

Q3 2016; announced agreement to sell Newmont’s ownership stake in

PTNNT

- Shareholder returns: Maintained

second quarter dividend of $0.025 per share6

“Newmont’s strong second quarter results included delivering

adjusted EBITDA of more than $800 million, free cash flow of $486

million, and announcing the sale of our 48.5 percent stake in PTNNT

for total consideration of $1.3 billion including $920 million cash

at close.” said Gary Goldberg, President and Chief Executive

Officer. “Consistently strong operational performance has given us

the means to strengthen our portfolio and balance sheet, and

position Newmont to continue outperforming. We progressed

construction of two new mines, and are now building three higher

margin expansion projects including Northwest Exodus – on time and

at or below budget. We have also been able to reduce our net debt

by nearly 50% since 2013.”

____________________________________

1 Non-GAAP measure. See end of release for reconciliation to net

income attributable to Newmont stockholders.2 Non-GAAP measure. See

end of release for reconciliation to net income attributable to

Newmont stockholders.3 Non-GAAP measure. See end of release for

reconciliation to net cash provided by operating activities.4

Non-GAAP measure. See end of release for reconciliation to costs

applicable to sales.5 Non-GAAP measure. See end of release for

reconciliation to cost applicable to sales.6 Such policy is

non-binding; declaration of future dividends remains subject to

approval and discretion of the Board of Directors.

Second Quarter Summary Results

GAAP Net income attributable to Newmont stockholders from

continuing operations was $50 million, or $0.09 per share, compared

to $63 million or $0.13 per share in the prior year quarter.

Adjusted Net Income was $231 million or $0.44 per share, compared

to $131 million or $0.26 per share in the prior year quarter. The

primary adjustment to net income in the second quarter is a $174

million movement in tax valuation allowances and tax adjustments

related to prior period earnings.

Revenue totaled $2.0 billion in the quarter, in line with

$1.9 billion in the second quarter of 2015 as higher gold volumes

and pricing offset lower copper volumes and pricing.

Average net realized gold and copper price7 was

$1,260 per ounce and $1.94 per pound, respectively, compared with

$1,179 per ounce and $2.41 per pound in the prior year quarter.

Attributable production totaled 1.3 million ounces,

compared to 1.2 million ounces in the second quarter of 2015.

During the quarter, new production from CC&V and higher

production at Tanami, Kalgoorlie and Ahafo more than offset

declining production at Yanacocha and the sale of Waihi.

Attributable copper production totaled 38,000 tonnes compared to

42,000 tonnes in the prior year period due to slightly lower grade

and throughput at Batu Hijau.

CAS Total costs applicable to sales of $1,059 million and

$637 per ounce in the second quarter compared to $1,027 million and

$642 per ounce in the prior year quarter. Second quarter CAS per

ounce improvements were led by Kalgoorlie and the inclusion of

CC&V. Higher production offset processing lower grade and deep

transitional ore at Yanacocha. Copper CAS was $1.21 per pound in

the second quarter, no change from the prior year quarter.

AISC was $876 per ounce and $1.53 per pound,

respectively, compared to $909 per ounce and $1.61 per pound in the

prior year quarter. AISC benefitted from production and CAS

improvements detailed above and further improved due to

timing-related reductions in sustaining capital. Full year

sustaining capital is expected to be slightly lower due to ongoing

cost and efficiency improvements.

Capital expenditures8 for the second quarter were

$294 million, including $155 million of sustaining capital,

compared to $322 million in the prior year quarter, including $170

million sustaining capital. Sustaining capital for the quarter

declined slightly due to timing of spend. Development capital was

used to construct projects, including new mines at Merian and Long

Canyon, and expansions at CC&V and Tanami.

Net cash provided by continuing operating

activities was $780 million in the second quarter, compared to

$441 million in the prior year quarter primarily due to increased

gold pricing and volumes, assisted by lower costs. Free cash flow

was $486 million in the second quarter, compared to $119 million in

the prior year quarter. The company held $2,902 million of

consolidated cash on its balance sheet at the end of the second

quarter.

Newmont has also generated approximately $1.9 billion in asset

sales since 2013 while maintaining steady attributable gold

production. Gross proceeds from asset sales would increase further

with the expected sale of Batu Hijau.

On June 30, Newmont announced an agreement to sell its interests

in PTNNT, which operates the Batu Hijau copper and gold mine in

Indonesia. The total consideration of $1.3 billion for Newmont’s

48.5 percent economic interest includes cash proceeds of $920

million expected to be paid at closing and contingent payments of

$403 million tied to metal price upside and development of the

Elang deposit.

7 Non-GAAP measure. See end of release for reconciliation to

sales.8 Capital expenditures refers to Additions to property plant

and mine development from the statements of consolidated cash

flows.

Three Months Ended

June 30, Six Months Ended June 30,

2016 2015 % Change

2016 2015 % Change

Attributable Sales (koz, kt) Attributable gold ounces sold

1,279 1,157 11 % 2,491 2,351 6 % Attributable copper tonnes sold 33

37 (11) % 76 75 1 %

Average Realized Price ($/oz,

$/lb) Average realized gold price $ 1,260 $ 1,179 7 % $ 1,226 $

1,192 3 % Average realized copper price $ 1.94 $ 2.41

(19) % $ 1.98 $ 2.37 (16) %

Attributable Production (koz, kt) North America 477 377 27 %

933 782 19 % South America 81 111 (27) % 173 238 (27) % Asia

Pacific 522 520 - % 1,001 958 4 % Africa 205

195 5 % 407 411

(1) %

Total Gold 1,285

1,203 7

% 2,514

2,389 5 % North America 5 6 (17) % 10

11 (9) % Asia Pacific 33 36 (8)

% 66 68 (3) %

Total

Copper 38 42

(10) %

76 79 (4)

% CAS Consolidated ($/oz, $/lb) North America

$ 700 $ 764 (8) % $ 716 $ 726 (1) % South America 773 635 22 % 743

543 37 % Asia Pacific 577 618 (7) % 573 648 (12) % Africa

560 488 15 % 558

481 16 %

Total Gold $ 637

$ 642 (1)

% $

638 $ 628 2

% Total

Gold (by-product) $ 577 $

518 11 %

$ 550 $

515 7 % North America $ 2.02 $ 1.83 10 % $

2.07 $ 1.89 10 % Asia Pacific 1.13 1.17

(3) % 1.04 1.23 (15) %

Total

Copper $ 1.21 $ 1.21

- %

$ 1.12 $ 1.28

(13)

% AISC Consolidated ($/oz, $/lb)

North America $ 884 $ 973 (9) % $ 880 $ 931 (5) % South America

1,260 1,000 26 % 1,123 844 33 % Asia Pacific 706 771 (8) % 695 796

(13) % Africa 733 711 3 %

716 672 7 %

Total Gold

$ 876 $ 909 (4)

%

$ 852 $ 879 (3)

% Total Gold (by-product) $ 843

$ 826 2 %

$ 795

$ 806 (1) % North America $ 2.27

$ 2.44 (7) % $ 2.38 $ 2.32 3 % Asia Pacific 1.46

1.55 (6) % 1.34

1.61 (17) %

Total Copper $ 1.53

$ 1.61 (5)

% $

1.42 $ 1.67 (15)

%

Projects Update

Cripple Creek & Victor (CC&V)

expansion includes a new leach pad, recovery plant and mill.

Leach pad construction finished ahead of schedule with first

production in March 2016. The recovery plant remains on schedule to

be completed later this year. Gold production for 2016 is expected

to be between 350,000 and 400,000 ounces at CAS of between $500 and

$550 per ounce and AISC of between $600 and $650 per ounce, with

production weighted toward the latter part of the year. CC&V

development capital is forecasted at approximately $185 million,

with $70 million to be spent in 2016.

Merian is a new mine in Suriname

expected to deliver more than a decade of profitable production and

accretive returns. Construction is approximately 90% complete. The

project remains $100 million below initial budget and is on track

to reach commercial production in the second half of 2016. Merian

will produce between 400,000 and 500,000 ounces (on a 100% basis)

of gold annually during its first five years at CAS of between $575

and $675 per ounce and AISC of between $650 and $750 per ounce.

Newmont’s 75% share of development capital is estimated at between

$575 million and $625 million, with an expenditure of between $170

million and $210 million in 2016.

Long Canyon is an oxide ore body

that provides significant exploration upside potential in an

emerging district. The Phase 1 project is approximately 80%

complete and remains on budget and on schedule to reach commercial

production in the first quarter of 2017. This first phase of

development includes an open pit mine and heap leach operation.

Production is expected to average between 100,000 and 150,000

ounces per year at CAS of between $400 and $500 per ounce and AISC

of between $500 and $600 per ounce over an eight year mine life.

Approximately half of the total capital costs of between $250

million and $300 million will be spent in 2016 with minimal

spending in 2017.

