Halliburton Swings to Loss but Signals Upturn -- 2nd Update

July 20 2016 - 2:59PM

Dow Jones News

By Alison Sider and Anne Steele

Halliburton Co. revealed that it has cut another 9% of its

workforce, or roughly 5,000 employees, even though the oil-field

service company's management now predicts that the global energy

outlook is finally improving.

The company booked a hefty loss for the second quarter thanks to

charges related to its failed tie-up with Baker Hughes Inc., its

rival that also helps oil-and-gas producers drill new wells and

flush out more fuel from the ground.

Halliburton's head count around the world now stands over 50,000

employees, down from more than 55,000 in the spring. At its peak in

2014, Halliburton employed more than 80,000 people.

Despite a loss of $3.21 billion, or $3.73 a share, for the

period that ended June 30, Halliburton's results beat analyst

expectations. Analysts polled by Thomson Reuters had projected an

adjusted loss of 19 cents a share on $3.75 billion in revenue.

Stock in the company dropped nearly 1% to $44.58 a share in

Wednesday afternoon trade.

Halliburton, which is the second largest oil-field-services

company in the world behind Schlumberger Ltd., is an industry

bellwether. Chief Executive Dave Lesar emphasized that the North

American oil sector is poised for a turnaround in the second half

of the year.

An emotional threshold was crossed in the oil patch when crude

prices rebounded to $50 a barrel during the quarter, Mr. Lesar

said. They have since slid back to less than $45 a barrel, but

companies are starting to think about growing again rather than

just hanging on, he added.

"There's a spring in their step I didn't see earlier in the

year," Mr. Lesar said of Halliburton's customers. "In short, they

are getting back to business."

The hope, however, is forward facing. In the second quarter,

Halliburton said revenue in its North American operations -- the

largest contributor to its top line -- tumbled 43% amid reduced

activity throughout the U.S., particularly for pressure pumping

services and drilling.

Mr. Lesar said that Halliburton executives believes the U.S.

drilling rig count bottomed out during the last quarter. He pointed

to improving utilization numbers in recent weeks. So far, 26 rigs

have been redeployed, reflecting operator confidence in stabilizing

oil and gas prices.

Halliburton expects a modest uptick in the rig count later this

year and a significant ramp up in 2017, Mr. Lesar said.

Some of the pain from nearly two years of low oil prices will

linger. During a conference call with analysts Wednesday morning,

Halliburton President Jeff Miller said the company is still working

to cut its costs. He conceded that some laid-off oil workers won't

ever return to the industry, but stressed that Halliburton has

tried to retain experienced people so it can be ready when the

industry rebounds.

"We know how to do that, and we know how to make those people

effective. So I feel like Halliburton is well positioned," he

said.

Oil-field services companies like Halliburton and Schlumberger

made deep pricing concessions at the depths of the downturn, idling

equipment and laying off tens of thousands of employees.

Exploration and production companies will have to adjust to paying

more for their services if they expect vendors to stay in business,

Mr. Lesar said.

"They know in their heart of hearts that service prices have to

go up," he said.

In May, Halliburton and Baker Hughes called off their merger,

once valued at nearly $35 billion, amid intense regulatory pressure

on several continents. They initially struck a deal in 2014, but it

stalled and in April the U.S. Justice Department filed a lawsuit to

block it.

Halliburton booked $3.52 billion of costs related to terminating

the merger, as well as $423 million of other impairments and

charges during the quarter. Excluding special items, the company

posted an adjusted loss from continuing operations of 14 cents a

share. Total revenue slid 35% to $3.84 billion.

Write to Alison Sider at alison.sider@wsj.com and Anne Steele at

Anne.Steele@wsj.com

(END) Dow Jones Newswires

July 20, 2016 14:44 ET (18:44 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

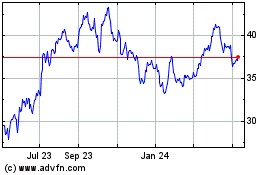

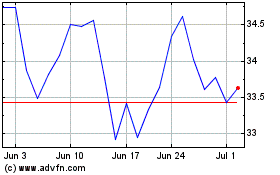

Halliburton (NYSE:HAL)

Historical Stock Chart

From Mar 2024 to Apr 2024

Halliburton (NYSE:HAL)

Historical Stock Chart

From Apr 2023 to Apr 2024