Tanami Expansion Project includes

constructing a second decline in the mine and building incremental

capacity in the plant to increase profitable production and serve

as a platform for future expansion. The project is on budget and on

schedule to deliver additional production beginning in 2017. The

expansion expects to maintain annual gold production of between

425,000 and 475,000 ounces per year at CAS of between $550 and $600

per ounce and AISC of between $700 and $750 per ounce for the first

five years. The expansion will also increase mine life by three

years. Capital costs for the project are estimated at between $100

million and $120 million with approximately half of that amount

spent in 2016.

Northwest Exodus is a sustaining

capital underground extension in the Carlin North Area that is

expected to extend mine life by seven years, to produce incremental

gold production between 50,000 and 75,000 ounces per year in the

first five years, and to improve Carlin’s CAS by an average of $20

per ounce and AISC by an average of $25 per ounce. The project will

produce first gold in Q3 2016.

Ahafo Mill Expansion and Subika

Underground represent opportunities not currently included

in Newmont’s outlook. The two projects would increase profitable

production at Ahafo while lowering costs and offsetting the impacts

of lower grades and harder ore. Both projects will be reviewed in

the second half of 2016.

Outlook

Outlook excludes Batu Hijau for all periods for illustrative

purposes. The transaction is expected to close in the third quarter

following receipt of regulatory approvals and satisfaction of other

conditions precedent.

Attributable gold production is expected to increase from

between 4.7 and 5.0 million ounces in 2016 to between 4.9 and 5.4

million ounces in 2017, and remain stable at between 4.5 and 5.0

million ounces through 2020. New production at CC&V, Long

Canyon Phase 1, Northwest Exodus, Tanami and Merian is expected to

offset the impacts of maturing operations at Yanacocha and the sale

of Batu Hijau. Projects that are not yet approved, including Ahafo

Mill Expansion and Subika Underground, represent production upside

of between 200,000 and 300,000 ounces of gold beginning in

2018.

Attributable copper production is expected to be between

40,000 and 60,000 tonnes in 2016 and between 40,000 and 65,000

tonnes in 2017 and 2018, with stable production expected at Phoenix

Copper Leach and Boddington.

Gold cost outlook – CAS is expected to be between $630

and $680 per ounce in 2016, and remain stable at between $650 and

$750 per ounce in 2017 and 2018. Costs benefit from higher grades

at Carlin underground mines through 2017, and from lower cost

production at Tanami and Merian through 2018. Ongoing cost and

efficiency improvements are expected to offset lower grades and

throughput at Ahafo and maturing operations at Yanacocha. Full

Potential savings and lower cost ounces from projects that have yet

to be approved could further improve costs in 2017 and beyond.

AISC is expected to improve to between $870 and $930 per ounce

in 2016, holding relatively steady at between $850 and $950 per

ounce in 2017. Long term AISC guidance is improved to between $880

and $980 per ounce based on inclusion of Northwest Exodus and

improved oil price assumptions.

Copper cost outlook – Copper CAS is expected to be

between $1.80 and $2.00 per pound in 2016 and 2017 rising

temporarily to between $2.30 and $2.50 per pound in 2018 due to

stripping at Boddington. Copper AISC is expected to average between

$2.20 and $2.40 per pound in 2016 increasing to between $2.30 and

$2.60 in 2017 due to timing on sustaining capital spend. Copper

AISC is expected to increase to between $2.75 and $2.95 per pound

in 2018 due to stripping at Boddington.

Capital – 2016 capital is expected to be between $1.1 and

$1.3 billion including between $650 and $700 million of sustaining

capital. Sustaining capital is expected to increase to between $800

and $900 million in 2017 to cover equipment rebuilds, water

treatment and tailings storage facilities. Technical and

operational cost and efficiency improvements represent further

upside. Long-term sustaining capital is expected to remain stable

at between $700 and $800 million to cover infrastructure, equipment

and ongoing mine development.

Debt – The company expects approximately $260 to

$280 million of interest expense in 2016. Year-to-date, Newmont has

reduced debt by more than $600 million in 2016. The Company remains

on track to repay $800 million to $1.3 billion of debt between 2016

and 2018, targeting the highest rates and nearest-term maturities

first.

2016 Outlooka

Consolidated

Attributable Consolidated

Consolidated All-in

Sustaining

ConsolidatedTotal

Capital

Production Production CAS Costsb

Expenditures (Koz, Kt) (Koz,

Kt) ($/oz, $/lb) ($/oz, $/lb)

($M) North America Carlin 1,040 – 1,100 1,040

– 1,100 $750 – $800 $950 – $980 $190 – $210 Phoenixc 180 – 200 180

– 200 $825 – $875 $975 – $1,025 $20 – $30 Twin Creeksd 400 – 430

400 – 430 $550 – $600 $650 – $700 $25 – $35 CC&V 350 – 400 350

– 400 $500 – $550 $600 – $650 $80 – $90 Long Canyon $140 – $160

Other North America

$5 – $15

Total 1,970 –

2,130 1,970 – 2,130 $650

– $700 $825 – $900 $460

– $540 South America Yanacochae 630 –

660 310 – 350 $820 – $870 $1,100 – $1,170 $70 – $90 Merian

120 – 140 90 – 100 $430 – $460 $650 – $700

$210 – $250

Total 750 – 800

400 – 450 $760 – $810

$1,050 – $1,150 $280 –

$340 Asia Pacific Boddington 725 – 775 725 –

775 $660 – $700 $750 – $800 $60 – $70 Tanami 400 – 475 400 – 475

$500 – $550 $750 – $800 $150 – $160 Kalgoorlief 350 – 400 350 – 400

$650 – $700 $725 – $775 $10 – $20 Other Asia Pacific

$5 – $15

Total 1,475 – 1,650 1,475

– 1,650 $600 – $650 $760

– $820 $225 – $265

Africa Ahafo 330 – 360 330 – 360 $760 – $810 $990 – $1,070

$60 – $80 Akyem 430 – 460 430 – 460 $500 –

$540 $600 – $650 $20 – $30

Total 760

– 820 760 – 820 $615

– $665 $780 – $830 $80

– $110 Corporate/Other

$10 – $15

Total

Goldg

5,000 – 5,350

4,700 – 5,000 $630 –

$680 $870 – $930

$1,055 – $1,270 Batu Hijauh 525

– 575 250 – 275 $500 – $550 $650 – $700

$50 – $60

Total Gold with Batu 5,525 –

5,925 4,950 – 5,275

$625 – $675 $870 –

$930 $1,105 – $1,330

Phoenix 15 – 25 15 – 25 $1.90 – $2.10 $2.30 – $2.40 Boddington

25 – 35 25 – 35 $1.80 – $2.00 $2.20 –

$2.30

Total Copper 40 –

60 40 – 60 $1.80

– $2.00 $2.20 – $2.40

Batu Hijauh 170 – 190 80 – 100

$1.00 – $1.20 $1.40 – $1.60

Total

Copper with Batu 210 – 250

120 – 160 $1.20 –

$1.40 $1.50 – $1.70

Consolidated Expense Outlooki General

& Administrative $ 225 – $ 275 Interest Expense $ 260 – $ 280

DD&A $ 1,100 – $

1,175

Exploration and Projects $ 275 – $ 300 Sustaining Capital $ 650 – $

700 Tax Rate 33% – 37%

a2016 Outlook in the table above are considered “forward-looking

statements” and are based upon certain assumptions, including, but

not limited to, metal prices, oil prices, certain exchange rates

and other assumptions. For example, 2016 Outlook assumes $1,300/oz

Au, $2.00/lb Cu, $0.75 USD/AUD exchange rate and $50/barrel WTI;

AISC and CAS cost estimates do not include inflation, for the

remainder of the year. Production, AISC and capital estimates

exclude projects that have not yet been approved, (Twin

Underground, Batu Phase 7, Ahafo Mill Expansion and Subika

Underground). The potential impact on inventory valuation as a

result of lower prices, input costs, and project decisions are not

included as part of this Outlook. Such assumptions may prove to be

incorrect and actual results may differ materially from those

anticipated. See cautionary note at the end of the release.bAll-in

sustaining costs as used in the Company’s Outlook is a non-GAAP

metric defined as the sum of cost applicable to sales (including

all direct and indirect costs related to current gold production

incurred to execute on the current mine plan), remediation costs

(including operating accretion and amortization of asset retirement

costs), G&A, exploration expense, advanced projects and

R&D, treatment and refining costs, other expense, net of

one-time adjustments and sustaining capital. See reconciliation at

end of release.cIncludes Lone Tree operations.dIncludes TRJV

operations.eConsolidated production for Yanacocha is presented on a

total production basis for the mine site; attributable production

represents a 51.35% interest.fBoth consolidated and attributable

production are shown on a pro-rata basis with a 50% ownership for

Kalgoorlie.gProduction outlook does not include equity production

from stakes in TMAC (29.4%) or La Zanja (46.94%).hConsolidated

production for Batu Hijau is presented on a total production basis

for the mine site; whereas attributable production represents a

48.5% ownership interest in 2016 outlook. Outlook for Batu Hijau

remains subject to various factors, including, without limitation,

renegotiation of the CoW, issuance of future export approvals,

negotiations with the labor union, future in-country smelting

availability and regulations relating to export quotas, and certain

other factors.iConsolidated expense outlook is adjusted to exclude

extraordinary items. For example, the tax rate outlook above is a

consolidated adjusted rate, which assumes the exclusion of certain

tax valuation allowance adjustments. Beginning in 2016, regional

general and administrative expense is included in total general and

administrative expense (G&A) and community development cost is

included in CAS.

NEWMONT MINING

CORPORATIONSTATEMENTS OF CONSOLIDATED

INCOME(unaudited, in millions except per share)

Three Months Ended Six Months Ended June

30, June 30, 2016 2015

2016 2015 Sales $ 2,038 $ 1,908

$ 4,070 $ 3,880 Costs and expenses Costs applicable to sales

(1) 1,059 1,027 2,140 2,054 Depreciation and amortization 314 276

636 565 Reclamation and remediation 25 26 50 49 Exploration 38 48

68 81 Advanced projects, research and development 44 33 72 61

General and administrative 64 68 121 126 Other expense, net

19 27 37 44

1,563 1,505 3,124 2,980

Other income (expense) Other income, net — (23 ) 98 (12 )

Interest expense, net (71 ) (82 ) (150 )

(167 ) (71 ) (105 ) (52 ) (179 )

Income (loss) before income and mining tax and other items 404 298

894 721 Income and mining tax benefit (expense) (310 ) (152 ) (634

) (345 ) Equity income (loss) of affiliates (5 ) (7 )

(10 ) (16 ) Income (loss) from continuing operations

89 139 250 360 Income (loss) from discontinued operations

(27 ) 9 (53 ) 17 Net income

(loss) 62 148 197 377 Net loss (income) attributable to

noncontrolling interests (39 ) (76 ) (122 )

(122 ) Net income (loss) attributable to Newmont

stockholders $ 23 $ 72 $ 75 $ 255

Net income (loss) attributable to Newmont stockholders:

Continuing operations $ 50 $ 63 $ 128 $ 238 Discontinued operations

(27 ) 9 (53 ) 17 $ 23

$ 72 $ 75 $ 255 Income (loss) per

common share Basic: Continuing operations $ 0.09 $ 0.13 $ 0.24 $

0.48 Discontinued operations (0.05 ) 0.01

(0.10 ) 0.03 $ 0.04 $ 0.14 $

0.14 $ 0.51 Diluted: Continuing operations $ 0.09 $

0.13 $ 0.24 $ 0.48 Discontinued operations (0.05 )

0.01 (0.10 ) 0.03 $ 0.04 $ 0.14

$ 0.14 $ 0.51 Cash dividends declared

per common share $ 0.025 $ 0.025 $ 0.050 $ 0.050

(1) Excludes Depreciation and amortization

and Reclamation and remediation.

NEWMONT MINING

CORPORATIONSTATEMENTS OF CONSOLIDATED CASH

FLOWS(unaudited, in millions)

Three Months Ended Six Months

Ended June 30, June 30, 2016

2015 2016 2015 Operating

activities: Net income (loss) $ 62 $ 148 $ 197 $ 377 Adjustments:

Depreciation and amortization 314 276 636 565 Stock-based

compensation 21 20 37 40 Reclamation and remediation 24 24 48 47

Loss (income) from discontinued operations 27 (9 ) 53 (17 )

Impairment of investments — 16 — 73 Deferred income taxes 288 69

441 130 Gain on asset and investment sales, net — 1 (104 ) (43 )

Other operating adjustments and impairments 89 91 181 165 Net

change in operating assets and liabilities (45 ) (195

) (185 ) (268 ) Net cash provided by continuing

operating activities 780 441 1,304 1,069 Net cash used in

discontinued operations (3 ) (3 ) (5 )

(6 ) Net cash provided by operating activities 777

438 1,299 1,063 Investing

activities: Additions to property, plant and mine development (294

) (322 ) (591 ) (606 ) Proceeds from sales of investments — — 184

29 Proceeds from sales of other assets 2 — 8 44 Other (2 )

(3 ) (6 ) (6 ) Net cash used in investing

activities (294 ) (325 ) (405 ) (539 )

Financing activities: Repayment of debt (142 ) (76 ) (641 ) (281 )

Proceeds from stock issuance, net — 675 — 675 Proceeds from sale of

noncontrolling interests — — — 37 Funding from noncontrolling

interests 38 15 50 62 Dividends paid to noncontrolling interests —

— (146 ) (3 ) Dividends paid to common stockholders (14 ) (11 ) (27

) (23 ) Increase in restricted cash, net 78 (4 ) (13 ) (59 ) Other

— (3 ) (1 ) (8 ) Net cash (used

in) provided by financing activities (40 ) 596

(778 ) 400 Effect of exchange rate changes on

cash (2 ) 1 4 (19 ) Net

change in cash and cash equivalents 441 710 120 905 Cash and cash

equivalents at beginning of period 2,461 2,598

2,782 2,403 Cash and cash

equivalents at end of period $ 2,902 $ 3,308 $ 2,902

$ 3,308

NEWMONT MINING

CORPORATIONCONSOLIDATED BALANCE SHEETS(unaudited, in

millions)

At June 30, At December 31, 2016

2015 ASSETS Cash and cash equivalents $

2,902 $ 2,782 Trade receivables 315 260 Other accounts receivables

194 185 Investments 46 19 Inventories 728 710 Stockpiles and ore on

leach pads 953 896 Other current assets 156

131 Current assets 5,294 4,983 Property, plant and mine

development, net 14,234 14,303 Investments 237 402 Stockpiles and

ore on leach pads 2,956 3,000 Deferred income tax assets 1,264

1,718 Other non-current assets 718 730

Total assets $ 24,703 $ 25,136

LIABILITIES Debt $ 196 $ 149 Accounts payable 348 396

Employee-related benefits 211 293 Income and mining taxes payable

126 38 Other current liabilities 479 540

Current liabilities 1,360 1,416 Debt 5,375 6,041 Reclamation

and remediation liabilities 1,835 1,800 Deferred income tax

liabilities 926 840 Employee-related benefits 463 437 Other

non-current liabilities 361 310 Total

liabilities 10,320 10,844

EQUITY Common stock 849 847 Additional paid-in capital 9,457

9,427 Accumulated other comprehensive income (loss) (341 ) (334 )

Retained earnings 1,458 1,410 Newmont

stockholders' equity 11,423 11,350 Noncontrolling interests

2,960 2,942 Total equity 14,383

14,292 Total liabilities and equity $ 24,703 $

25,136

Regional Operating Statistics

Consolidated gold Attributable

gold ounces produced ounces produced

(thousands): (thousands): Three Months Ended

Three Months Ended June 30, June 30,

2016 2015 2016 2015 North

America Carlin

204 200

204 200 Phoenix

45

52

45 52 Twin Creeks

114 125

114 125 CC&V

114 —

114 —

477 377

477 377

South America Yanacocha

156 216

81 111

156 216

81 111

Asia Pacific Boddington

192 201

192 201 Tanami

142 116

142 116

Waihi

— 33

— 33 Kalgoorlie

96 83

96 83

Batu Hijau

189 181

92 87

619 614

522

520

Africa Ahafo

90 74

90 74 Akyem

115

121

115 121

205 195

205 195

1,457 1,402

1,285 1,203

Consolidated copper pounds produced

(millions): Phoenix

10 12

10 12 Boddington

19 20

19 20 Batu Hijau

115 125

56 60

144 157

85 92

Consolidated copper tonnes produced

(thousands): Phoenix

5 6

5 6 Boddington

8

9

8 9 Batu Hijau

53 57

25 27

66 72

38 42

Non-GAAP Financial Measures

Non-GAAP financial measures are intended to provide additional

information only and do not have any standard meaning prescribed by

generally accepted accounting principles (GAAP). These measures

should not be considered in isolation or as a substitute for

measures of performance prepared in accordance with GAAP.

Adjusted net income (loss)

Management uses Adjusted net income (loss) to evaluate the

Company’s operating performance, and for planning and forecasting

future business operations. The Company believes the use of

Adjusted net income (loss) allows investors and analysts to

understand the results of the continuing operations of the Company

and its direct and indirect subsidiaries relating to the production

and sale of minerals, by excluding certain items that have a

disproportionate impact on our results for a particular period. The

net income (loss) adjustments are presented net of tax generally at

the Company’s statutory effective tax rate of 35% and net of our

partners’ noncontrolling interests when applicable. The impact

of the adjustments through the Company’s Valuation allowance is

shown separately. The tax adjustment includes items such as

foreign tax credits, alternative minimum tax credits, capital

losses and disallowed foreign losses. Management’s determination of

the components of Adjusted net income (loss) are evaluated

periodically and based, in part, on a review of non-GAAP financial

measures used by mining industry analysts. Net income (loss)

attributable to Newmont stockholders is reconciled to Adjusted net

income (loss) as follows:

Three Months Ended Six Months

Ended June 30, June 30, 2016 2015

2016 2015 Net income (loss)

attributable to Newmont stockholders $ 23 $ 72 $ 75 $ 255 Loss

(income) from discontinued operations (1) 27 (9 )

53 (17 ) Net income (loss) attributable to

Newmont stockholders from continuing operations 50 63 128 238

Impairment of investments (2) — 10 — 47 Impairment of long-lived

assets (3) 2 2 2 2 Restructuring and other (4) 4 5 11 7 Acquisition

costs (5) 1 5 1 5 Loss (gain) on asset and investment sales (6) — 1

(104 ) (27 ) Loss on debt repayment (7) — — 2 — Tax adjustments (8)

174 45 373 89

Adjusted net income (loss) $ 231 $ 131 $ 413 $ 361

Net income (loss) per share, basic $ 0.04 $ 0.14 $

0.14 $ 0.51 Loss (income) from discontinued operations, net of

taxes 0.05 (0.01 ) 0.10 (0.03 )

Net income (loss) attributable to Newmont stockholders from

continuing operations 0.09 0.13 0.24 0.48 Impairment of

investments, net of taxes — 0.02 — 0.09 Impairment of long-lived

assets, net of taxes — — — — Restructuring and other, net of taxes

0.01 0.01 0.02 0.01 Acquisition costs, net of taxes — 0.01 — 0.01

Loss (gain) on asset and investment sales, net of taxes — — (0.20 )

(0.05 ) Loss on debt repayment, net of taxes — — — — Tax

adjustments 0.34 0.09 0.72

0.18 Adjusted net income (loss) per share, basic $

0.44 $ 0.26 $ 0.78 $ 0.72 Net income

(loss) per share, diluted $ 0.04 $ 0.14 $ 0.14 $ 0.51 Loss (income)

from discontinued operations, net of taxes 0.05 (0.01

) 0.10 (0.03 ) Net income (loss) attributable

to Newmont stockholders from continuing operations 0.09 0.13 0.24

0.48 Impairment of investments, net of taxes — 0.02 — 0.09

Impairment of long-lived assets, net of taxes — — — — Restructuring

and other, net of taxes 0.01 0.01 0.02 0.01 Acquisition costs, net

of taxes — 0.01 — 0.01 Loss (gain) on asset and investment sales,

net of taxes — — (0.20 ) (0.05 ) Loss on debt repayment, net of

taxes — — — — Tax adjustments 0.34 0.09

0.72 0.18 Adjusted net income (loss) per

share, diluted $ 0.44 $ 0.26 $ 0.78 $ 0.72 (1)

Loss (income) from discontinued operations relates to

adjustments in our Holt property royalty and is presented net of

tax expense (benefit) of $(12), $4, $(23) and $8, respectively. (2)

Impairment of investments, included in Other income, net,

represents other-than-temporary impairments on equity and cost

method investments and does not relate to our core operations.

Amounts are presented net of tax expense (benefit) of $-, $(6), $-

and $(26), respectively. (3) Impairment of long-lived assets,

included in Other expense, net, represents non-cash write-downs

that do not impact our core operations. Amounts are presented net

of tax expense (benefit) of $(1), $-, $(1) and $(1), respectively,

and amounts attributed to noncontrolling interest income (expense)

of $(1), $-, $(1) and $-, respectively. (4) Restructuring and

other, included in Other expense, net, represents certain costs

associated with the Full Potential initiative announced in 2013, a

one-time payment to PT Freeport Indonesia for engineering studies

related to their smelter project in the second quarter of 2016,

accrued legal costs in our Africa region during 2016 as well as

system integration costs related to our acquisition of CC&V.

Amounts are presented net of tax expense (benefit) of $(3), $(3),

$(8) and $(5), respectively, and amounts attributed to

noncontrolling interest income (expense) of $(2), $(1), $(3) and

$(2), respectively. (5) Acquisition costs, included in Other

expense, net, represents adjustments made in the second quarter of

2016 to the contingent consideration liability from the acquisition

of Boddington and costs associated with the acquisition of CC&V

in 2015. Amounts are presented net of tax expense (benefit) of

$(1), $(3), $(1) and $(3), respectively. (6) Loss (gain) on asset

and investment sales, included in Other income, net, primarily

represents the sale of our holdings in Regis Resources Ltd. in the

first quarter of 2016 and land sales of Hemlo mineral rights in

Canada and the Relief Canyon mine in Nevada during the first

quarter of 2015. Amounts are presented net of tax expense (benefit)

of $-, $-, $- and $16, respectively. (7) Loss on debt repayment,

included in Other income, net and Interest expense, net, represents

the impact of the debt tender offer on our 2019 Notes and 2039

Notes during the first quarter of 2016. Amounts are presented net

of tax expense (benefit) of $-, $-, $(1) and $-, respectively. (8)

Tax adjustments include movements in tax valuation allowance and

tax adjustments not related to core operations. Second quarter and

year to date tax adjustments were primarily the result of a tax

restructuring and a loss carryback, both of which resulted in an

increase in the Company’s valuation allowance on credits.

Adjusted Earnings Before Interest, Taxes, Depreciation, and

Amortization (Adjusted EBITDA)

Management uses Earnings before interest, taxes and depreciation

and amortization (“EBITDA”) and EBITDA adjusted for non-core or

certain items that have a disproportionate impact on our results

for a particular period (“Adjusted EBITDA”) as non-GAAP measures to

evaluate the Company’s operating performance. EBITDA and Adjusted

EBITDA do not represent, and should not be considered an

alternative to, net earnings (loss), operating earnings (loss), or

cash flow from operations as those terms are defined by GAAP, and

does not necessarily indicate whether cash flows will be sufficient

to fund cash needs. Although Adjusted EBITDA and similar measures

are frequently used as measures of operations and the ability to

meet debt service requirements by other companies, our calculation

of Adjusted EBITDA is not necessarily comparable to such other

similarly titled captions of other companies. The Company believes

that Adjusted EBITDA provides useful information to investors and

others in understanding and evaluating our operating results in the

same manner as our management and board of

directors. Management’s determination of the components

of Adjusted EBITDA are evaluated periodically and based,

in part, on a review of non-GAAP financial measures used by mining

industry analysts. Net income (loss) attributable to Newmont

stockholders is reconciled

to EBITDA and Adjusted EBITDA as follows:

Three Months Ended Six Months

Ended June 30, June 30, 2016 2015

2016 2015 Net income (loss)

attributable to Newmont stockholders $ 23 $ 72 $ 75 $ 255 Net

income (loss) attributable to noncontrolling interests 39 76 122

122 Loss (income) from discontinued operations 27 (9 ) 53 (17 )

Equity loss (income) of affiliates 5 7 10 16 Income and mining tax

expense (benefit) 310 152 634 345 Depreciation and amortization 314

276 636 565 Interest expense, net 71 82

150 167 EBITDA $ 789 $ 656 $ 1,680 $ 1,453

Adjustments: Impairment of investments (1) $ — $ 16 $ — $ 73

Impairment of long-lived assets (2) 4 2 4 3 Restructuring and other

(3) 9 9 22 14 Acquisitions costs (4) 2 8 2 8 Loss on debt repayment

(5) — — 3 — Loss (gain) on asset and investment sales (6) —

1 (104 ) (43 ) Adjusted EBITDA $ 804 $

692 $ 1,607 $ 1,508 (1) Impairment of

investments, included in Other income, net, represents

other-than-temporary impairments on equity and cost method

investments and does not relate to our core operations. (2)

Impairment of long-lived assets, included in Other expense, net,

represents non-cash write-downs that do no impact our core

operations. (3) Restructuring and other, included in Other expense,

net, represents certain costs associated with the Full Potential

initiative announced in 2013, a one-time payment to PT Freeport

Indonesia for engineering studies related to their smelter project

in the second quarter of 2016, accrued legal costs in our Africa

region during 2016 as well as system integration costs related to

our acquisition of CC&V. (4) Acquisition costs, included in

Other expense, net represents adjustments made in the second

quarter of 2016 to the contingent consideration liability from the

acquisition of Boddington, and costs associated with the

acquisition of CC&V in 2015. (5) Loss on debt repayment,

included in Other income, net and Interest expense, net, represents

the impact of the debt tender offer on our 2019 Notes and 2039

Notes during the first quarter of 2016. (6) Loss (gain) on asset

and investment sales, included in Other income, net, represents

primarily the sale of our holdings in Regis Resources Ltd. in the

first quarter of 2016 and land sales of Hemlo mineral rights in

Canada and the Relief Canyon mine in Nevada during the first

quarter of 2015.

Free Cash Flow

Management uses Free Cash Flow as a non-GAAP measure to analyze

cash flows generated from operations. Free Cash Flow is Net cash

provided by operating activities plus Net cash used in discontinued

operations less Additions to property, plant and mine development

as presented on the Condensed Consolidated Statements of Cash Flow.

The Company believes Free Cash Flow is also useful as one of the

bases for comparing the Company’s performance with its competitors.

Although Free Cash Flow and similar measures are frequently used as

measures of cash flows generated from operations by other

companies, the Company’s calculation of Free Cash Flow is not

necessarily comparable to such other similarly titled captions of

other companies.

The presentation of non-GAAP Free Cash Flow is not meant to be

considered in isolation or as an alternative to net income as an

indicator of the Company’s performance, or as an alternative to

cash flows from operating activities as a measure of liquidity as

those terms are defined by GAAP, and does not necessarily indicate

whether cash flows will be sufficient to fund cash needs. The

Company’s definition of Free Cash Flow is limited in that it does

not represent residual cash flows available for discretionary

expenditures due to the fact that the measure does not deduct the

payments required for debt service and other contractual

obligations or payments made for business acquisitions. Therefore,

the Company believes it is important to view Free Cash Flow as a

measure that provides supplemental information to the Company’s

Condensed Consolidated Statements of Cash Flow.

The following table sets forth a reconciliation of Free Cash

Flow, a non-GAAP financial measure, to Net cash provided by

operating activities, which the Company believes to be the GAAP

financial measure most directly comparable to Free Cash Flow, as

well as information regarding net cash used in investing activities

and net cash used in financing activities.

Three Months Ended Six Months

Ended June 30, June 30, 2016

2015 2016 2015 Net cash

provided by operating activities $ 777 $ 438 $ 1,299 $ 1,063 Plus:

Net cash used in discontinued operations 3 3

5 6 Net cash provided by

continuing operating activities 780 441

1,304 1,069 Less: Additions to

property, plant and mine development (294 ) (322 )

(591 ) (606 ) Free Cash Flow $ 486 $ 119

$ 713 $ 463 Net cash (used in)

investing activities (1) $ (294 ) $ (325 ) $ (405 ) $ (539 ) Net

cash (used in) provided by financing activities $ (40 ) $ 596 $

(778 ) $ 400 (1)

Net cash used in investing activities

includes Additions to property, plant and mine development, which

is included in the Company’s computation of Free Cash Flow.

Costs applicable to sales per ounce/pound

Costs applicable to sales per ounce/pound are non-GAAP financial

measures. These measures are calculated by dividing the costs

applicable to sales of gold and copper by gold ounces or copper

pounds sold, respectively. These measures are calculated on a

consistent basis for the periods presented on a consolidated basis.

Costs applicable to sales per ounce/pound statistics are intended

to provide additional information only and do not have any

standardized meaning prescribed by GAAP and should not be

considered in isolation or as a substitute for measures of

performance prepared in accordance with GAAP. The measures are not

necessarily indicative of operating profit or cash flow from

operations as determined under GAAP. Other companies may calculate

these measures differently.

The following tables reconcile these non-GAAP measures to the

most directly comparable GAAP measures.

Costs applicable to sales per ounce

Three Months Ended Six Months

Ended June 30, June 30, 2016 2015

2016 2015 Costs applicable to sales (1) $ 912 $ 858 $

1,818 $ 1,698 Gold sold (thousand ounces) 1,429 1,337 2,850 2,704

Costs applicable to sales per ounce $ 637 $ 642 $ 638 $ 628

(1)

Includes by-product credits of $14 and $27 during the three

and six months ended June 30, 2016, respectively, and $12 and $26

during the three and six months ended June 30, 2015, respectively.

Costs applicable to sales per pound

Three Months Ended Six Months

Ended June 30, June 30, 2016 2015

2016 2015 Costs applicable to sales (1) $ 147 $ 169 $

322 $ 356 Copper sold (million pounds) 122 139 289 278 Costs

applicable to sales per pound $ 1.21 $ 1.21 $ 1.12 $ 1.28

(1)

Includes by-product credits of $6 and $13 during the three

and six months ended June 30, 2016, respectively, and $5 and $11

during the three and six months ended June 30, 2015, respectively.

All-In Sustaining Costs

Newmont has worked to develop a metric that expands on GAAP

measures such as cost of goods sold and non-GAAP measures, such as

Costs applicable to sales per ounce, to provide visibility into the

economics of our mining operations related to expenditures,

operating performance and the ability to generate cash flow from

operations.

Current GAAP-measures used in the mining industry, such as cost

of goods sold, do not capture all of the expenditures incurred to

discover, develop, and sustain gold production. Therefore, we

believe that all-in sustaining costs is a non-GAAP measure that

provides additional information to management, investors, and

analysts that aid in the understanding of the economics of our

operations and performance compared to other producers and in the

investor’s visibility by better defining the total costs associated

with production.

All-in sustaining cost (“AISC”) amounts are intended to provide

additional information only and do not have any standardized

meaning prescribed by GAAP and should not be considered in

isolation or as a substitute for measures of performance prepared

in accordance with GAAP. The measures are not necessarily

indicative of operating profit or cash flow from operations as

determined under GAAP. Other companies may calculate these measures

differently as a result of differences in the underlying accounting

principles, policies applied and in accounting frameworks such as

in International Financial Reporting Standards (“IFRS”), or by

reflecting the benefit from selling non-gold metals as a reduction

to AISC. Differences may also arise related to definitional

differences of sustaining versus development capital activities

based upon each company’s internal policies.

The following disclosure provides information regarding the

adjustments made in determining the all-in sustaining costs

measure:

Cost Applicable to Sales - Includes all direct and indirect

costs related to current gold production incurred to execute the

current mine plan. Costs Applicable to Sales (“CAS”)

includes by-product credits from certain metals obtained during the

process of extracting and processing the primary ore-body. CAS is

accounted for on an accrual basis and

excludes Amortization and Reclamation and

remediation, which is consistent with our presentation of CAS on

the Statement of Consolidated Income. In determining AISC, only the

CAS associated with producing and selling an ounce of gold is

included in the measure. Therefore, the amount of gold CAS included

in AISC is derived from the CAS presented in the Company’s

Statement of Consolidated Income less the amount of CAS

attributable to the production of copper at our Phoenix, Boddington

and Batu Hijau mines. The copper CAS at those mine sites is

disclosed in Note 4 to the Condensed Consolidated Financial

Statements. The allocation of CAS between gold and copper at the

Phoenix, Boddington and Batu Hijau mines is based upon the relative

sales percentage of copper and gold sold during the period.

Remediation Costs - Includes accretion expense related to asset

retirement obligations (“ARO”) and the amortization of the related

Asset Retirement Cost (“ARC”) for the Company’s operating

properties recorded as an ARC asset. Accretion related to ARO and

the amortization of the ARC assets for reclamation and remediation

do not reflect annual cash outflows but are calculated in

accordance with GAAP. The accretion and amortization reflect the

periodic costs of reclamation and remediation associated with

current gold production and are therefore included in the measure.

The allocation of these costs to gold and copper is determined

using the same allocation used in the allocation of CAS between

gold and copper at the Phoenix, Boddington and Batu Hijau

mines.

Advanced Projects and Exploration - Includes incurred expenses

related to projects that are designed to increase or enhance

current gold production and gold exploration. We note that as

current resources are depleted, exploration and advanced projects

are necessary for us to replace the depleting reserves or enhance

the recovery and processing of the current reserves. As this

relates to sustaining our gold production, and is considered a

continuing cost of a mining company, these costs are included in

the AISC measure. These costs are derived from the Advanced

projects, research and

development and Exploration amounts presented in the

Company’s Statement of Consolidated Income less the amount

attributable to the production of copper at our Phoenix, Boddington

and Batu Hijau mines. The allocation of these costs to gold and

copper is determined using the same allocation used in the

allocation of CAS between gold and copper at the Batu Hijau,

Boddington and Phoenix mines.

General and Administrative - Includes cost related to

administrative tasks not directly related to current gold

production, but rather related to support our corporate structure

and fulfilling our obligations to operate as a public company.

Including these expenses in the AISC metric provides visibility of

the impact that general and administrative activities have on

current operations and profitability on a per ounce basis.

Other expense, net - Includes administrative costs to support

current gold production. We exclude certain exceptional or unusual

expenses from Other expense, net, such as restructuring, as

these are not indicative to sustaining our current gold operations.

Furthermore, this adjustment to Other expense, net is

also consistent with the nature of the adjustments made to Net

income (loss) as disclosed in the Company’s non-GAAP financial

measure Adjusted net income (loss). The allocation of these costs

to gold and copper is determined using the same allocation used in

the allocation of CAS between gold and copper at the Phoenix,

Boddington and Batu Hijau mines.

Treatment and Refining Costs - Includes costs paid to smelters

for treatment and refining of our concentrates to produce the

salable metal. These costs are presented net as a reduction

of Sales.

Sustaining Capital - We determined sustaining capital as those

capital expenditures that are necessary to maintain current gold

production and execute the current mine plan. Capital expenditures

to develop new operations, or related to projects at existing

operations where these projects will enhance gold production or

reserves, are considered development. We determined the breakout of

sustaining and development capital costs based on a systematic

review of our project portfolio in light of the nature of each

project. Sustaining capital costs are relevant to the AISC metric

as these are needed to maintain the Company’s current gold

operations and provide improved transparency related to our ability

to finance these expenditures from current operations. The

allocation of these costs to gold and copper is determined using

the same allocation used in the allocation of CAS between gold and

copper at the Batu Hijau, Boddington and Phoenix mines.

Advanced Treatment All-In Costs

Projects General Other and

All-In Ounces Sustaining Three Months

Ended Applicable Reclamation and

and Expense, Refining Sustaining

Sustaining (000)/Pounds Costs per June 30,

2016 to Sales (1)(2)(3) Costs (4)

Exploration Administrative Net (5)

Costs Capital (6) Costs (millions)

Sold oz/lb Gold Carlin $ 184 $ 1 $ 4 $ 2 $ — $ —

$ 38 $ 229 203 $ 1,128 Phoenix 39 1 1 1 — 2 3 47 50 940 Twin Creeks

58 1 2 — — — 12 73 115 635 Long Canyon — — 7 — — — — 7 — — CC&V

(7) 58 1 1 1 — — 2 63 115 548 Other North America — —

5 — — 1 2 8 — —

North America 339 4 20 4 —

3 57 427 483 884 Yanacocha 120

14 11 2 1 1 24 173 154 1,123 Merian — — 11 — — — — 11 — — Other

South America — — 10 — —

— — 10 — — South America 120 14

32 2 1 1 24 194 154

1,260 Boddington 141 2 — — — 5 10 158 198 798 Tanami

64 — 3 — — — 20 87 144 604 Kalgoorlie 67 1 2 — — 2 5 77 96 802 Batu

Hijau 65 4 — 1 — 8 4 82 148 554 Other Asia Pacific —

— 2 5 2 — 1 10 — —

Asia Pacific 337 7 7 6 2

15 40 414 586 706 Ahafo 60 1 7 — — — 16

84 91 923 Akyem 56 2 3 — — — 5 66 115 574 Other Africa —

— — 1 — — — 1 —

— Africa 116 3 10 1 —

— 21 151 206 733 Corporate and

Other — — 13 50 1 —

2 66 — — Total Gold $ 912 $ 28 $ 82 $ 63 $ 4 $

19 $ 144 $ 1,252 1,429 $ 876

Copper Phoenix $ 22 $ —

$ — $ — $ — $ 1 $ 2 $ 25 11 $ 2.27 Boddington 33 — — — — 3 2 38 18

2.11 Batu Hijau 92 6 — 1 —

18 7 124 93 1.33 Asia Pacific

125 6 — 1 — 21 9

162 111 1.46 Total Copper $ 147 $ 6 $ — $ 1 $ — $ 22 $ 11 $

187 122 $ 1.53

Consolidated $ 1,059 $ 34 $ 82 $ 64 $ 4 $ 41 $ 155 $ 1,439 (1)

Excludes Depreciation and amortization and

Reclamation and remediation.

(2) Includes by-product credits of $20. (3) Includes stockpile and

leach pad inventory adjustments of $23 at Carlin, $8 at Twin Creeks

and $26 at Yanacocha. (4) Reclamation costs include operating

accretion of $23 and amortization of asset retirement costs of $11.

(5) Other expense, net is adjusted for restructuring costs of $9,

acquisition costs of $2 and write-downs of $4. (6) Excludes

development capital expenditures, capitalized interest and the

increase in accrued capital of $139. The following are major

development projects: Merian, Long Canyon, and the CC&V and the

Tanami expansion. (7) The Company acquired the CC&V gold mining

business on August 3, 2015.

Advanced Treatment

All-In Costs Projects

General Other and All-In Ounces

Sustaining Three Months Ended Applicable

Reclamation and and Expense,

Refining Sustaining Sustaining

(000)/Pounds Costs per June 30, 2015 to

Sales (1)(2)(3) Costs (4)

Exploration Administrative Net (5)

Costs Capital (6) Costs (millions)

Sold oz/lb Gold Carlin $ 187 $ 1 $ 4 $ 2 $ — $ —

$ 38 $ 232 204 $ 1,137 Phoenix 32 2 — — — 1 5 40 43 930 Twin Creeks

65 — 3 1 — — 12 81 125 648 Long Canyon — — 3 — — — — 3 — — Other

North America — — 4 — 1 —

1 6 — — North America 284 3

14 3 1 1 56 362 372

973 Yanacocha 130 24 8 6 1 — 19 188 204 922 Merian —

— 3 — — — — 3 — — Other South America — — 12

— 1 — — 13 — — South

America 130 24 23 6 2 —

19 204 204 1,000 Boddington 122 2 — 1 —

4 15 144 175 823 Tanami 59 1 2 — — — 23 85 117 726 Waihi (7) 18 — 1

— — — 1 20 33 606 Kalgoorlie 78 2 1 — — 1 4 86 86 1,000 Batu Hijau

73 3 2 — — 9 7 94 156 603 Other Asia Pacific — —

1 3 2 — 2 8 — —

Asia Pacific 350 8 7 4 2

14 52 437 567 771 Ahafo 43 3 5 — 1 — 17

69 72 958 Akyem 51 1 4 1 — — 8 65 122 533 Other Africa —

— 1 3 — — — 4 —

— Africa 94 4 10 4 1

— 25 138 194 711 Corporate and

Other — — 24 49 1 —

— 74 — — Total Gold $ 858 $ 39 $ 78 $ 66 $ 7 $

15 $ 152 $ 1,215 1,337 $ 909

Copper Phoenix $ 17 $ —

$ 1 $ — $ — $ 2 $ 2 $ 22 9 $ 2.44 Boddington 29 1 — — — 3 3 36 18

2.00 Batu Hijau 123 5 2 2 1

20 13 166 112 1.48 Asia Pacific

152 6 2 2 1 23 16

202 130 1.55 Total Copper $ 169 $ 6 $ 3 $ 2 $ 1 $ 25 $ 18 $

224 139 $ 1.61

Consolidated $ 1,027 $ 45 $ 81 $ 68 $ 8 $ 40 $ 170 $ 1,439 (1)

Excludes Depreciation and amortization and

Reclamation and remediation.

(2) Includes by-product credits of $17. (3) Includes stockpile and

leach pad inventory adjustments of $27 at Carlin, $3 at Twin Creeks

and $18 at Yanacocha. (4) Reclamation costs include operating

accretion of $21 and amortization of asset retirement costs of $24.

(5) Other expense, net is adjusted for restructuring costs of $9,

acquisition costs of $8 and write-downs of $2. (6) Excludes

development capital expenditures, capitalized interest and the

increase in accrued capital of $152. The following are major

development projects: Turf Vent Shaft, Merian, and Conga. (7) On

October 29, 2015, the Company sold the Waihi mine.

Advanced Treatment

All-In Costs

Projects General Other and

All-In Ounces Sustaining Six Months

Ended Applicable Reclamation and

and Expense, Refining Sustaining

Sustaining (000)/Pounds Costs per June 30,

2016 to Sales (1)(2)(3) Costs (4)

Exploration Administrative Net (5)

Costs Capital (6) Costs (millions)

Sold oz/lb Gold Carlin $ 373 $ 2 $ 7 $ 3 $ — $ —

$ 70 $ 455 411 $ 1,107 Phoenix 88 2 1 1 — 5 5 102 103 990 Twin

Creeks 118 2 4 — — — 18 142 251 566 Long Canyon — — 13 — — — — 13 —

— CC&V (7) 91 2 4 1 — — 2 100 170 588 Other North America

— — 6 — 2 1 2

11 — — North America 670 8 35

5 2 6 97 823 935 880

Yanacocha 248 28 20 5 2 1 38 342 333 1,027 Merian — — 14 — —

— — 14 — — Other South America — — 16 2

— — — 18 — — South America

248 28 50 7 2 1 38

374 333 1,123 Boddington 252 3 — — — 10 19 284

361 787 Tanami 123 1 6 — — — 34 164 245 669 Kalgoorlie 132 2 3 — —

3 8 148 184 804 Batu Hijau 165 8 1 4 — 19 8 205 384 534 Other Asia

Pacific — — 3 8 3 —

1 15 — — Asia Pacific 672 14

13 12 3 32 70 816 1,174

695 Ahafo 117 3 12 — — — 26 158 178 888 Akyem 111 4 4

— — — 12 131 230 570 Other Africa — — 1

2 — — — 3 — — Africa 228

7 17 2 — — 38 292

408 716 Corporate and Other — —

25 93 2 — 4 124 — — Total

Gold $ 1,818 $ 57 $ 140 $ 119 $ 9 $ 39 $ 247 $ 2,429 2,850 $ 852

Copper Phoenix $ 44 $ 1 $ — $ — $ — $ 2 $ 3 $ 50 21 $

2.38 Boddington 56 — — — — 6 4 66 33 2.00 Batu Hijau 222

11 — 2 — 46 12 293

235 1.25 Asia Pacific 278 11 — 2

— 52 16 359 268 1.34 Total

Copper $ 322 $ 12 $ — $ 2 $ — $ 54 $ 19 $ 409 289 $ 1.42

Consolidated $ 2,140 $ 69

$ 140 $ 121 $ 9 $ 93 $ 266 $ 2,838 (1)

Excludes Depreciation and amortization and

Reclamation and remediation.

(2) Includes by-product credits of $40. (3) Includes stockpile and

leach pad inventory adjustments of $43 at Carlin, $10 at Twin

Creeks and $54 at Yanacocha. (4) Reclamation costs include

operating accretion of $46 and amortization of asset retirement

costs of $23. (5) Other expense, net is adjusted for restructuring

costs of $22, acquisition costs of $2 and write-downs of $4. (6)

Excludes development capital expenditures, capitalized interest and

the increase in accrued capital of $325. The following are major

development projects: Merian, Long Canyon, and the CC&V and the

Tanami expansion. (7) The Company acquired the CC&V gold mining

business on August 3, 2015.

Advanced Treatment

All-In Costs Projects

General Other and All-In Ounces

Sustaining Six Months Ended Applicable

Reclamation and and Expense,

Refining Sustaining Sustaining

(000)/Pounds Costs per June 30, 2015 to

Sales (1)(2)(3) Costs (4)

Exploration Administrative Net (5)

Costs Capital (6) Costs (millions)

Sold oz/lb Gold Carlin $ 365 $ 2 $ 7 $ 4 $ — $ —

$ 75 $ 453 431 $ 1,051 Phoenix 73 3 1 1 — 2 9 89 95 937 Twin Creeks

124 1 5 1 — — 30 161 247 652 Long Canyon — — 6 — — — — 6 — — Other

North America — — 6 — 3 —

2 11 — — North America 562 6

25 6 3 2 116 720 773

931 Yanacocha 245 49 13 10 1 — 34 352 450 782 Merian

— — 5 — — — — 5 — — Other South America — — 22

— 1 — — 23 — — South

America 245 49 40 10 2 —

34 380 450 844 Boddington 279 5 1 1 —

11 24 321 377 851 Tanami 117 2 3 — — — 37 159 215 740 Waihi (7) 37

1 2 — — — 1 41 74 554 Kalgoorlie 138 3 1 — — 2 11 155 147 1,054

Batu Hijau 124 5 2 1 — 18 13 163 260 627 Other Asia Pacific

— — 2 6 5 — 2 15 —

— Asia Pacific 695 16 11 8

5 31 88 854 1,073 796

Ahafo 99 4 11 — 1 — 29 144 172 837 Akyem 97 2 4 — 1 — 19 123 236

521 Other Africa — — 2 5 —

— — 7 — — Africa 196 6

17 5 2 — 48 274 408

672 Corporate and Other — — 45

94 7 — 3 149 — — Total

Gold $ 1,698 $ 77 $ 138 $ 123 $ 19 $ 33 $ 289 $ 2,377 2,704 $ 879

Copper Phoenix $ 42 $ 1 $ 1 $ 1 $ — $ 1 $ 5 $ 51 22 $

2.32 Boddington 68 1 — — — 7 5 81 38 2.13 Batu Hijau 246

9 3 2 — 44 27 331

218 1.52 Asia Pacific 314 10 3 2

— 51 32 412 256 1.61 Total

Copper $ 356 $ 11 $ 4 $ 3 $ — $ 52 $ 37 $ 463 278 $ 1.67

Consolidated $ 2,054 $ 88

$ 142 $ 126 $ 19 $ 85 $ 326 $ 2,840 (1)

Excludes Depreciation and amortization and

Reclamation and remediation.

(2) Includes by-product credits of $37. (3) Includes stockpile and

leach pad inventory adjustments of $51 at Carlin, $5 at Twin

Creeks, $22 at Yanacocha and $18 at Boddington. (4) Reclamation

costs include operating accretion of $42 and amortization of asset

retirement costs of $46. (5) Other expense, net is adjusted for

restructuring costs of $14, acquisition costs of $8 and write-downs

of $3. (6) Excludes development capital expenditures, capitalized

interest and the increase in accrued capital of $280. The following

are major development projects: Turf Vent Shaft, Conga, Long Canyon

and Merian. (7) On October 29, 2015, the Company sold the Waihi

mine.

Similar to the historical AISC amounts presented above, AISC

outlook is also a non-GAAP financial measure. A reconciliation of

the 2016 Gold AISC outlook range to the 2016 CAS outlook range is

provided below. The estimates in the table below are considered

“forward-looking statements” within the meaning of Section 27A of

the Securities Act of 1933, as amended, and Section 21E of the

Securities Exchange Act of 1934, as amended, which are intended to

be covered by the safe harbor created by such sections and other

applicable laws. See the Cautionary Statement on page 22 for

additional information.

2016 Outlook - Gold Outlook range Low

High Costs Applicable to Sales 1,2 $ 3,700 $ 4,050

Reclamation Costs 3 75 150

Advanced Projects and Exploration

250 300 General and Administrative 200 250 Other Expense 20 50

Treatment and Refining Costs 50 100 Sustaining Capital 4 600

700 All-in Sustaining Costs $ 4,850 $ 5,500 Ounces (000)

Sold 5,525 5,925 All-in Sustaining Costs per oz $ 870

$ 930 (1)

Excludes Depreciation and amortization and

Reclamation and remediation.

(2) Includes stockpile and leach pad inventory adjustments. (3)

Remediation costs include operating accretion and amortization of

asset retirement costs. (4) Excludes development capital

expenditures, capitalized interest and increase in accrued capital.

Net average realized price per ounce/ pound

Average realized price per ounce/ pound are non-GAAP financial

measures. The measures are calculated by dividing the Net

consolidated gold and copper sales by the consolidated gold ounces

or copper pounds sold, respectively. These measures are calculated

on a consistent basis for the periods presented on a consolidated

basis. Average realized price per ounce/ pound statistics are

intended to provide additional information only, do not have any

standardized meaning prescribed by GAAP and should not be

considered in isolation or as a substitute for measures of

performance prepared in accordance with GAAP. The measures are not

necessarily indicative of operating profit or cash flow from

operations as determined under GAAP. Other companies may calculate

these measures differently.

The following tables reconcile these non-GAAP measures to the

most directly comparable GAAP measure:

Three Months Ended Six Months

Ended June 30, June 30, 2016

2015 2016 2015 Sales $

2,038 $ 1,908 $ 4,070 $ 3,880 Consolidated copper sales, net

(235 ) (334 ) (573 ) (661 ) Consolidated gold

sales, net $ 1,803 $ 1,574 $ 3,497 $ 3,219 Gross before

provisional pricing $ 1,808 $ 1,588 $ 3,493 $ 3,252 Provisional

pricing mark-to-market 10 1 40

— Gross after provisional pricing 1,818 1,589

3,533 3,252 Treatment and refining charges (15 ) (15

) (36 ) (33 ) Net $ 1,803 $ 1,574 $

3,497 $ 3,219 Consolidated gold ounces sold

(thousands): 1,429 1,337 2,850 2,704 Average realized gold price

(per ounce): Gross before provisional pricing $ 1,264 $ 1,190 $

1,225 $ 1,204 Provisional pricing mark-to-market 7

1 14 — Gross after

provisional pricing 1,271 1,191 1,239 1,204 Treatment and refining

charges (11 ) (12 ) (13 ) (12 ) Net $

1,260 $ 1,179 $ 1,226 $ 1,192

Three Months Ended Six Months Ended

June 30, June 30, 2016 2015

2016 2015 Sales $ 2,038 $ 1,908

$ 4,070 $ 3,880 Consolidated gold sales, net (1,803 )

(1,574 ) (3,497 ) (3,219 ) Consolidated copper sales,

net $ 235 $ 334 $ 573 $ 661 Consolidated copper sales: Gross

before provisional pricing $ 266 $ 377 $ 622 $ 747 Provisional

pricing mark-to-market (8 ) (18 ) 6

(34 ) Gross after provisional pricing 258 359 628 713

Treatment and refining charges (23 ) (25 ) (55

) (52 ) Net $ 235 $ 334 $ 573 $ 661

Consolidated copper pounds sold (millions): 122 139 289 278

Average realized copper price (per pound): Gross before provisional

pricing $ 2.18 $ 2.71 $ 2.15 $ 2.68 Provisional pricing

mark-to-market (0.06 ) (0.13 ) 0.02

(0.12 ) Gross after provisional pricing 2.12 2.58 2.17 2.56

Treatment and refining charges (0.18 ) (0.17 )

(0.19 ) (0.19 ) Net $ 1.94 $ 2.41 $ 1.98

$ 2.37

Gold By-Product Metrics

Copper is a by-product often obtained during the process of

extracting and processing the primary ore-body. In our GAAP

Condensed Consolidated Financial Statements, the value of these

by-products is recorded as a credit to our CAS and the value of the

primary ore is recorded as Sales. In certain instances, copper is a

co-product, or significant resource in the primary ore-body, and

the revenue is recorded as Sales in our GAAP Condensed Consolidated

Financial Statements.

Gold By-Product Metrics are non-GAAP financial measures that

serve as a basis for comparing the Company’s performance with

certain competitors. As Newmont’s operations are primarily focused

on gold production, “Gold By-Product Metrics” were developed to

allow investors to view Sales, CAS per ounce and AISC per ounce

calculations that classify all copper production as a by-product,

even when copper is the primary ore-body. These metrics are

calculated by subtracting copper sales recognized from Sales and

including these amounts as offsets to CAS.

Gold By-Product Metrics are calculated on a consistent basis for

the periods presented on a consolidated basis. These metrics are

intended to provide supplemental information only, do not have any

standardized meaning prescribed by GAAP and should not be

considered in isolation or as a substitute for measures of

performance prepared in accordance with GAAP. Other companies may

calculate these measures differently as a result of differences in

the underlying accounting principles, policies applied and in

accounting frameworks, such as in IFRS.

The following tables reconcile these non-GAAP measures to the

most directly comparable GAAP measures:

Three Months EndedJune

30,

Six Months EndedJune 30,

2016 2015 2016

2015 Consolidated gold sales, net $ 1,803 $ 1,574 $

3,497 $ 3,219 Consolidated copper sales, net 235

334 573 661 Sales $ 2,038

$ 1,908 $ 4,070 $ 3,880 Costs

applicable to sales $ 1,059 $ 1,027 $ 2,140 $ 2,054 Less:

Consolidated copper sales, net (235 ) (334 )

(573 ) (661 ) By-Product costs applicable to sales $ 824

$ 693 $ 1,567 $ 1,393 Gold sold

(thousand ounces) 1,429 1,337

2,850 2,704 Total Gold CAS per ounce

(by-product) $ 577 $ 518 $ 550 $ 515

Total AISC $ 1,439 $ 1,439 $ 2,838 $ 2,840 Less:

Consolidated copper sales, net (235 ) (334 )

(573 ) (661 ) By-Product AISC $ 1,204 $ 1,105

$ 2,265 $ 2,179 Gold sold (thousand ounces)

1,429 1,337 2,850 2,704

Total Gold AISC per ounce (by-product) $ 843 $ 826

$ 795 $ 806

Conference call information

A conference call will be held on Thursday, July 21, 2016

at 10:00 a.m. Eastern Time (8:00 a.m. Mountain Time); it

will also be carried on the Company’s website.

Conference Call Details

Dial-In Number

800.857.6428 Intl Dial-In Number 517.623.4916 Leader Meredith Bandy

Passcode Newmont Replay Number 800.925.0851 Intl Replay Number

402.220.3075 Replay Passcode 2016

Webcast DetailsURL:

http://event.on24.com/wcc/r/1203160/7D2C07F959EE2899B0229E9C377BB39E

The second quarter 2016 results will be available after the

market closes on Wednesday, July 20, 2016 on the “Investor

Relations” section of the Company’s website, www.newmont.com.

Additionally, the conference call will be archived for a limited

time on the Company’s website.

Cautionary Statement Regarding Forward-Looking Statements,

Including Outlook:

This release contains “forward-looking statements” within the

meaning of Section 27A of the Securities Act of 1933, as amended,

and Section 21E of the Securities Exchange Act of 1934, as amended,

which are intended to be covered by the safe harbor created by such

sections and other applicable laws. Such forward-looking statements

may include, without limitation: (i) estimates of future

consolidated and attributable production and sales; (ii) estimates

of future costs applicable to sales and All-in sustaining costs;

(iii) estimates of future consolidated and attributable capital

expenditures; (iv) our efforts to continue delivering reduced costs

and efficiency; (v) expectations regarding the development, growth

and potential of the Company’s operations, projects and

investments; (vi) expectations regarding future debt repayments;

and (vii) expectations regarding the completion of the sale of Batu

Hijau, including, without limitation, the timing of closing of the

sale transaction, future receipt of contingent payments, expected

use of proceeds, expected accounting impacts resulting from the

proposed transaction, future operation and transition of Batu Hijau

(including Phase 7) and future development of Elang. Estimates or

expectations of future events or results are based upon certain

assumptions, which may prove to be incorrect. Such assumptions,

include, but are not limited to: (i) there being no significant

change to current geotechnical, metallurgical, hydrological and

other physical conditions; (ii) permitting, development, operations

and expansion of the Company’s operations and projects being

consistent with current expectations and mine plans, including

without limitation receipt of export approvals; (iii) political

developments in any jurisdiction in which the Company operates

being consistent with its current expectations; (iv) certain

exchange rate assumptions for the Australian dollar to the U.S.

dollar, as well as other the exchange rates being approximately

consistent with current levels; (v) certain price assumptions for

gold, copper and oil; (vi) prices for key supplies being

approximately consistent with current levels; (vii) the accuracy of

our current mineral reserve and mineralized material estimates;

(viii) the acceptable outcome of negotiation of the amendment to

the Contract of Work and/or resolution of export issues in

Indonesia; and (ix) other assumptions noted herein. Investors are

cautioned that no assurances can be made with respect to the

closing of the pending sale of the Company’s interest in

PTNNT,which remains contingent on the receipt of regulatory

approvals, buyer shareholder approval, and satisfaction of other

conditions precedent, including, without limitation, government

approval of the PTNNT share transfer, maintenance of valid export

license at closing, the concurrent closing of the PTMDB sale of its

24 percent stake to the buyer, resolution of certain tax matters,

and no occurrence of material adverse events that would

substantially impact the future value of Batu Hijau. Potential

additional risks include other political, regulatory or legal

challenges and community and labor issues. The amount of contingent

payment will also remain subject to risks and uncertainties,

including copper prices and future production and development at

Batu Hijau and Elang. Where the Company expresses or implies an

expectation or belief as to future events or results, such

expectation or belief is expressed in good faith and believed to

have a reasonable basis. However, such statements are subject to

risks, uncertainties and other factors, which could cause actual

results to differ materially from future results expressed,

projected or implied by the “forward-looking statements”. Other

risks relating to forward looking statements in regard to the

Company’s business and future performance may include, but are not

limited to, gold and other metals price volatility, currency

fluctuations, increased production costs and variances in ore grade

or recovery rates from those assumed in mining plans, political and

operational risks, community relations, conflict resolution and

outcome of projects or oppositions and governmental regulation and

judicial outcomes. For a more detailed discussion of such risks and

other factors, see the Company’s 2015 Annual Report on Form 10-K,

filed on February 17, 2016, with the Securities and Exchange

Commission (SEC), as well as the Company’s other SEC filings. The

Company does not undertake any obligation to release publicly

revisions to any “forward-looking statement,” including, without

limitation, outlook, to reflect events or circumstances after the

date of this news release, or to reflect the occurrence of

unanticipated events, except as may be required under applicable

securities laws. Investors should not assume that any lack of

update to a previously issued “forward-looking statement”

constitutes a reaffirmation of that statement. Continued reliance

on “forward-looking statements” is at investors' own risk.

Investors are reminded that this news release should be read in

conjunction with Newmont’s Form 10-Q expected to be filed on or

about July 20, 2016 with the SEC (also available at

www.newmont.com).

View source

version on businesswire.com: http://www.businesswire.com/news/home/20160720006413/en/

Newmont Mining CorporationInvestor

ContactMeredith Bandy,

303-837-5143meredith.bandy@newmont.comorMedia

ContactOmar Jabara, 303-837-5114omar.jabara@newmont.com

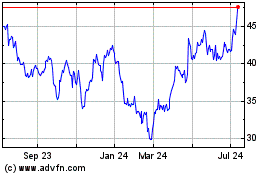

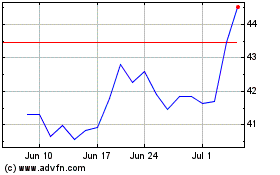

Newmont (NYSE:NEM)

Historical Stock Chart

From Mar 2024 to Apr 2024

Newmont (NYSE:NEM)

Historical Stock Chart

From Apr 2023 to Apr 2024